Why So Many Experts Consider Annuities a Win for Retirees

Rising interest rates, pressure on Social Security, unpredictable markets and longevity risks are making annuities ever more attractive as a part of retirement planning.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Do you know what type of retirement product saw sales soar 44% in 2022 — and received praise and positive publicity in the finance field as consumers saw their other retirement investments lose value?

It’s not cryptocurrency! It’s not some hedge fund. Or junk bonds. It’s easily understood and won’t be seen as a fad in future years.

I’ve described it as a product that “doesn’t make your retirement; it makes your retirement better.”

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

So, what is it?

Its technical term is single premium immediate annuity, or SPIA. Some finance experts call it a simple annuity. As just one element of a plan for retirement income, I consider simplicity a plus, particularly when you read the positive reasons for the experts’ praise for this product. Others call it a paycheck annuity. It’s utilitarian. And I’ve used the term annuity payment contracts in earlier blogs. Whatever you call this annuity, it pays you a guaranteed income for life.

Experts weigh in on annuities

- “An annuity can not only reduce the risk of an unknown lifespan, it can also allow retirees to spend their savings without the discomfort generated by seeing one’s nest egg get smaller,” wrote David Blanchett and Michael Finke in a Think Advisor article. Blanchett is managing director of PGIM DC Solutions, a division of Prudential Financial, and Finke is a professor of wealth management at the American College of Financial Services.

- “I call it the bus problem. They’re afraid they’re going to buy an annuity and walk outside and get hit by a bus. The reality is you also might live to be 105 years old,” economist Olivia Mitchell of the Wharton School told Annuity.org.

- “Annuities deserve an equal seat at the table with any other strategy that meets the style of the client. Annuities are quite competitive with the risk premium for the stock market as a way to fund retirement expenses,” Wade Pfau, professor of retirement income at the American College of Financial Services, said in a Think Advisor article.

- “I think it can make great sense to use some of your retirement savings to purchase an income annuity. ... You can buy an immediate income annuity with a single lump-sum payment you make right when you are ready to start living off your retirement income,” financial adviser and author Suze Orman wrote for AARP.

Bottom line, while retires may not be experts in the field, studies show that retirees feel more secure if they are receiving annuity payments.

Why Now?

These experts all acknowledge the benefits of these simple annuities — something I’ve been doing for decades. Why is the financial press seeking out these experts in annuities now?

- Rising interest rates, pushed by inflation, have brought new attention to annuity payments, which under new contracts over the past year have increased by 25% to 60%. (I have pointed out that these annuities from top-rated insurers are always a good source of lifelong income, but the higher rates do attract notice.)

- At the same time, another lifelong income source, Social Security, is under pressure, not just from political arguments but also because the government needs to bolster the program to make sure it stays strong for future generations. (See my article that The Hill published in 2016. Although the president and Congress have changed, the principles still apply.)

- You may have noticed the stock and bond markets are still wobbly after last year’s double whammy that saw both nose-dive. How much will the Fed raise interest rates? What are the prospects for a recession? Will consumers continue to spend and drive inflation? Until those are answered, the markets will be especially difficult to predict.

- Over the long term — despite COVID — retirees are living longer, which increases “longevity risk.” When you plan your retirement savings to last to your life expectancy, whether it be age 90 if you’re single or 95 if you’re a couple, remember that by definition 50% of you will survive to the life expectancy.

How Much? What Type? Which Accounts?

A do-it-yourselfer can learn a lot about longevity, taxation, risks and market volatility by reading — well, by reading my articles. But there are plenty of others who can add to your education, including a knowledgeable financial adviser. But even with all the information you can gather, you won’t get the answers you need until you develop a plan with your unique set of numbers.

Only then will you be able to determine how this annuity will work for you and improve your peace of mind about your plan.

A number of experts suggest that your combination of Social Security, any pension and an annuity should generate income to cover your essential expenses. By simple arithmetic, that means that most plans would include some annuity payments. Of course, under some circumstances, an annuity may not fit into your plan.

For example, if your immediate family’s history of life expectancy is low, it’s probably smarter to develop a strategy without annuities, or with an annuity that includes a life-refund benefit.

Types of annuity payment contracts

If your plan does call for annuities, they can form a foundation of continuing and lifetime income. Besides annuities with payments that start immediately, there are two other forms that allow you to choose a start date for future income.

By selecting several start dates, you can even create laddered income that provides a type of inflation protection. Here’s a brief description of all three:

- A SPIA is purchased with a lump sum, often upon retirement, and as its name suggests, payments start immediately or at least within a month. If you buy it with money that has already been taxed, i.e., personal savings, you pay taxes only on the previously untaxed portion of your payments.

- A QLAC (qualified longevity annuity contract) begins payments in the future, not later than 85, to supplement income when health care and similar high costs might be expected. As a special tax benefit, a QLAC must be purchased from your IRA or 401(k), permitting you to defer taxable RMDs, or required minimum distributions, from a portion of your account.

- A DIA (deferred income annuity) is similar to a QLAC, but is purchased from your personal savings. You might have several DIAs, in fact, that add to your lifetime income stream at different ages. IRS rules allow you to exclude a portion of your DIA payments from taxes as well. There are DIAs with guaranteed fixed payments, and variable and index annuities that can be converted to income.

