My First $1 Million: Banking Executive, 48, Southeast US

"We just did it by rigorous budgeting and saving for nine years. No business, no real estate, no inheritance."

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Welcome to Kiplinger's My First $1 Million series, in which we hear from people who have made $1 million. They're sharing how they did it and what they're doing with it.

This time, we hear from a married 48-year-old banking executive who lives in the Southeast but is originally from the Northeast. He's still working, but his wife left her job when they had the first of three children many years ago.

See our earlier profiles, including a writer in New England, a literacy interventionist in Colorado, a semiretired entrepreneur in Nashville and an events industry CEO in Northern New Jersey. (See all of the profiles here.)

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Each profile features one person or couple, who will always be completely anonymous to readers, answering questions to help our readers learn from their experience.

These features are intended to provide a window into how different people build their savings — they're not intended to provide financial advice.

THE BASICS

How did you make your first $1 million?

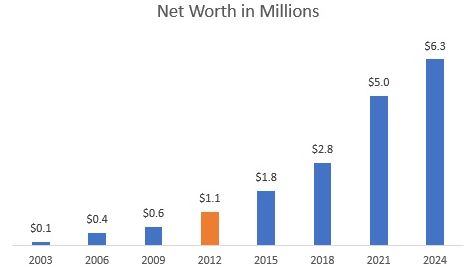

We eclipsed $1 million in net worth in 2012 when we were both 35. My goal was to hit that threshold when I was 40, so I was excited to have been ahead of schedule.

Our combined incomes up to that point had been less than $200,000 each year. We just did it by rigorous budgeting and saving for nine years. No business, no real estate, no inheritance.

Just fully funding retirement and health savings accounts (HSAs), starting college accounts, investing and dollar-cost averaging.

We don't spend recklessly. I've had the same car for 12 years.

I was interested in saving and investing at a young age and invested all of my summer job income and lifetime savings ($1,800) at age 18 into a Fidelity Select Technology Mutual Fund.

We actually still use the same Excel file that I've used for the past 20-plus years to track all of our income and expenses. We categorize spending by must/core expenses and then other/optional.

Additionally, I update our balance sheet at year-end. We still track it today, and we have been able to grow our net worth with the luck of home price appreciation, higher income, the magic of compounding and adding a couple of real estate rental properties in the past 10 years.

Here's a graphic of our income growth since 2003:

What are you doing with the money?

We paid off our mortgage early, increased our charitable giving as we made more, bought some rental property, and now we spend a bit more on vacations.

THE FUN STUFF

Did you do anything to celebrate?

We probably went out to dinner.

What is the best part of making $1 million?

Security.

Did your life change?

Not really, but we felt a lot more secure and knew we could face an emergency and do some more fun things and give back a lot more.

Any plans to retire early?

I'd like to retire around age 55.

LOOKING BACK

Anything you would do differently?

Not that I can think about, other than investing early in Apple (AAPL), Amazon (AMZN), Nivida (NVDA) and some others! 😊 Maybe we could have gone out to dinner more.

What would you tell your younger self about making $1 million?

"Well done!"

Did you work with a financial adviser?

Yes.

Did anyone help you early on?

Not really. My finance and accounting background in college and my first job as a credit analyst served me very well.

LOOKING AHEAD

Plans for your next $1 million?

Now that we are at $6 million, I'd like to double that to $12 million in seven years (about a 10% rate of return).

Any advice for others trying to make their first $1 million?

Track everything so you know where your money goes. Estimate what you will make, take home and spend in the next year and set savings goals.

Do all of this with your spouse — recap the prior year and talk about the next year's goals together.

Do you have an estate plan?

Yes, we have a revocable living trust, wills, powers of attorney, health care proxies, etc. We set those up after reading Money magazine and Kiplinger all these years.

We wanted to avoid probate and prevent our kids from inheriting a ton of money at too young of an age if we died early.

Anything you'd like to add?

The best lessons learned were all in the first decade of my investing career (that was a tough decade!).

I graduated from college right before the tech bubble in 2000 and learned to not rely too much on what stock pickers say or on individual stocks (especially avoiding companies that don't make money or have too much debt 😊).

