Stock Market Today: Stocks Slip After Dismal Jobs Number

The U.S. added a much lower-than-expected 194,000 new jobs in September.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

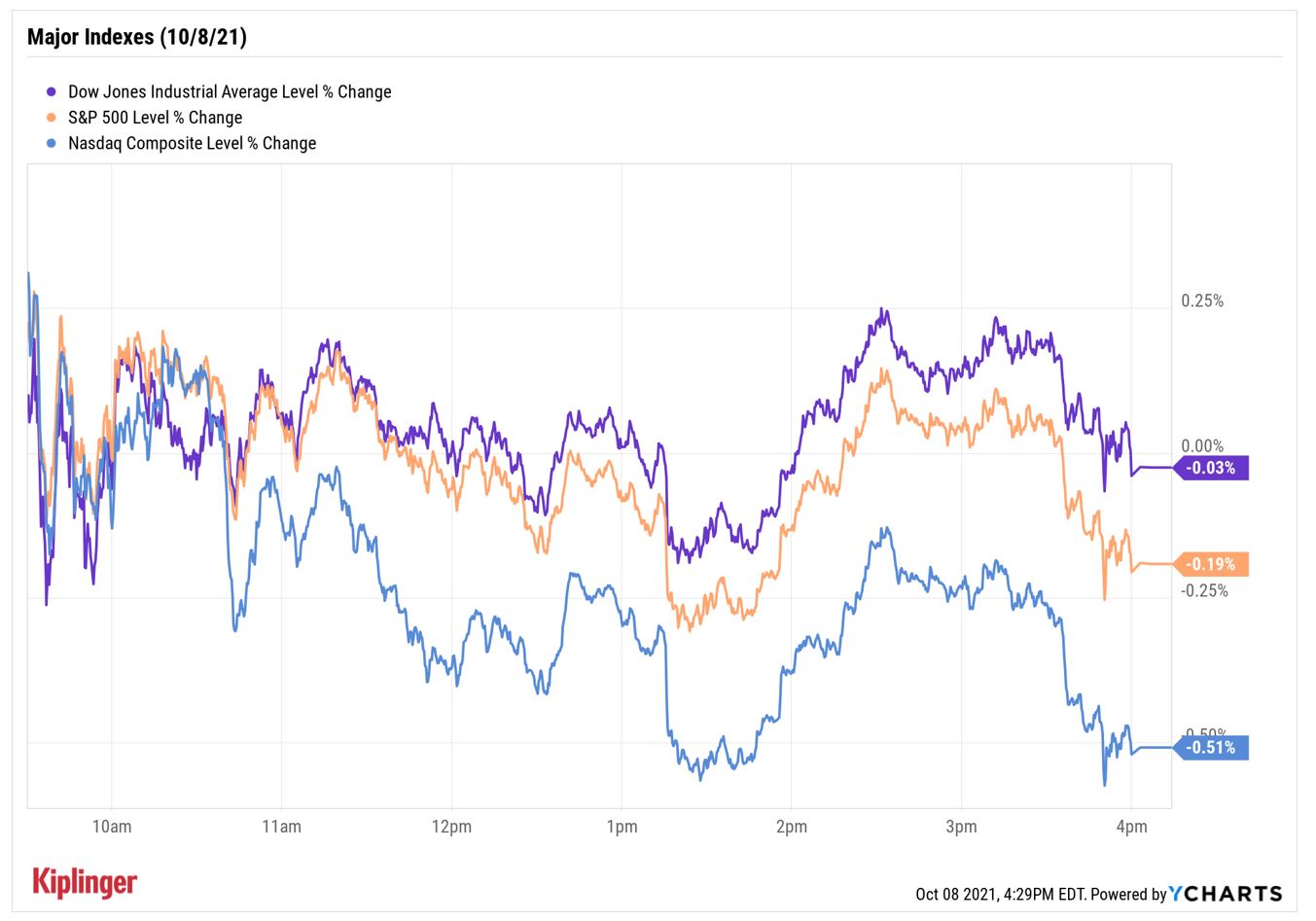

It was a choppy end to the week as the markets weighed mixed messages from the latest jobs report.

