Stock Market Today: Stocks Rise Despite Rate Concerns, Mixed Earnings

Johnson & Johnson, Lockheed Martin Q1 reports underwhelm; Netflix severely disappoints after the bell with a Q1 subscriber loss.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The major indexes traded well into the green Tuesday, and they did so while flying into a couple of headwinds.

Rising interest rates, which have helped to keep stocks grounded of late, continued their 2022 climb, with the 10-year Treasury reaching 2.948% today as it marches toward a 3% threshold last crossed in late 2018.

Meanwhile, the corporate earnings calendar was largely a mixed affair.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Johnson & Johnson (JNJ, +3.1%) beat first-quarter earnings expectations but missed on revenues and lowered its full-year 2022 sales and profit forecasts. It did, however, announce its 60th consecutive annual dividend hike – a 6.6% bump to $1.13 per share quarterly – to extend its membership in the Dividend Aristocrats.

Defense contractor Lockheed Martin (LMT, -1.6%) sagged after delivering a bottom-line beat but missing both on Q1 revenues and its full-year 2022 sales outlook.

Insurer Travelers (TRV, -4.9%) reported a better-than-expected 48% jump in profits thanks to lower catastrophe losses, though it did suffer a decline in its ratio of claims and related costs to premiums collected.

Also Tuesday, fresh data showed that housing permits rose 0.4% month-over-month in March to 1.873 million annualized, while housings starts were up 0.3% to 1.793 million units annualized.

"Housing starts rose solidly in March; residential construction added to real GDP growth in the first quarter," says Bill Adams, chief economist for Comerica Bank. But he adds that supply chain issues are a huge problem for housing. "The backlog of houses that are permitted or started but not completed is the biggest since the 1970s."

