Another Epidemic to Worry About: Identity Theft

Fraud losses grew in 2019 and are likely to increase in 2020.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Identity thieves are increasingly using stolen information to hijack their victims’ accounts, a costly type of fraud that’s expected to increase as the COVID-19 pandemic forces more Americans to work and shop online.

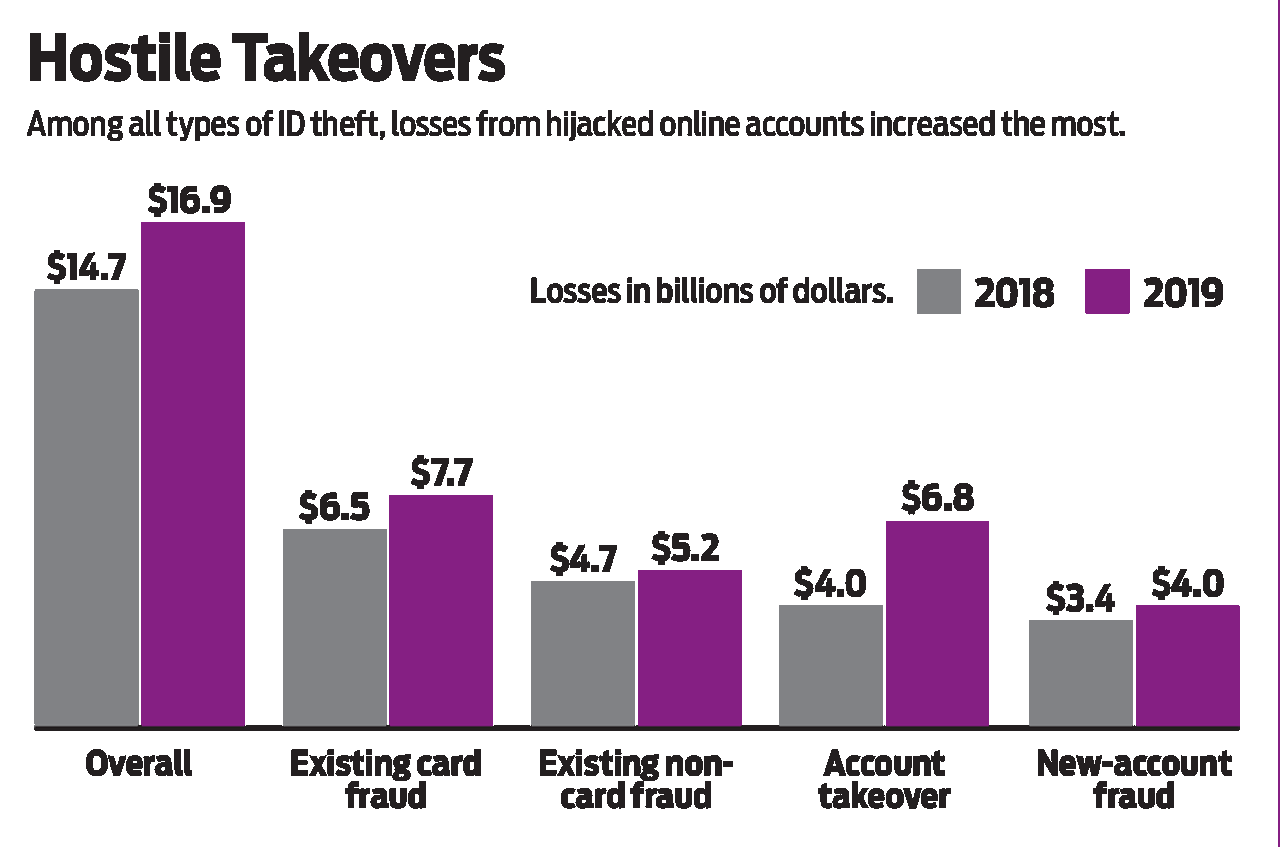

The number of victims of account takeovers, in which a criminal takes control of an existing online account, rose more than 20% last year, according to a report by Javelin Strategy & Research, a financial advisory firm. While the number of victims of ID theft declined in 2019, total losses rose because account-takeover fraud is more profitable for perpetrators. Javelin also predicts an increase in phishing attacks and “card not present” fraud, in which stolen credit card data is used to make purchases online, by phone or through the mail.

