5 Stock Picks With Bulletproof Profit Margins

Companies that can squeeze a lot of blood from the revenue stone can flourish, even in tough times.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Making good stock picks is challenging at any time. But these days, investors must be wary of companies that are vulnerable to higher-for-longer inflation, as well as lingering supply-chain disruptions, rising interest rates and the scary geopolitical situation in eastern Europe.

Some companies hold up better than others in tough times. Firms that lead their market or industry, for example, typically have strong pricing power – think Apple or Nike. These types of companies can pass on higher wages and material costs to customers by raising prices for goods or services without seeing much slip in demand.

Other firms fortify their results by controlling costs (Johnson & Johnson has proved adept at this in years past). Still others have businesses that are simply less sensitive to rising material and labor costs, or even supply-chain issues, because of the services or goods they sell (Netflix, say, or Airbnb).

One way to find companies with those attributes is to scrutinize profit margins. Why not profits alone? A company's bottom line – its net income or profit – matters, of course. But profit margins can show how efficiently a company manages its operations and costs over time, in good and bad periods. Well-managed firms can maintain or expand profit margins through changing economic and market conditions. Often, these companies also have strong balance sheets and a steady stream of free cash flow (cash profits left after expenses to maintain or expand the business).

"These companies are well placed to do well in different economic environments," says Ian Mortimer, portfolio manager of SmartETFs Dividend Builder ETF (DIVS).

There are different ways to measure profit margins. Gross margins show the percentage of revenue that remains after deducting the costs of producing the goods or services a company has sold. Operating margins reflect the percentage of revenue left after on-going expenses to run the business, which includes the costs of goods, wages and other expenses related to running the company. And net margins are the ratio of net income to revenues and show how much of every dollar actually hits the bottom line.

The stock picks below have the potential for improving profit margins of one kind or another. In most cases, we're talking about gross margins, but in a few cases, we refer to operating or net margins. We also looked for growth catalysts that might propel profits higher, as well as reasonably valued shares relative to peers or the broad market.

Returns and data are through April 26.

Amazon.com

- Market value: $1.4 trillion

E-commerce giant Amazon.com (AMZN, $2,814.50) just raised its annual membership fee for Prime (its free shipping and streaming video services) by 17%, to $139 from $119. It's a good bet that most of Prime's current 200 million members, and perhaps millions more, will pony it up. The last time Amazon increased the annual fee (in 2018 by 20%), the number of subscribers doubled in three years. That's pricing power.

More important, however, is the shift in Amazon's overall business to a mix with higher gross margins.

E-commerce is still the main business, and online retail is a low-margin trade. However, Amazon's growth now comes from two other businesses with healthy margins: advertising sales and Amazon Web Services, its cloud-computing business.

And they're growing fast. Ad sales – for spots on Amazon's website, Prime Video and Fire TV – topped $31 billion in 2021, a 58% jump from 2020. The firm's new contract to stream the NFL's Thursday Night Football games should propel ad sales even more this year. And AWS revenues, which account for 13% of overall sales, increased 37% in 2021.

As these divisions continue to grow, it should fatten Amazon's gross margins to 43.5% in 2023, up from 42.0% in 2021, says analyst CFRA analyst Tuna Amobi. Look past 2022, during which wage inflation and investments in shipping and logistics may hamper gross-margin expansion.

Amazon's not exactly among the cheapest stock picks you'll find right now – shares trade at a whopping 53 times estimated earnings for the year ahead. But that's a discount to its five-year historical P/E of 85. And analysts expect the mega-cap company to pump out 25% average annual earnings growth over the next three years.

Bio-Techne

- Market value: $15.0 billion

The pandemic revitalized spending on health-science research, and that's to the benefit of Bio-Techne (TECH, $382.54). The company is a leader in the production of proteins, antibodies and other compounds used in medical research, drug development and diagnostic tests. Its proteins, for instance, are necessary for COVID vaccines and treatments.

That's just part of the reason Argus Research analyst David Toung rates Bio-Techne stock a Buy.

The company is re-investing its robust operating cash flow to expand production capacity and make what Toung calls tuck-in acquisitions – small cash deals for private companies. It has completed more than a dozen such deals since 2014. Most recently, in 2021 it acquired Asuragen, a maker of diagnostic and research products such as oncology testing kits, for $215 million in cash plus $105 million more if certain milestones are achieved.

