Stock Market Today: Monday Surge Sparks Santa Claus Rally Hopes

The S&P 500 notched its 69th closing high of 2021, and the Dow and Nasdaq also finished solidly green as traders returned from the long holiday weekend.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

For many Christmas celebrators, any expectations for Saint Nicholas's generosity are realized (or not) on Dec. 25. But investors remain on alert for a week or so longer in hopes of a "Santa Claus rally" – and so far for 2021-22, their wishes have been answered.

Despite a holiday season that has been undermined by the omicron variant, disrupting travel plans and canceling get-togethers, stocks got off to a hot start Monday. Following up on earlier data out of South Africa suggesting the omicron variant is less lethal than its predecessors, additional studies from that country, as well as Scotland and England, similarly showed that omicron cases were less likely to result in hospitalization.

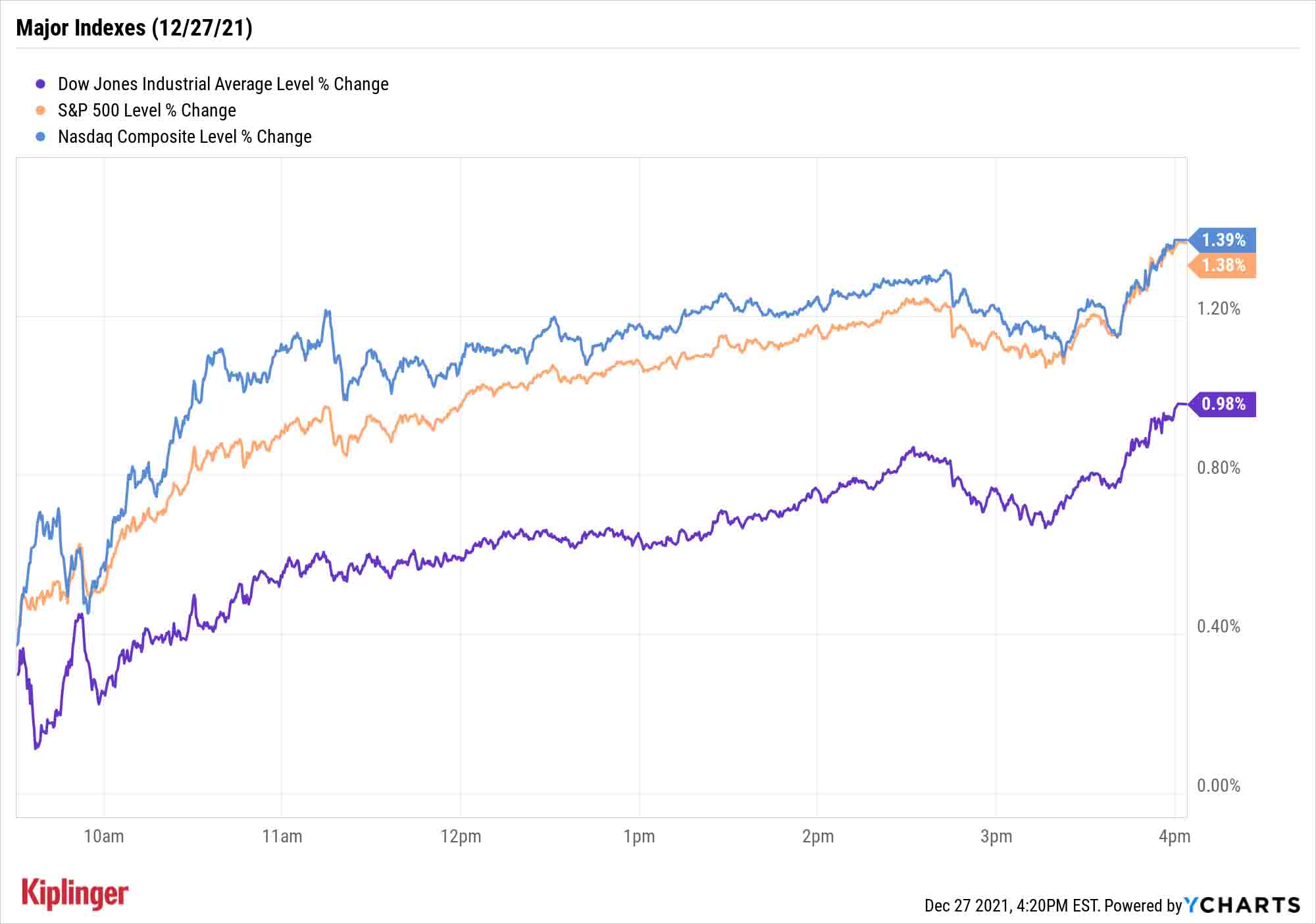

Wall Street responded with widespread buying; all 11 S&P 500 sectors finished in the green, pushing the index up 1.4% to a new record close of 4,791. The Dow Jones Industrial Average (+1.0% to 36,302) and Nasdaq Composite (+1.4% to 15,871) also ended the day higher.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

It's a promising start to that potential Santa Claus rally – a period of historical outperformance during the final five trading days of December and the first two days of the following January.

It's also a welcome bit of excitement in what should be a lackluster week from a data perspective.

"There is virtually nothing on the calendar," says Michael Reinking, senior market strategist for the New York Stock Exchange. "In the U.S., the only impactful economic data is on Thursday with claims and the Chicago [purchasing managers indexes]. China PMI on Friday could get some attention if there is anyone still watching at that point."

Other news in the stock market today:

- The small-cap Russell 2000 improved by 0.9% to 2,261.

- U.S. crude oil futures rose 2.4% to settle at $75.57 per barrel.

Gold futures slipped 0.2% to settle at $1,808.80 an ounce. - Bitcoin joined in Monday's rally, gaining 0.6% to $51,252.57. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- GoDaddy (GDDY) was a big mover, jumping 8.4% after The Wall Street Journal said Starboard Value took a large stake in the domain registration firm. According to the report, which cited people familiar with the matter, the activist investor holds a roughly 6.5% position, worth roughly $800 million, and plans to find ways for GDDY to boost its share performance. Even with today's surge, the stock is down about 3% over the last 12 months.

- Cruise stocks got knocked down after reports surfaced over the past few days that several ships were returning to port after discovering omicron outbreaks onboard. Among them were Royal Caribbean's (RCL) Odyssey of the Seas, which last Thursday reported 55 confirmed cases among passengers. RCL stock fell 1.4%, Carnival (CCL) gave back 1.2% and Norwegian Cruise Line (NCLH) dropped 2.6%.

Pros Say to Bank on Banks in 2022

A weakened COVID variant would do much for analysts predicting continued economic recovery in 2022 – and the sectors they see benefiting from it.

Cyclical sectors such as materials and energy are popular calls heading into the new year, but one of the most ballyhooed corners of the market going into 2022 is financials. That's because the sector's banks and insurers are not only poised to benefit from additional economic expansion, but from an increasingly hawkish Federal Reserve that's projecting three increases to its benchmark interest rate in 2022.

"Financials have historically been the biggest beneficiary of higher interest rates as a result of a steeper yield curve and greater willingness to lend," says Global X Chief Investment Officer Jon Maier. "As rates trend upwards, banks tend to benefit from higher lending activity and higher interest rates charged to their consumers."

Like with many slices of the market, investors looking for broad, diversified access to the sector can do so via exchange-traded funds (ETFs), but those who want to make concentrated bets can start with our short list of 2022's top financial picks.

Read on as we explore the 12 highest-rated financial-sector stocks heading into the new year, and discuss why they appear likely to follow up 2021's outperformance with even more gains in 2022.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.