12 Vulnerable Stocks to Watch on Market-Wide Weakness

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Several companies that have been red-hot over the past few months have suddenly become stocks to watch for all the wrong reasons.

Stocks do suffer setbacks from time to time. Too many investors have forgotten it, largely thanks to the market’s mostly unfettered advance since 2016. But we caught a brief glimpse of that reality in early 2018, when the Standard & Poor's 500-stock index fell roughly 10% from its peak. The bigger-picture backdrop was so overwhelmingly bullish, however, that investors were quick to forget it and rekindle the rally.

This more recent stumble in October was a not-so-gentle reminder that stocks aren’t bulletproof. Indeed, equities – still up 12% since early April and headed into a time of year known for marketwide weakness – appear ripe for the bearish pressures of heavy profit-taking. And some stocks that have outperformed their peers of late suddenly seem more vulnerable than others.

Here are a dozen stocks to watch that may well take the biggest hits should the market tide turn fully bearish. They’ve been big winners of late, but they don’t appear to have the kind of staying power they need to hold their ground when things get rocky.

Data is as of Oct. 10, 2018.

- Market value: $442.1 billion

- Facebook (FB, $151.38) has been contending with some noncyclical problems of late, putting serious selling pressure on the stock. The 30% loss from its July peak, however, may only be part of its repricing should the market’s broad tide worsen any further.

Much of Facebook’s weakness has been spurred by its own hand, such as the fallout from the Cambridge Analytica debacle. There have been other external drivers, too, including the possibility that the company is nearing its maximum user headcount. Whatever the case, the collective impact of Facebook’s headwinds prompted Chief Financial Officer David Wehner to caution a quarter ago that the company expects “revenue growth rates to decline by high single-digit percentages from prior quarters.”

Wehner also warned that operating margins likely would fall from Q2’s 44% to somewhere in the mid-30% area in the foreseeable future.

Further fanning the selling flames is a frothy valuation that was deliberately dismissed for too long. Even after losing 30% of their value, FB shares trade at nearly 24 times trailing earnings, and 18.5 times 2019 profit expectations that may be too optimistic.

Combine all that with the increasingly troubling market backdrop, and Facebook is among a handful of mega-cap stocks to watch as potential liabilities.

Netflix

- Market value: $144.0 billion

- Netflix (NFLX, $325.89) is undeniably a “story” stock, bid up to nosebleed valuations based on its premise and hopes for significant profits in the future … at the expense of comfortable near-term results.

The dynamic works when things are good. But when the backdrop turns rocky, the fragility of mere stories – rather than actual results – becomes a liability.

Despite the stock’s 62% advance so far this year, the pros maintain their price target of $382, up another 17% from current levels. They also still (mostly) rate it a buy, even if not an outright strong buy. That optimism also may quickly turn into a liability, however, if traders start seeing the Netflix glass as half-empty. In that case, that trailing price-to-earnings ratio of 148 starts to look really, really ugly, and the potential for downgrades adds to the threat.

Another pitfall could just as easily put Netflix shares into a nosedive in the foreseeable future. Should subscriber growth come up short again as it did a quarter ago, investors may assume it’s a sign that Netflix’s service is within reach of saturation.

Advanced Micro Devices

- Market value: $25.0 billion

Semiconductor company Advanced Micro Devices (AMD, $25.00) was teetering on the brink of collapse just a few years ago, but some savvy design work has brought AMD back from zombie status. Tech customers are choosing Advanced Micro Devices’ wares.

Investors have taken notice, and responded. Even with the recent lull, AMD shares are up more than 160% since April’s low, and are up nearly 900% since the end of 2015, in anticipation of sales growth that ended up panning out.

Sooner or later, though, Advanced Micro Devices must turn that revenue into a respectable profit. It’s not clear whether AMD will be able to do that well enough to justify a forward-looking P/E ratio of 38.

Rival Intel (INTC) admittedly was caught unaware by AMD’s overhaul, but it’s not as dead in the water as some observers have suggested. Baird analyst Tristan Gerra expressed such doubts in early October, downgrading AMD and saying:

“While AMD’s fundamentals continue to improve: 1). PC share gains expectations resulting from Intel’s CPU shortage may be too high; 2). Graphic cards channel inventory deleveraging is likely a multi-quarter dynamic; 3). EPYC ramp outlook is impressive but remains limited and Intel will react with new architectures,” he wrote. “(The) stock is currently trading at 25x our new 2020 EPS estimate. Expectations are high while Intel continues to execute and will likely introduce new architectures to protect its share in data center in the medium term.”