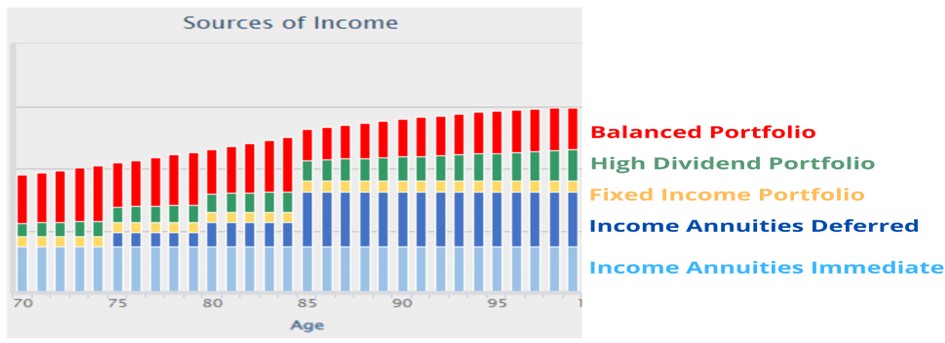

Here’s a graphic showing how annuities can provide the foundation for your plan.

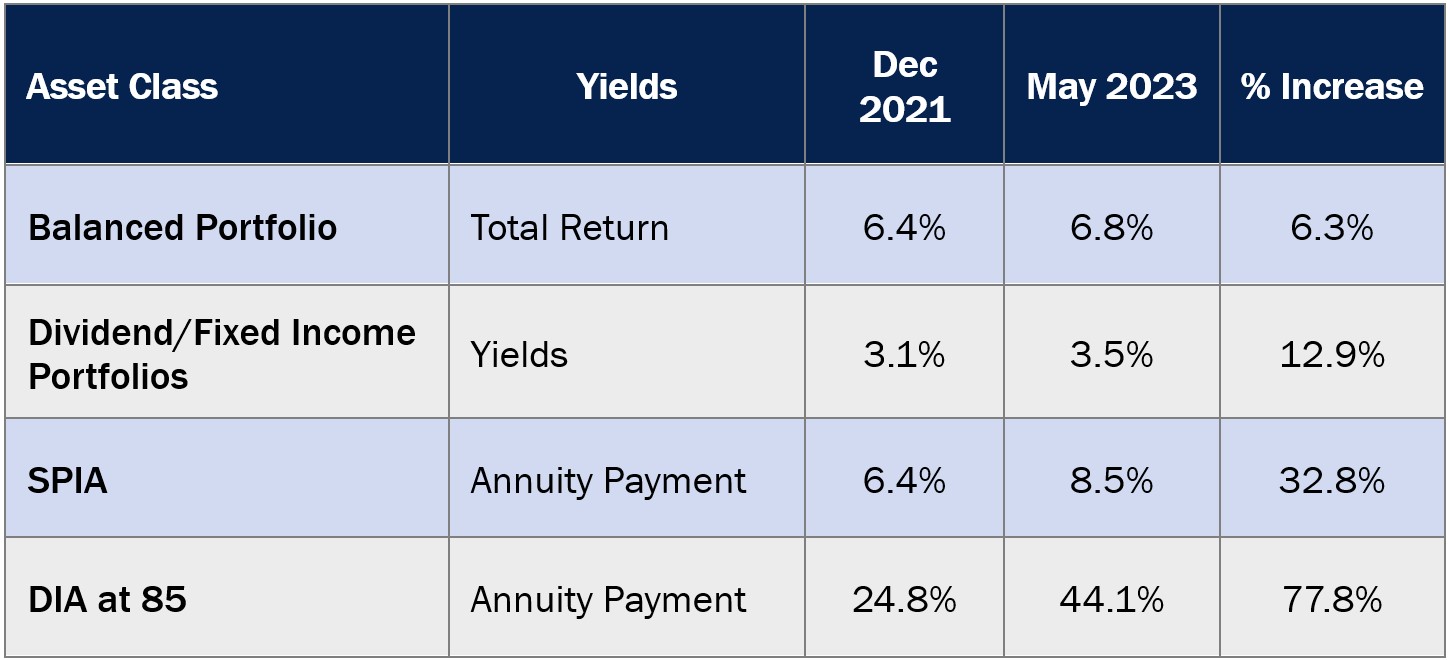

The next graphic shows that even during the market downturns and higher inflation of 2022, annuity payment contracts became more attractive than the outlook for investment portfolios.

When you combine these results into a Go2Income plan and consider possible increases in interest rates by May 2023, the starting income for a typical Go2Income plan is up 17%, from 5.1% to 5.9% of retirement savings.

And it still has its features of increasing income, lower taxes and long-term growth of a legacy.

Start building your plan

Some advisers argue that you’re better off investing all your retirement savings in the markets. They don’t recognize that annuities provide lifelong safe income, a steady source of money even when markets crash.

Last year, for instance, according to a report by Fidelity Investments, the average 401(k) account lost 21% of its value. The average individual retirement account — or IRA — fell by 23%.

A Go2Income plan helps you build your foundation of retirement income. If you are ready to follow the recommendations of the experts, take the simple step of answering a few questions at Go2Income and read the easy-to-understand results.

You can look at different plans until you get one that works best for you and your unique circumstances. Our counselors are always available to answer questions. Try it now, at no obligation, and discover how simple can work for you.

Related Content

- Should You Add an Annuity to Your Retirement Portfolio?

- For Sustainable Retirement Income, You Need These Five Building Blocks

- Doing Your Retirement Income Planning in the Right Order Matters

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.