Kiplinger Readers' Choice Awards 2025: Peer-to-Peer Apps

The winners of the Kiplinger Readers’ Choice Awards' best peer-to-peer apps category.

Lisa Gerstner

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

About the Kiplinger Readers’ Choice Awards 2025

The Kiplinger Readers’ Choice Awards aim to recognize and celebrate the best products and services in the personal finance arena. We asked you, our Kiplinger community, to help us name the products and services you think have delivered excellent value in the past year.

The survey results, which we’re sharing here in our second annual Readers’ Choice Awards, offer valuable insight into which providers shine when it comes to your everyday interactions and experiences with them. Our Awards recognize excellence in everything from credit cards, banks and brokers to insurers, tax software and financial apps. For each category, we’ve listed an overall winner that earned the highest score. We’ve also highlighted other products and services that earned above-average scores for various criteria we asked readers to assess.

By voting, our community has helped us form our guide to the very best financial products. These are the products and companies that you think stand out from the crowd.

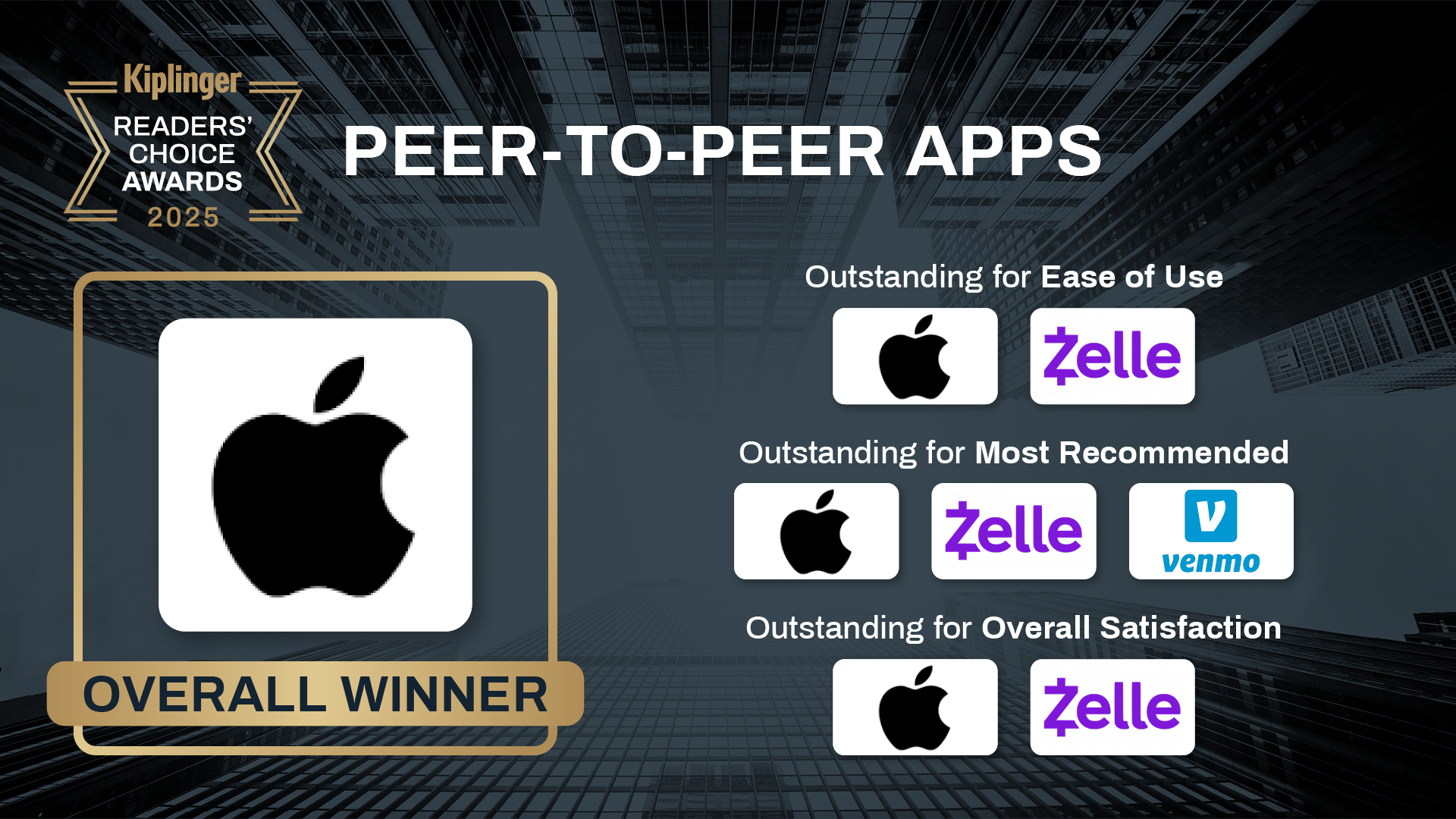

Kiplinger Readers' Choice Awards: Peer-to-Peer Apps

Peer-to-peer payment apps allow you to digitally send and receive money with friends and family from your smartphone. We asked readers to evaluate their preferred payment app’s ease of use, their overall satisfaction with it and how likely they are to recommend it to others.

OVERALL WINNER: Apple Cash

Outstanding for:

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

- Ease of use

- Most recommended

- Overall satisfaction

Apple Cash topped the charts this year as readers’ favorite peer-to-peer payment tool, earning above-average scores for all three surveyed criteria. To use Apple Cash for a peer-to-peer payment, tap the Apple Pay icon in an iPhone’s Messages app, enter the amount, and authenticate using Face ID, Touch ID, or your passcode.

“Overall, my experience is positive,” says one reader. There are no fees for transferring money out of your Apple Cash balance if you select a standard transfer, which takes one to three days.

For an instant transfer, a 1.5% fee applies, with a minimum of 25 cents and there's a maximum charge of $15 per transaction.

Zelle

Outstanding for:

- Ease of use

- Most recommended

- Overall satisfaction

Zelle also earned high marks all around. The service no longer has a standalone app, but if your financial institution offers Zelle, you can use it through your banking app to easily make transfers from one checking account to another.

“I prefer Zelle because it’s direct,” says one reader. “I love using Zelle,” says another. “Zelle is very straightforward and easy to use. Plus, it is really fast in sending and receiving funds.” Typically, Zelle transfers are instant and require no transfer fees.