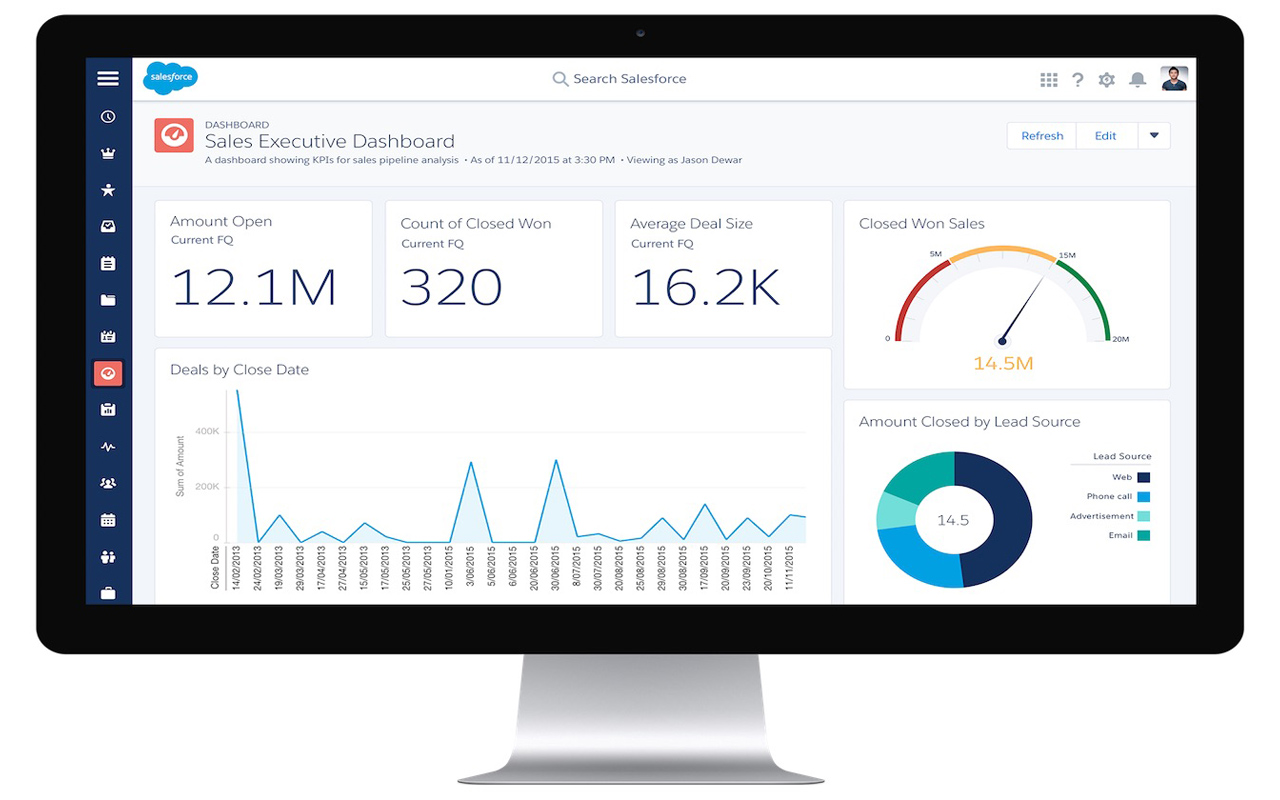

Salesforce.com

- Market value: $106.5 billion

Customer relationship management platform provider Salesforce.com (CRM, $137.81) has been pegged as a buyout candidate for a while now. However, it has largely sidestepped any prospective overtures by being a buyer – of companies including MuleSoft and Demandware – more than dressing itself up as a buyee.

Investors have loved all the growth (organic and inorganic alike) that deal-making has driven. CRM shares are up a whopping 33% so far this year even factoring in the stock’s recent weakness; they’ve roughly doubled since the end of 2016.

Those bulls may have gotten ahead of themselves. Salesforce.com’s revenues are projected to rise 26% this year and another 20% in 2019, while per-share earnings are expected to improve from $1.35 in 2017 to $2.51 this year and $2.73 next. But the stock’s current valuation is nearly impossible to justify outside of the now-waning market euphoria. CRM is priced at 51 times its forward-looking earnings, and traders are taking notice, hence the 14% slide in just two weeks. And the bears might not be done repricing Salesforce.com to reflect newly realized market risks.

Advance Auto Parts

- Market value: $12.2 billion

- Advance Auto Parts (AAP, $163.17) is a company that has been strangely resilient of late, defying the broad tide. But it’s still just as prone to a pullback amid greater weakness, and has more to pay the piper than its peers should the ball get rolling.

