Stock Market Today: Wall Street Lays an Egg Heading Into Easter Weekend

Profit drops among Wall Street's big banks and slowing retail sales weighed down the major indices Thursday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks fell across the board at the holiday-shortened trading week's conclusion as mixed bank earnings and cloudy economic data dampened bulls' enthusiasm.

The Commerce Department on Thursday reported that while retail sales did indeed grow for the third consecutive month, inflation clearly took a bite. March's retail sales were up 0.5% month-over-month, a slowdown from February's upwardly revised 0.8% growth and lower than expectations for 0.6% expansion.

"There's no doubt rising energy and gas prices are starting to take a toll on household budgets," says Peter Essele, head of portfolio management for Commonwealth Financial Network. "March's report could be an early sign that consumers are starting to put away their wallets as prices for many goods soar across the board."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also Thursday, the Labor Department said initial jobless claims for the week ending April 9 climbed a bit from the prior week, to 185,000 from 167,000 (revised), which was well more than the 170,000 expected.

Meanwhile, the first-quarter earnings season continued its debut with a mixed slate of reports from the nation's largest financial-sector firms.

Wells Fargo (WFC, -4.5%) stumbled hard as a decline in mortgage lending caused its Q1 revenues to come up short of Wall Street's mark; profits were better than expected but still were off 21% year-over-year.

Morgan Stanley's (MS, +0.8%) earnings were off 8%, but the stock was slightly in the green as a blowout quarter for its trading desks fueled easy top- and bottom-line beats. Similar success in Goldman Sachs (GS, -0.1%) and Citigroup's (C, +1.6%) trading divisions helped them easily hurdle earnings expectations, though both suffered 40%-plus declines in profits.

And super-regional bank U.S. Bancorp (USB, +4.2%) was one of the sector's top performers after besting Q1 estimates, though here too, earnings were off from year-ago levels.

"This looks like a case where the banks underpromised and overdelivered as a way of putting lipstick on a very unattractive quarter," says Anthony Denier, CEO of trading platform Webull. "Overall earnings were terrible, but because they led analysts to believe their earnings would be worse, investors were happy."

Even Twitter (TWTR, -1.7%) managed to fall despite explosive M&A news. Just more than a week after it was reported that Tesla (TSLA, -3.7%) CEO Elon Musk had built up a 9%-plus stake in the social media platform, a new filing revealed that Musk is trying to buy Twitter outright for $54.20 per share.

