Stock Market Today: Stocks Bounce Back to Hit New Highs

Reopening stocks and financials were some of the day's biggest gainers.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

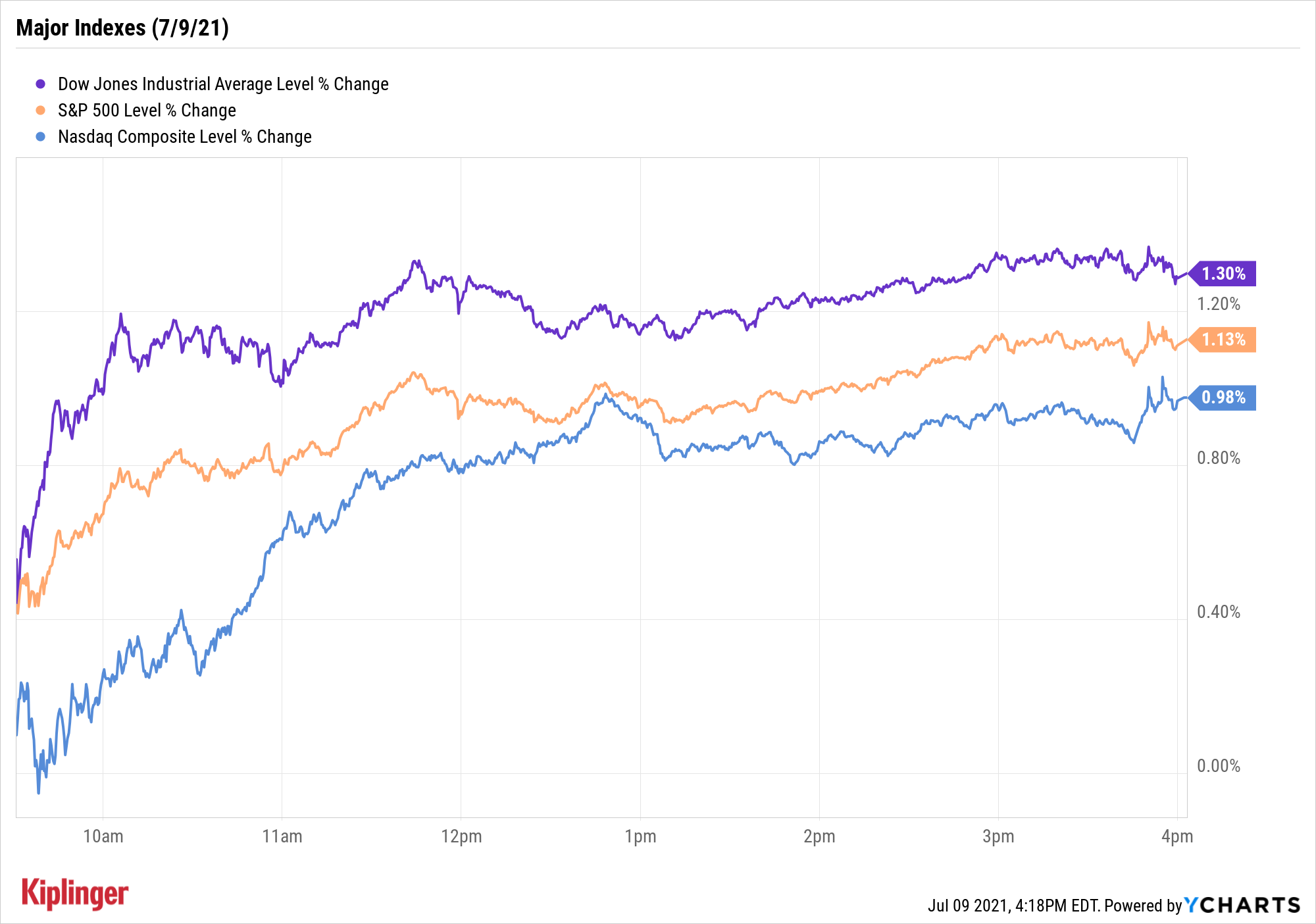

The major market indexes finished a holiday-shortened week in fine fashion, leaving behind Thursday's Treasury-rate tumult to end today at record highs.

