Stock Market Today: S&P Creeps Closer to Bear Market

An earnings bust from Cisco and higher-than-expected jobless claims helped nudge the S&P 500 toward the bear-market cliff.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

If there was any good news Thursday, it was that the market's downward momentum from yesterday largely fizzled out. But the S&P 500 still edged ever nearer to bear-market territory in a mixed day for U.S. equities.

The Department of Labor reported that initial unemployment claims for the week ending May 14 rose to 218,000 – their highest level since January, well more than expectations for 200,000 filings, and up from last week's revised 197,000.

Bill Adams, chief economist for Comerica Bank, said later Thursday that he believes job growth looks ready to slow across 2022. "Major retailers are reporting margin pressure and softer consumer demand … This will lead to slower job growth in the retail and e-commerce industries in the rest of 2022," he says. Adams adds that companies in other sectors could become more cautious about hiring if the stock market selloff further dampens business sentiment.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also Thursday, the National Association of Realtors reported that April existing-home sales fell 2.4% month-over-month (and 5.9% year-over-year) to an annualized rate of 5.61 million.

The earnings calendar once again featured a blue-chip bust. This time it was Dow component Cisco Systems (CSCO, -13.7%), which edged out quarterly profit estimates (87 cents per share vs. 86 est.) but reported disappointing revenues ($12.8 billion vs. $13.3 billion est.) and forecast an unexpected drop in sales for the current three-month period.

Kohl's (KSS, +4.4%) added to a stack of weak retail reports, delivering a wide miss on profits and slashing its full-year financial forecast; KSS shares still improved after the company said it expects several buyout bids to be submitted in the next few weeks.

BJ's Wholesale (BJ, +7.4%) was a pleasant outlier, however, rising on its own earnings merits; revenues, comparable-store sales and earnings all topped analysts' views.

