Stock Market Today: Taper Tantrum? Not Today!

Fed Chair Jerome Powell indicated Friday that tapering likely would begin before year's end. A prepared Wall Street bid stocks higher anyway.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Federal Reserve Chairman Jerome Powell made the long-awaited signal that the central bank is likely to reel in some of its stimulus measures soon.

And if Friday's stock-market surge is any indication, Wall Street is OK with that.

Powell, speaking at the Federal Reserve's annual symposium in Jackson Hole, indicated that the Fed would probably begin paring back some of its $120 billion in monthly asset purchases. But he added that any such taper, when it comes, wouldn't mean that an interest-rate hike was close behind.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The timing and pace of the coming reduction in asset purchases will not be intended to carry a direct signal regarding the timing of interest rate liftoff, for which we have articulated a different and substantially more stringent test," Powell said.

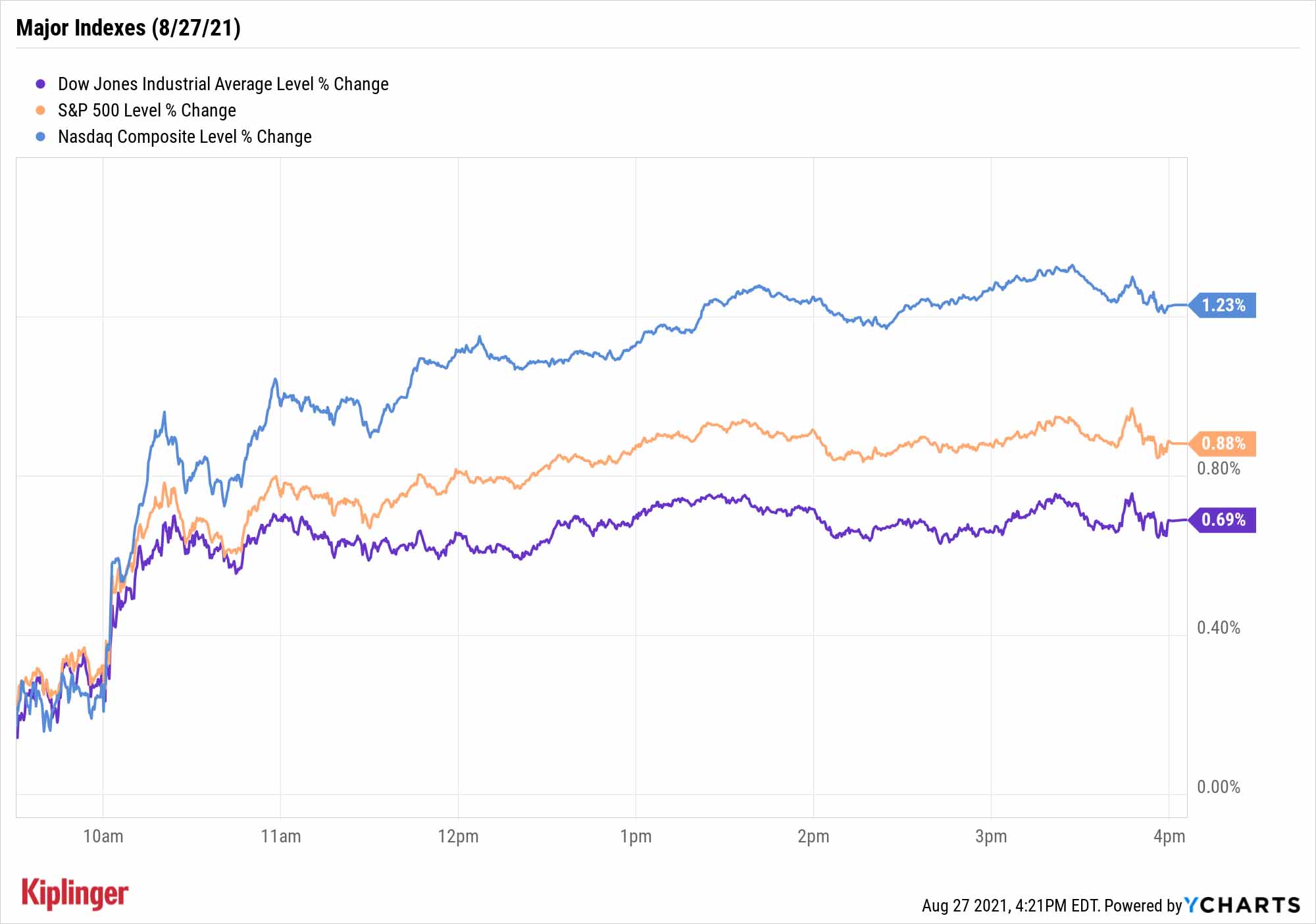

Stocks lifted off almost immediately after the announcement.

