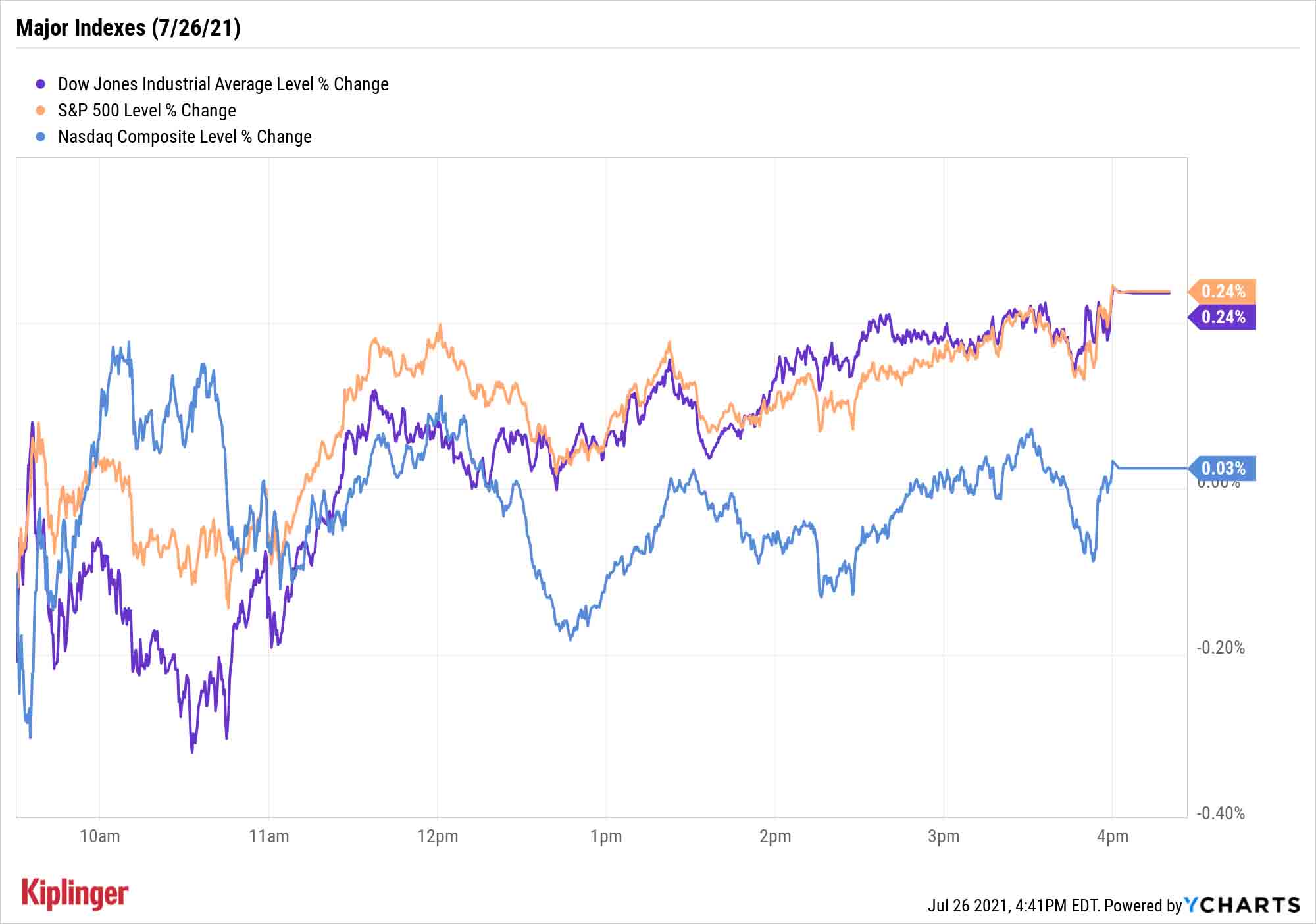

Stock Market Today: Major Indexes Quietly Etch New Highs

The Dow, S&P 500 and Nasdaq all squeaked out fresh highs in a fairly quiet Monday session. Much more explosive was the cryptocurrency space.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Monday was a slow-news day for the equity markets, but you might consider it the calm before the storm.

