Things to Consider Before You Refinance Your Mortgage

With mortgage rates hovering near all-time lows, refinancing is on many homeowners’ minds right now. Are you a good candidate?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Refinancing your mortgage simply means you are taking out a new home loan to replace your current mortgage. There are several reasons why someone may want to refinance their mortgage, but most commonly, it is when mortgage interest rates have fallen. By refinancing to a new mortgage with a lower rate, there can be significant savings on your monthly payment.

A good rule of thumb is to start considering refinancing when interest rates have dropped at least a half a percentage point from what you are currently paying.

Once you decide now might be a good time for you to refinance your mortgage, you will want to keep these things in mind as you go through the process.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Get Several Quotes

To make sure you are getting the best possible rate when you refinance, you will want to get quotes from a few different sources. The first place you can look for a quote is your current bank, even if it is the one that your current mortgage is with. Next, you will want to jump on the computer and get a quote from an online bank. Online lenders generally offer lower interest rates and less fees since they save on the normal expenses a brick and mortar bank would have.

Lastly, you should contact a mortgage broker who will work to connect with a lender who will best meet your needs.

What to Watch Out For

Reducing the interest rate on your mortgage and in turn your monthly payment may seem like a no-brainer, but there a few additional things to consider before refinancing. If you are replacing a 30-year mortgage with another 30-year mortgage, you may see a reduced monthly payment, but you may actually pay more over the life of the loan. Refinancing a 30-year mortgage with another 30-year mortgage can add extra years to the amount of time you will repaying the debt. This means you will pay more in interest over the combined lives of both loans than what you expected to pay for the original loan.

A great way to avoid paying this extra interest is to refinance a 30-year mortgage to a 15-year mortgage. By taking on a loan with a shorter term you will pay off your mortgage in fewer payments, reducing the amount of interest you will pay over the life of the loan. However, it is important to note that this strategy will increase your monthly payment, since larger payments will be required to pay off your balance in a shorter amount of time. This can be a terrific strategy for people who have lived in their homes for several years and have strong enough incomes to handle an increase in the monthly payments.

On the other hand, to avoid the fees and hassles of refinancing, it might make sense to keep your existing loan and just pay extra on it to pay it off early. However, you will want to find out if your current loan has a prepayment penalty. Some lenders charge a fee for paying your loan back too early. Depending on the size of the loan and the penalty, it still may make more sense to just stick with your original loan despite the higher interest rate. Truthfully, this is pretty rare, but still something to keep an eye on.

Before you refinance you will want to calculate how much equity you have in the home. This can be done by subtracting your mortgage balance from your home's current value. You can determine your home’s value using several methods but the easiest way is to use online valuation tools offered by lenders or real estate sites such as Zillow. Typically all you have to do is enter your address and their software will give you a rough estimate (keyword is “rough”) based on public records (such as tax assessments) and what similar homes in the area have sold for. Some lenders may allow you to refinance your loan with as little as 5% equity, but you will get a better interest rate if you have 20%+ equity.

Finally, while preparing to refinance it could also be a good idea to spend a few months working to improve your credit score. The higher your credit score, the lower the interest rate you will be offered from creditors. If you are considering refinancing to lower your interest rates to begin with, you might as well put in the work to raise your credit score to get as low of a rate as possible. Taking the time to do this could save you thousands of dollars in interest.

Costs to Consider

Refinancing your mortgage comes with many of the same fees that were charged for your original mortgage. These can include origination fees, taxes, an appraisal and others. Some lenders may charge these upfront, while others may roll them into the loan balance or raise the interest rate to compensate for these fees. Deciding whether it makes sense to pay these fees to refinance comes down to several factors: the total amount of the fees, how much you are saving in your monthly payment by refinancing, and how long you expect to continue living in your home.

A simple calculation can be used to decide whether these costs are worth it. First, subtract your new expected monthly payment from your current monthly payment. This is the amount you will save on a monthly basis by refinancing to a lower rate. Next, take the total cost of the fees and divide it by the monthly savings you just calculated. This shows you the number of months you will need to live in the house to break even on the costs of refinancing. If you do not expect to live in your home for that many months, you are better off sticking with your original loan.

Here is an example of what this calculation would look like:

Let’s say you are refinancing a 30-year mortgage with an original loan amount of $275,000, a current loan balance of $250,000 and an interest rate of 4.25%. You plan to replace this loan with a new 30-year mortgage with a loan amount of $250,000 and an interest rate of 3.25%.

Your monthly payment of the original loan is $1,353. Your new payment after refinancing would be about $1,197. This results in a monthly savings of $156.

Let’s assume the total fees of the new loan (including application fee, origination fee, appraisal, etc.) come out to 1.5% of the amount of the new loan. Based on the $250,000 loan, these fees would equal $3,750. Therefore, you would need to continue living in your home for about two years ($3,750 ÷ $156 = 24.04 months) for the refinance to be worth it.

Another important factor, if you are already five years into your mortgage — say, you’ve paid five years on a 30-year loan, meaning you have 25 years left — your goal should be to keep your new loan to that same duration (or less). So, if you can’t swing the higher payments of a 15-year mortgage when you refinance, go for a new 30-year mortgage … but plan to pay it off in 25 years or less by paying extra each month.

