Mortgage Denials Spike Among Seniors. Here's How to Boost Your Approval Chances

New mortgage study shows that older Americans, especially those over 70, aren’t being paranoid about increased mortgage loan denials.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The cost of living has become a flashpoint for many Americans, especially seniors. Sticky inflation is still driving monthly costs higher and eating away at retirement savings and the Federal Reserve’s aggressive interest rate hikes to curb said inflation have driven mortgage rates to the highest mark since 2008. The pandemic-driven boom in housing prices has combined with surging rates to push up mortgage payments as a share of buyers’ income to their highest level since 1985. And now, to add insult to injury, new research shows that seniors have real reason to fear systemically-higher mortgage denials among their demographic.

Mortgage rejections surge for seniors

A new report from the Center for Retirement Research at Boston College concludes that older homebuyers are more likely to be rejected than younger ones when they apply for a first-time mortgage or mortgage refinance. The report builds on a 2022 study from the Federal Reserve Bank of Philadelphia. The study pulled together data from 5 million single-borrower mortgage applications, containing details on applicant, property, and loan characteristics. It examined the probability of rejection across age and gender categories.

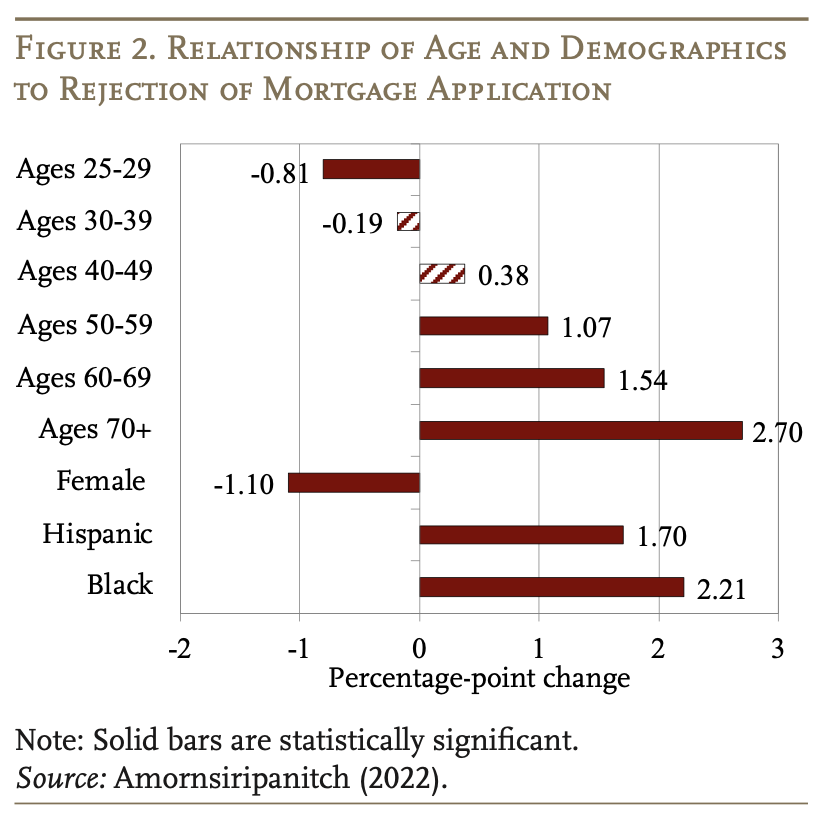

The study author suggests that age “appears to be an equally important correlate of mortgage application outcomes as race and ethnicity,” and that “overall, the results suggest that older individuals systematically face higher barriers to mortgage access.”

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Who are the most-rejected applicants

Study author Natee Amornsiripanitch concludes that mortgage rejection rates rise consistently with age. Applications for the three oldest age groups are 1-3 percentage points more likely to be rejected than those of younger applicants. Here are the exact breakdowns:

- Borrowers between the ages of 60 and 69 were 1.54 percentage points more likely to be rejected than younger borrowers (specifically, those between the ages of 18 and 24).

- Borrowers over age 70 were 2.7 percentage points more likely to be rejected.

- Across all borrowers, the rejection rate was 17.5%.

