Stock Market Today: Dow Ekes Out Record, Nasdaq Retreats Again

Energy and materials stocks led the way Wednesday as good (albeit not great) economic data was enough to push the Dow to new highs.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The Dow Jones Industrial Average managed to set an all-time high amid, for a third straight day, a palpable investor preference for the reopening trade.

Payroll provider ADP on Wednesday reported that American private-sector employers added 742,000 jobs last month – below consensus expectations for 800,000 jobs, but a massive improvement from March's 565,000.

Meanwhile, the Institute for Supply Management showed a services index reading of 62.7 in April; while anything above 50 suggests expansion, the reading missed forecasts and was down a point from March.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"April's print is very strong any way you slice it, with the reading still at its second-highest level, and accompanied by an even more robust 64.7 print for the Markit service sector PMI," says Barclays economist Jonathan Millar. "Hence, we see little reason to infer anything but positive signals from today's report, which points to a sustained acceleration in service sector activity with ongoing progress in the vaccination campaign and measures by many states and municipalities to ease social distancing restrictions."

Both data points still represented signs of growth, which was enough to bolster energy stocks such as Exxon Mobil (XOM, +3.0%) and Chevron (CVX, +2.7%) on a slightly down day for oil prices, and jolt materials plays such as Dow (DOW, +2.8%) and gases firm Linde (LIN, +3.0%).

Other notable movers were General Motors (GM, +4.1%), which gained on a wide Q1 earnings beat ($2.25 per share vs. estimates for $1.04), and Peloton Interactive (PTON, -14.6%), whose shares cratered after announcing voluntary recalls of all Tread and Tread+ treadmills, which have caused one death and several injuries.