Andy Adams, a portfolio manager with the mutual fund company Mairs & Power, says the company has been able to improve gross margins in recent years, from 65% in 2017 to 68.1% in 2021, despite its many acquisitions.

Analysts predict average annual earnings growth of 26% over the next three years. That comes at a premium, however, and shares trade at a price-earnings multiple of 45 times year-ahead estimates. Still, that's below the average P/E for biotech firms of 59.

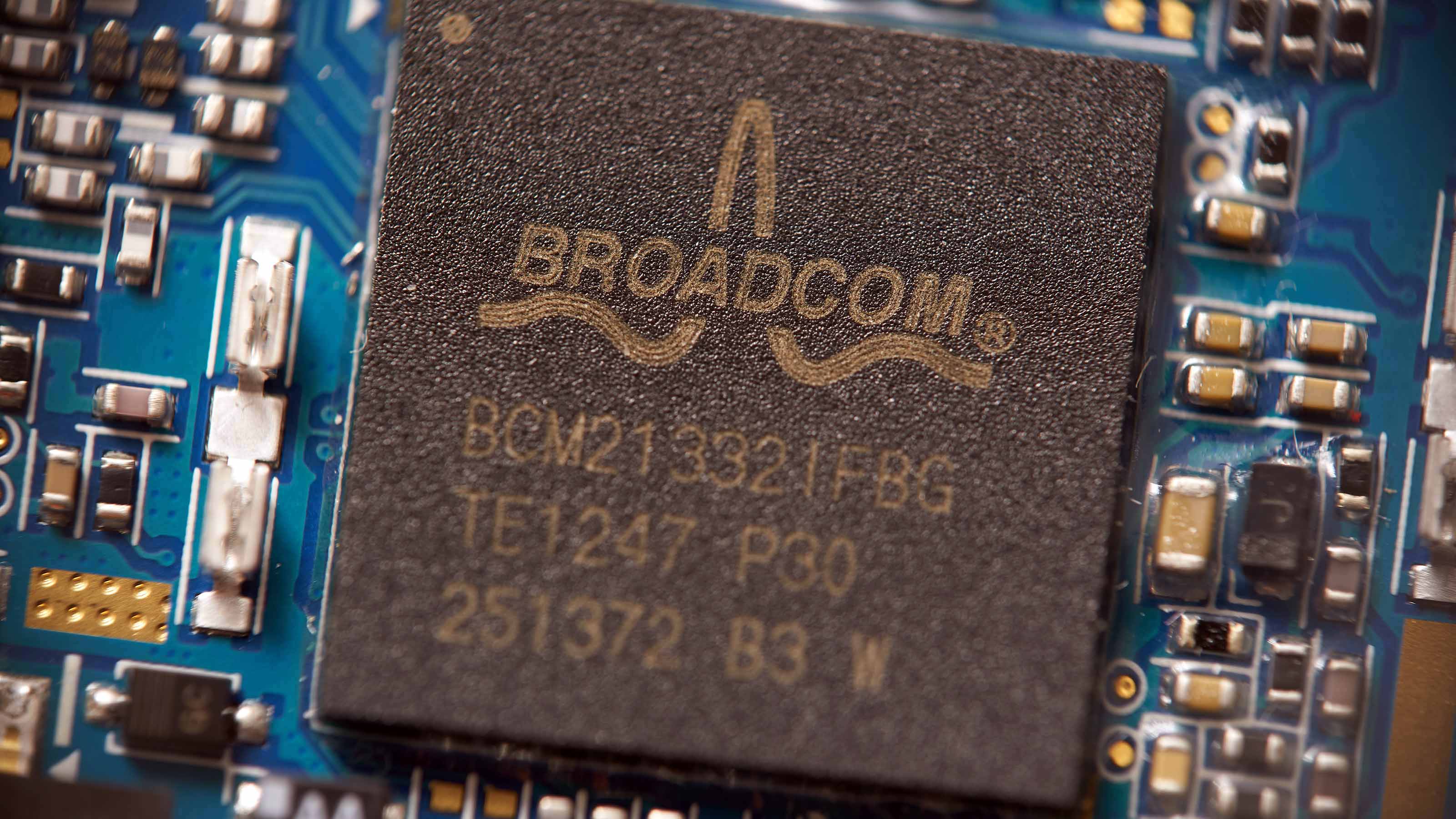

Broadcom

- Market value: $228.7 billion

Semiconductor giant Broadcom (AVGO, $555.05) is best known for its networking-switch chips for data centers and its radio-frequency filters for high-end smartphones. But thanks to well-executed acquisitions, Broadcom is highly diversified across a range of fast-growing tech areas.