A target-rich environment. Fears of the pandemic and confusion about stimulus checks sent to millions of Americans have created new opportunities for scammers. Fraudsters are bombarding Americans with e-mails and phone calls that use the uncertainty surrounding COVID-19 to persuade them to divulge personal information and download malware. The Federal Trade Commission says it received four times as many complaints about identity fraud in the first few weeks of April than it had received in the previous three months combined.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

There are steps you can take to protect yourself from account takeovers and other scams. Biometrics, which use fingerprints and facial recognition, are a more effective way to protect smartphones and other devices than passwords. Using digital wallets, such as Apple Pay or Google Pay, to make online purchases is also a good idea, because the merchant doesn’t get your credit card information, Javelin says. Even if the merchant is hit by a data breach, your credit card information should be secure.

You should periodically check your bank statements online to detect signs of fraud. The sooner you catch ID thieves, the less damage they can do. If you think you’ve been a victim of identity fraud, put a freeze on your credit reports with the three credit bureaus. That won’t prevent someone from taking over an existing account, but it will stop crooks from opening new accounts in your name.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Emma Patch joined Kiplinger in 2020. She previously interned for Kiplinger's Retirement Report and before that, for a boutique investment firm in New York City. She served as editor-at-large and features editor for Middlebury College's student newspaper, The Campus. She specializes in travel, student debt and a number of other personal finance topics. Born in London, Emma grew up in Connecticut and now lives in Washington, D.C.

-

Ask the Editor: Questions on Tax Breaks for Caregivers

Ask the Editor: Questions on Tax Breaks for CaregiversAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on tax breaks for caregivers

-

Are You Making These Savings Mistakes?

Are You Making These Savings Mistakes?Avoiding these common mistakes can help you build a foundation of wealth while not leaving thousands of dollars on the table.

-

I See the Freedom in My Friend's Late-Life Divorce

I See the Freedom in My Friend's Late-Life DivorceHaving gone through a divorce myself, I know it can bring financial and emotional peace in the long run.

-

How to Search For Foreclosures Near You: Best Websites for Listings

How to Search For Foreclosures Near You: Best Websites for ListingsMaking Your Money Last Searching for a foreclosed home? These top-rated foreclosure websites — including free, paid and government options — can help you find listings near you.

-

Work Email Phishing Scams on the Rise: The Kiplinger Letter

Work Email Phishing Scams on the Rise: The Kiplinger LetterThe Kiplinger Letter Phishing scam emails continue to plague companies despite utilizing powerful email security tools.

-

Four Tips for Renting Out Your Home on Airbnb

Four Tips for Renting Out Your Home on Airbnbreal estate Here's what you should know before listing your home on Airbnb.

-

Is Relief from Shipping Woes Finally in Sight?

Is Relief from Shipping Woes Finally in Sight?business After years of supply chain snags, freight shipping is finally returning to something more like normal.

-

Economic Pain at a Food Pantry

Economic Pain at a Food Pantrypersonal finance The manager of this Boston-area nonprofit has had to scramble to find affordable food.

-

The Golden Age of Cinema Endures

The Golden Age of Cinema Enduressmall business About as old as talkies, the Music Box Theater has had to find new ways to attract movie lovers.

