Stock Market Today: Dow Officially Enters a Bear Market After Monday's Slide

Casino stocks were a pocket of strength after Macau said it will ease COVID-related travel restrictions in November.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

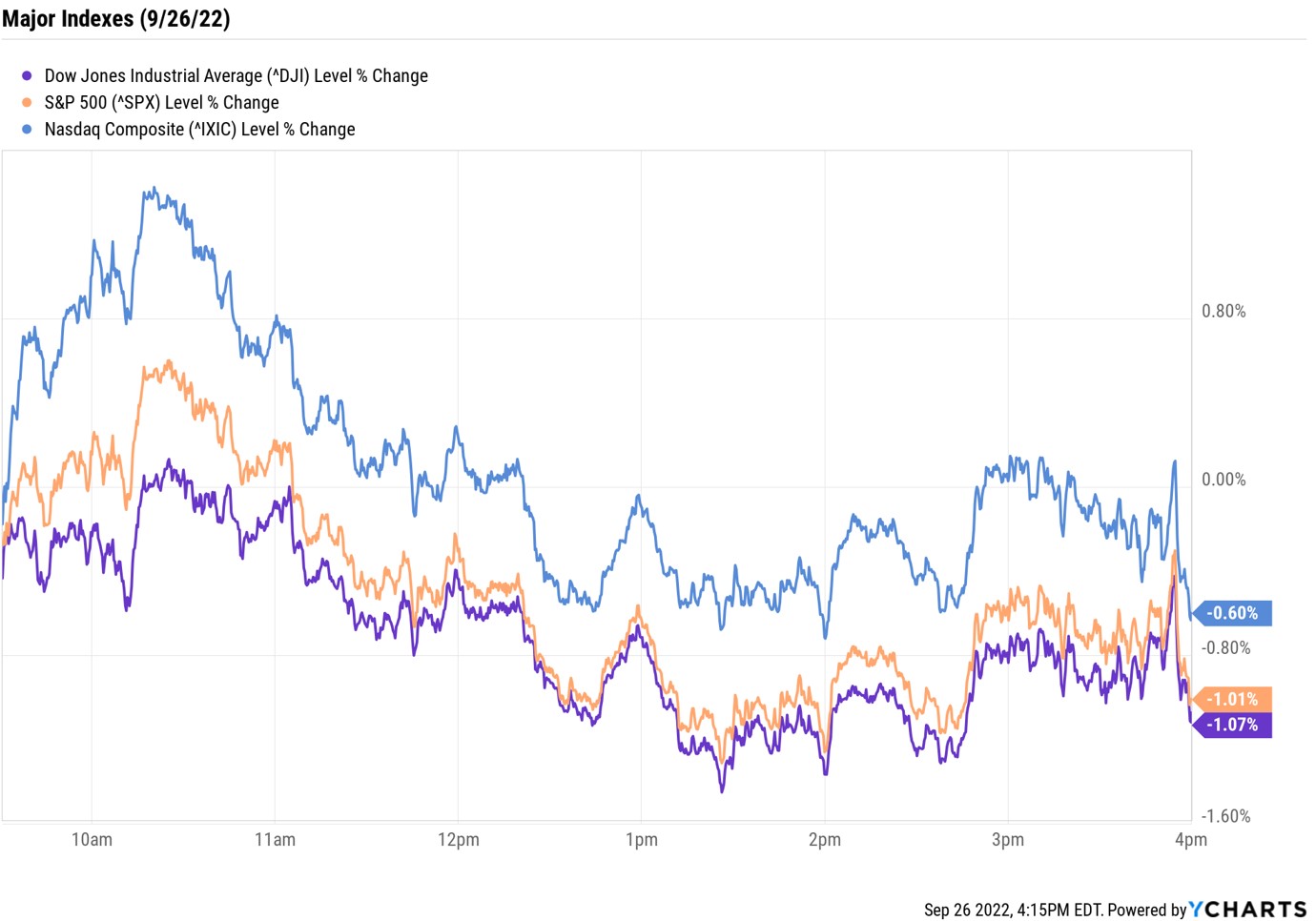

Selling in the stock market picked right back up Monday, and despite a brief mid-morning push into positive territory, the major indexes still ended lower.