"Put it all together, and you have a combination of end markets with big growth," from cloud computing and factory automation to data centers and 5G, says Mortimer, the Dividend Builder portfolio manager. "That will drive growth regardless of the economic environment."

The company is extremely profitable and well run. Annual gross margins have climbed steadily in recent years. And analysts expect them to widen to 76% over the next two fiscal years (ending in October), up from 73.9% in fiscal 2021. Meanwhile, costs have barely budged in recent years, and the company pays a hefty dividend, which it has raised for 13 consecutive years.

The semiconductor industry has been dealing with supply-chain bottlenecks since the start of the pandemic, says John Buckingham, editor of investing newsletter The Prudent Speculator. Broadcom isn't immune to that, but its size and "tight" supplier relationships have helped minimize the impact, he says. AVGO has a good handle on supply and demand through the first half of 2023, and so far, it has been passing on material cost increases to customers.

Analysts expect earnings to jump an average of 15% a year over the next three years. And shares trade at 17 times expected year-ahead earnings, below the typical P/E of 21 for its semiconductor peers.

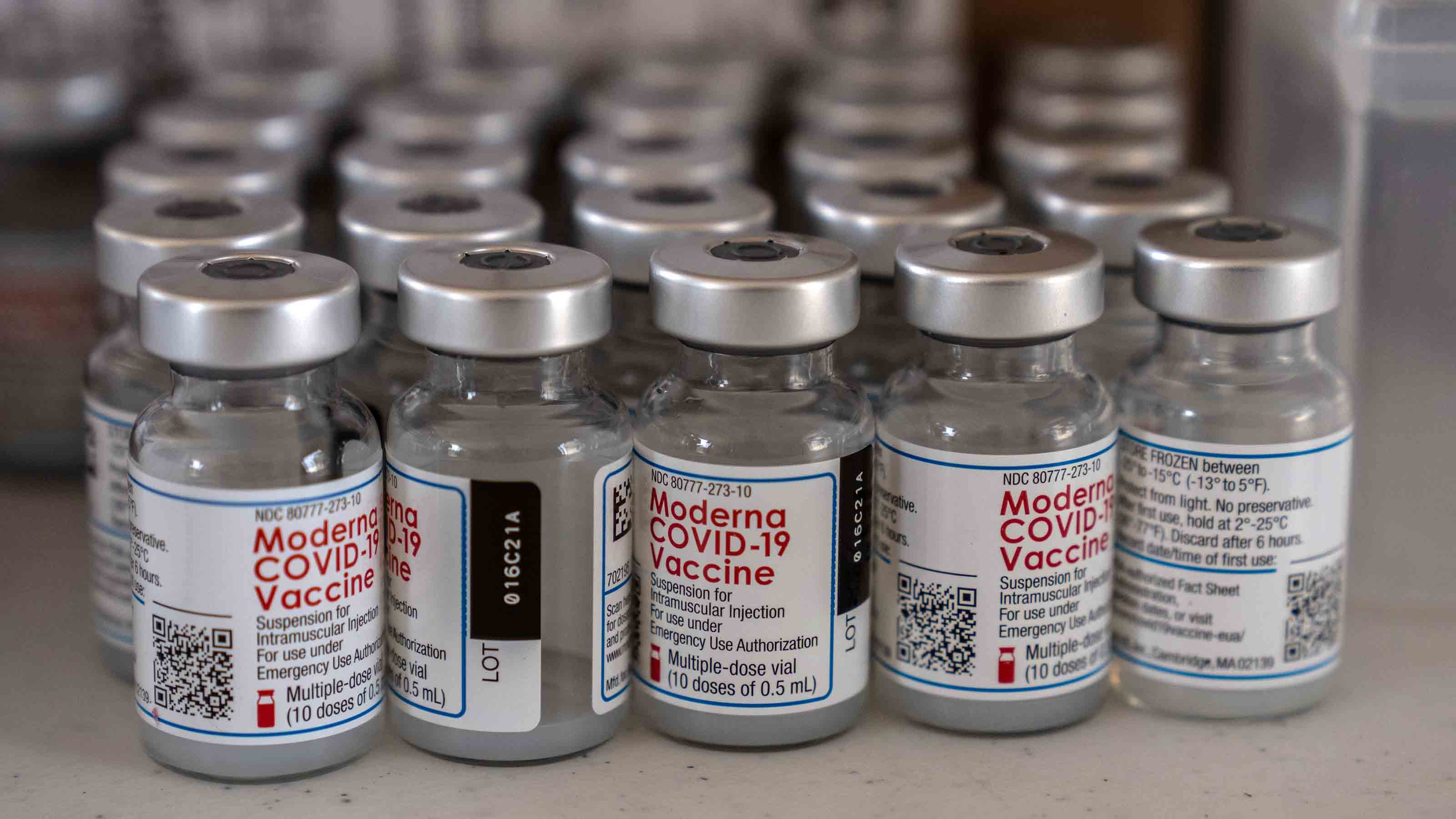

Moderna

- Market value: $58.8 billion

Moderna (MRNA, $144.14) doesn't fit squarely in the expanding-profit-margin box, at least historically.

The biotech stock, a pioneer in mRNA technology, has only just become profitable thanks to demand last year for its COVID-19 vaccine. In 2021, Moderna reported $28.29 in earnings per share, a titanic shift from its $2 loss per share the previous year. Gross margins were a fat 75.1% for 2021, above the 61.3% average for peers, and a net profit margin of 66.0% was well ahead of the average 19% for the biotech industry, according to Zacks Investment Research.

Shares are down 70% from their high last August – a much bigger decline than the typical biotech stock experienced – which makes Moderna a compelling value. The stock suffered as investors worried that its COVID vaccine was less effective against new variants of the virus.