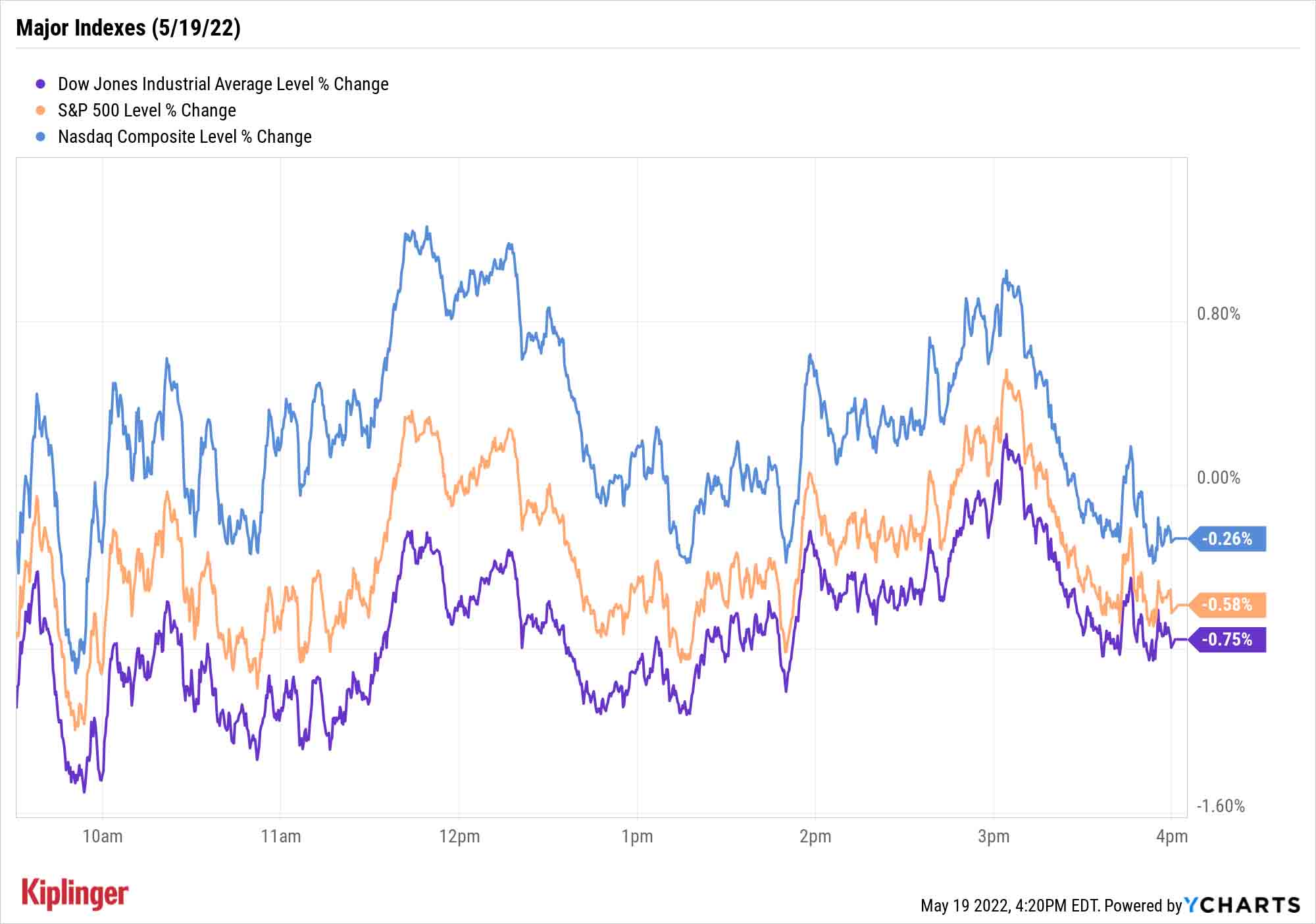

The major indexes all managed to bounce back a little from yesterday's drubbing. The Nasdaq Composite was down 0.3% to 11,388, while the Dow Jones Industrial Average dropped 0.8% to 31,253. The S&P 500, meanwhile, fell 0.6% to 3,900 – a close below 3,837.25, just a 1.6% decline from here, would put the index in a bear market.

Another area to watch is around 3,800, where the S&P 500 could find stock-chart support, says Dan Wantrobski, technical strategist and associate director of research at Janney Montgomery Scott. Wantrobski adds that he was "encouraged" by yesterday's washout and felt "it brings us closer to an eventual low for the year."

Other news in the stock market today:

- The small-cap Russell 2000 bucked the trend, finishing marginally higher to 1,776.

- U.S. crude oil futures gained 2.7% to finish at $109.89 per barrel.

- Gold futures rose 1.7% to settle at $1,841.20 an ounce.

- Bitcoin's back-and-forth ways continued, with the digital currency up 2.4% to 29,934.68. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Harley-Davidson (HOG) shed 9.3% after the company said it will halt production and delivery of its motorcycles for two weeks. "This decision, taken out of an abundance of caution, is based on information provided by a third-party supplier to Harley-Davidson late on Tuesday (5/17) concerning a regulatory compliance matter relating to the supplier's component part," HOG said in a statement.

- Several rail stocks fell today after Citi analyst Christian Wetherbee cut his ratings on a number of names in the industry. The analyst lowered his outlook for CSX (CSX, -4.3%), Norfolk Southern (NSC, -4.0%) and Union Pacific (UNP, -3.8%) to Neutral (Hold) from Buy, suggesting a slowing economy will drag on consumer demand for goods. Wetherbee said that while Citi is not "full baking in a recession" across their coverage, "an environment in which the U.S. avoids a recession" includes one where "consumer spending pivots meaningfully toward services and goods are sluggish."

Canada: Go for the Poutine, Stay for the Dividends

If you're searching for safety from 2022's market losses and volatility, don't duck for cover – climb up to Canada.

While the S&P 500 has spent the past week aggressively flirting with bear-market territory (20%-plus decline from a high), the S&P TSX Composite Index – a major Canadian stock-market benchmark – hasn't even fallen into a correction (10%-plus drop).

Part of this outperformance admittedly comes from how differently that index is structured than the S&P 500. Says Credit Suisse: "Perhaps most notably, the Canadian market benefits from large index weights in financials (generally positive with rising rates), energy (Canada is one of the world's largest oil and natural gas producers) and materials (multiple commodities with a renewed focus on potash and continued interest in ags, copper and gold)."

Nonetheless, Canadian stocks might be worth a look – especially if you're interested in securing reliable sources of rising income.

Earlier this week, we mentioned that the U.S. isn't the only part of the world that boasts Dividend Aristocrats – you can find a similar elite group in Europe, and yes, Canada has its own Dividend Aristocrats as well.

Again, like the European Aristocrats, these Canadian dividend growers have slightly different rules for inclusion than their U.S. counterparts. But they're nonetheless a great starting point for income hunters looking for fresh places to put new money to work – and we've singled out 20 of the best Canadian Dividend Aristocrats for American investors.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market Today

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market TodayMarket participants had plenty of news to sift through on Friday, including updates on inflation and economic growth and a key court ruling.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.