Stock Market Today: S&P 500 Sets New High as Inflation Stays Red-Hot

May's consumer price index (CPI) growth was even hotter than expected, but investors didn't shy from the news, pushing the S&P 500 just over the new-high hump.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

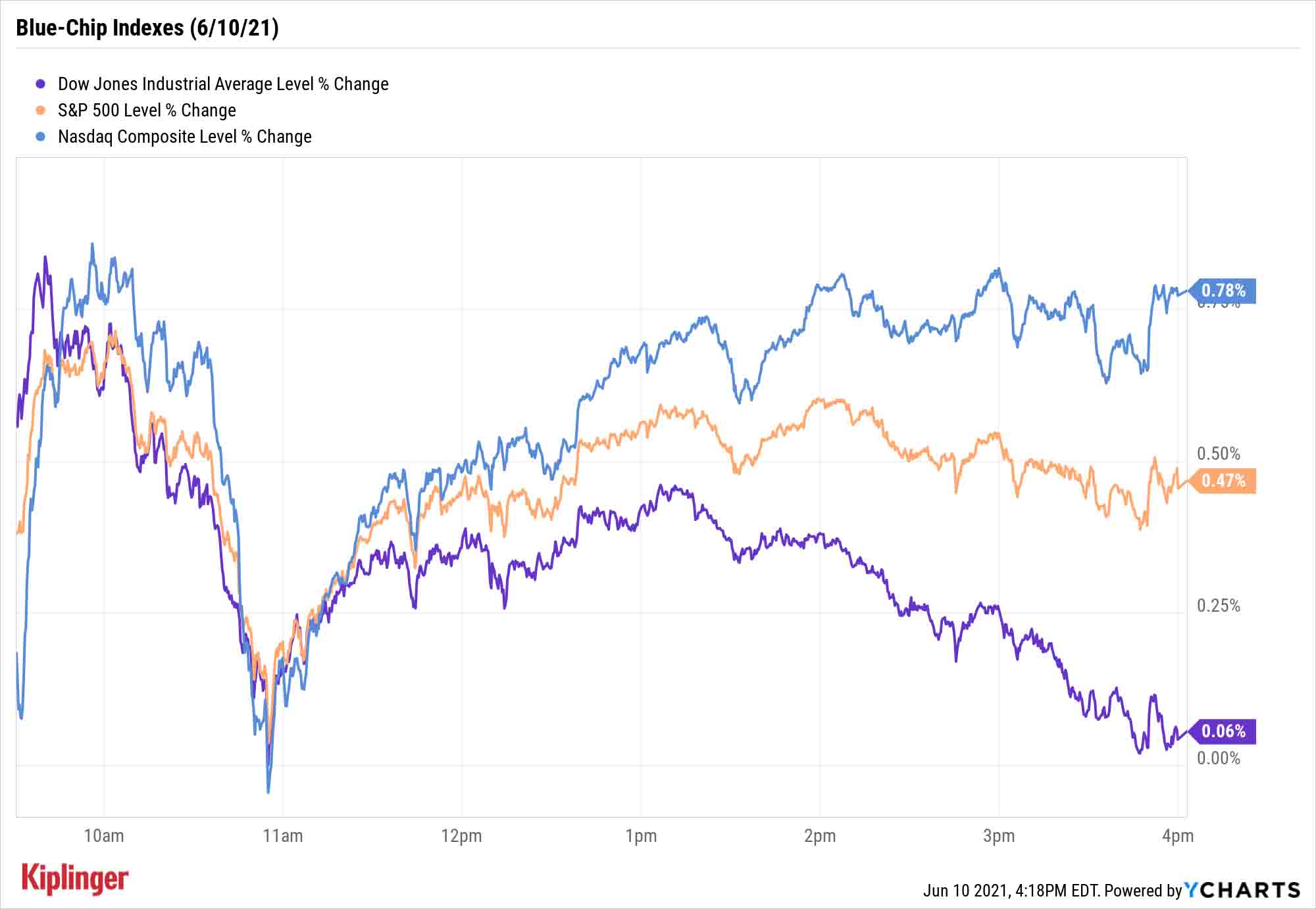

The S&P 500 finally notched a new record high Thursday as investors focused on the May consumer price index (CPI) report, which showed another month of rising inflation.

