Soon-to-Be Retirees, Beware: Small-Caps Are Cheap for a Reason

Higher interest rates make debt more expensive for smaller companies, and that could become challenging for them if we head into slower economic times.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

We’re well into the new year now, and investors are naturally wondering which investments will prosper in the months ahead. With the Magnificent 7 stocks (that is, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA and Tesla) making up the bulk of 2023’s market gains, many are expecting broader participation from the rest of the market.

Small-caps in particular seem overdue to outperform. Their rally at the end of the year might seem to be confirmation of that idea, but even with the year-end push, small-cap stocks are trading at a significant discount.

I know it’s tempting to dive in. But investors should always be aware of risk. That’s particularly true if you’re retired or close to retirement. Simply put, you don’t have much time to make up for mistakes. And getting overly excited about small-caps could be a mistake.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Cheap stocks are often cheap for a reason. That certainly appears to be the case with small-cap stocks today.

Larger companies more likely to have lower rates locked in

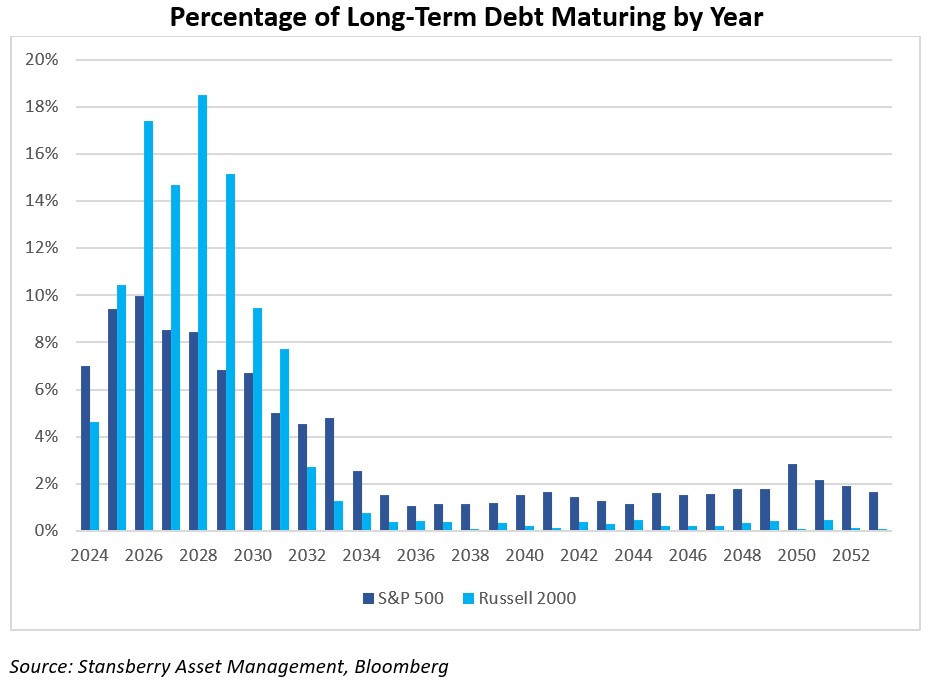

For starters, there’s debt. Generally, bigger companies have much less debt maturing in the near future. Over the past few years, the majority of U.S. homeowners locked in low-rate mortgages. They will enjoy the benefits of that decision for years to come. It’s the same with large companies that have locked in long-term debt at favorable rates.

Smaller companies, on the other hand, don’t have the same access to bond markets for raising long-term debt. They generally use bank lines of credit and shorter-term sources of liquidity. That means their debt is being repriced at substantially higher interest rates, which is a headwind to profits.

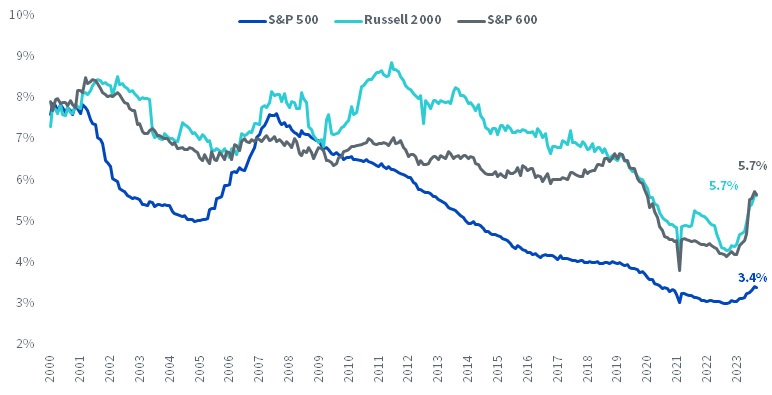

Average Interest Rate Paid on Debt

Source: Wisdom Tree, FactSet, MSCI, as of 9/30/2023. Excludes financials sector.

As shown in the chart above, the interest cost over the past year for large-cap companies (S&P 500) is notably lower than for small-cap companies in the S&P 600 and Russell 2000. For weaker companies, higher rates could mean the difference between being profitable or in the red, especially in a recession.

Many smaller companies are unprofitable

Speaking of in the red, did you know that 40% of companies in the small-cap Russell 2000 index are unprofitable today? And that’s with a pretty strong economy. For now. Consumer credit card delinquencies and auto loan defaults are spiking. Bankruptcies are on the rise, as are delinquent commercial real estate loans. These are certainly signs that we may be in for more challenging times, if not an outright recession.

Higher rates plus a slowing economy could mean a spike in bankruptcies in the small-cap universe. But there’s good news: There are some great small-cap stocks out there! Not every small-cap company is drowning in debt, and in some niche areas, smaller companies can be industry leaders. They’re often overlooked — especially in an environment like today when the biggest stocks are getting all the attention.

If you are a roll-up-your-sleeves investor (or have a financial adviser who is), you may be able to find some wonderful businesses at attractive prices. However, if you or your adviser are the type to buy mutual funds and ETFs that own hundreds of positions, be careful. If those funds are broadly invested across the small-cap universe, you may be exposed to a collection of unprofitable and highly levered companies. If we head into slower economic times, what looks cheap today may cost you dearly.

Related Content

- Stock Picks That Billionaires Love

- Warren Buffett Stocks: The Berkshire Hathaway Portfolio

- Best Dividend Stocks for Dependable Dividend Growth

- Kiplinger Interest Rates Outlook: Short-Term Rate Decline May be Pushed Back to June

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Michael is a Portfolio Manager and Deputy Chief Investment Officer at SAM, a Registered Investment Advisor with the United States Securities and Exchange Commission. File number: 801-107061. He sources investment opportunities and conducts ongoing due diligence across SAM’s portfolios. Michael co-manages SAM’s Income and Tactical Select strategies. Prior to joining SAM, Michael worked with high-net-worth private clients for the largest independent wealth management firm in the United States. He was also a senior analyst for one of the largest investment-grade bond managers in America. Michael joined SAM in 2017.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial Planner

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial PlannerRetirement planning is less about hitting a "magic number" and more about an intentional journey — from understanding your relationship with money to preparing for your final legacy.