Stock Market Today: Stocks Close Out Worst April in Years With Another Slide

Negative earnings reactions for mega-caps Amazon.com and Apple weighed on broader markets today.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

U.S. stocks finished both the day and the month on a down note as a fresh round of earnings forecasts from companies only added to investors' laundry list of concerns.

Last night, Amazon.com (AMZN, -14.1%) said first-quarter revenue rose 7% on a year-over-year basis – the slowest pace in 20 years – to $116.4 billion, just shy of the consensus estimate. AMZN also offered lower-than-expected Q2 revenue guidance due to forex headwinds and the company's plan to move this year's Prime Day to July from June.

Apple (AAPL) was another post-earnings decliner, sliding 3.7%. The tech giant reported a 9% annual rise in revenue to $97.3 billion – the most ever for a March quarter – but warned supply-chain issues caused by COVID-related lockdowns in China could create a $4 billion to $8 billion drag on sales in the current quarter.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The guidance from multiple companies on the supply-chain situation and expenses going up seems to be weighing down the market after the brief recovery days," says Jimmy Lee, CEO of independent wealth management firm The Wealth Consulting Group. "So, I'm fairly happy with how the consumer seems to be holding up so far [adjusted for inflation, consumer spending rose 0.2% month-over-month in March, according to this morning's Commerce Department report], but Q2 will be more telling and sets up stocks to continue the volatility that we've seen so far this year."