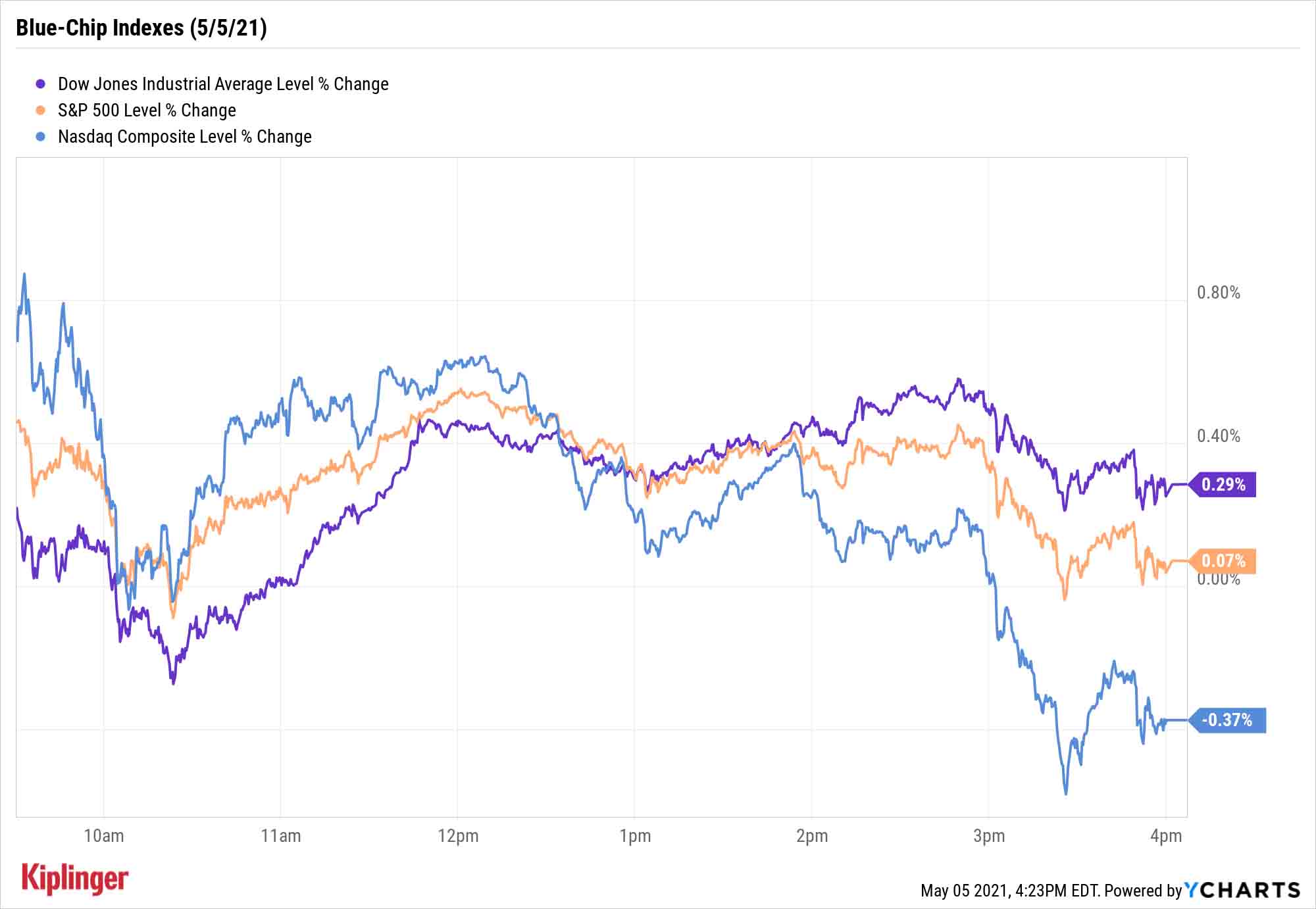

While early gains fizzled late, the Dow once again led the major indexes with a modest 0.3% gain to a record 34,230. The S&P 500 (up marginally to 4,167) inched ahead, while the Nasdaq Composite (-0.4% to 13,582) suffered its fourth consecutive decline.

Other action in the stock market today:

- Facebook (FB, 1.1%) was in focus today, after the company's oversight committee said it was right to ban former President Donald Trump from its platform following the Jan. 6 attack on the U.S. Capitol citing a "clear, immediate risk of harm," but it was not justified in making the ban indefinite. "The reaction on both sides to Facebook's Oversight Board statement on former President Trump's suspension speaks to how central these social media platforms have become for interpersonal communication," says David Keller, Chief Market Strategist at StockCharts.com. Facebook now has six months to decide if the ban will be permanent.

- Jessica Alba's Honest (HNST, +43.8%) surged in its market debut, after the initial public offering (IPO) last night was priced at $16 per share. HNST stock opened today at $21.22, climbed as high as $23.88, and closed at $23.00.

- The small-cap Russell 2000 was off by 0.3% to 2,241.

- U.S. crude oil futures slipped marginally to end at $65.63 per barrel.

- Gold futures gained 0.5% to settle at $1,784.30 an ounce.

- The CBOE Volatility Index (VIX) declined by 2.1% to 19.08.

- Bitcoin prices rebounded 4.5% to $57,105.99. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

How to Get Out of This Holding Pattern

Even with the Dow at new highs, the broader market has been mired in mostly sideways action for weeks. Fortunately, investors looking to liven up their portfolios have quite a few options at their disposal.

Longer-term, you can find difference makers by looking at companies that are shaping the future via innovative technologies that could be with us for years to come. You can find a host of these among Argus Research's best "innovator" picks.

In the shorter term, you can join in the reopening trade via oil stocks, travel plays and other clear beneficiaries of ramped-up vaccinations and looser COVID restrictions. But you can also do well by listening closely for the sound of sabers rattling.

Activist investors – Wall Street's well-known (and often productive) malcontents – have made a name for themselves by taking significant stakes in underperforming companies and rallying shareholder votes to implement measures they believe will drive up their stocks' value. Their mere involvement can put a charge into shares, and occasionally their successes do end up translating into stronger operations … and stronger returns.

Read on as we check out 13 such stocks that are currently getting the full-court press from Wall Street activists.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Nasdaq Adds 211 Points as Greenland Tensions Ease: Stock Market Today

Nasdaq Adds 211 Points as Greenland Tensions Ease: Stock Market TodayWall Street continues to cheer easing geopolitical tensions and President Trump's assurances that there will be no new tariffs on Europe.