The study breaks down the issue in chart form:

Age/Demographic Mortgage Rejection Chart from Amornsiripanitch study

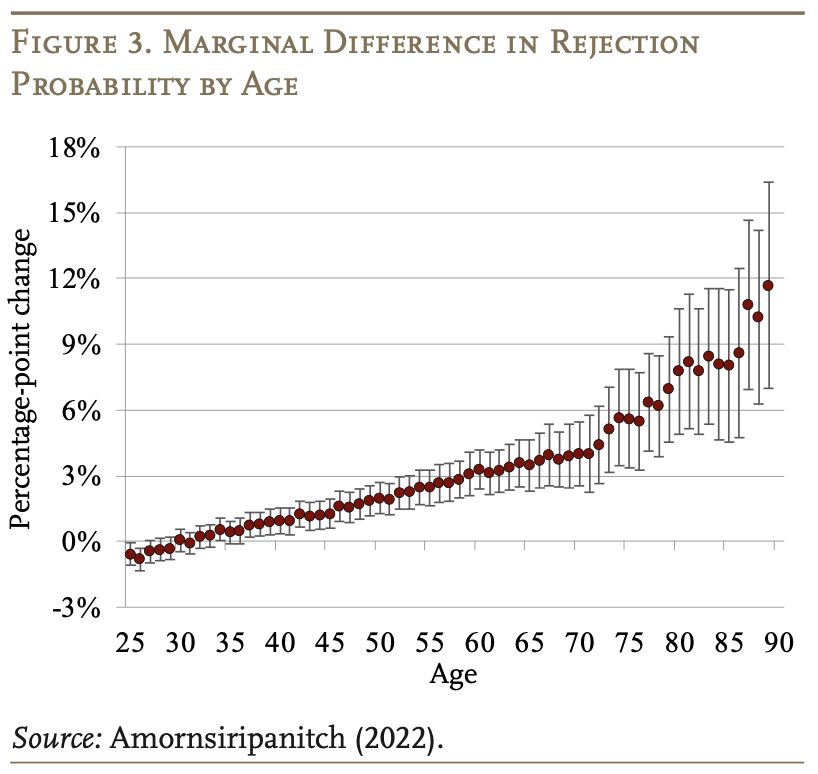

The study also shows that mortgage rejection rates generally increase faster after the age of 70, soaring to 12% more on average than the lowest rejection rate (among 25 year olds), by the time the borrower reaches age 90.

Reasons for higher mortgage rejections

The study examines why older homeowners could be rejected more often, considering they tend to have more wealth and better credit scores than their younger counterparts. The study offers two explanations:

Insufficient collateral

Amornsiripanitch reveals that insufficient collateral accounts for approximately 50 to 70% of the age penalty. Other studies conclude that older homeowners are less able than their younger counterparts to keep their homes in good quality, greatly decreasing the value of their collateral from when they first bought the property and when they applied for refinancing.

