Stock Market Today: Stocks Paper Over Lousy Week With Wild Friday

Investors get a much-needed respite from heavy selling in the week's final session. But how long will the relief last?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Wall Street spent most of Friday applying some vibrant lipstick to what was otherwise a pig of a week for investors.

A broad market rally – one that saw each of the S&P 500's 11 sectors finish higher – wasn't a response to any new positive catalysts. Quarterly reports were light today, with most investors flipping the earnings calendar to next week's retail-heavy slate.

And Friday's most noteworthy datapoint was the University of Michigan's latest consumer sentiment index reading, which dropped from 65.2 in April to 59.1 in May – a 10-year nadir that was well lower than the 64.1 reading expected.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Sometimes the market just enjoys a relief rally.

"Following a week of heavy selling, but with inflationary pressures easing just at the margin, and the Fed still seemingly wedded to 50-basis-point hikes for each of the next two FOMC meetings, the market was poised for the kind of strong rally endemic to bear market rallies," says Quincy Krosby, chief equity strategist for LPL Financial.

He adds that given the Federal Reserve is only at the beginning of its rate-hike cycle and would like to see demand pull back further, "this rally will most likely weaken."

Of course, even if this is just a pause before more market declines, investors don't necessarily have to time the bottom to buy in at a decent valuation.

"This is still an attractive entry point, as we do not believe this is 1999/2000," says Nancy Tengler, CEO and CIO of asset management firm Laffer Tengler Investments.

The buying was strongest in consumer discretionary stocks (+3.9%) such as Amazon.com (AMZN, +5.7%) and Tesla (TSLA, +5.7%), along with technology plays (+3.3%) including Nvidia (NVDA, +9.5%) and Advanced Micro Devices (AMD, +9.3%).

Energy (+3.4%) was also bid higher amid a big pop in oil; U.S. crude futures finished 4.1% higher to $110.49 per barrel, helping to spark new highs in gasoline futures prices.

Notably absent from the rally was Twitter (TWTR, -9.7%), which sank after Elon Musk tweeted that the deal was "temporarily on hold."

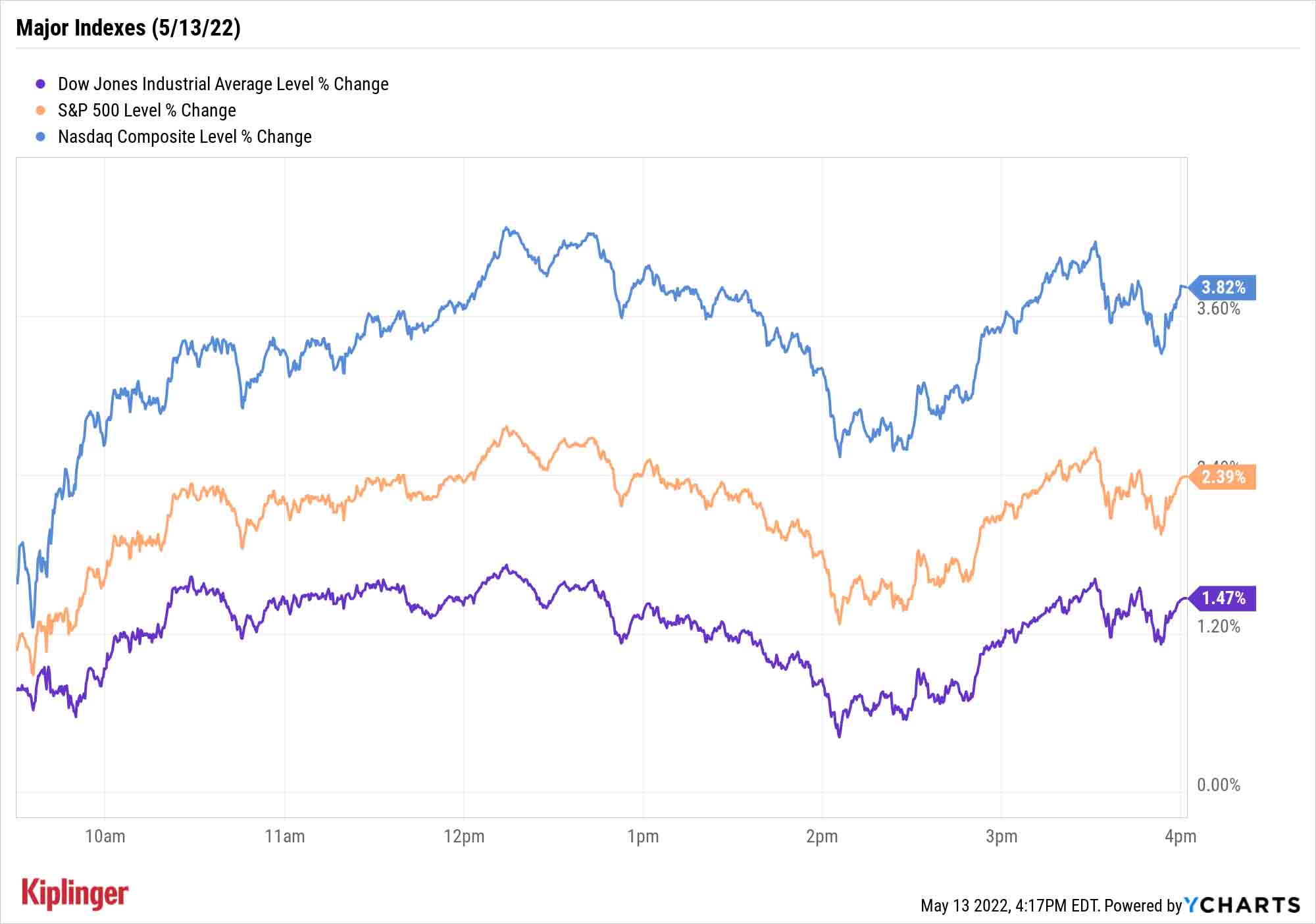

All the major indexes put up spectacular gains Friday, though for the week, it was still losses all around: The Nasdaq Composite (+3.8% to 11,805) still finished off 2.8% for the week, the S&P 500 (+2.4% to 4,023) was down 2.4% across the five days, and the Dow Jones Industrial Average (+1.5% to 32,196) closed the week 2.1% in the red.

Other news in the stock market today:

- The small-cap Russell 2000 bounced 3.1% to 1,792.

- Gold futures had no such luck. The yellow metal was off 0.9% to a 14-week low of $1,808.20 per ounce.

- Bitcoin snapped back 5.1% to $30,034.99. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

Keep Your Guard Up Against Inflation

Inflation is prevalent virtually everywhere – including on corporate America's earnings calls.

We're most of the way through the first-quarter earnings season, and over the past few months, publicly traded companies keep repeating the "I" word as they discussed their most recent financial results.

FactSet used its Document Search technology to track mentions of the term "inflation" on corporate earnings calls, According to their senior earnings analyst, John Butters, of the 455 S&P 500 companies that have conducted earnings conference calls from March 15 through May 12, "377 have cited the term 'inflation' … which is well above the five-year average of 155."

In fact, this is the highest overall number of S&P 500 companies citing inflation on their calls going back to at least 210. (The previous record? 356 … in the final quarter of 2021.)

It's another signal that inflation continues to be a persistent problem – and with forecasts calling for still-high inflation to come, more active investors might do well to pack a little more protection. We've previously analyzed other ways to stay in front of inflation, such as stocks with pricing power and inflation-fighting funds.

Today, we look at another batch of investments that can help harness high inflation, with a focus on commodities, real estate and other areas of the market.

Kyle Woodley was long AMD, AMZN and NVDA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.