After falling to its lowest level since February yesterday, the 10-year Treasury yield stabilized, settling up 7 basis points (one basis point is one-one hundredth of a percentage point) to 1.36%.

Also moving higher today were reopening stocks like American Airlines (AAL, +2.7%) and Carnival (CCL, +2.3%), as well as financials (+2.8%).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The Dow Jones Industrial Average gained 1.3% to finish at 34,870 as big banks Goldman Sachs (GS, +3.6%) and JPMorgan Chase (JPM, +3.2%) surged ahead of next week's earnings reports, while the S&P 500 Index jumped 1.1% to 4,369. Even the Nasdaq Composite brushed off news of President Joe Biden's executive order aimed at promoting competition in a wide range of sectors, including technology, to finish up 1.0% at 14,701.

Other action in the stock market today:

- The small-cap Russell 2000 rose 2.2% to 2,280.

- Discover Financial Services (DFS) jumped 6.2% today. Citi upgraded the big bank stock to Buy, saying it "has the clearest near-term path to benefit from the return of consumer card spending and lending as pandemic-related benefits expire and elevated payment rates return to lower levels."

- There were a number of stocks that moved on M&A news today. Philip Morris International (PM) rose 1.1% after the tobacco titan said it was buying U.K. respiratory treatment specialist Vectura for $1.4 billion. Additionally, Stamps.com (STMP) soared 64.0% after the mailing company agreed to be taken private by Thoma Bravo in a deal valued at $6.6 billion.

- U.S. crude oil futures spiked 2.3% to $74.60 per barrel, but still fell 0.8% on the week.

- Gold futures gained 0.6% to finish at $1,810.60 an ounce. For the week, gold rose 1.5% – its third consecutive weekly win.

- The CBOE Volatility Index (VIX) plunged 14.8% to end at 16.18.

- Bitcoin added 1.3% to $33,446.99. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.

So, What's in Store for Next Week?

While the start to second-quarter earnings season will certainly be front and center, Wall Street will also be watching inflation with the latest consumer price index (CPI) due out ahead of the opening bell on Tuesday, July 13.

Last month's CPI reading rose 5% on a year-over-year basis – its biggest annual increase since August 2008. And according to Gargi Chaudhuri, head of iShares Investment Strategy, Americas at BlackRock, inflation is going to continue to run hot. This is due to several factors, including the Fed's easy money policy, higher production costs and supply bottlenecks.

However, Chaudhuri says that the rising-inflation trend bodes well for "cyclically oriented value stocks in sectors such as financials that have been strong performers so far in 2021."

For investors looking to position for higher inflation, we've recently compiled a list of top-rated financial stocks to watch for the remainder of the year. These are the most compelling plays in the space, according to Wall Street's analysts. Check them out here.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Small Caps Can Only Lead Stocks So High: Stock Market Today

Small Caps Can Only Lead Stocks So High: Stock Market TodayThe main U.S. equity indexes were down for the week, but small-cap stocks look as healthy as they ever have.

-

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market Today

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market TodayTaiwan Semiconductor's strong earnings sparked a rally in tech stocks on Thursday, while Goldman Sachs' earnings boosted financials.

-

Visa Stamps the Dow's 398-Point Slide: Stock Market Today

Visa Stamps the Dow's 398-Point Slide: Stock Market TodayIt's as clear as ever that President Donald Trump and his administration can't (or won't) keep their hands off financial markets.

-

Stocks Climb Wall of Worry to Hit New Highs: Stock Market Today

Stocks Climb Wall of Worry to Hit New Highs: Stock Market TodayThe Trump administration's threats to Fed independence and bank profitability did little to stop the bulls on Monday.