"Despite a quiet global economic data front, this weekend and Monday morning have been anything but quiet as global yields are surging to record highs," said Stefanos Bazinas, execution strategist at the New York Stock Exchange. Indeed, both the 2-year Treasury yield (+10.5 basis points to 4.319%) and the 10-year Treasury yield (+20.3 basis points to 3.90%) continued to climb, hitting levels not seen in over a decade.

And this, Bazinas says, comes after the U.K. last week announced the biggest tax cuts in more than 50 years and indicated more were to come. This sent the British pound to an all-time low against the U.S. dollar earlier today. The dollar, for its part, hit its highest level since early 2002.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Most sectors finished lower, led by sharp losses for real estate (-2.7%) and utility (-2.4%) stocks. And while consumer discretionary (-0.2%) also ended in the red, its loss wasn't nearly as deep thanks to strength in Las Vegas Sands (LVS, +11.8%) and Wynn Resorts (WYNN, +12.0%). The casino stocks rallied after Macau, a huge destination for Asian gambling, said it is planning on relaxing COVID-related travel restrictions as soon as November.

As for the major indexes, the Dow Jones Industrial Average ended the day down 1.1% at 29,260, falling into its first bear market since 2020. The S&P 500 Index (-1.0% at 3,655) and the Nasdaq Composite (-0.6% at 10,802) also finished the day notably lower.

Other news in the stock market today:

- The small-cap Russell 2000 fell 1.4% to 1,655.

- U.S. crude futures slumped 2.6% to end at $76.71 per barrel.

- Gold futures shed 1.3% to settle at $1,633.40 an ounce.

- Bitcoin gained 1.9% to $19,186.36. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- News that Beijing will extend a tax break on electric vehicles (EVs) through the end of 2023 boosted several U.S.-listed Chinese EV stocks. Li Auto (LI, +5.6%) and Xpeng (XPEV, +4.8) were among the biggest gainers.

- Planet Fitness (PLNT) rose 1.2% after Raymond James analyst Joseph Altobello upgraded the fitness chain to Strong Buy from Market Perform (Neutral). "Our bullish stance on the shares of Planet Fitness reflects the company's highly resilient business model and value gym positioning, ample store growth opportunity (just over halfway toward its current 4,000 stores target in the U.S.), and what we believe is an attractive valuation," Altobello says. The analyst points to PLNT's "recession-resistant business model" and healthy growth opportunity in 2023. "Further, PLNT has no interest rate risk and very little near-term debt maturities, while current valuation is well below its recent historical average," he adds.

The Pros' Favorite Retail Stocks Right Now

There's a lot that to look forward to in October, including an early start to the holiday shopping season. Amazon.com (AMZN) will kick things off by hosting a second Prime Day mid-month, called Amazon Prime Early Access.

It's been a rough year for the retail sector amid several headwinds, including stubbornly high inflation, slowing demand and excess inventory. However, in spite of these hurdles, consumer spending has stayed steady, as evidenced by an unexpected rise in retail sales last month. "August retail sales show consumers' resiliency to spend on household priorities despite persistent inflation and rising interest rates," says Matthew Shay, president and CEO of the National Retail Federation. "As we gear up for the holiday season, consumers are seeking value to make their dollars stretch." In other words, consumers are willing to spend, but will seek out the best deals to get the most bang for their buck.

As for investors, they can find plenty of deals in both the consumer discretionary and consumer staples sectors at the moment. For a short list of the best retail stocks around, consider these five picks, each of which sports top ratings from Wall Street analysts.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market Today

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market TodayMarket participants had plenty of news to sift through on Friday, including updates on inflation and economic growth and a key court ruling.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.