Are You Worried About Running Out of Money in Retirement?

Planning that integrates income annuities can help alleviate the No. 1 fear of retirees, even in worst-case investment scenarios and when living way beyond your life expectancy.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Some people make retirement seem like so much carefree fun. And ideally it is a time to enjoy yourself, travel, and spoil your children. If we could just forget that Social Security is slipping toward a steep cliff, inflation continues at nearly three times what the Fed says is acceptable, and health care costs are soaring even as we age and are more likely to get sick, while the stock market looks sick, too.

If we could forget about all that, we would never worry about our retirement finances affecting our retirement lifestyle. Running out of money during retirement is the concern that consistently ranks as the No. 1 fear of retirees. (Here is one survey, from SeniorLiving.org, but there are many more.)

You may not be concerned about literally going broke, but market calamities, recessions and other economic potholes can put a dent in your income plan unless you prepare.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

You will always have some income: Social Security and possibly pension or annuity payments. But you may be forced to liquidate your rollover IRA faster than planned or sell securities to meet unplanned medical or caregiver expenses. That might be the case even if your planned income is substantial.

With a little bit of research, you can create a plan that will provide growing and guaranteed income during retirement even in worst-case scenarios. Most of the time, you can also meet other objectives, like legacy goals and caregiver costs. Read the rest of this article and then work it out with your own Go2Income plan.

What does the AI chatbot say?

I have been asking the new AI chatbots questions about retirement finances to determine whether they are up to the hype. This week I posed the question this way:

Q: I’m concerned about running out of money in retirement using drawdown strategies like the 4% rule of thumb. What should I do?

A: Consider conservative withdrawal rates: While the 4% rule of thumb can provide a starting point, it's important to recognize that individual circumstances can vary. Depending on factors like your life expectancy, risk tolerance and portfolio composition, you may need to adjust your withdrawal rate to ensure sustainable income throughout retirement. Working with a financial adviser can help you determine a withdrawal strategy that aligns with your unique circumstances.

Not bad, for a machine. Protecting against the downside means you’re more likely to stay the course and do well if prognosticators are too pessimistic. But thinking about retirement in terms of simply withdrawing from savings suggests that income could run out when your withdrawals exceed your savings.

How fear affects our finances

The concern about running low on income, even when you have plenty of savings now, affects how retirees spend or don’t spend, how they invest and how they feel about their financial situation.

The financial planning world doesn’t help when it provides retirees with traditional spend-down plans that express success based on a Monte Carlo simulation of results; i.e., “Your savings should last you until age X,” likely before you plan to leave this world. For the client who is dissatisfied with the probability or the run-out age, the adviser’s answer is often to “spend less.”

The unfortunate result is that a large percentage of the retired population is skeptical about approaches or products that “reduce risk” of limiting your lifestyle. And, of course, the majority of firms don’t include risk-reduction products in their standard set of offerings.

This skepticism turns into downright fear when well-regarded advisers like Felix Zulauf predict a stock market return of 0% for passively invested index funds over the next 10 years. (Full disclosure: Felix and I did a countrywide roadshow on a new investment portfolio 30 or so years ago.)

For the moment, let’s agree that the market will underperform long-term averages, which forces us to throw out any hypotheticals in excess of, say, an 8% stock market return. Is there a solution that not only delivers a satisfactory amount of income, but also does not dry up in worst-case scenarios?

Yes. And it is Go2Income planning that integrates different forms of income annuities to provide more income, particularly late in retirement.

Stress-test your plan

Let’s look at the impact of income annuities on a prediction like Zulauf’s. What happens if the value of the stocks in your portfolio doesn’t grow at all — not just for 10 years, but for your entire retirement? You still get dividends, but in 2050, the Dow would be stuck at 33,000. We applied this scenario to our usual suspect — a woman age 70 with $2 million in savings, with 50% in a rollover IRA account.