Have a Plan

Before you ultimately decide to refinance, it's crucial to have a plan you have thought through. There is clearly a lot to consider, and having a plan will help with that. A good starting point would be to think through how long you intend to live in your home. If you plan on moving in the next few years you can stop the process there, because the cost of refinancing will likely outweigh the benefit.

From there, you can dig deeper into the numbers to determine whether refinancing would truly be worth it. And finally, make sure you have a plan for what you want to do with the extra cash you could generate by lowering your payments through refinancing, otherwise that money will likely just be spent and you will be no better off than you were with the original loan!

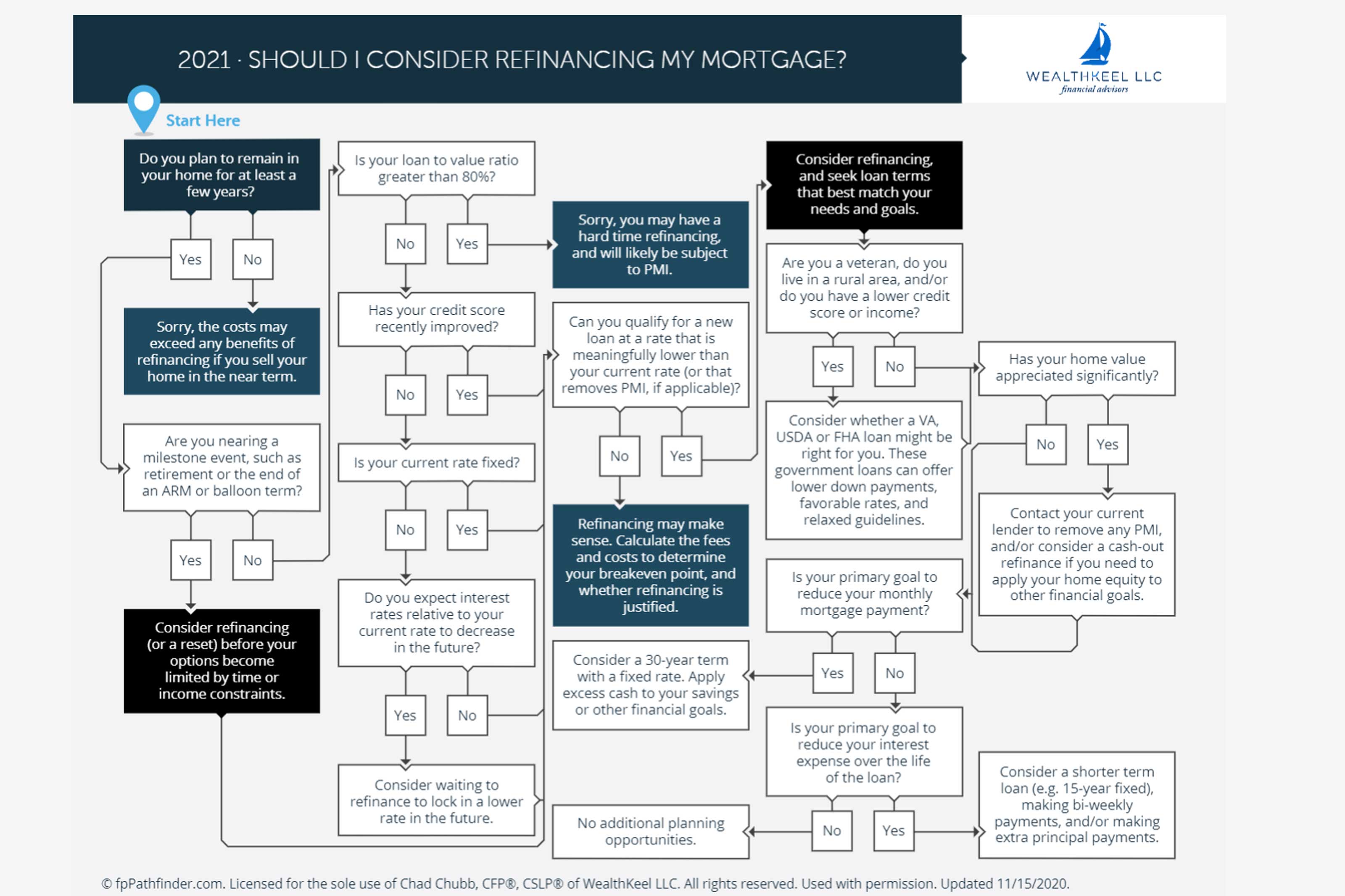

To help with your decision-making process, here is an easy-to-follow flowchart (and for a full size image, please click here).

Financial planning and advisory services offered through Vicus Capital Inc., a federally registered investment adviser. Any information contained in this article is not intended to serve as personalized investment advice. To the extent that you have any questions regarding a specific issue discussed, please consult with a financial professional.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Chad Chubb is a Certified Financial Planner™, Certified Student Loan Professional™ and the founder of WealthKeel LLC. He works alongside Gen X & Gen Y physicians to help them navigate the complexities of everyday life by crafting streamlined financial plans that are agile for his clients' evolving needs. He helps them utilize their wealth to free up time and energy to focus on their family, their practice and what they love most.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.