Stock Market Today: FedEx Warning Amplifies Wall Street Jitters

The delivery giant said its fiscal Q1 results will come in lower than expected and withdrew its full-year guidance as demand slows.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

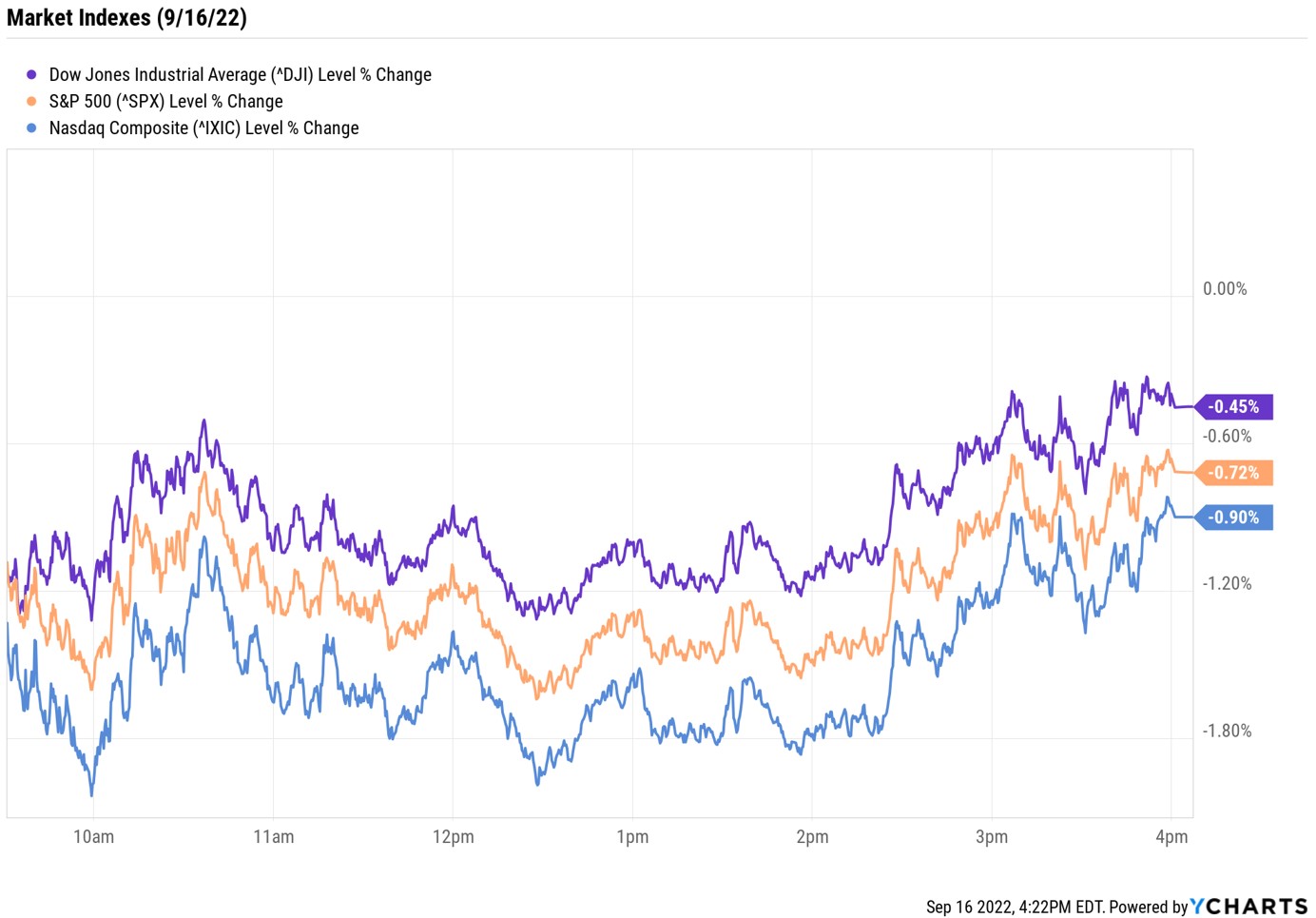

Stocks capped off a terrible week with another slide as a warning from one of Wall Street's bellwether firm's stoked concern about the U.S. economy.

After Thursday's close, delivery giant FedEx (FDX, -21.4%) – whose financial results are often seen as a read on broader economic conditions – issued preliminary fiscal first-quarter earnings and revenue figures that were well below estimates. The company cited a recent acceleration in "global volume softness," and specifically pointed to "macroeconomic weakness in Asia and service challenges in Europe." FDX also withdrew its outlook for the full fiscal year, and said it is initiating several cost-cutting measures to offset the effects of lowered demand, including deferring staff hiring, closing 90 FedEx office locations and ending Sunday operations for several FedEx Ground locations. The company is slated on the earnings calendar to report its full quarterly results after next Thursday's close.

Wall Street's nerves were already frayed ahead of FedEx's financial warning, as this week's red-hot inflation reading all but assured another large rate hike from the Federal Reserve at next week's meeting. But an additional contributing factor to this week's massive volatility is likely today's quadruple-witching options expiration, which is when index futures, index options, stock options and individual-stock futures all expire at once. This happens four times a year – on the third Friday in March, June, September and December – and sometimes leads to heavy volume and erratic moves in parts or all of the market.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

At the close, the Nasdaq Composite was down 0.9% at 11,448, the S&P 500 Index was off 0.7% at 3,873, and the Dow Jones Industrial Average was 0.5% lower at 30,822. All three indexes suffered significant weekly losses.

Other news in the stock market today:

- The small-cap Russell 2000 fell 1.5% to 1,798.

- U.S. crude futures eked out a modest gain to end at $85.11 per barrel.

- Gold futures rose 0.4% to finish at $1,683.50 an ounce.

- Bitcoin slipped 0.9% to $19,629.81. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- International Paper (IP, -11.2%) and Packaging Corporation of America (PKG, -11.0%) plunged after Jefferies analyst Philip Ng downgraded the packaging stocks to Underperform, the equivalent of Sell. The downgrade reflects "the massive inventory glut in containerboard, with our checks indicating orders decelerating sharply & broad based downtime taken even by the smaller players," Ng writes in a note. "Our contacts believe a fourth-quarter price cut is imminent, and considering the 5%-6% of new capacity slated to come online the next 12 months have yet to impact the mkt, conditions could worsen in 2023."

- Growth stocks were some of the biggest decliners today, with Meta Platforms (META, -2.2%), Twilio (TWLO, -4.8%) and Snowflake (SNOW, -6.1%) seeing big declines.

Why Low-Volatility Funds Could Be a Good Strategy

Don't be discouraged. Yes, it's a difficult time for the stock market – and there's likely more volatility to come. But investing is a marathon, not a sprint, and there are ways to ride out the storm. Most recently, we've mentioned the use of quality income-paying stocks, like the Dividend Kings or Dividend Aristocrats, all of which have decades of consistent dividend growth under their belts.

But given this week's panic-selling, it seems like an opportune time to revisit low-volatility strategies. "Minimum volatility is a defensive bet," says Huw Roberts, head of analytics at data research firm Quant Insight. "The whole aim is to keep people invested in the market, but targets stocks that aren't as volatile or don't always behave in the same way as the overall index (say the S&P 500)." Huw adds that for those "worried about inflation, Fed rate hikes etc.," taking this route might be a good strategy. Here, we've compiled 10 low-volatility funds that could give investors peace of mind over the long run. Check them out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.