During the financial crisis in 2008-2011, I learned to not panic-sell and stay the course. I started investing more in low-volatility and value companies.

Once we got through two bubbles, I felt real estate would be a great way to build wealth (especially in such a low-interest-rate environment).

If you have made $1 million or more and would like to be anonymously featured in a future My First $1 Million profile, please fill out and submit this Google Form or send an email to MyFirstMillion@futurenet.com to receive the questions. We welcome all stories that add up to $1 million or more in your accounts, although we will use discretion in which stories we choose to publish, to ensure we share a diversity of experiences. We also might want to verify that you really do have $1 million. Your answers may be edited for clarity.

RELATED CONTENT

- You're 62 Years Old With $1 Million Saved: Can You Retire?

- Want to Earn $1 Million More Over Your Lifetime? Do This

- Do You Have at Least $1 Million in Tax-Deferred Investments?

- Are You Rich? U.S. Net Worth Percentiles Can Provide Answers

- Compare Your Net Worth by Age

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

As Contributed Content Editor for the Adviser Intel channel on Kiplinger.com, Joyce edits articles from hundreds of financial experts about retirement planning strategies, including estate planning, taxes, personal finance, investing, charitable giving and more. She has more than 30 years of editing experience in business and features news, including 15 years in the Money section at USA Today.

-

4 High-End Experiences Worth the Splurge After 50

4 High-End Experiences Worth the Splurge After 50These curated date ideas provide the perfect backdrop for couples ready to enjoy the very best that the world has to offer.

-

Health Care Stocks Have Sagged. Can You Bet on a Recovery?

Health Care Stocks Have Sagged. Can You Bet on a Recovery?The flagging health care sector has perked up a bit lately. Is it time to invest?

-

Costco's Auto Program: Can Membership Pricing Really Save You Money on a Car?

Costco's Auto Program: Can Membership Pricing Really Save You Money on a Car?Costco's Auto Program can simplify the car-buying process with prearranged pricing and member perks. Here's what to know before you use it.

-

What Is an Assumable Mortgage and Could It Save You Thousands?

What Is an Assumable Mortgage and Could It Save You Thousands?With mortgage rates still elevated, taking over a seller’s existing home loan could lower monthly payments — if the numbers work.

-

Have You Fallen Into the High-Earning Trap? This Is How to Escape

Have You Fallen Into the High-Earning Trap? This Is How to EscapeHigh income is a gift, but it can pull you into higher spending, undisciplined investing and overreliance on future earnings. These actionable steps will help you escape the trap.

-

I'm a Financial Adviser: These 3 Questions Can Help You Navigate a Noisy Year With Financial Clarity

I'm a Financial Adviser: These 3 Questions Can Help You Navigate a Noisy Year With Financial ClarityThe key is to resist focusing only on the markets. Instead, when making financial decisions, think about your values and what matters the most to you.

-

Where Olympians Store Their Medals is a Great Lesson For Your Valuables and Cash

Where Olympians Store Their Medals is a Great Lesson For Your Valuables and CashWhat you can learn about protecting your cash and values from where Olympians store their medals.

-

An Executive's 'Idiotic' Idea: Skip Safety Class and Commit a Federal Crime

An Executive's 'Idiotic' Idea: Skip Safety Class and Commit a Federal CrimeSeveral medical professionals reached out to say that one of their bosses suggested committing a crime to fulfill OSHA requirements. What's an employee to do?

-

How You Can Use the Financial Resource Built Into Your Home to Help With Your Long-Term Goals

How You Can Use the Financial Resource Built Into Your Home to Help With Your Long-Term GoalsHomeowners are increasingly using their home equity, through products like HELOCs and home equity loans, as a financial resource for managing debt, funding renovations and more.

-

How to Find Free Money for Graduate School as Federal Loans Tighten in 2026

How to Find Free Money for Graduate School as Federal Loans Tighten in 2026Starting July 1, federal borrowing will be capped for new graduate students, making scholarships and other forms of "free money" vital. Here's what to know.

-

How to Choose the Best Internet Plan in Retirement

How to Choose the Best Internet Plan in RetirementYour internet needs can change dramatically after you stop working. Here's how to make sure you're not overpaying (or underpowered).