By almost all accounts, Advance Auto Parts should be fighting a losing battle. Not only is it competing with Amazon.com (AMZN), it’s fighting a war against more durable, longer-lasting vehicles. New-car sales may be slowing, but with so many barely used cars on the road and much older vehicles still working just fine, repairs and maintenance needs are minimized.

The proof is in the numbers. Advance Auto Parts’ revenues and operating income have been down more often than not since late 2015. Yet AAP shares are up 55% year-to-date, translating into an uncomfortably frothy forward-looking P/E of 20.5 -- and have given up very little ground since the end of August despite all the red flags.

Don’t blindly rely on this apparent strength. This may be a case where the would-be sellers haven’t gotten around to tearing into Advance Auto Parts, and are instead waiting on just the right trigger. With so much pent-up downside, however, AAP could get hard in one sweeping selloff.

Illumina

- Market value: $46.0 billion

Shares of health diagnostic outfit Illumina (ILMN, $304.76) have already been backpedaling, losing more than 15% of their value just since the beginning of the month. However, ILMN still is up about 40% for the year, and the drubbing might not be over yet if the environment remains bearish.

Illumina is the real deal within the genome-sequencing realm. It can look at anyone’s DNA and spot potential genetic problems, diagnose vulnerability to cancer and weigh reproductive hurdles. More tests are on the way too, as medical science continues to figure out exactly how human genetic material works. But even without more testing options, Illumina has enjoyed years’ worth of double-digit sales growth and reliable net profits since 2014.

A lot can change when investors become nervous, however. Even acknowledging strong predicted earnings growth for Illumina this year and next, ILMN’s trailing P/E of 70 and projected P/E of 50 start to look problematic, especially when viewed through a bear’s spectacles. Indeed, valuation might be what has sparked the selloff so far.

Cincinnati Financial

- Market value: $12.2 billion

Most financial stocks have struggled since August, as investors weighed the potential impact of an inverted yield curve and priced in the raw toll that higher interest rates might take on finance-related activity. Shares of insurer Cincinnati Financial (CINF, $76.33) have mostly sidestepped this headwind.

But it might not be able to do so indefinitely.

Sure Dividend CEO Ben Reynolds explains about this Dividend Aristocrat, “Cincinnati Financial is extremely overvalued today. The company is currently trading for a price-to-earnings ratio of 29.5 and a forward price-to-earnings ratio of 23.6. Over the past decade, the company’s stock has traded for an average price-to-earnings ratio of 20.5.”

Reynolds also is concerned about the time it takes CINF to work past cyclical problems, which would include a yield-curve inversion. Sure Dividend’s chief continues, “Cincinnati Financial is vulnerable during recessions. Earnings per share declined from $3.54 in 2007 down to $1.32 in 2009, a 63% decline. And the company’s adjusted earnings-per-share have still not hit pre-Great Recession highs.”

Even if turbulence doesn’t turn into a full-blown recession, it could do enough damage to ding the company’s bottom line for the foreseeable future. Suddenly, investors have good reason to second-guess the resiliency they’ve priced into CINF shares.

TripAdvisor

- Market value: $6.2 billion

- TripAdvisor (TRIP, $44.20) already was in trouble before the market bumped into a headwind. While TripAdvisor still is a destination within the online travel-booking arena, its role and value are being increasingly questioned by at least a couple of its biggest customers: Booking.com (BKNG) and Expedia (EXPE).

Many consumers assume all these companies are doing the same thing, in competition with one another. That’s not exactly the case. Expedia and Booking rely on TripAdvisor to connect its customers with their clients, and they pay TripAdvisor for those referrals.

As time marches on, though, Expedia, Booking.com and their peers increasingly don’t need TripAdvisor to serve as a middleman. Meanwhile, Alphabet (GOOGL) division Google – which has been in this business for a while – just rolled out a few more tools that allow it to more effectively act as an online travel agent.

Both are problematic for the beleaguered TripAdvisor. But more than that, it’s a double-barreled liability most investors are choosing not to stomach. Shares are down 27% since July’s high, but could fall more if investors believe the economy’s recent strength is in jeopardy.

ANGI Homeservices

- Market value: $9.2 billion

Online services conglomerate ANGI Homeservices (ANGI, $18.97) – you may know it better as its combined brands, Angie’s List and HomeAdvisor – is a great concept. That’s a big part of why IAC/InterActiveCorp (IAC) acquired Angie’s List in 2017, then spun it off after combining it with HomeAdvisor. It has acquired several other similar platforms before that deal and even a couple more in the meantime, all in the name of greater scale that would lead to wider profit margins.

But online consumer services is an increasingly crowded market with an increasingly limited potential for profit growth. And IAC’s strategy hasn’t worked out all that well. Some would say it hasn’t worked at all.

