Stock Market Today: Stocks Rally, Then Retreat, Amid 40-Year-High CPI

Moderating core CPI gave optimists some hope that inflation has peaked, but stocks still couldn't hold on to Tuesday's early momentum.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Today's much-awaited March inflation figures showed prices rocketing at their quickest pace in more than four decades. And yet, the report appeared poised to drive stocks higher … right up until it didn't.

The Labor Department said Tuesday that March's consumer price index (CPI) rose 8.5% year-over-year – the fastest such rate since December 2021 and ahead of broader expectations of 8.4%, though shy of Kiplinger forecasts – and 1.2% month-over-month.

There was a shred of good news in the core CPI reading, which excludes food and energy prices. Core prices grew 6.5% year-over-year, but just 0.3% month-over-month, below forecasts for 0.3% and down from February's 0.5% rate.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Inflation optimists may take this as a sign that inflation is peaking, or has already peaked and may now begin to decline," says Andy Sparks, head of portfolio management research at index provider MSCI.

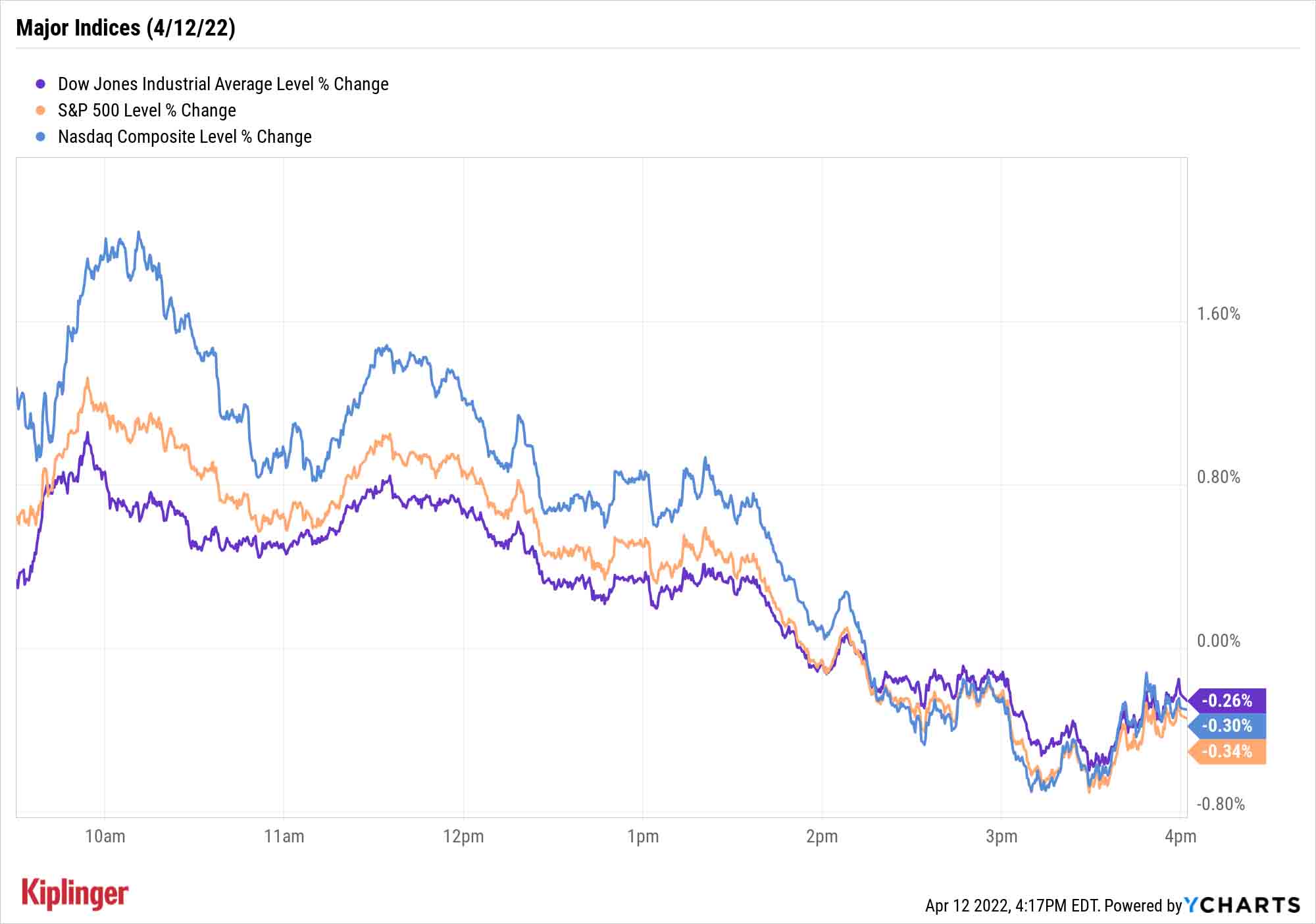

Those optimists drove the major indexes to significant gains right after the opening bell, but the bulls' energy was depleted early, and selling dominated the rest of the day as Wall Street further absorbed the consumer-price figures.

"Momentum in core inflation still looks too strong," says Bill Adams, chief economist for Comerica Bank. "The biggest part of this is surging costs of rents and owners' equivalent rent of primary residence. These CPI components are stickier than other consumer prices; they rose at the fastest rates in 20 years in March, and they are accelerating."

Adams adds that housing-related costs in the consumer price index tend to follow home-price indexes such as the Case-Shiller and FHFA with a lag of between six and 18 months.

"This will continue to be a driver of hot inflation well into 2023," he says.

Energy stocks (+1.7%) surged, largely because of a boom in U.S. crude oil futures, which finished up 6.7% to $100.60 per barrel after Shanghai eased some of its COVID-related lockdowns.

But the rest of the market let early gains slip. The Dow Jones Industrial Average (-0.3% to 34,220), S&P 500 (-0.3% to 4,397) and Nasdaq Composite (-0.3% to 13,371) all closed out Tuesday's session with modest declines.

Other news in the stock market today:

- The small-cap Russell 2000 managed to finish 0.3% in the green, to 1,986.