Mortality risk

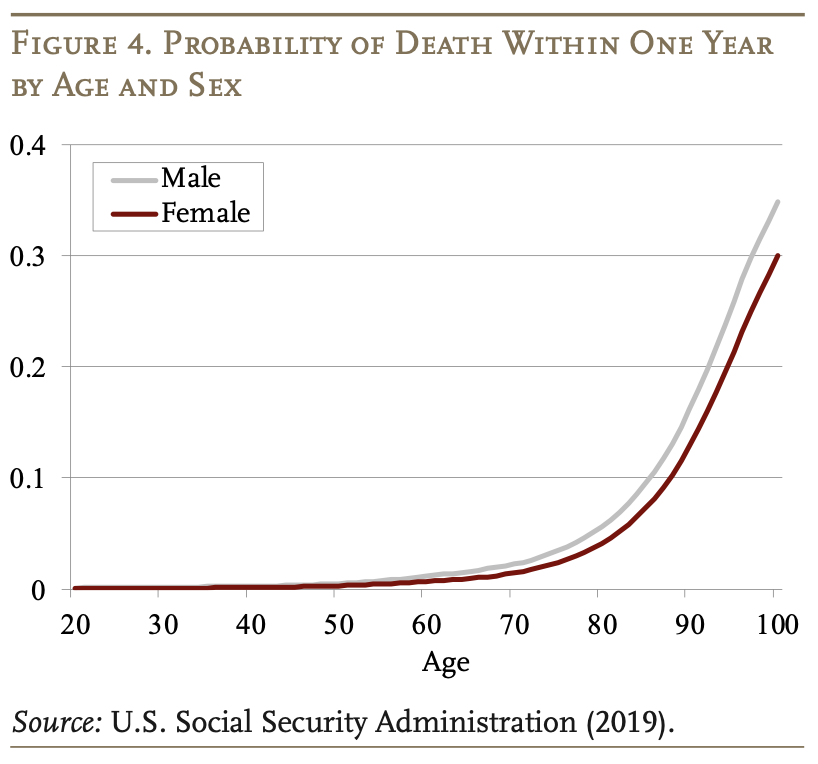

Another explanation for increased rejections centers on increasing mortality risk to borrowers. Mortality risk increases in a dramatic fashion as borrowers age (as shown in the chart below), mirroring the upward trend in mortgage rejection probability. The difference in mortgage rejection probability between men and women becomes larger in old age, which also tracks with divergent mortality risks between men and women in old age. Women generally live longer than males for a variety of health factors. The previously mentioned insufficient collateral issues plaguing older borrowers could be a symptom of lenders simply requiring older borrowers to put up more collateral than younger buyers, to offset increased mortality risk.

The study author also theorizes that increased “insufficient-collateral” mortgage denials among older borrowers could be the result of lenders requiring older borrowers to put up more assets, in order to offset their increased mortality risk over younger borrowers.

How to boost your mortgage approval chances

No matter your age, there are a number of moves you can make to improve your chances to get your mortgage or refinancing application approved.

- Get your credit score in good shape

- Pay off high-interest debt

- Conduct a financial review to identify weak spots in your plan

- Build up your savings for a larger down payment

- Make energy efficient home improvements before refinancing

- Shop around for the best rate and lender to fit your unique financial situation

Getting your financial and physical houses in order first will reduce the number of reasons for a mortgage lender to deploy the dreaded “rejected” stamp.

Editor's note: This article was updated to reflect the fact that mortgage rejection rates generally increase faster after the age of 70, rather than steadily increasing every year after borrowers reach that age.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ben Demers manages digital content and engagement at Kiplinger, informing readers through a range of personal finance articles, e-newsletters, social media, syndicated content, and videos. He is passionate about helping people lead their best lives through sound financial behavior, particularly saving money at home and avoiding scams and identity theft. Ben graduated with an M.P.S. from Georgetown University and a B.A. from Vassar College. He joined Kiplinger in May 2017.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

5 Ways to Shop for a Low Mortgage Rate

5 Ways to Shop for a Low Mortgage RateBecoming a Homeowner Mortgage rates are high this year, but you can still find an affordable loan with these tips.

-

Mortgage Rates and Payments Keep Rising, Creating Market Misery

Mortgage Rates and Payments Keep Rising, Creating Market MiseryMortgages Current mortgage rates and payments continue to rise resulting in buyer demand stalling and housing sentiment at low levels.

-

Is Now a Good Time to Buy a House?

Is Now a Good Time to Buy a House?The last several years have been confusing for potential home buyers. Here are four key questions you can ask yourself to help decide if you’re ready.

-

Low Interest Rates Reduce the Cost of Mortgages

Low Interest Rates Reduce the Cost of Mortgagesreal estate Interest rate reductions triggered by the coronavirus crisis can create money-saving opportunities for mortgage shoppers.

-

2019 Real Estate Report: How Does the Multifamily Market Look?

2019 Real Estate Report: How Does the Multifamily Market Look?Smart Buying If you're considering investing in a multifamily venture, or if you're already in the market, there are challenges and opportunities to watch for in the coming year. From rent trends to supply and cost factors, here's what to expect in 2019.

-

Why Homeowners Are Richer Than Renters

Why Homeowners Are Richer Than Rentersreal estate The reason: You can't help but build savings as you pay down a mortgage.