Remember: Retirement Accounts Are Not All Taxed the Same

How you handle your pre-tax and after-tax accounts can make a big difference in your income in retirement and the legacy you leave.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

As you formulate your plan for retirement, you may be pleased with the amount of money saved over your working life and now invested in your after-tax investment accounts, IRA/401(k) accounts and as equity in your house.

Yes, you can convert your savings to income in a variety of ways, but how you plan and allocate income among investments and annuities — and between accounts — can enhance your ability to take vacations, make gifts, provide health care and generally support your lifestyle for the rest of your retired life.

I’ve said before that while planning for retirement income is not rocket science, there are literally trillions of potential plans you could design with your adviser. Naturally, we want to make it easy for you to choose one — without a degree in investment management or actuarial science. However, there’s one area we can’t oversimplify: Do not treat all your savings alike in creating your plan.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Treating all savings the same invariably leads to rule-of-thumb shortcuts, riskier deaccumulation strategies and betting solely on market performance to deliver on your spendable income needs and legacy objectives.

Two main sources of retirement savings

In this article, we will look separately at most investors’ two largest savings sources — the “qualified” savings in pre-tax accounts and the personal savings on which you have paid taxes — to see how you might use them to deliver income and a legacy most efficiently. We’ll bring them together again at the end to show how to take advantage of every tax benefit you can get.

But as background, here’s how our typical female, 70-year-old investor with $2 million in savings split equally between qualified and after-tax savings, will fare with her Go2Income plan prepared in late August. The plan delivers 5.94% (nearly $119,000) in starting income, growing by 2% a year, and a lifetime value (of investment portfolio and annuities) of about $2 million at age 95. About 40% of her income was taxable in the first year.

IRA2Income: Plan with qualified savings only

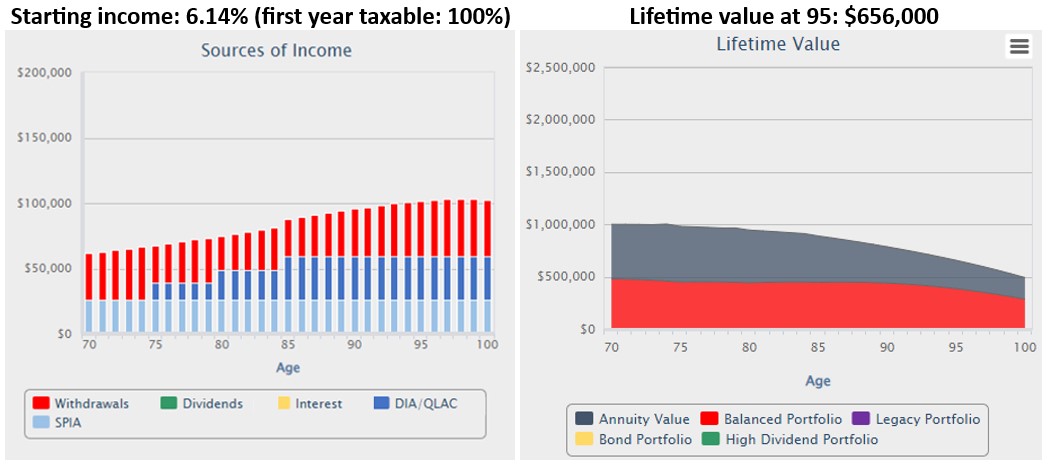

Splitting our investor’s plan into two gives us some insights into how each element contributes to overall success. Set out below is the plan for our investor that deploys only her $1 million of qualified savings.

Highlights of IRA2Income: Our investor is generating a higher percentage of first-year cash flow (6.14%). than other planning methods and sees it growing by 2% a year until age 85. On the other hand, her lifetime value will decline over time because of the requirement to withdraw required minimum distributions, or RMDs, from her account. The only constant in this plan will be the taxes on both income and her legacy. It’s a basic law of U.S. taxation: If you don’t pay taxes upfront, you’ll pay at the back end.

Summary of tax treatment of qualified account: One benefit of accumulating savings in an IRA or 401(k) is, of course, the tax deferral until you must start to take RMDs. For most of us, that is at age 73 under the new RMD rules. Here are some other insights:

- Tax deferral in qualified accounts enables you to rebalance your portfolios and avoid tax on capital gains within the account.

- Use up to $200,000 of your qualified savings to purchase a deferred income annuity called a QLAC, enabling you to delay the payments until as late as age 85.

- QLAC can supply income starting when expenses for medical support and home health care can be expected to skyrocket.

- One negative is that using rollover IRA savings to purchase an immediate income annuity means you’re paying current taxes without any benefit of deferral.

