TikTok 'Door Knock Challenge': The Risky Viral Trend Putting Homeowners on Edge

Learn more about the challenge going viral on TikTok that could cost you more than just sleep.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

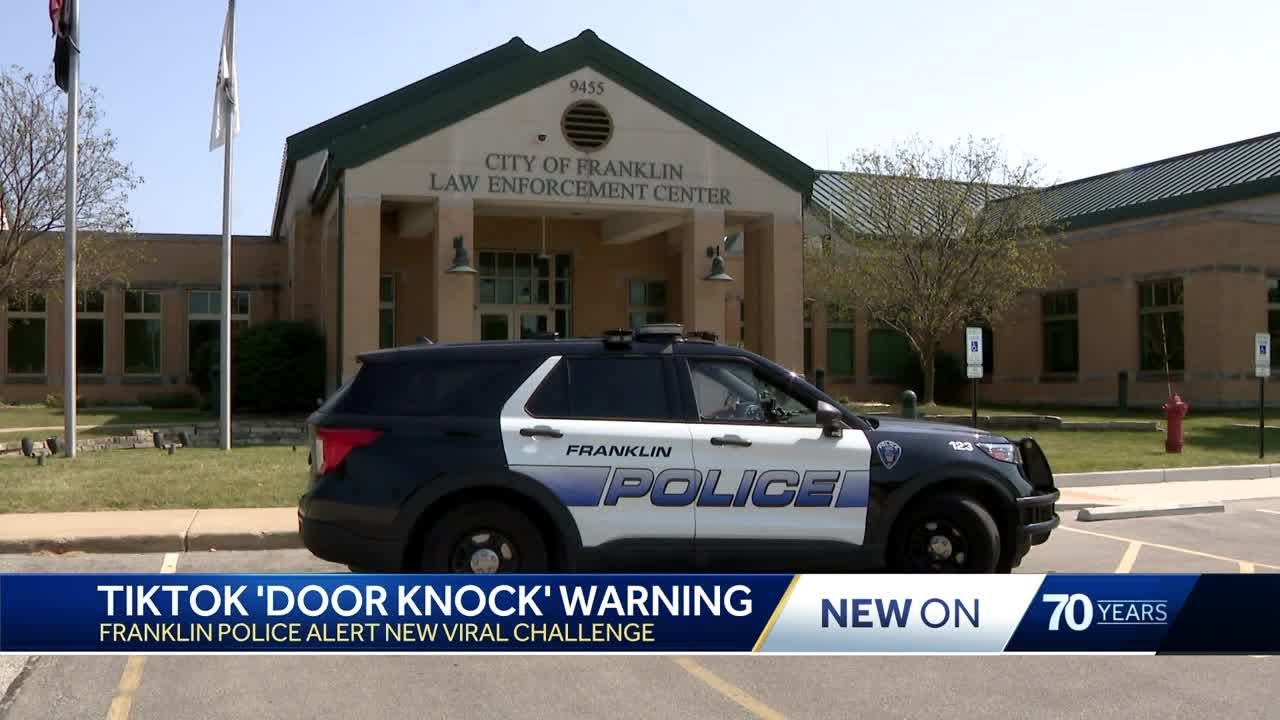

Social media trends come and go, but some can have real financial and security implications. The latest viral trend on TikTok — the 'Door Knock Challenge' — has many homeowners on edge.

The challenge is simple, social media influencers kick, knock and bang on random doors, sometimes in the middle of the night, then run away while filming reactions. While it may seem like a harmless prank, the trend raises serious concerns about safety, liability and home security.

Some homeowners have reported broken doorbells, damaged security cameras and even cracked doors from aggressive kicking. Others worry that startled homeowners, particularly in states with strong self-defense laws, might respond forcefully, leading to dangerous confrontations for homeowners and pranksters alike.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

What to do if you experience the door knock challenge

The loud, unexpected banging or kicking on your door — especially in the middle of the night — can be deeply unsettling. It may leave you feeling startled, anxious and fearful for your safety. To help you stay prepared and respond effectively, here are a few key steps to take if you experience a door knock incident:

- Document the incident. If you have a doorbell camera or home security system, save the footage immediately, as video evidence can be crucial if you need to report the incident or file an insurance claim. If you don’t have camera footage, take note of the date, time and any details you can recall, such as suspicious activity or individuals in the area.