Venmo

Outstanding for:

- Most recommended

Readers who use Venmo noted its popularity among their friends and family members. The app has about 90 million users, according to parent company PayPal.

Venmo offers two options for transferring money from your Venmo balance to your bank account: instantly for a fee of 1.75% of the transfer amount (with a minimum of 25 cents and a maximum of $25), or a standard transfer, which comes with no fee but takes one to three business days.

Kiplinger Readers' Choice Awards 2025 Awards Categories

- Readers' Choice Full-Service Brokers

- Readers' Choice Wealth Management

- Readers' Choice Cash Back Credit Cards

- Readers' Choice Travel Rewards Credit Cards

- Readers' Choice Airline Credit Card Rewards Programs

- Readers' Choice Hotel Credit Card Rewards Programs

- Readers' Choice National Banks

- Readers' Choice Internet Banks

- Readers' Choice Auto Insurance Companies

- Readers' Choice Homeowners Insurance Companies

- Readers' Choice Annuity Providers

- Readers' Choice Tax Software

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Emma Patch joined Kiplinger in 2020. She previously interned for Kiplinger's Retirement Report and before that, for a boutique investment firm in New York City. She served as editor-at-large and features editor for Middlebury College's student newspaper, The Campus. She specializes in travel, student debt and a number of other personal finance topics. Born in London, Emma grew up in Connecticut and now lives in Washington, D.C.

- Lisa GerstnerEditor, Kiplinger Personal Finance magazine

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)February gets a bad rap for being the month when resolutions fade — in fact, it's the perfect time to reset and focus on small changes that actually pay off.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

My Spouse and I Are Saving Money for a Down Payment on a House. Which Savings Account is the Best Way to Reach Our Goal?

My Spouse and I Are Saving Money for a Down Payment on a House. Which Savings Account is the Best Way to Reach Our Goal?Learn how timing matters when it comes to choosing the right account.

-

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

Why Most Millionaires Don't Feel Wealthy — and What It Really Takes to Feel Financially Secure

Why Most Millionaires Don't Feel Wealthy — and What It Really Takes to Feel Financially SecureA growing share of Americans reach millionaire status yet still worry about money. Here's why wealth feels different today and how to build true financial confidence.

-

You Could Be Overpaying for Internet. Here’s How to Choose the Right Type

You Could Be Overpaying for Internet. Here’s How to Choose the Right TypeFiber, cable, 5G wireless and satellite internet all offer different speeds, reliability and price points. Understanding the differences could help you lower your monthly bill or improve performance.