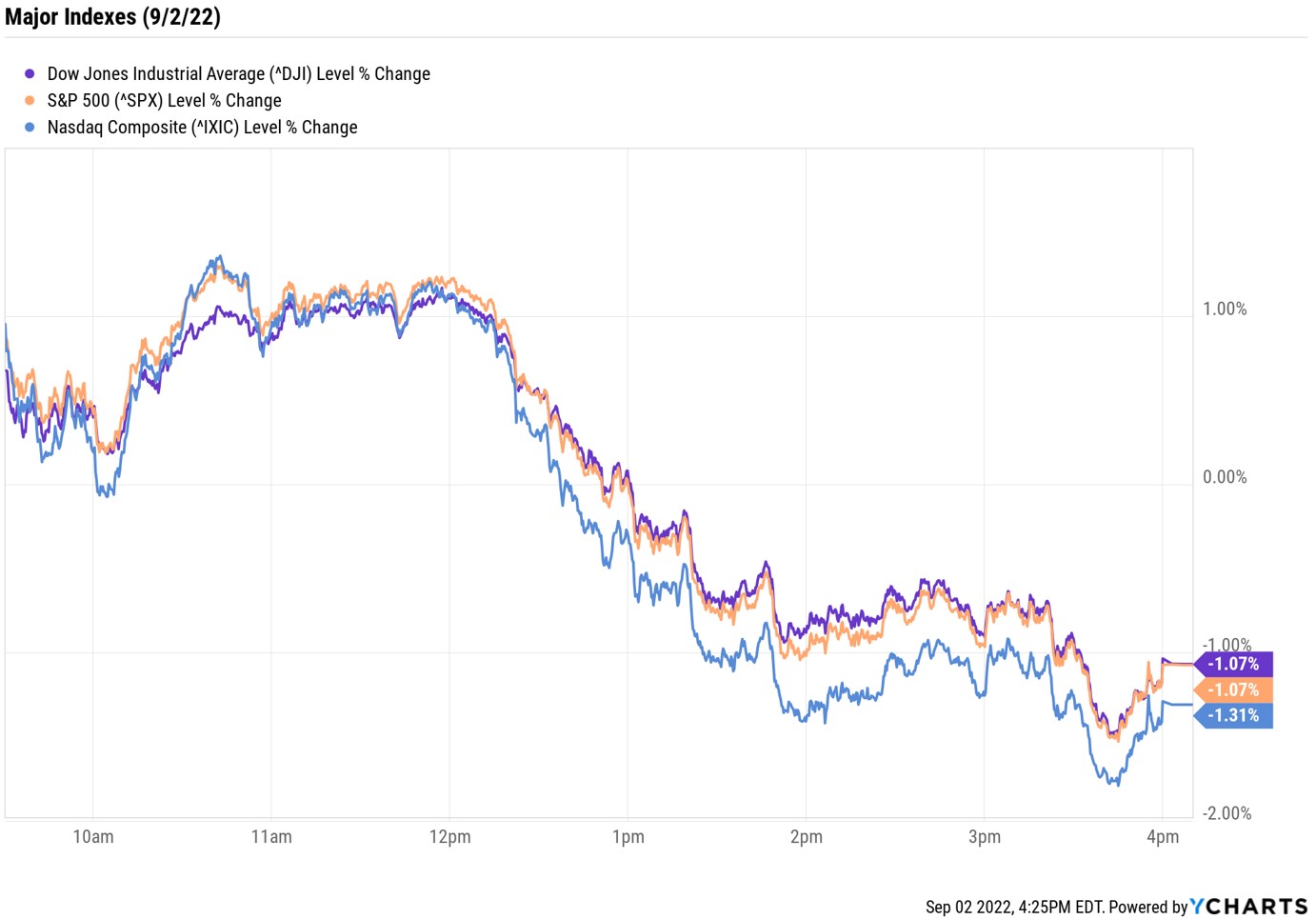

Stock Market Today: Stocks Swing Lower as Early Jobs-Fueled Rally Fizzles

The major indexes all rose more than 1% after data showed job growth slowed in August, but erased those gains by the close.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks jumped out of the gate Friday after the release of the August jobs report. But enthusiasm from the few investors that stuck around ahead of the long holiday weekend didn't last, with all three indexes ending in the red.