-

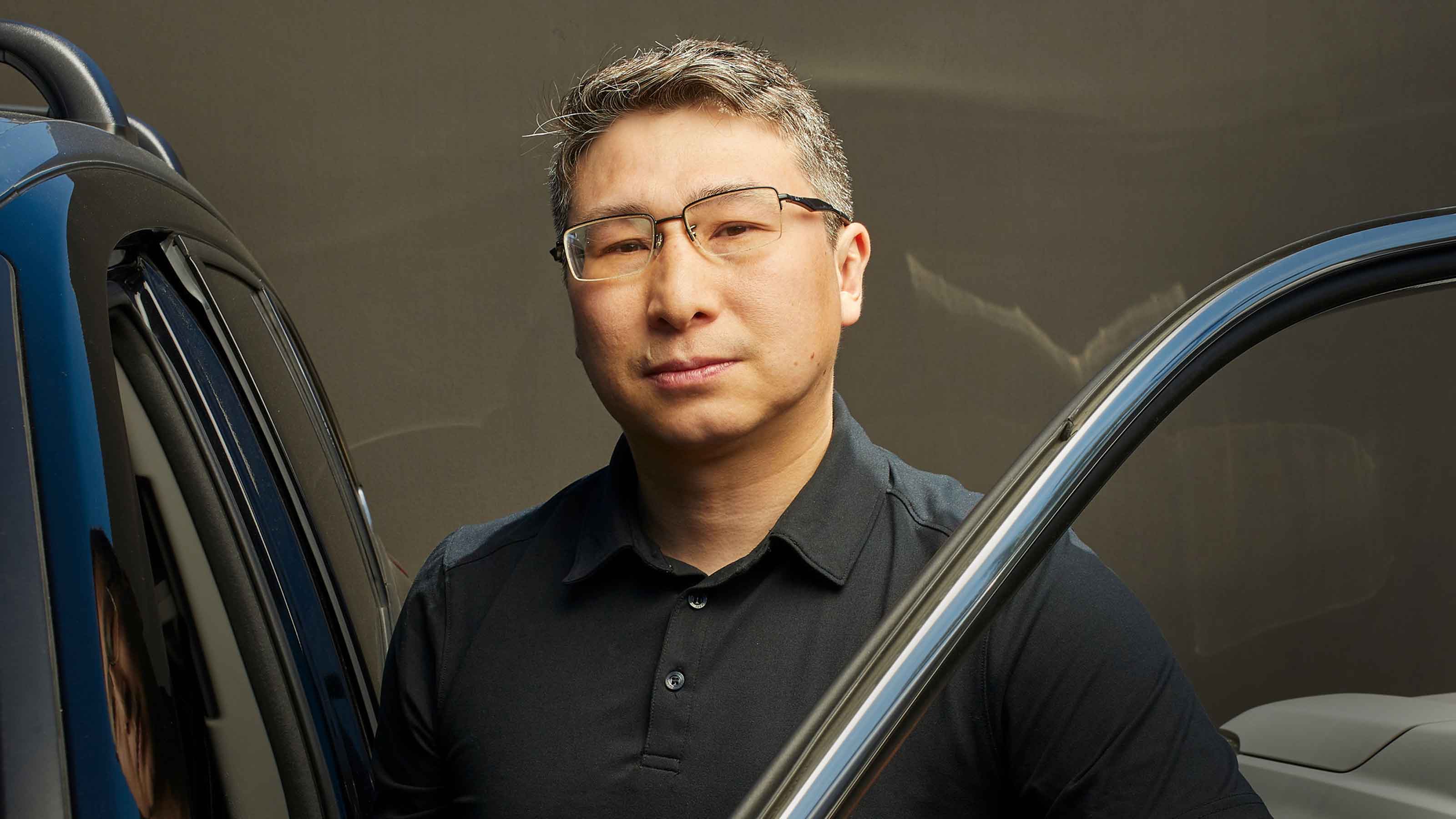

Pricey Gas Derails This Uber Driver

Pricey Gas Derails This Uber Driversmall business With rising gas prices, one Uber driver struggles to maintain his livelihood.

-

Smart Strategies for Couples Who Run a Business Together

Smart Strategies for Couples Who Run a Business TogetherFinancial Planning Starting an enterprise with a spouse requires balancing two partnerships: the marriage and the business. And the stakes are never higher.