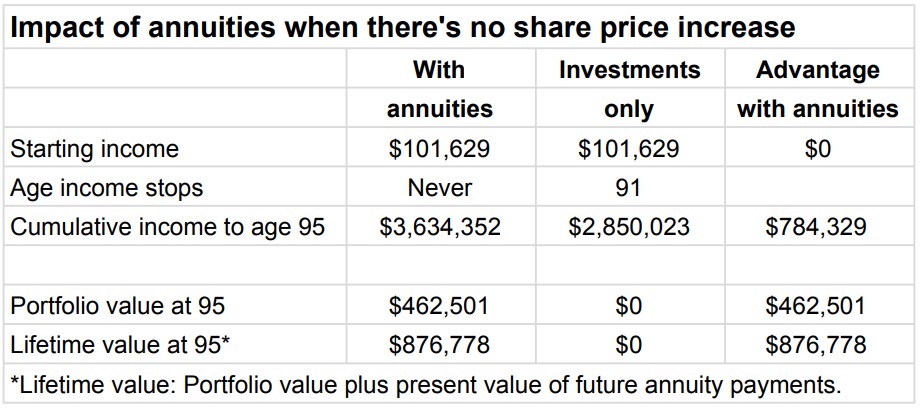

The table below summarizes the results for Go2Income planning with and without annuities. We started each plan with the same starting income, grew it at the same rate of inflation and used the identical investment portfolios with the same low level of fees. (Don’t forget that fees in the beginning impact your income late in retirement.) We allocated about 40% of the savings to annuity payments in the “with annuities” plan.

Note that the “with annuity” plan never stops paying income and has more cumulative income to 95 and a positive portfolio value.

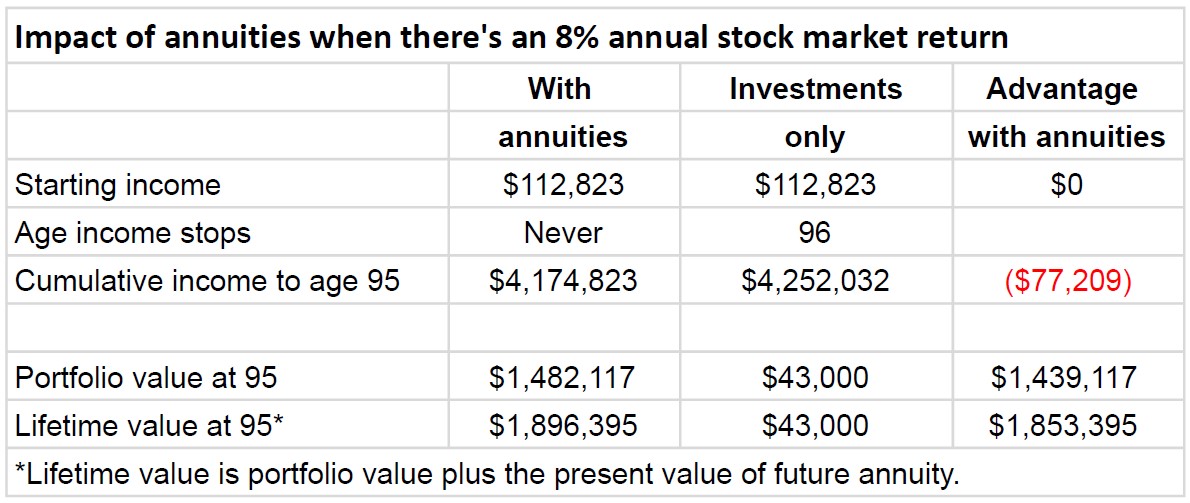

So, what is the price you pay for being so conservative in your planning? None, really, since you live in the real world and you’ll get your results. But you may have underspent, been less generous or not upgraded your house. Let’s look at the same comparison, but with an 8% total return in the stock market.

Note the equivalence in cumulative income and the substantial advantage in portfolio value for the “with annuities” plan. By the way, this example confirms the point we’ve made previously that delivering income more efficiently leads to a larger portfolio value and legacy in the long run.

Plan “insurance”

The favorability rating of the plan with annuities doesn’t surprise me, since they really are the superior vehicles to “insure” your plan. These annuities are the “don’t run out of income” kind, which are priced favorably today because of high interest rates. The Go2Income plan integrates them for optimal impact. (Look for an upcoming article on ways to create that insured plan.)

So, even with conservative market return assumptions or a worst-case scenario, plans that provide a reasonable amount of guaranteed income allow retirees to stop worrying about the stark fear of “running out of money.”

Visit Go2Income to fill out your own Go2Income plan and work out the best way for you to find income and reduce your worries about money in retirement.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.