The Labor Department this morning said the U.S. added 315,000 new jobs in August, well below July's 526,000. Also in the jobs report: the unemployment rate edged up to 3.7% from 3.5%; the labor participation rate, or the number of people actively seeking work, improved to 62.4% from 62.1%; and average hourly earnings – a key measure of labor cost inflation – was up 5.2% year-over-year, same as it was in July.

"Friday's jobs data provided some moderate relief, with payrolls almost landing precisely on consensus at +315,000 in August," says Douglas Porter, chief economist at BMO Capital Markets." While no doubt a solid advance – and completely inconsistent with recession chatter – other aspects of the report sent some calming signals." Porter points to steady wage growth, an increasing labor force and the rising unemployment rate that suggest "the extreme tightness in the job market may be beginning to moderate – almost exactly what the Fed doctor ordered."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Still, the major indexes, after being up more than 1% each around lunchtime, swung lower in afternoon trading after news reports indicated Russian energy giant Gazprom will indefinitely suspend operations of a natural-gas pipeline to Germany.

By the close, the Nasdaq Composite was down 1.3% at 11,630, bringing its daily losing streak to six. The S&P 500 Index (-1.1% at 3,924) and the Dow Jones Industrial Average (-1.1% at 31,318) also finished in negative territory. All three indexes were lower for a third consecutive week.

As a reminder, the stock market is closed this Monday, Sept. 5, in observance of Labor Day.

Other news in the stock market today:

- The small-cap Russell 2000 droppped 0.7% to 1,809.

- U.S. crude futures edged up 0.3% to $86.87 per barrel today, but still finished 6.7% lower on the week.

- Gold futures rose 0.8% Friday to settle at $1,722.60 an ounce, but gave back 1.6% on a weekly basis.

- Bitcoin ticked 0.1% higher to $19,900.05. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Starbucks (SBUX) fell 2.9% after the coffee-shop chain said it has appointed Laxman Narasimhan as its new CEO. Narasimhan is the former CEO of U.K. consumer brands company Reckitt Benckiser Group (RBGLY). He is slated to start at Starbucks on Oct. 1, before completely taking over the reins from interim CEO Howard Schultz next spring. "Defying expectations for someone on the board or formerly in Starbucks management to take the helm, Starbucks instead tapped an outsider to lead the company," says William Blair analyst Sharon Zackfia. The analyst has an Outperform rating on SBUX, which is the equivalent of a Buy, "given ongoing healthy domestic demand, the global strength of the brand (and concurrent pricing power), and healthy balance sheet."

- Lululemon Athletica (LULU) jumped 6.7% after the athletic apparel maker reported earnings. In its second quarter, LULU brought in earnings of $2.20 per share on revenue of $1.9 billion, easily beating analysts' consensus estimates. The company also said same-store sales were up 28% in the three-month period. "Lululemon has a strong brand and growing direct-to-consumer sales, which we expect will lead to higher margins over the next several years," says Argus Research analyst John Staszak. "Despite headwinds, we expect the company’s momentum to continue." Staszak says that even though inventory was up 85% in Q2, the company "sells a higher percentage of its products at full price than its competitors and should not have to cut its prices in order to move its inventory." He adds that LULU's prospects "are among the best in the apparel sector."

Why Investors Should Consider Dividend Stocks

Today's jobs data is certainly an important factor in the Fed's rate-hike plans, but it's arguably not the most important one. The August consumer price index (CPI), which is set for release on Sept. 13, "will remain key for how the Fed weighs its decision regarding the magnitude of the September hike," says Luke Tilley and Rhea Thomas, chief economist and senior economist, respectively, at Wilmington Trust. "The outlook for inflation remains the primary concern for investors. Persistent inflation is weighing on sentiment for consumers and businesses and renewing concern that aggressive Fed policy could push the U.S. into recession."

Ahead of this data point and the Fed's policy meeting, markets are likely to stay volatile. Investors have options for riding out the market's twists and turns, and one of the better ones is to focus on reliable equity income stocks. There's no shortage of dividend-paying names on Wall Street, including those that issue monthly dividends. But what better way to find the cream of the crop than by looking at the Dividend Aristocrats? These S&P 500 stocks have earned their stripes by consistently raising annual distributions for at least 25 years without interruption. Investors wanting to add income stability to their portfolios amid an unstable market will certainly want to check out this list.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Farmers Brace for Another Rough Year

Farmers Brace for Another Rough YearThe Kiplinger Letter The agriculture sector has been plagued by low commodity prices and is facing an uncertain trade outlook.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.

-

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAA

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAATax Breaks A new tax deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.