Nike Stock: China Worries Hang Over NKE Earnings

Our preview of the upcoming week's earnings reports includes Nike (NKE), Micron Technology (MU) and CarMax (KMX).

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Nike (NKE, $161.78) headlines a thin earnings calendar this week. BofA Global Research analysts Lorraine Hutchinson and Christopher Nardone aren't expecting any surprises when the athletic apparel maker reports its fiscal second-quarter results after Monday's close.

Indeed, Nike may have caught the Street off-guard in its last two reports, updating its five-year plan in June and then lowering its fiscal 2022 sales guidance in September – the latter due to supply-chain issues and COVID-related factory closures in Vietnam and Indonesia. But management has already warned of a few challenging quarters ahead, the analysts say.

As for the details of the report, Hutchinson and Nardone will be watching for updates on China, where data points remain volatile following supply-chain disruptions and last spring's boycott of the brand by consumers on the mainland.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Specifically, data from Tmall – a China-based e-commerce site run by Alibaba (BABA) – shows Nike revenues were down 31% year-over-year in the company's fiscal second quarter, while monthly sales at Pou Sheng, a major Chinese distributor for NKE, were off 30% compared to the year prior. The pair has a Neutral rating on the stock – which is the equivalent of a Hold – saying "the risk/reward remains balanced until we have more visibility on the rebound in China."

This outlook is shared by UBS Global Research analyst Jay Sole. "Sentiment on Nike has improved over the past two months as the Vietnam factory shutdown issue has faded," Sole writes in a note. However, he's keeping his expectations in check amid "concern around how Nike is performing in China."

Still, Sole has a Buy rating on the Dow Jones stock. "We continue to believe Nike will be a long-term global share taker (including within China) and outperform over the near term," he says.

Amid these overhangs, analysts, on average, are expecting Nike to report a 19.2% year-over-year (YoY) drop in earnings to 63 cents per share. Revenues are expected to edge up to $11.26 billion from last year's $11.24 billion.

Micron Stock Rebound Stalls Ahead of Earnings

After bottoming near $66 in mid-October, Micron Technology (MU, $82.13) rebounded sharply, gaining more than 38% to hit its late-November highs around $87. More recently, though, this rally has stalled, with MU stock last seen trading closer to $82.

Can earnings give the semiconductor stock the jolt it needs to finish the year strong?

"We see results and guidance biased higher amid early signs of improvement in calendar fourth-quarter DRAM contract pricing that we think sustains into the February quarter and into summer 2022," says UBS Global Research analyst Timothy Arcuri (Buy). As such, he raised his price target on MU to $99 from $90 ahead of the company's fiscal first-quarter earnings report, due out after Monday's close.

Arcuri isn't alone in his upbeat outlook toward Micron. Of the 35 analysts covering the stock that are tracked by S&P Global Market Intelligence, 20 call it a Strong Buy and seven say Buy. This compares to six that have it at Hold, one that rates it a Sell and one that has it at Strong Sell.

As for MU's upcoming earnings report, consensus estimates are for earnings of $2.11 per share (+170.5% YoY) and revenues of $7.67 billion, a 32.9% improvement over the year-ago period.

Analyst: Expect CarMax Earnings to Beat Estimates

Used car dealer CarMax (KMX, $tk) has thrived in 2021 as a global chip shortage created a dearth of new vehicles – and ramped up sales (and prices) of used ones. Year-to-date, the stock is up 50%, though it's currently off about 10% from its mid-November record high around $156.

So, what should we expect from KMX's fiscal third-quarter earnings report, due out ahead of the Dec. 22 open?

"We believe CarMax is poised to easily exceed third-quarter consensus top-line expectations given very healthy sales momentum, improved inventory levels, improved conversion on better staffing levels and ongoing robust used car pricing," says William Blair analyst Sharon Zackfia. She has an Outperform rating on the stock, which is the equivalent of a Buy.

As for those consensus estimates, analysts, on average, are expecting fiscal third-quarter earnings of $1.46 per share – up 2.8% from the year prior – and revenues of $7.34 billion (+41.7% YoY). For the sake of comparison, Zackfia is anticipating slightly higher earnings of $1.48 per share on $8.08 billion in sales.

