Nike (NKE) Earnings: Can the Dow Stock Shrug Off Supply Chain Woes?

Our preview of the upcoming week's earnings reports include Nike (NKE), FedEx (FDX) and Darden Restaurants (DRI).

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It's the tail end of earnings season, but there are still some heavy-hitters on tap. Among them is athletic apparel maker Nike (NKE, $156.42), which is scheduled to tell all in the earnings confessional after the Sept. 23 close.

Investors would certainly welcome a positive reaction to NKE earnings, given the struggles the stock has seen over the past month. Since topping out at a record high near $174 in early August, Nike shares have shed more than 10%.

While some of the more recent sell-off could be due to broad-market headwinds – the Dow and S&P 500 are both down about 0.2% so far in September – Wall Street appears to be a bit concerned over COVID-related global supply chain issues, particularly after Nike was forced to shutter factories in Vietnam in July because of the pandemic.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

These factories accounted for roughly 51% of NKE's total production capacity in Asia ahead of the shutdown. "The risk of significant cancellations beginning this holiday and running through at least next spring has risen materially for NKE as it is now facing at least two months of virtually no unit production at its Vietnamese factories," BTIG analyst Camilo Lyon wrote in a note. He recently downgraded the stock to Neutral (Hold) from Buy.

These months-long Vietnamese production disruptions also prompted UBS analyst Jay Sole to lower his fiscal 2022 earnings per share (EPS) estimate by 3%. Nevertheless, Sole – who has a Buy rating on the Dow stock – believes supply chain fears are likely already priced in.

Stifel analysts (Buy) also cut sales and earnings estimates, for the second and third quarters of fiscal 2022, but they see the "supply-oriented shocks to the business as one-time in nature and representing opportunity for positive reversal in future periods."

Additionally, any pullbacks in NKE should be viewed as a buying opportunity, "particularly if the stock sees a negative reaction to tempered fiscal 2022 guidance," they say. "There is no change to our constructive long-term outlook."

As far as Nike's upcoming fiscal first-quarter report: The pros, on average, are looking for a 17.9% year-over-year (YoY) rise in earnings to $1.12 per share. Revenue, meanwhile, is expected to arrive at $12.5 billion, a 17.9% improvement from the year prior.

FedEx Stock Stalls Ahead of Earnings

FedEx (FDX, $255.22) will report its fiscal first-quarter earnings after the Sept. 21 close.

The shares of the freight giant have been trending lower since May, and are now in negative territory on a year-to-date basis. But while "valuation has become more interesting … greater conviction in a sustained improvement in Express operating margin and return on invested capital (ROIC) is still needed for a more constructive view," BMO Capital analyst Fadi Chamoun says.

He adds that growth in FedEx's ground segment has slowed and "there appears to be limited opportunity for further improvement in the operating margin as the segment faces inflationary cost pressures, further capital investment needs and likely greater competitive intensity."

While Chamoun maintains a Market Perform (Neutral) rating on FDX, most pros are bullish. According to S&P Global Market Intelligence, 18 analysts call FedEx a Strong Buy, while five have a Buy rating. The other seven following the stock say it's a Hold, with not one Sell or Strong Sell rating out there. Plus, the average target price of $341.25 represents implied upside of roughly 34% over the next 12 months or so.

In terms of earnings, analysts, on average, see EPS of $5.00 in FedEx's fiscal first quarter, which is 2.7% higher than the year-ago period, and revenue of $21.9 billion (+13.5% YoY).

Darden Restaurants Expected to Report Major Growth

Darden Restaurants (DRI, $149.43) has had a choppy year, but the broader path has been higher. To wit, the shares are up more than 25% so far in 2021, and are trading about 3 percentage points below their late-August all-time peak of $153.

The stock could take out this technical milestone after it reports fiscal first-quarter earnings ahead of the Sept. 23 open, should history repeat itself. Following the release of its fiscal fourth-quarter results in June – which handily beat expectations and showed the Olive Garden parent's same-store sales had nearly returned to pre-pandemic levels – the shares jumped 3.2%.

Wall Street pros are certainly upbeat ahead of the company's results. Oppenheimer analysts Brian Bittner and Michael Tamas, for instance, are anticipating year-over-year same-store sales growth of 45.1% for DRI's fiscal first quarter, with 48.9% revenue growth expected for the three-month period.

Darden Restaurants "remains our favorite pick within full-service dining," they say. "Based on our analysis, we believe the model is uniquely positioned to at least achieve fiscal 2022 EPS forecasts despite industry-wide cost pressures. Plus, management is armed with unique sales levers to accelerate share gains if industry demand becomes choppier into year-end." They have an Outperform rating on DRI, which is the equivalent of a Buy.