Headline CPI grew 5.0% year-over-year and 0.6% versus April, with both metrics exceeding consensus expectations thanks to big leaps in airline fares and used cars. And yet, the market didn't flinch.

Anu Gaggar, senior global investment analyst for registered investment adviser (RIA) Commonwealth Financial Network, says the May CPI data offered no "definite answer to the great inflation debate," and forces investors instead to read the bond market tea leaves.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The 10-year Treasury yield is back at levels last seen in early March," Gaggar says, "signaling that the bond market is falling in line with the Fed's thinking that inflation is transitory and does not warrant tapering of monetary stimulus any time soon."

"We don't expect the Federal Reserve's narrative to change after Thursday's inflation data," adds Nancy Davis, portfolio manager of the Quadratic Interest Rate Volatility and Inflation Hedge Exchange-Traded Fund (IVOL). "We believe the Federal Reserve is ready to allow inflation to continue to overshoot its 2% target in an effort to achieve maximum employment, which is the Fed's focus right now."

That, as well as a sixth consecutive drop in weekly unemployment filings (-9,000 to 376,000), was just enough to push the S&P 500 to a new record close of 4,239, up 0.5%.

Ryan Detrick, chief market strategist at LPL Financial, notes that for 10 consecutive days, the S&P 500 had closed within 1% of an all-time high, yet didn't close at an all-time high. "Over the past 50 years that has only happened three other times," he says.

Meanwhile, the Nasdaq Composite (+0.8% to 14,020) finished above 14,000 for the first time since late April. And another strong day from Big Pharma stocks such as Merck (MRK, +2.9%) and Amgen (AMGN, +2.1%) helped the Dow Jones Industrial Average close marginally higher, to 34,466.

Other action in the stock market today:

- The small-cap Russell 2000 retreated yet again, off 0.7% to 2,311.

- Signet Jewelers (SIG, +14.0%) got a lift today after the jewelry retailer reported earnings. In its first quarter, SIG brought in earnings and revenues above analyst estimates, while both same-store and e-commerce sales doubled year-over-year in the 13-week period ended May 1.

- RH (RH, +15.7%) was another big earnings winner. The home furnishings retailer – formerly known as Restoration Hardware – beat on both the top and bottom lines in its first quarter and boosted its full-year revenue growth and adjusted operating margin forecasts.

- U.S. crude oil futures added 0.5% to end at $70.29 per barrel.

- Gold futures eked out a marginal gain to settle at $1,896.40 an ounce.

- The CBOE Volatility Index (VIX) sank 10.2% to 16.07.

- Bitcoin advanced 1.2% to $36,703.39, though it had ascended to as high as $38,200 during Thursday's trade before retreating to more modest gains. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

No Reason to Panic About Inflation Yet

Although some inflationary pressures we're seeing might indeed be transitory, several experts believe they could stick if economic growth exceeds expectations past 2021.

"Those investors in the bond market that think 1.5% interest for 10 years is enough to compensate them for the likely economic growth and 'normalized' inflation … that we will see between now and 2031 are making a huge bet that U.S. economic growth will be subpar and that consumers will 'get everything out of their system' in one year, and that's a bet we're unwilling to make," says Chris Zaccarelli, chief investment officer for Independent Advisor Alliance, another RIA.

And if growth does indeed stick, the path of least resistance for the stock market (longer-term, at least) remains up.

If you're one for playing the hot hand, you could stay with stocks that leverage the continued fever pitch in housing – which could mean homebuilders and housing-adjacent stocks such as DIY retailers, or you could go straight to the source, via these timber stocks.

On the other hand, if you're a stickler for reliability and stability over a long-term time horizon, you can still do well with the tried-and-true blue chips of the Dow.

But perhaps don't grab the first one off the rack.

While every Dow member is a well-known large-cap with ample financial means, the best investments at any moment can vary from time to time. Today, we've taken a refreshed look at the 30-component Dow Jones Industrial Average to see which stocks have accumulated the largest bull camps.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Dow Hits New High Then Falls 466 Points: Stock Market Today

Dow Hits New High Then Falls 466 Points: Stock Market TodayThe Nasdaq Composite, with a little help from tech's friends, rises to within 300 points of its own new all-time high.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

Dow Climbs 559 Points to Hit a New High: Stock Market Today

Dow Climbs 559 Points to Hit a New High: Stock Market TodayThe rotation out of tech stocks resumed Tuesday, with buying seen in more defensive corners of the market.