Karee Venema was long NKE as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

Stocks End Volatile Year on a Down Note: Stock Market Today

Stocks End Volatile Year on a Down Note: Stock Market TodayAfter nearing bear-market territory in the spring, the main market indexes closed out the year with impressive gains.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

These Were the Hottest S&P 500 Stocks of the Year

These Were the Hottest S&P 500 Stocks of the YearAI winners lead the list of the S&P 500's top 25 stocks of 2025, but some of the names might surprise you.

-

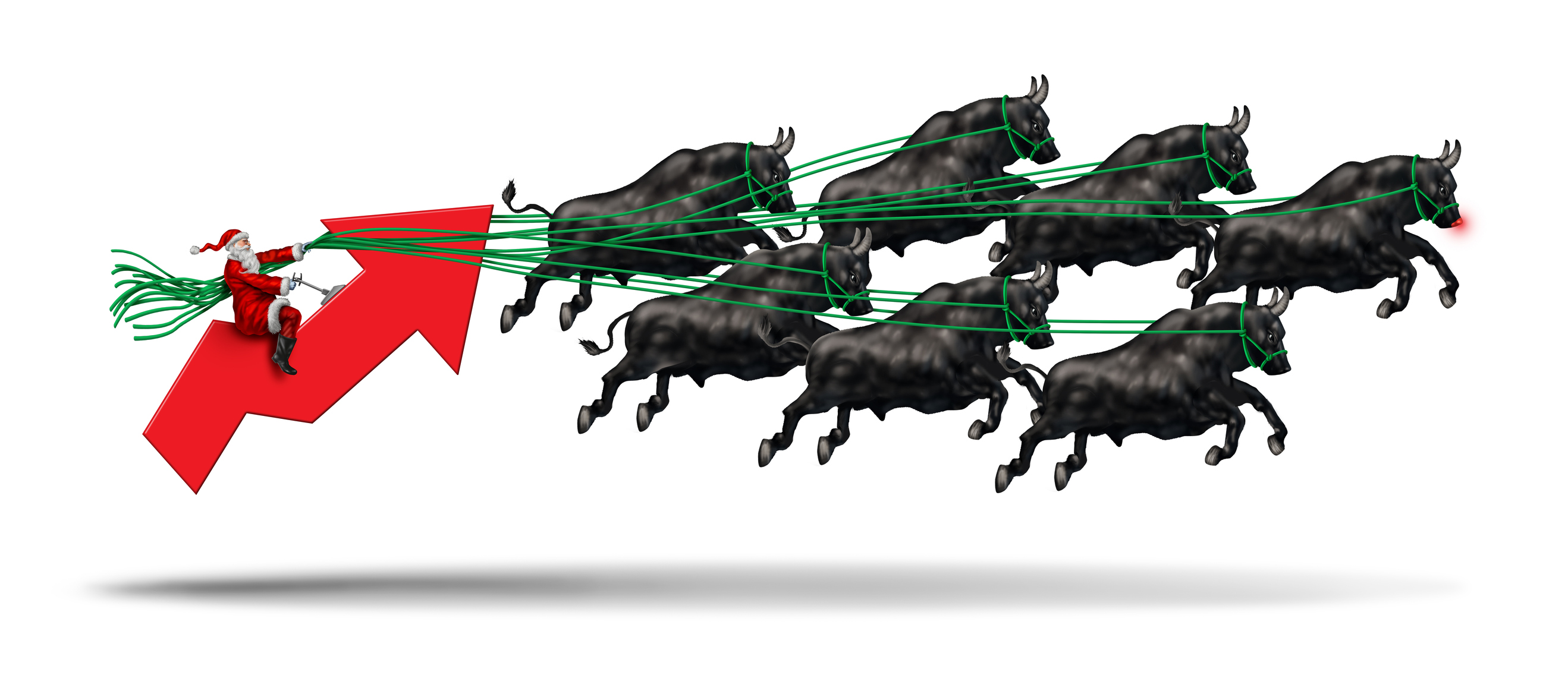

The Santa Claus Rally Officially Begins: Stock Market Today

The Santa Claus Rally Officially Begins: Stock Market TodayThe Santa Claus Rally is officially on as of Wednesday's closing bell, and initial returns are positive.