- Report it to local law enforcement. If your property has been damaged or you feel unsafe, filing a police report is essential. Authorities should be aware of these incidents so they can help prevent them in your community.

- Check your homeowners insurance policy. If your home sustains damage, review your policy to determine what is covered. Many policies include protection against vandalism or malicious mischief, but you will likely need documentation, such as a police report and any available photo and video evidence, when filing a claim.

- Stay vigilant. Let your neighbors and local community groups know about the challenge so they can stay alert. You may also want to enhance your home security by upgrading your doorbell camera, installing motion-sensor lighting or reinforcing entry points to help deter potential threats.

Protecting your home: Security measures to consider

Investing in or upgrading smart home devices and security systems is a proactive step toward protecting your property.

These solutions not only enhance your safety but also serve as a strong deterrent against pranksters and potential intruders. Here are some security measures that can help safeguard your home:

Video doorbells - Devices like the Ring video doorbell or Google Nest doorbell allow homeowners to monitor activity at their doorstep in real time. These cameras can provide a live feed to your phone, record unexpected visitors and feature two-way audio, enabling you to communicate with someone at your door without opening it. If you have an existing doorbell, installation is often simple and can be done by yourself or a handyman.

For renters or those who prefer a non-permanent option, the Blink video doorbell has high-quality 1080p HD video, motion detection alerts and a rechargeable battery. It works with Alexa, requires no screws and won’t damage your door, making it a great choice for rental properties.

Home security systems - Comprehensive home security systems like those offered by SimpliSafe and ADT can add an additional layer of protection with motion sensors, alarms and professional monitoring services that can alert authorities if suspicious activity is detected.

While some systems require professional installation and a monthly service fee, upgrading your home security could qualify you for a discount on your homeowners insurance. It’s worth checking with your provider to see if you’re eligible for savings.

Motion-activated lights - Bright outdoor lighting can deter pranksters and potential intruders. The Blink floodlight camera provides 2600 lumens of illumination, enhanced motion detection and a built-in siren for added security. For a combination of safety and style, the Good Earth floodlight delivers 7000 lumens while maintaining a sleek, aesthetically pleasing look.

Solar-powered floodlights offer a low-maintenance solution to brighten dark areas around your home and property line, enhancing security without increasing energy costs.

Smart Locks and secure entryways - Ensuring your home is secure while you're away can provide peace of mind. Smart locks like the Kwikset Halo Keyless Entry Smart Lock and the Schlage Encode Century Smart Lock offer keyless entry and remote access control, allowing you to monitor and manage your home’s security from anywhere.

For added protection at your entryway, consider installing a door reinforcement lock for under $50 to further strengthen your home’s security.

The bottom line

While social media challenges may seem like harmless fun to some, they can pose serious risks for homeowners and the influencers who attempt them. Investing in home security measures can provide peace of mind while away and help prevent property damage, unexpected costs and potential legal issues. When it comes to security, it’s always better to be proactive than reactive.

related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Carla Ayers joined Kiplinger in 2024 as the eCommerce and Personal Finance Editor. Her professional background spans both commercial and residential real estate, enriching her writing with firsthand industry insights.

Carla has worked as a personal finance and real estate writer for Rocket Mortgage, Inman and other industry publications.

She is passionate about making complex real estate and financial topics accessible to all readers. Dedicated to transparency and clarity, her ultimate goal is to help her audience make informed and confident decisions in their financial pursuits.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

My Spouse and I Are Saving Money for a Down Payment on a House. Which Savings Account is the Best Way to Reach Our Goal?

My Spouse and I Are Saving Money for a Down Payment on a House. Which Savings Account is the Best Way to Reach Our Goal?Learn how timing matters when it comes to choosing the right account.

-

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

Why Most Millionaires Don't Feel Wealthy — and What It Really Takes to Feel Financially Secure

Why Most Millionaires Don't Feel Wealthy — and What It Really Takes to Feel Financially SecureA growing share of Americans reach millionaire status yet still worry about money. Here's why wealth feels different today and how to build true financial confidence.

-

You Could Be Overpaying for Internet. Here’s How to Choose the Right Type

You Could Be Overpaying for Internet. Here’s How to Choose the Right TypeFiber, cable, 5G wireless and satellite internet all offer different speeds, reliability and price points. Understanding the differences could help you lower your monthly bill or improve performance.

-

My First $1 Million: Retired From Real Estate, 75, San Francisco

My First $1 Million: Retired From Real Estate, 75, San FranciscoEver wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.