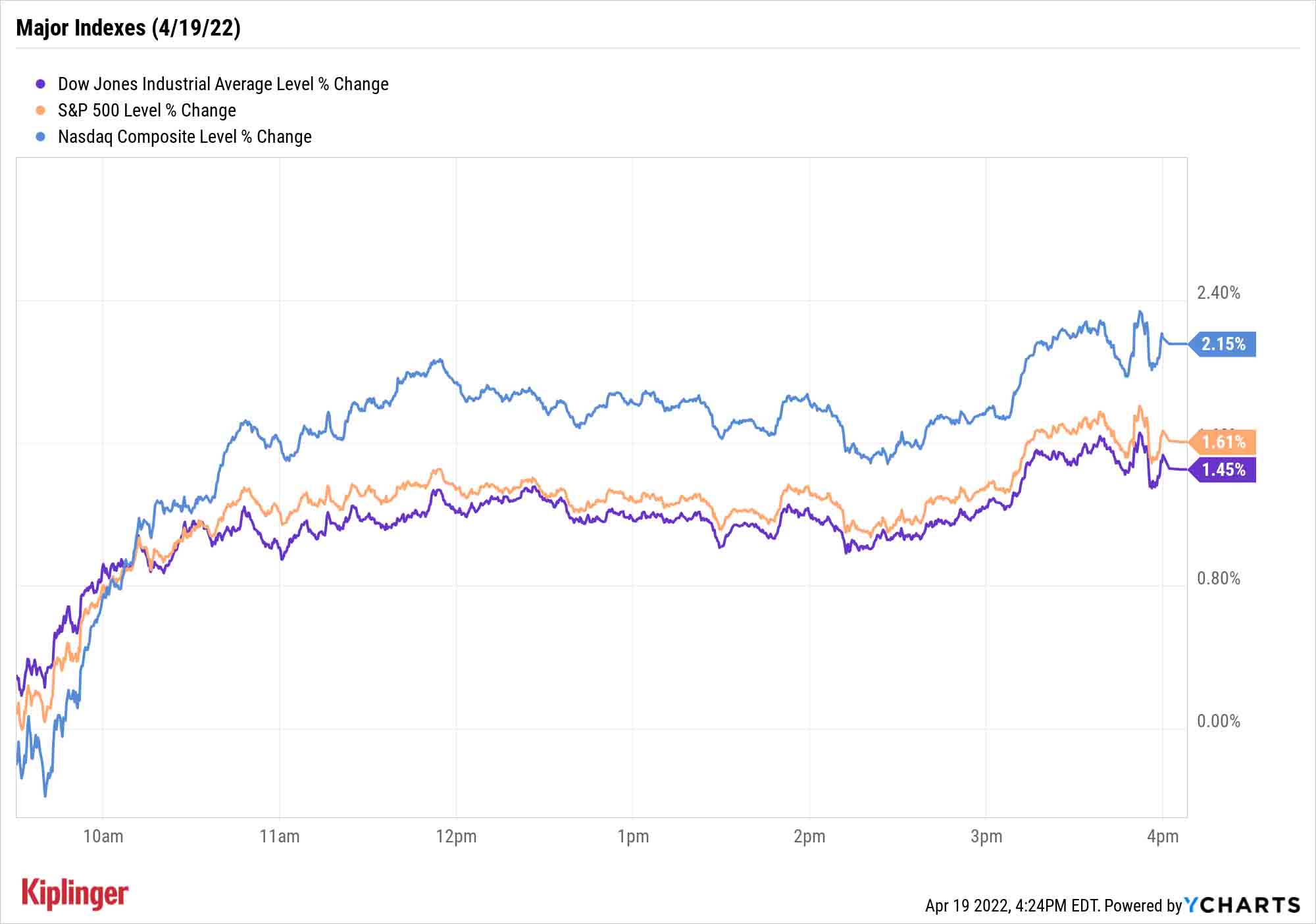

The Nasdaq Composite advanced 2.2% to 13,619, while the S&P 500 (+1.6% to 4,462) and Dow Jones Industrial Average (+1.5% to 34,911) also finished with substantial gains.

After the closing bell, Netflix (NFLX) reported its first quarterly subscriber decline in more than a decade. Shares plunged by 23% in early after-hours trading as Netflix said it suffered a Q1 loss of 200,000 subs, which kept revenues of $7.78 billion below analyst expectations. That overshadowed an easy earnings beat of $3.53 per share vs. estimates of $2.89.

Other news in the stock market today:

- The small-cap Russell 2000 continued to bounce back and forth across the 2,000 level, gaining 2.0% to 2,030.

- U.S. crude futures plummeted 5.2% to end at $102.56 per barrel, weighed on by a strengthening U.S. dollar and worries over slowing Chinese demand.

- A stronger dollar pressured gold futures too, ending the day down 1.4% at 1,959.00 an ounce.

- Bitcoin recovered another 1.4% to $41,349.59. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.

- Hasbro (HAS) advanced 5.2% after the toymaker reported revenue of 1.16 billion for its first quarter – in line with what analysts were expecting – and raised its 2022 revenue forecast, now expecting sales to grow in the mid-single digits this year compared to previous guidance for low-single-digit growth. This helped offset a bottom-line miss, with HAS reporting earnings of 57 cents per share versus the consensus estimate for 62 cents per share. "The company saw 76% sales growth in entertainment as the division benefitted from resumed productions and deliveries and 32% sales growth in digital gaming as they see continued momentum in the space," says CFRA Research analyst Zachary Warring (Buy). "We believe HAS will outperform as its entertainment and digital segments drive margins and sales higher."

Real Estate With Rising Payouts

Having itself a day was equity real estate (+2.1%), a sector that so far delivered a middling 2022.

Helping push it higher was Prologis (PLD, +4.0%), a logistics-focused real estate investment trust (REIT) that reported Street-beating earnings and raised its full-year guidance amid "record demand" thanks to supply-chain issues.

Also moving the sector was American Campus Communities (ACC), which spiked 12.5% after The Wall Street Journal reported asset management firm Blackstone (BX, +4.9%) will buy the student housing developer in a $12.8 billion deal that includes debt.

"The premium to Monday's close [for ACC stock] is ~15%," says Piper Sandler analyst Alexander Goldfarb. "While we certainly were not expecting this deal, it doesn't totally surprise given the Street has long valued the company below net asset value versus the ebullient private market that clearly showed the demand for student housing."

So far in 2022, rising rates have held back REITs, which as a sector are off a little more than 4% year-to-date. But a team of Janus Henderson portfolio chiefs believes any future rate headwinds should be largely limited.

"Should bond yields and interest rates move significantly higher, this could impact property capital values," the portfolio managers say. "However, most REITs have been very proactive in recent years in extending and fixing their debt book, which should reduce their exposure to short-term rate rises."

Remember: Real estate investment trusts are largely appreciated by the income-investing crowd because their mandate to deliver at least 90% of taxable earnings back into the hands of investors typically translates into better-than-normal yields.

But sweetening the pot even more are those REITs that can muster exceptional dividend growth as well. We've recently explored seven real estate plays that have reliably raised payouts in previous years and have delivered double-digit growth of late.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.