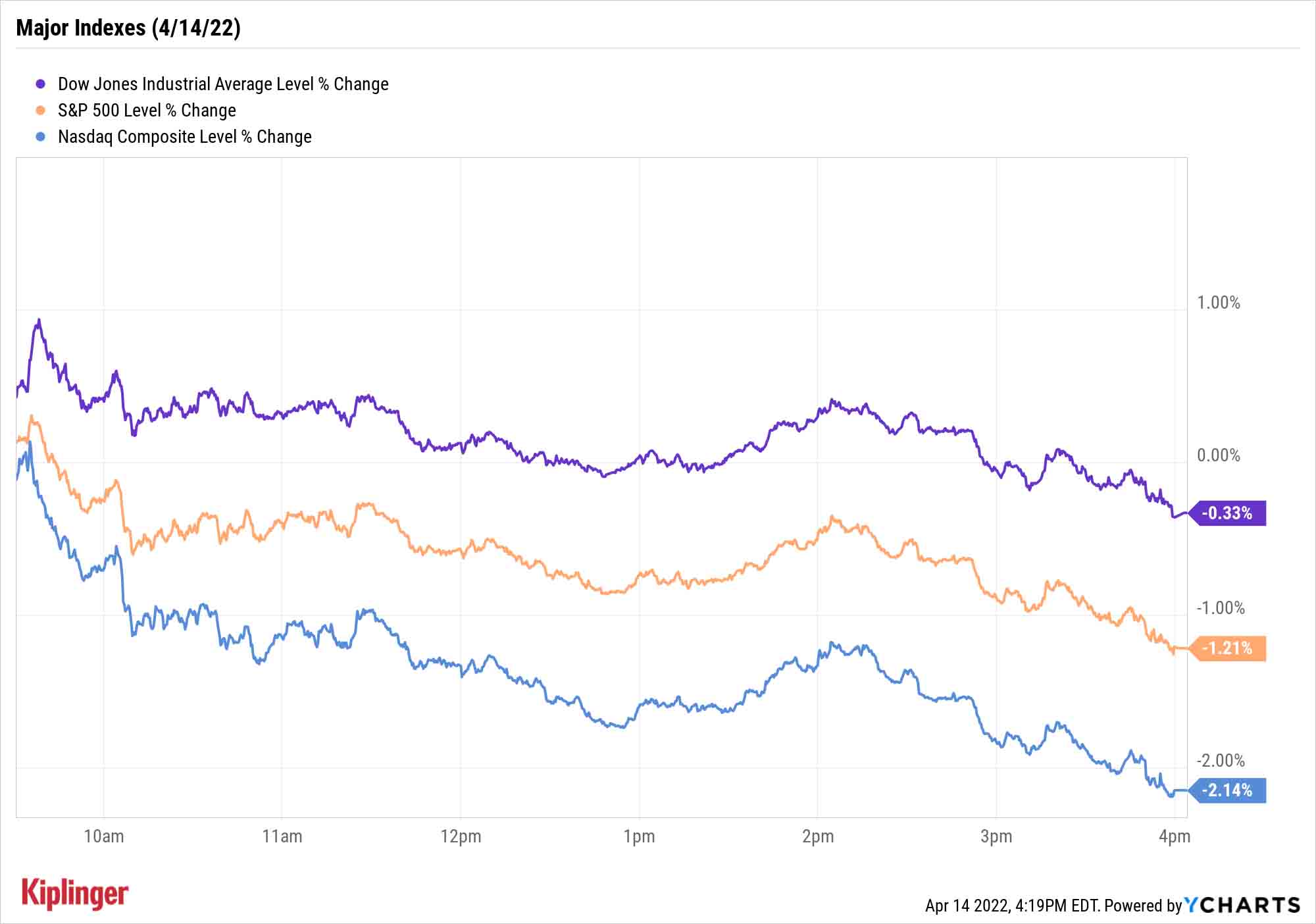

The Nasdaq Composite took the worst brunt, off 2.1% to 13,351, good for a 2.6% weekly decline. The S&P 500 (-1.2% to 4,392) was down 2.2% for the week, and the Dow Jones Industrial Average's modest 0.3% dip to 34,451 cemented a 0.8% weekly loss.

And a quick reminder: Tomorrow (Good Friday) is a stock market holiday.

Other news in the stock market today:

- The small-cap Russell 2000 shed another 1% to 2,004, putting the index ahead by 0.5% for the week.

- U.S. crude oil futures jumped 2.6% to finish at $106.95 per barrel.

- Gold futures snapped their five-day winning streak, slipping 0.5% to settle at $1,974.90 an ounce.

- Bitcoin dropped back below the $40,000 mark, declining 3.1% to $39,782.41. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.

- Susquehanna Financial Group analyst Mehdi Hosseini downgraded Seagate Technology (STX, -3.2%) to Negative (Sell), saying quarterly cloud spending may peak in the second half of this year. This will likely be followed by relatively weaker spend trends into 2023, the analyst adds. While some of this is already priced, Hosseini argues "the extent of deceleration in cloud capex spend by year-end 2022 and into 2023, and its impact, is still not dialed into expectations and certainly not in the current consensus.. The analyst also downgraded fellow tech stock Western Digital (WDC, -3.2%), to Neutral (Hold).

- Nike (NKE) was the best Dow Jones stock today, gaining 4.7% after UBS Global Research analyst Jay Sole (Buy) said he was "very bullish" on the blue chip. "Nike will be a long-term outperformer, in our view," Sole says. "The company's investments in product innovation, supply chain speed, and digital are unlocking what is likely a multiyear period of above average growth. We forecast a 16% four-year earnings per share compound annual growth rate."

How Do You Fight Off Rising Prices? With Pricing Power!

Earlier this week, consumer and producer price reports alike showed that U.S. inflation is still in a full-blown sprint. That has Wall Street strategists continuing to look for stocks that can stave off inflation.

UBS's analyst team has just taken a look into pricing power, a company's ability to raise prices without significantly reducing demand.

"With inflation pressures surging, pricing power relative to cost exposures will be a key theme and source of alpha for global equity markets," says UBS's team. "Historically, when the U.S. two-year inflation breakeven has been above 2.5%, companies with strong pricing power have outperformed their weak counterparts by nearly 14% on average over the next 12 months."

UBS goes on to highlight a number of U.S. and international stocks that boast strong pricing power – as well as some names that come up short and could struggle as long as inflation remains hot. Read on as we explain more about this tactic for tackling inflation and look at UBS's winners and losers.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.