Stock Market Today: Dow Falls for Third Straight Day

Oil futures logged their sixth consecutive loss.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It was another volatile day on Wall Street.

The quickly spreading delta variant of COVID-19 continued to spook investors, and Thursday’s unemployment claims data – which showed first-time applicants fell by 29,000 last week to a pandemic-low 348,000 filings – only underscored signs of a tightening pool of available workers.

"The labor market is the Fed's primary target with its stimulus programs," says Andy Kapyrin, partner and co-head of Investments at wealth management firm RegentAtlantic. "It wants to see very significant progress towards full employment before it backs off."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

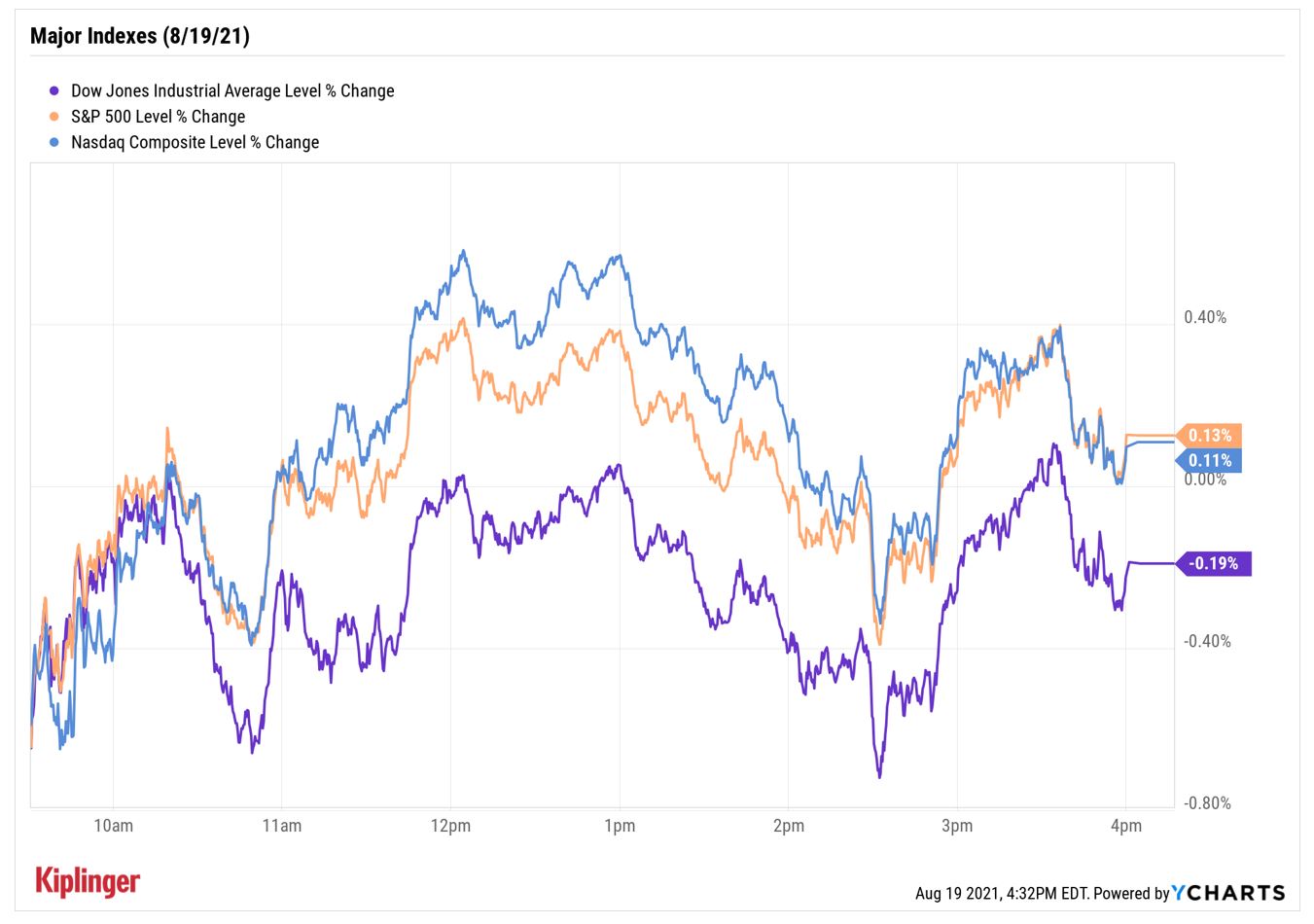

Although the major indexes traded on either side of breakeven all day, bargain-hunters helped pull the S&P 500 Index (+0.1% at 4,405) and Nasdaq Composite (+0.1% at 14,541) to a higher close.

The Dow Jones Industrial Average, however, wasn't so resilient, slipping 0.2% to 34,894, as oil major Chevron (CVX, -2.5%) plunged on a sixth straight drop for U.S. crude futures (-2.7% to $63.69 per barrel) – the longest such streak since February 2020. The industrial average has now closed lower for three consecutive sessions.

Other news in the stock market today:

- The small-cap Russell 2000 gave back 1.2% to 2,132.

- Chip giant Nvidia (NVDA, +4.0%) gained ground on the back of a strong second quarter. Revenues of $6.51 billion and earnings of $1.04 per share both beat analysts' expectations, and current-quarter sales forecasts of $6.8 billion also beat the Street's estimates. "Headline results + guidance were solid yet again and met elevated investor expectations, particularly with respect to implied guidance for data center," say UBS analysts Timothy Arcuri and Pradeep Ramani, who rate the stock at Buy. "Gaming is trending more in-line into the seasonally strong Oct Q, ProVis has stepped up as Ampere starts to penetrate these high-end workstations, and data center is so strong that it is more than offsetting a decline in the crypto-specific CMP SKU."

- Also rising Thursday was Cisco Systems (CSCO, +3.8%), which also beat the pros' expectations on the top and bottom lines. Revenues of $13.1 billion were up 8% year-over-year to close out the company's fiscal fourth quarter. Better still, the networking hardware firm believes it will grow sales by 7.5% to 9.5%, beating Street expectations, though the midpoint of its earnings guidance (80 cents per share) came in slightly under analysts' views (81 cents).

- Gold futures slipped 0.1% to $1,782.30.

- The CBOE Volatility Index (VIX) rose 0.5% to 21.67.

- Bitcoin prices jumped 3.9% to $46,690.83. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Build Up That Defense

Is it time to go to cash?

Not necessarily, says Phil Toews, CEO of advisory firm Toews Corporation. "In the current market environment, investors should be focused on riding the 'crash up' while still maintaining a more defensive position in their portfolio."

To do so, he recommends low-volatility stocks, which tend to be more value-oriented. "Their positioning is defensive, with reasonable valuations, historically reduced max drawdowns during bear markets, and stronger cumulative returns during bear-market decline and recovery."

Investors looking to bolster the defensive part of their portfolios may want to consider yield-friendly names from the utilities or consumer staples sectors.

There's also plenty of generous dividend payers – and lower volatility options – to be found among real estate investment trusts (REITs). And if you're looking for easy diversification in your defensive plays, consider these seven REIT ETFs. They represent numerous industries and investment approaches, all with attractive yields to boot.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.