While the headline number was a major disappointment – 194,000 new jobs added versus expectations of 500,000 – there was more promising news elsewhere, including an upward revision in August's numbers, to 366,000 from 235,000.

Additionally, wages rose 4.6% on an annualized basis and the unemployment rate fell to 4.8%, signaling "that labor conditions are fairly tight given the current amount of job openings in the economy," says Charlie Ripley, senior investment strategist for Allianz Investment Management. "Ultimately, today's report shouldn't sway the Fed from moving forward with tapering the bond program in the coming months."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Kiplinger Letter economist David Payne agrees. "The lackluster September report is not likely to slow the Federal Reserve's plans to begin cutting back on its purchases of government and mortgage-backed securities before the end of the year," he says.

The Dow Jones Industrial Average spent most of the day higher as energy giant Chevron (CVX, +2.2%) gained alongside oil prices (+1.3% to $79.35 per barrel), but slipped into the red at the close (-0.03% to 34,746). The S&P 500 Index fell 0.2% to 4,391, while the Nasdaq Composite gave back 0.5% to 14,579.

As a reminder, the stock market will be open on Monday, Oct. 11, despite it being Columbus Day (increasingly known as Indigenous Peoples' Day). However, the bond market, which is more closely tied to federal holidays, will be closed, reopening on Tuesday, Oct. 12.

Other news in the stock market today:

- The small-cap Russell 2000 shed 0.8% to finish at 2,233.

- General Motors (GM, +3.8%) got a boost after Credit Suisse analyst Dan Levy reiterated his Outperform (Buy) rating on the auto stock in the wake of the company's annual investor day. "GM is trying to shatter the perception that they are a no-growth Auto 1.0 company facing powertrain risk, and instead show us the potential for growth, electric vehicle (EV) leadership and significant revenue outside core vehicle sales," he wrote in a note, calling both the company's earnings targets and the stock's potential upside "compelling."

- Charter Communications (CHTR, -4.8%) and Comcast (CMCSA, -4.7%) were both pelted on Friday following a dour note from Wells Fargo's Steven Cahall. The analyst has taken a more bearish view of the broader cable industry amid growing competition and increased cord-cutting. Cahall slapped Charter with a rare double downgrade – from Overweight (Buy) to Underweight (Sell) – and lowered his price target to $665 per share (5.8% downside) from $848. He also maintained his Underweight on CMCSA shares but dropped his PT to $41 per share (25% downside) from $49.

- Gold futures eased back 0.1% to $1,757.40 an ounce.

- The CBOE Volatility Index (VIX) fell 3.9% to 18.77.

- Bitcoin prices rose 1.3% to $54,677.20. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Here Comes Earnings Season

In store for next week: The start to third-quarter earnings season.

Results this time around likely won't be as explosive as they were in Q2, when S&P 500 companies reported earnings growth of 91% – the highest since Q4 2009, according to FactSet.

Nevertheless, 56 of the 500 S&P 500 companies have already issued positive earnings per share (EPS) guidance for the quarter, which is more than 43% higher than the five-year average, says John Butters, vice president and senior earnings analyst at FactSet.

At present, this is "the fourth-highest number of S&P 500 companies issuing positive EPS guidance for a quarter since FactSet began tracking this metric in 2006," he adds. "The current record is 67, which occurred in the previous quarter (Q2 2021)."

JPMorgan Chase (JPM) will kick off a busy stretch of earnings for both Dow Jones stocks and financial firms – the latter of which has been catching attention lately due to rising interest rates, higher inflation and expectations for imminent tapering by the Fed. Here, we've compiled a list of the most compelling plays in the space, according to Wall Street's analysts. Check them out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Dow, S&P 500 Rise to New Closing Highs: Stock Market Today

Dow, S&P 500 Rise to New Closing Highs: Stock Market TodayWill President Donald Trump match his Monroe Doctrine gambit with a new Marshall Plan for Venezuela?

-

'Donroe Doctrine' Pumps Dow 594 Points: Stock Market Today

'Donroe Doctrine' Pumps Dow 594 Points: Stock Market TodayThe S&P 500 rallied but failed to turn the "Santa Claus Rally" indicator positive for 2026.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.