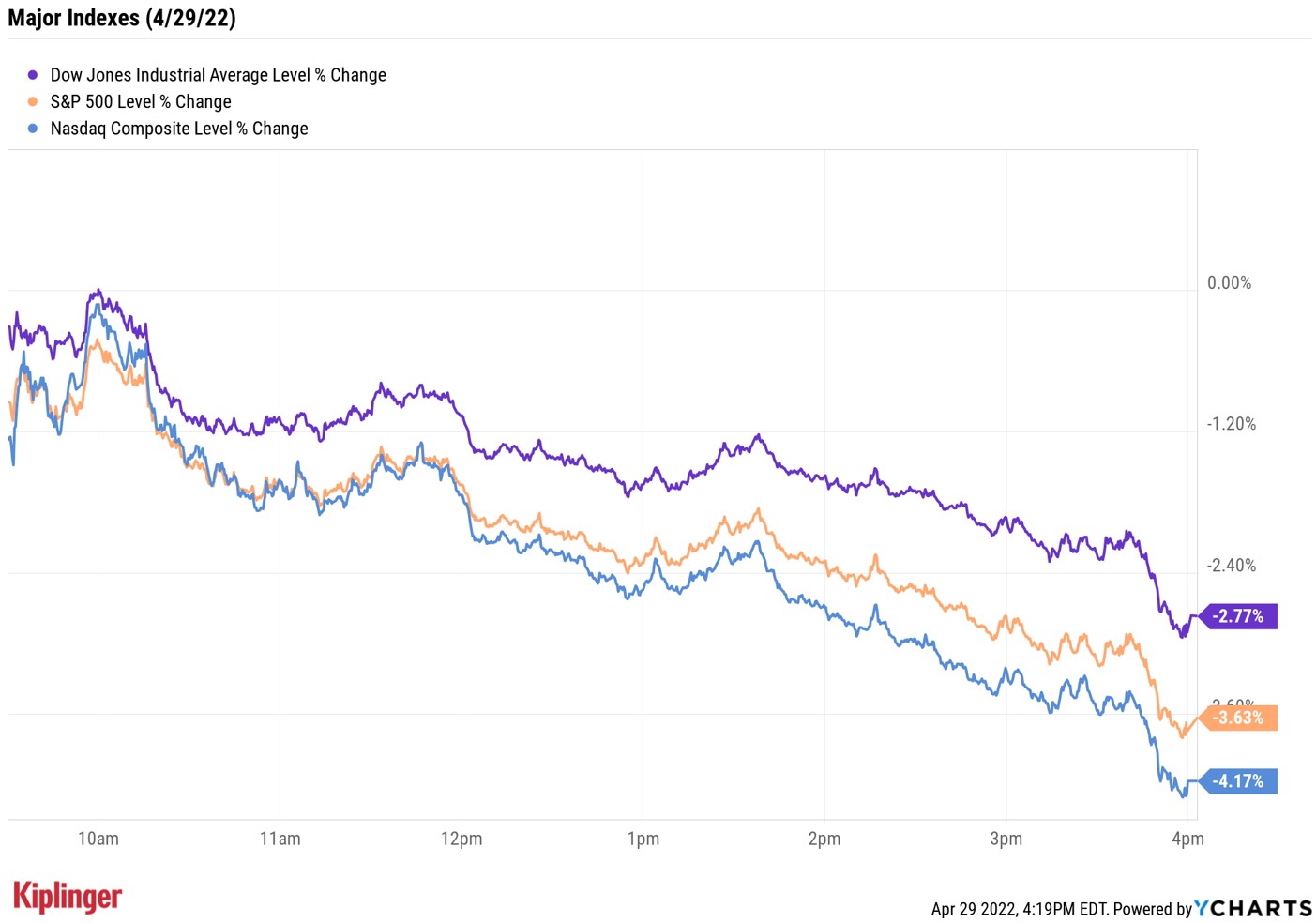

That volatility was on full display today, with the Nasdaq Composite sinking 4.2% to 12,334, the S&P 500 Index spiraling 3.6% to 4,131 and the Dow Jones Industrial Average surrendering 2.8% to 32,977.

For all of April, the Nasdaq shed 13.3% – marking its biggest monthly decline since October 2008 – the S&P 500 fell 8.8% and Dow gave back 4.9% for their worst months since March 2020.

Other news in the stock market today:

- The small-cap Russell 2000 slumped 2.8% to 1,864.

- U.S. crude oil futures slipped 0.6% to end at $104.69 per barrel.

- Gold futures gained 1.1% to finish at $1,911.70 an ounce.

- Bitcoin fell 4% to $38,351.14. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Tesla (TSLA) closed down 0.8% amid headlines that CEO Elon Musk sold roughly $8.4 billion in TSLA shares this week, according to the Securities and Exchange Commission (SEC). The reports follow Monday's headlines that Musk will buy Twitter (TWTR) for $44 billion. Yesterday, the billionaire tweeted that he is not planning to sell any additional shares. TSLA stock finished the week down more than 12%, but CFRA Research analyst Garrett Nelson said this "weakness presents an attractive entry point in one of the market's most compelling growth stories." He reiterated a Strong Buy recommendation on the shares, adding that "pressure from large stock sales by Musk have created opportunity for investors to buy shares at a discount in the past."

- Intel (INTC) was the worst Dow Jones stock today, shedding 6.90% after earnings. In its fiscal second quarter, the semiconductor firm reported a 7%year-over-year decline in revenue to $18.35 billion – slightly more than analysts were expecting – while gross margin narrowed to 50.4% from 55.2%. INTC also offered weaker-than-anticipated current-quarter guidance, citing inventory and inflation challenges. Oppenheimer analyst Rick Schafer maintained a Perform (Neutral) rating on Intel, saying the bar is raised for the second half. "The company is in prove-it mode as management pushes capacity expansion and return to process leadership," Schafer writes in a note to clients. "We remain sidelined for now."

Sell in May and Go Away? Not So Fast.

What can investors expect going forward? Next week brings the start of a new month – as well as renewed focus on the old "Sell in May and Go Away" adage, familiar to many because of the tendency for stock returns to historically underperform in the six months between May and October. Here at Kiplinger, we believe investors are better off just sticking around.

That certainly doesn't mean that we think stocks have the all-clear to head higher in May. There are numerous worries – inflation and rate hikes, for example – that will likely continue to impact markets.

What's more, "down Aprils tend to be followed by down Mays," says Chris Larkin, managing director of trading at E*TRADE. "And on top of that, May's average return is even worse when the S&P 500 is red for the year heading into the month."

Instead of fretting, investors should focus on their core portfolio, which can easily be built with some solid, low-cost funds such as those that make up our Kiplinger 25 – our favorite actively managed no-load mutual funds – or our Kiplinger ETF 20, the best cheap exchange-traded funds you can buy. And for those who want to mix some tactical positions into their portfolio, consider these stocks with strong profit margins. These well-managed firms have the potential to do well across different economic environments and have reasonable valuations to boot.

Karee Venema was long AAPL as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.