The Nasdaq Composite (+1.2% to 15,129) returned to record territory, as did the S&P 500 (+0.9% to 4,509), which finished above 4,500 for the first time. The Dow Jones Industrial Average (+0.7% to 35,455) joined them in the green, while the small-cap Russell 2000 topped them all, bounding 2.9% higher to 2,278.

"Powell's Jackson Hole speech was dovish in tone and consistent with the market's expectations," says David Bahnsen, chief investment officer of wealth management firm The Bahnsen Group. "The Federal Reserve has done ample work in recent weeks to prepare the market for the potential of a late 2021 tapering announcement."

"[Powell] successfully threaded the needle in communicating that tapering will likely begin this year, while reinforcing the notion that tapering does not mean tightening," adds Cliff Hodge, chief investment officer of Cornerstone Wealth. "We believe that barring further setbacks from the Delta variant, that September will likely produce a blowout jobs number and set the table for the official tapering announcement at the September FOMC meeting."

Other news in the stock market today:

- The small-cap Russell 2000 tktktk

- Peloton Interactive (PTON, -8.6%) took a tumble in the wake of its fiscal fourth-quarter results. For the three-month period, the company reported a wider-than-anticipated per-share loss of $1.05 as a result costs related to treadmill recalls, though revenue of $936.9 million came in above the consensus estimate. PTON also gave weaker-than-expected current-quarter revenue guidance due in part to a roughly 20% price drop to its original Peloton Bike.

- Big Lots (BIG, -4.8%) was another post-earnings loser. In its second quarter, the discount retailer recorded earnings of $1.09 per share on revenues of $1.46 billion – both figures lower than what Wall Street was expecting. BIG also said same-store sales slumped 13% on a year-over-year basis. CFRA analyst Arun Sundaram isn't too concerned, and reiterated her Buy rating on the shares. "Similar to peers, BIG is facing supply chain disruptions, surging freight rates and labor challenges," Sundaram says. "While the labor issues could be more structural in nature if BIG has to increase compensation to stay competitive, the supply chain and freight issues should be transitory, meaning these headwinds should turn into tailwinds with time."

- U.S. crude futures jumped 2% to settle at $68.74 per barrel – boosted by Hurricane Ida. The storm is expected to make landfall along the northern Gulf Coast in the U.S. on Sunday.

- Gold futures rose 1.4% to end at $1,819.50 an ounce.

- The CBOE Volatility Index (VIX) slumped 12.8% to 16.43.

- Bitcoin bounced back 2.9% to $48,327.39. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Starting to Get Nervous?

Are you celebrating … or are you wondering how the market can go any higher from here? Patrick Brewer, president of registered investment advisor WealthSource, can relate.

"Have you ever been on a roller coaster at Six Flags? Do you know that feeling when you're being dragged up to the top? You're just sitting there and thinking, 'Is this thing ever going to drop?' Well, that's what the financial markets feel like right now," he says. "This week I saw Visa paid $170k for a CryptoPunk NFT, people are paying premiums for used boats, and my dad called me last week with a stock that he thinks is a sure winner (which is always a good forward indicator for a pullback) – to me, it feels a little manic right now."

That hardly means a pullback is imminent – Brewer adds that Delta variant risks are baked into stock prices, and that the labor market remains strong, which is supportive – but a little caution might be warranted.

Brewer, for instance, says that some of his portfolio moves have included pulling back on cyclical holdings and adding technology stocks, as well as reducing emerging-market exposure and adding to developed international markets, where vaccination rates are stronger.

If you are considering adding a little padding to your defense, one place to start is this list of 11 stocks with safe financial profiles. Respected research firm Value Line has selected each of these stocks for both financial security and share-price stability – as well as expectations for market-beating gains over the next 18 months or so.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.