Who Are the Worst Tippers?

Who are the worst tippers? A new study found that while most Americans have a negative view of tipping, some are tipping worse than others.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If you find yourself experiencing tip fatigue, you’re not alone. Nearly 3 in 5 U.S. adults (59%) have a negative view of tipping, and 35% of Americans believe tipping has "gotten out of control," according to a recent study from Bankrate. The study, which questioned 2,445 U.S. adults from April 29 to May 1, 2024, also found which groups of people tip the most versus who tips the least.

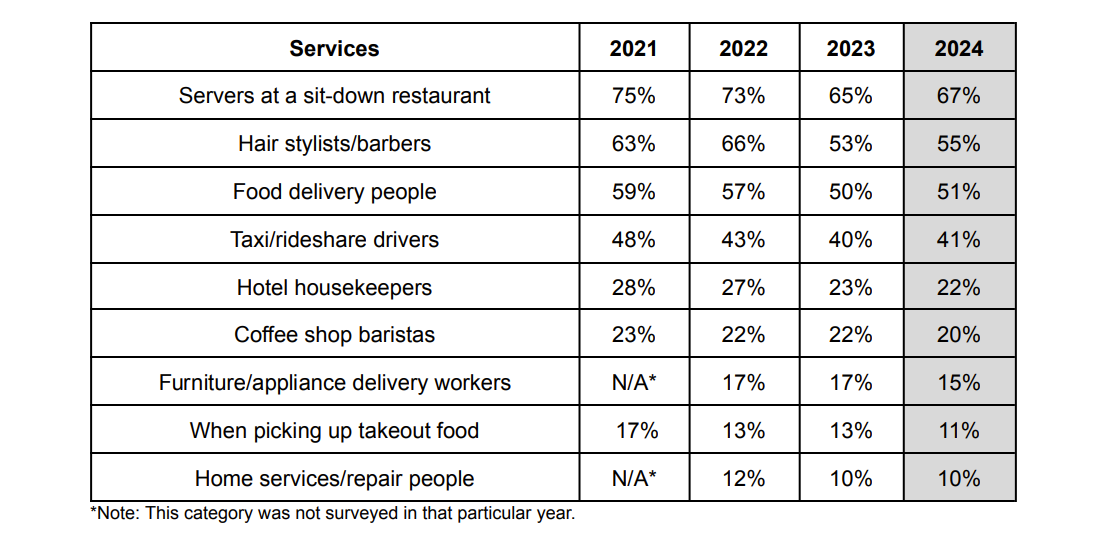

So while people are still leaving tips, who they tip, and how much, depends on several factors, including quality of service, complexity of order and service and wait times. According to Bankrate, 55% of adults always leave a tip or gratuity for hair stylists, compared to only 20% for baristas and 11% when picking up take-out.

There is one apparent certainty, though: "Tipping is a hot-button issue that doesn’t seem to be going away anytime soon.” says Ted Rossman, senior industry analyst at Bankrate.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Changes in tipping

Since 2023, the percentage of people who always tip in certain categories has fluctuated. Between 2023 and 2024, there's been an increase in the number of people always tipping in the following categories.

- Servers at a sit-down restaurant: 67%; up from 65%

- Hair stylists/barbers: 55%; up from 53%

- Food delivery people: 51%; up from 50%

- Taxi/rideshare drivers: 41%; up from 40%

And a decrease in the number of people always tipping in these categories.

- Hotel housekeepers: 22%; down from 23%

- Coffee shop baristas: 20%; down from 22%

- Furniture/appliance delivery workers: 15%; down from 17%

- When picking up takeout food: 11%; down from 13%

However, despite the increases from 2023 to 2024, if you compare these numbers to data from 2021, you'll notice an overall decrease. For example, while the number of individuals who always tip their server at sit-down restaurants has increased from 2023, going from 65% to 67%, it's still down from 73% in 2022, 75% in 2021 and 77% in 2019.

Negative views on tipping

Overall, Americans view tipping negatively for a number of reasons. Mark Hamrick, Bankrate senior economic analyst told Kiplinger: “In the past couple of years, consumers across all categories have been slammed by high and sustained inflation. In some cases, individuals may be deciding to be more or less generous with their tips as they try to manage through these financial headwinds.”

Here’s a breakdown of why people view tipping in a negative light, according to Bankrate.

- 37% believe businesses should pay their employees better, rather than relying so much on tips.

- 35% believe that tipping culture has gotten out of control.

- 34% are annoyed about the pre-entered tip screens they encounter at coffee shops, food trucks and elsewhere.

- 14% would be willing to pay higher prices in order to do away with tipping.

- 11% are confused about who and how much to tip.

Out of the 35% who feel that “tipping culture” has gotten out of control, this is mostly a view held among older generations, with 46% of baby boomers and 40% of Gen X agreeing with the sentiment, compared to only 23% of Gen Z and 27% of millennials.

Who are the worst tippers?

Last year, Bankrate's 2023 tipping study found that surprisingly, the worst tippers across multiple service categories were Gen Zers (ages 18-26), millennials (ages 27-42) and men.

The 2024 study yielded similar results. When it comes to sit-down restaurants, 71% of women and only 63% of men always tip. 35% of Gen Zers always tip when dining in, compared to 56% of millennials, 78% of Gen Xers and 86% of baby boomers.

“Those who are just starting out with their personal financial journeys, including careers, very often have less resources and flexibility with their money," Hamrick told Kiplinger. "By contrast, very broadly speaking, those who are more senior tend to have more established careers as well as more savings both for emergencies and retirement,”

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Erin pairs personal experience with research and is passionate about sharing personal finance advice with others. Previously, she was a freelancer focusing on the credit card side of finance, but has branched out since then to cover other aspects of personal finance. Erin is well-versed in traditional media with reporting, interviewing and research, as well as using graphic design and video and audio storytelling to share with her readers.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

My Spouse and I Are Saving Money for a Down Payment on a House. Which Savings Account is the Best Way to Reach Our Goal?

My Spouse and I Are Saving Money for a Down Payment on a House. Which Savings Account is the Best Way to Reach Our Goal?Learn how timing matters when it comes to choosing the right account.

-

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

My First $1 Million: Retired From Real Estate, 75, San Francisco

My First $1 Million: Retired From Real Estate, 75, San FranciscoEver wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

To Love, Honor and Make Financial Decisions as Equal Partners

To Love, Honor and Make Financial Decisions as Equal PartnersEnsuring both partners are engaged in financial decisions isn't just about fairness — it's a risk-management strategy that protects against costly crises.

-

Top 5 Career Lessons From the 2026 Winter Olympics (So Far)

Top 5 Career Lessons From the 2026 Winter Olympics (So Far)Five lessons to learn from the 2026 Winter Olympics for your career and finances.