Most growth has been inorganic, and losses (on operating and Generally Accepted Accounting Principles bases) remain the norm. That might be a key part of why CEO Chris Terrill will be stepping down at the end of this year and passing the torch to the company’s chief product officer, Brandon Ridenour. But ANGI may not have a personnel problem – it may the product (or products) itself that is the crux of the company’s growth challenges.

Between the sheer disruption of a CEO transition and the lingering doubts incited by the change, the 9% stumble ANGI shares have suffered since the Ridenour announcement may only be the beginning of the stock’s weakness.

Carvana

- Market value: $6.5 billion

Used-car sales venue Carvana (CVNA, $46.57) already is feeling the pressure of a cyclical slowdown in automobile sales. If the broad market hits a speedbump, it may feel worse than it really is, but it’ll still feel bad enough to bring Carvana to a screeching halt.

“Peak auto” in the United States was a real thing, marked by an annualized sales pace of 18.25 million new cars in November 2015. That peak caused a ripple effect, spurring the turn-ins of millions of barely used vehicles before and after the new-car mania. Now both face a slowdown; most anyone who wanted to purchase a new or relatively unused automobile now has one.

Carvana still is growing its top line, though the pace of growth has diminished over the past couple quarters. Meanwhile, the company has logged a net loss in each of those two quarters, pulling it back into red ink – something CVNA hadn’t planned on happening.

That brewing concern is a big part of the reason CVNA has peeled back roughly 35% from the high hit in September. But with 150% year-to-date gains still in its pocket, Carvana is one of several stocks to watch for continued profit-taking potential.

Twilio

- Market value: $7.0 billion

- Twilio (TWLO, $68.02) has had an amazing 2018. Shares were up more than 260% for the year at one point, and even the recent pullback leaves TWLO with an impressive 183% gain.

But like Carvana, those big gains leave Twilio vulnerable to further downside.

Twilio offers businesses a variety of cloud-based services, ranging from login authentications to text marketing to call-routing and more. There’s clearly a growing market for such services, as the world becomes increasingly digital and consumers are increasingly connected to their smartphones. This paradigm shift and Twilio’s real solutions made for an easy bullish argument.

The bulls have arguably gotten more than a little overzealous, however. TWLO shares are trading at nearly 470 times next year’s adjusted earnings estimates, and at 14 times the company’s trailing 12-month sales. The marketwide P/S average is a bit below 3.

Translation: Even if Twilio squeezes the most profit it possibly can out of its revenue, it’s still going to be valued well beyond the norm. Investors are more apt to sell off such wildly overpriced stocks if the market gets any hairier.

Iridium Communications

- Market value: $2.2 billion

- Iridium Communications (IRDM, $19.57) isn’t exactly a household name, but that doesn’t make it any less vulnerable to a setback. The stock is up more than 70% from May’s low despite a sizable pullback since the end of September, so there’s room for profit-takers to plow in. There’s reason, too.

Iridium Communications makes and market satellite-based communications solutions. It names the U.S. government as a customer, but it also offers services to and with private enterprises. It’s partnering with Amazon.com, for instance, to co-develop a platform that will power the Internet of Things.

Business has been stable, but not impressive. It hasn’t recorded sustained revenue growth since 2012, and operating income has been slipping since 2017.

So why this year’s big rally? Investors, as they usually do, are looking past the present into the future. The market believes Iridium’s Amazon partnership could become a model for similar deals, rekindling revenue and profit growth for good. That may happen.

But the difference between the company’s GAAP and non-GAAP (adjusted) earnings is difficult to handicap, and investors tend to be forgiving of actual losses when the backdrop turns bleak. Never even mind that non-GAAP profits are currently edging lower.

That makes IRDM among the momentum stocks to watch that are sitting dangerously close to the cliff’s edge.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

The Tool You Need to Avoid a Post-Divorce Administrative Nightmare

The Tool You Need to Avoid a Post-Divorce Administrative NightmareLearn why a divorce decree isn’t enough to protect your retirement assets. You need a QDRO to divide the accounts to avoid paying penalties or income tax.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off

When Estate Plans Don't Include Tax Plans, All Bets Are OffEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Relying on Real Estate in Retirement? Avoid These 3 Mistakes

Relying on Real Estate in Retirement? Avoid These 3 MistakesThe keys to successful real estate planning for retirees: Stop thinking of property income as a reliable paycheck, start planning for tax consequences and structure your assets early to maintain flexibility.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Nasdaq Adds 211 Points as Greenland Tensions Ease: Stock Market Today

Nasdaq Adds 211 Points as Greenland Tensions Ease: Stock Market TodayWall Street continues to cheer easing geopolitical tensions and President Trump's assurances that there will be no new tariffs on Europe.