Savings2Income: Plan with personal savings only

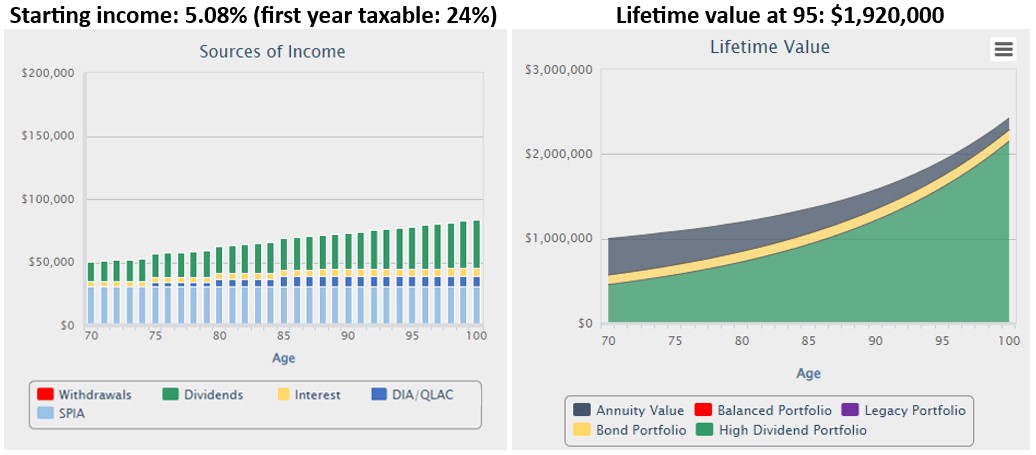

Here’s the plan if our retiree invested $1 million in after-tax savings:

Highlights of plan. As you can see, our investor’s starting income at 5.08% will be less than a plan with everything invested in qualified accounts. However, only 24% of first-year income is taxed, and her lifetime value will grow dramatically, instead of shrink.

Description of tax structure. In this account, our investor is generating a reasonable amount of income, particularly on an after-tax basis, as well as a growing legacy.

- Her personal savings, which have already been taxed, can purchase products like stocks that produce dividends and interest, as well as immediate income annuities.

- A large portion of annuity payments are excluded from tax when purchased with personal savings, driving down your overall tax rate.

- When our investor leaves personal savings to heirs, her beneficiaries will enjoy a step-up in basis at her passing and pay no tax on the gain.

Go2Income: Combining IRA2Income and Savings2Income plans

Assembling IRA2Income and Savings2Income into a single Go2Income plan involves adjustments made either by us or your adviser, particularly to take advantage of the tax breaks of each account. As suggested above, the tax savings you earn on income from personal savings or qualified plans individually can be significant. But the IRS doesn’t tax based on separate earning streams. You are taxed on all your income, and the benefits of each type of savings interrelates with the other. Stock dividends, for example, are taxed at a lower rate than other sources; your total taxes will depend on the entirety of your taxable income.

So, looking at the plan on a combined or holistic basis, there are certain things you might do if you’re not working with an adviser and instead developing a plan on your own:

- Purchase any immediate income annuities from your personal savings and as a result have a significant portion of income in early years excluded from tax.

- Allocate your growth equity portfolios to your rollover IRA and high-dividend equities to personal savings.

- Use a rollover IRA for rebalancing your investment portfolios to avoid taxes on sale of investments.

- Use personal savings for long-term compounding of investment returns to maximize the step-up in basis at your passing.

- Purchase longevity insurance in the form of deferred income annuities (QLAC) in your qualified account.

Bottom line, whether you’re planning by individual account or for all accounts, consider product selection and allocation.

Your next steps

It’s not rocket science. However, it can get complicated. At Go2Income, we can create plans that show the benefits of only qualified savings, or only personal savings, or everything together. Whatever you are ready for, we can help you find the most income and the lowest taxes.

related content

- Can AI Plan Your Retirement Better Than I Can?

- Can Your Retirement Income Plan Cover Unplanned Expenses?

- Four Tips to Help You Conquer the Retirement Mountain

- Are You Worried About Running Out of Money in Retirement?

- How, Like Indy, to Outrun the (Retirement) Boulder

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.

-

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial Planner

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial PlannerRetirement planning is less about hitting a "magic number" and more about an intentional journey — from understanding your relationship with money to preparing for your final legacy.

-

5 Mistakes to Avoid in the 5 Years Before You Retire, From a Financial Planner

5 Mistakes to Avoid in the 5 Years Before You Retire, From a Financial PlannerWhen retirement is in reach, financial planning gets serious — and there's a heightened risk of making serious mistakes, too. Here are five common slipups.