But Moderna has plenty of irons in the fire. It is still working on new coronavirus treatments, including vaccines for specific variants. It has signed $19 billion in agreements for its COVID vaccine for this year, and it has $3 billion more in potential orders for the vaccine in 2023. Plus, Moderna has 44 vaccines and therapeutics in development, half of which are in later-stage clinical trials, including mRNA-based vaccines for the flu and Zika and a personalized cancer vaccine.

What's more, the company is a financial stronghold, with $17.6 billion in cash and investments and minimal debt. Analysts expect 2022 earnings to be a tad lower than in 2021, but they see growth of 7% per year, on average, over the next three years. At current prices, Moderna trades at a price-earnings multiple of 5.3, a fraction of the average P/E of 59 for biotech stocks.

Visa

- Market value: $421.9 billion

Visa (V, $209.36) payment-processing network operates like a toll booth, so the more electronic transactions that Visa handles, the higher the company's revenue.

The ongoing shift to digital payments and online shopping has been a boon, as has strong growth in transactions using the company's crypto-linked cards, which make it easy to pay for products and services with digital currencies. A sharp recovery in international travel and cross-border money flows offers more upside. As long as higher price tags don't crimp consumer spending, stickier inflation is a positive: About 55% to 60% of Visa revenues will get a boost from inflation, says CFRA analyst David Holt.

Holt pays close attention to Visa's operating expenses and margins. If the firm can control costs, any increase in revenue from higher transaction volumes falls to its bottom line.

"The beauty of Visa's business model is its operating leverage. As volume builds, operating margins expand," says Holt, who rates the stock a "buy."

He sees operating margins widening over the next two years to 68.0% by the end of 2023, up from 65.6% in 2021, helping to fuel roughly 20% earnings growth over that period. He thinks the shares deserve a P/E of 38, which, applied to per share earnings estimates of more than $7 for the fiscal year ending in September, results in his 12-month price target of $270.

That's an "above-market P/E multiple," Holt says, but it's supported by achievable revenue targets and well-controlled expenses.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.