Could Musk's Twitter Buyout Hit the Skids?

Tesla's CEO tweeted Friday that his $44 billion buyout of Twitter was "temporarily on hold." The purported reason: bot traffic.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Anyone who expected turbulence amid Elon Musk's quest to acquire Twitter (TWTR) got precisely what they anticipated Friday morning, when the Tesla (TSLA) CEO tweeted that the Twitter deal was "temporarily on hold."

TWTR shares plunged roughly 10% early Friday following Musk's tweet, which linked to a May 2 Reuters story about Twitter's recent statement that "the average of false or spam accounts during the first quarter of 2022 represented fewer than 5% of our [monetizable daily active users] during the quarter."

Musk later tweeted that he is "still committed to acquisition," which helped cut into the losses somewhat, though another seed of doubt was already sown.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"[Musk] is clearly intent in querying the company's estimate that spam accounts make up less than 5% of active daily users – a key metric given that establishing an accurate number of real tweeters is considered to be key to future revenue streams via advertising or paid for subscriptions on the site," says Susannah Streeter, senior investment and markets analyst for U.K. firm Hargreaves Lansdown.

But she also raises the possibility of an ulterior motive.

"There will also be questions raised over whether fake accounts are the real reason behind this delaying tactic, given that promoting free speech rather than focusing on wealth creation appeared to be his primary motivation for the takeover," Streeter says. "The $44 billion price tag [of the Twitter deal] is huge, and it may be a strategy to row back on the amount he is prepared to pay to acquire the platform."

That price tag might seem like even more of a stretch now than when Musk first got involved with Twitter.

"I am offering to buy 100% of Twitter for $54.20 per share in cash, a 54% premium over the day before I began investing in Twitter and a 38% premium over the day before my investment was publicly announced," Musk said in April when he declared his bid for the social media platform.

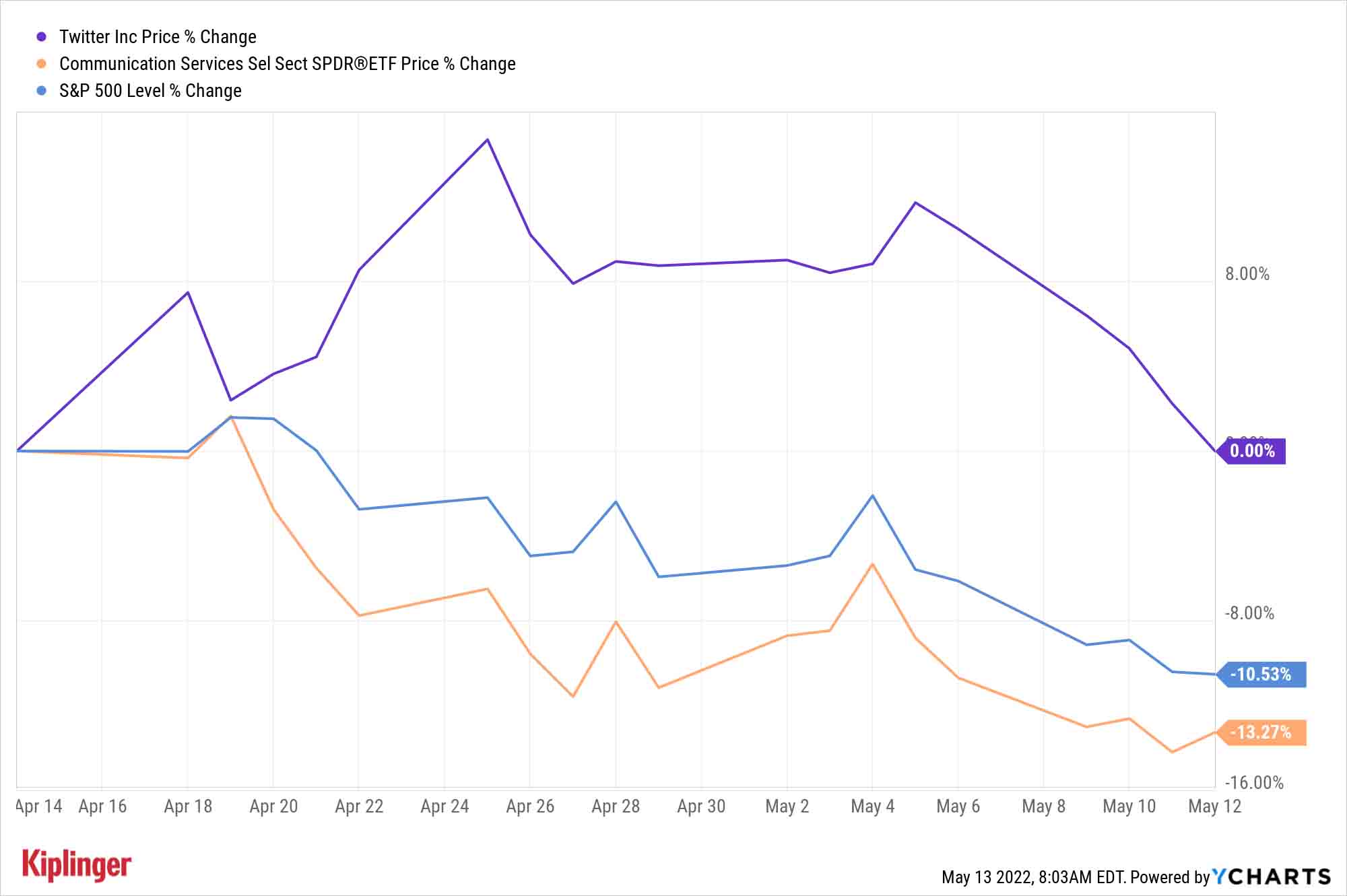

Since then, the S&P 500 and the communication services sector have both declined by double digits, with many high-priced technology and tech-esque shares plunging precipitously.

Twitter, to be fair, is roughly flat since then. But this latest hurdle puts his once seemingly imminent Twitter deal even further in doubt among investors and analysts alike.

The market has yet to price TWTR shares at the $54.20 level Musk offered in April. Not even after Musk revealed earlier this month that backers such as Andreessen Horowitz, Sequoia Capital and Oracle (ORCL) founder Larry Ellison were lined up to help provide more than $7 billion in financing.

As of Thursday's close, TWTR shares were trading 15% below Musk's bidding price. In Friday's premarket trade, that number was nearly 30%.

Wall Street's pros appear mildly skeptical the Twitter deal closing, too. According to S&P Global Market Intelligence, the 27 analysts who currently cover Twitter have an average price target of $51.50 and collectively consider the stock a Hold.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

Why I Trust These Trillion-Dollar Stocks

Why I Trust These Trillion-Dollar StocksThe top-heavy nature of the S&P 500 should make any investor nervous, but there's still plenty to like in these trillion-dollar stocks.

-

Elon Musk's $1 Trillion Pay Package Passes: What's at Stake for Tesla Stock

Elon Musk's $1 Trillion Pay Package Passes: What's at Stake for Tesla StockMore than 75% of Tesla shareholders voted to approve a massive pay package for CEO Elon Musk. Here's what it means for the Mag 7 stock.