Overall, the average analyst estimate is for Darden Restaurants to report fiscal Q1 EPS of $1.63 (+191% YoY). On the top line, estimates are for $2.2 billion, which is 43.8% more than what the company reported a year ago.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

Stocks End Volatile Year on a Down Note: Stock Market Today

Stocks End Volatile Year on a Down Note: Stock Market TodayAfter nearing bear-market territory in the spring, the main market indexes closed out the year with impressive gains.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

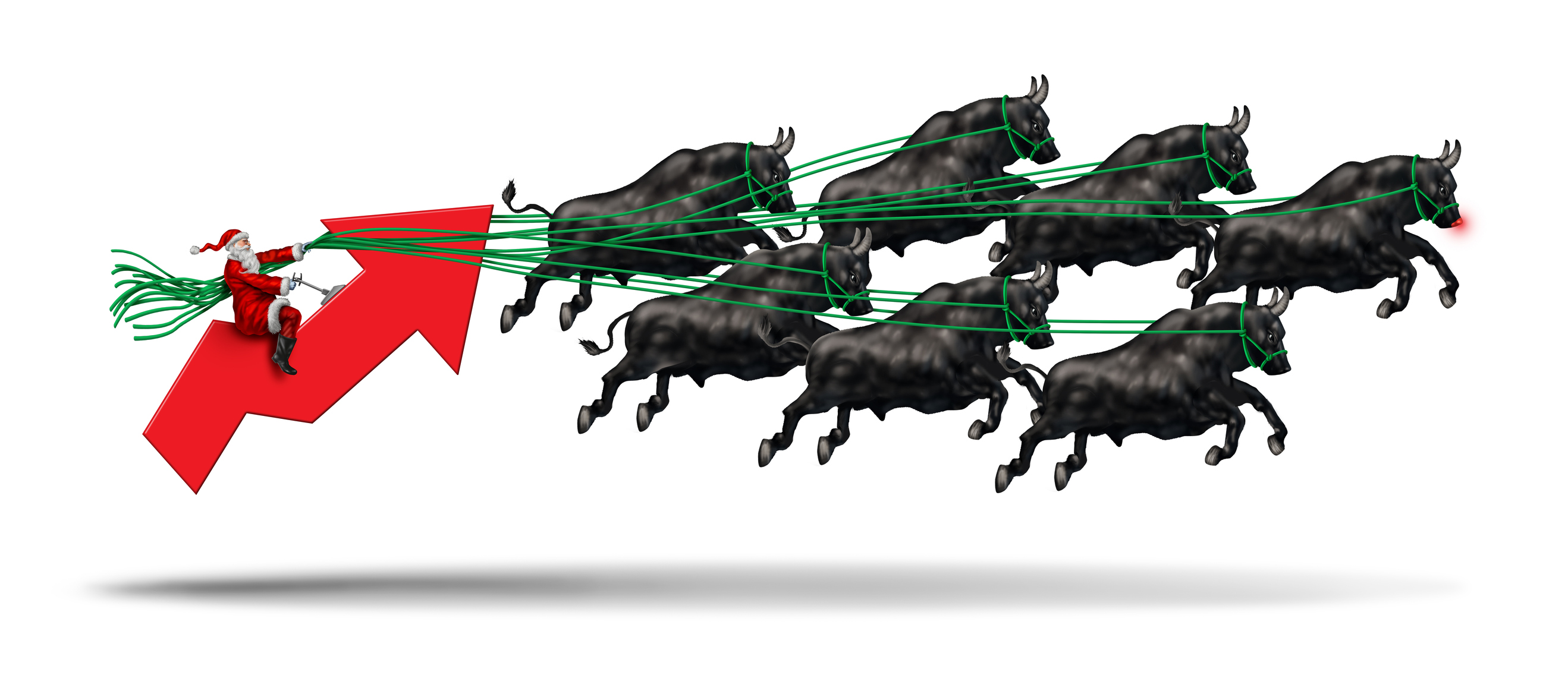

The Santa Claus Rally Officially Begins: Stock Market Today

The Santa Claus Rally Officially Begins: Stock Market TodayThe Santa Claus Rally is officially on as of Wednesday's closing bell, and initial returns are positive.

-

Nasdaq Leads as Tech Stages Late-Week Comeback: Stock Market Today

Nasdaq Leads as Tech Stages Late-Week Comeback: Stock Market TodayOracle stock boosted the tech sector on Friday after the company became co-owner of TikTok's U.S. operations.

-

Dow Rises 497 Points on December Rate Cut: Stock Market Today

Dow Rises 497 Points on December Rate Cut: Stock Market TodayThe basic questions for market participants and policymakers remain the same after a widely expected Fed rate cut.