- Gold futures climbed 1.4% to settle at $1,976.10 an ounce, marking their fourth straight gain.

- Bitcoin dipped below the $40,000 mark, off 1.8% to $39,324.96. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- CarMax (KMX) was a notable decliner today, falling 9.5% following the used car company's earnings report. In its fourth quarter, KMX reported revenue of $7.7 billion, up 49% year-over-year and more than analysts were expecting. But CarMax's earnings of 98 cents per share were 22.8% lower than the year-ago period and below Wall Street's consensus estimate. "We believe a number of macro factors weighed on our fourth-quarter unit sales performance, including declining consumer confidence, the omicron-fueled surge in COVID cases, vehicle affordability, and the lapping of stimulus benefits paid in the prior year period," said CarMax CEO Bill Nash in a statement.

- Several energy stocks rose alongside oil prices today. Marathon Oil (MRO, +4.2%), Devon Energy (DVN, +3.7%) and EOG Resources (EOG, +2.7%) were among some of the day's biggest advancers.

Keep Guarding Against Inflation

The name of the game, then, remains defense, with strategists continuing to suggest inflation protection until economic data signals otherwise.

Gargi Chaudhuri, head of investment strategy, Americas, for ETF provider iShares, says her firm favors "a diversified, multi-asset approach to navigate higher prices."

First, in equities, "companies with pricing power, strong balance sheets, and healthy profit margins, like those in the technology and healthcare sectors, should do well as inflation stays higher than average," she says. You can start your search among our top tech stocks and healthcare picks for the year, both of which boast a number of highly favored blue chips.

"In bonds," Chaudhuri continues, "we like inflation-protected and short-term Treasuries and credit, which should benefit from sticky inflation and the Federal Reserve's effort to tamp down inflation by raising rates."

While dedicated investors can seek out individual debt issues, most of us typically get our fixed-income exposure through bond mutual funds and bond exchange-traded funds (ETFs).

On both fronts, our suggestions mirror Chaudhuri's, with most of our recommendations designed to counter the effects of imminent inflation. Better still, our bond ETF picks can get you that kind of protection for a relative song. Read on as we highlight five fixed-income ETFs that also boast skinflint fees.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.