Stock Market Today: Stock Selloff Resumes After Sizzling Inflation Update

The latest consumer price index hit a 40-year high in February, led by big price spikes in food and energy.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Markets resumed their selloff today after cabinet-level talks between Ukraine and Russia failed to result in any progress toward a diplomatic solution to end the conflict between the two countries. Investors were also treated to the latest inflation update, which came in red-hot once again.

Specifically, the Labor Department said its consumer price index (CPI) – which measures the cost consumers pay for goods and services – rose at an annual rate of 7.9% in February, the quickest year-over-year (YoY) increase since January 1982.

"Notable increases came from food and energy, which increased 7.9% and 25.6% [YoY], respectively," says Peter Essele, head of portfolio management for Commonwealth Financial Network. However, "Gains were seen across the board, including the shelter component of CPI that typically makes up one-third of household budgets," Essele adds.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Core CPI, which excludes the volatile food and energy sectors, was up 6.4% from the year prior.

Also on the economic front, intial jobless claims rose 11,000 to 227,000 last week due to outsized layoffs in New York and California, while continuing claims, which are reported on a one-week lag, increased by 25,000 to 1.49 million in the week ended Feb. 26. "Initial jobless claims increased a bit more than expected, and continuing claims increased against expectations for a decline," says a team of Goldman Sachs economists.

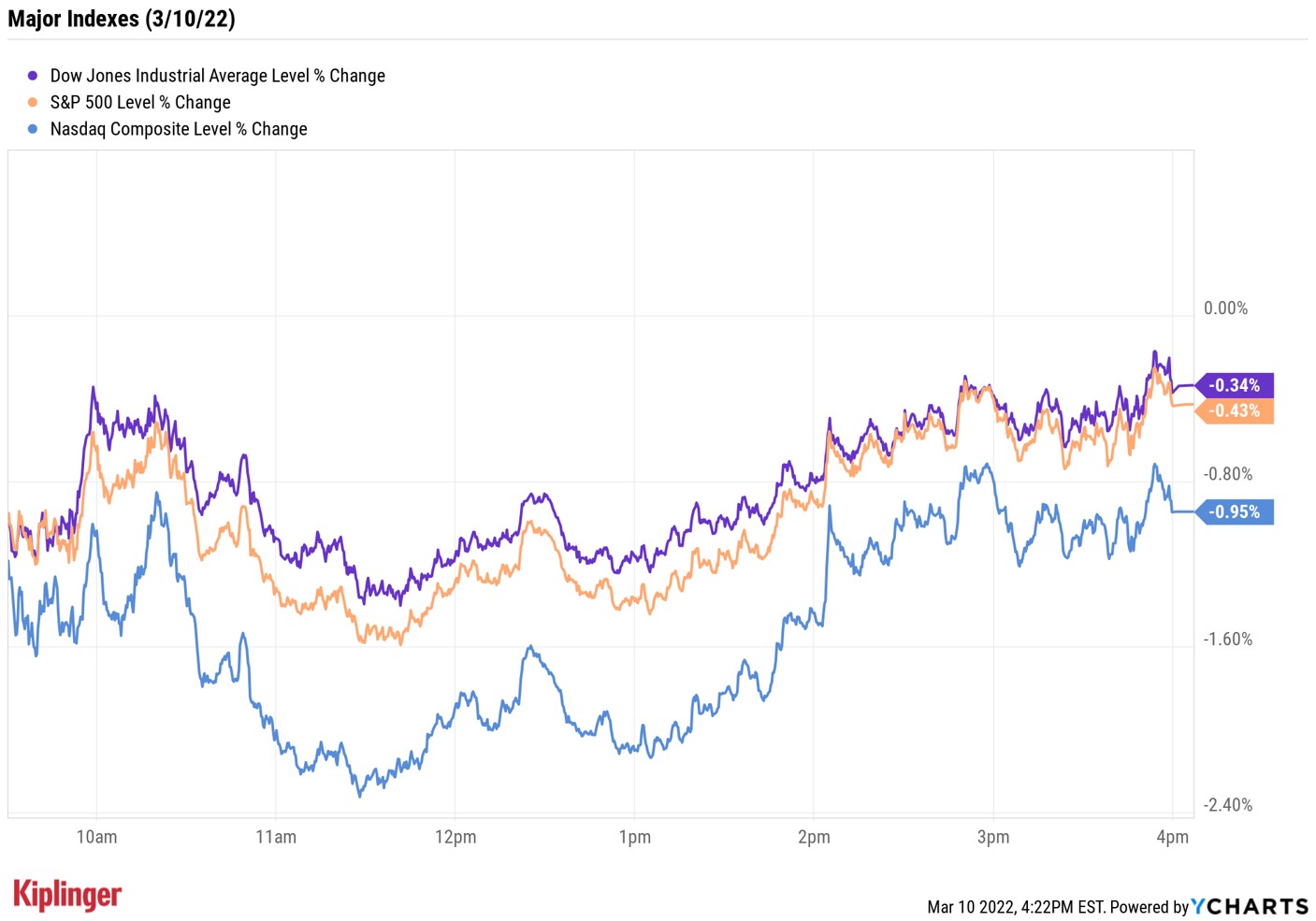

Although the major benchmarks finished off their session lows, the Nasdaq Composite still shed 1% to 13,129, the S&P 500 Index gave back 0.4% to end at 4,259 and the Dow Jones Industrial Average fell 0.3% to 33,174.

Other news in the stock market today:

- The small-cap Russell 2000 slipped 0.2% to 2,011.

- U.S. crude futures shed 2.5% to end at $106.02 per barrel, marking their second straight decline.

- Gold futures edged up 0.6% to settle at $2,000.40 an ounce.

- Bitcoin retreated 5.2% to $39,625.86. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Amazon.com (AMZN) turned in an impressive session, jumping 5.4% after the e-commerce giant last night announced a 20-for-1 stock split and $10 billion share buyback program. The Amazon stock split will occur in June – shortly before fellow mega-cap tech stock Alphabet (GOOGL) undergoes its own 20-for-1 stock split.

- CrowdStrike Holdings (CRWD) soared 12.5% after the cybersecurity firm reported earnings. In its fourth quarter, CRWD reported adjusted earnings of 30 cents per share on $431 million in revenue – more than analysts were expecting. The firm also offered higher-than-anticipated revenue guidance for the current quarter and full fiscal year. "The company is firing on all cylinders with impressive net new annual recurring revenue adds in Q4 (up 14.3% sequentially) reaching a record $217 million, led by strong broad-based demand for modules across its platform, large (eight-figure) deals and high dollar-based net retention rates," says CFRA Research analyst Janice Quek (Strong Buy). "CRWD is proving itself to be more than just an endpoint security vendor, as traction with its cloud, identity protection and log management products contributed to new wins."

How to Prepare for Even Higher Inflation

Today's CPI data confirms two things: Inflation is not transitory and price levels have not peaked. This is according to Robert Schein, chief investment officer at Blanke Schein Wealth Management.

"Thursday's data is for February, which does not account for the early March spike in oil prices," Schein says. "We believe there will be even stronger inflation reports over the coming months."

Inflation has already been "a key market concern" for investors, he adds, and with "the stock market trading near correction territory, investors should be adding exposure to quality companies with strong balance sheets and cash flows."

These can often be found in sturdy blue chips or steady dividend growers, but Schein also points to beaten-down tech stocks, which he calls a "gift" to investors that will reward them in the long run. Here, we take a look at 10 tech stocks that are trading at significant discounts to where they started the year, each of which has solid growth prospects over the long term.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.