This week's earnings calendar is packed to the gills, with some 35% of S&P 500 companies releasing their quarterly financials – including mega-caps such as Apple (AAPL), Google parent Alphabet (GOOGL) and Microsoft (MSFT).

For today, however, U.S. markets mostly seemed to ignore ripples from China, where the government cracked down both on Tencent Music (TME, -3.0%) and the country's for-profit education industry, sending stocks such as New Oriental Education (EDU, -33.8%) and TAL Education Group (TAL, -26.7%) plunging, which in turn weighed on Chinese and European indices.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Here at home, June new-home sales declined 6.6% month-over-month to a seasonally adjusted annualized rate of 676,000 homes, 120,000 below estimates. That appeared to hamper the SPDR S&P Homebuilders ETF (XHB, -0.9%).

"Although one should always be mindful of the imprecision of these estimates, due to the small sample size used in the survey, incoming data for the past few months show tentative signs that new housing demand has moderated after surging during the pandemic," says Barclays economist Jonathan Millar. "If sustained, this softening could have adverse implications for the residential construction outlook."

But the broader indexes remained aloft. The Dow Jones Industrial Average (+0.2% to 35,144), S&P 500 (+0.2% to 4,422) and Nasdaq (up marginally to 14,840) all scratched out new all-time highs.

- Hasbro (HAS) kicked off a busy week of corporate earnings with a big win. The toymaker reported second-quarter adjusted earnings of $1.05 per share on revenues of $1.32 billion – a marked improvement over its year-ago results of earnings of 2 cents per share on $1.16 billion in sales. The results easily topped analysts' estimates, as well. HAS stock finished the day up 12.2%.

- In M&A news, Aon (AON) and Willis Towers Watson (WLTW) agreed to end plans for a proposed $30 billion merger, which would have resulted in the largest global insurance firm. The deal was first announced in March 2020, but "reached an impasse with the U.S. Department of Justice," according to Aon CEO Greg Case. AON closed the session up 8.2%, while WLTW fell 9.0%.

- U.S. crude oil futures slipped 0.2% to end at $71.91 per barrel, snapping their four-day winning streak.

- Gold futures gave back 0.1% to settle at $1,799.20 an ounce.

- The CBOE Volatility Index (VIX) improved 2.2% to 17.58.

Cryptocurrency Parties Over the Weekend

However, one of the most exciting investment stories of late went down while equity markets were closed over the weekend.

A host of factors combined to spark a massive run in cryptocurrencies over the weekend, including Bitcoin, which shot 23.3% higher to $39,837 between Friday and Monday afternoon. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Chief among them were the discovery of an Amazon.com (AMZN) job posting seeking a "digital currency and blockchain product lead," driving speculation that the online retailer is somehow involving itself with cryptocurrency. Also helping was nearly $1 billion in bearish bets against cryptocurrency that were liquidated (to cover a short bet, an investor must buy more of the underlying asset, driving up prices further – a phenomenon known as a "short squeeze").

For many, it's a fresh reason to get excited about digital currencies – and for others, it's a new chance to get acquainted. We can help.

To start, it always helps to know what risks you're taking with any investment: These are the five biggest threats to cryptocurrency dominance.

You should also know how you can invest. If you're constrained to your brokerage account, for instance, you can't buy Bitcoin directly – but you can buy several stocks that get you exposed to it and/or other digital currencies. And if you simply want to know the biggest players in the space, look no further. From Bitcoin to Ethereum to … yes, even Dogecoin … we break down eight of the largest, most influential cryptocurrencies the market has to offer.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.