Stock Market Today: Investors Lose Patience as Stimulus Talks Stretch On

Washington still hasn't hammered out a final COVID rescue bill, prompting investors to pull their foot off the pedal Friday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

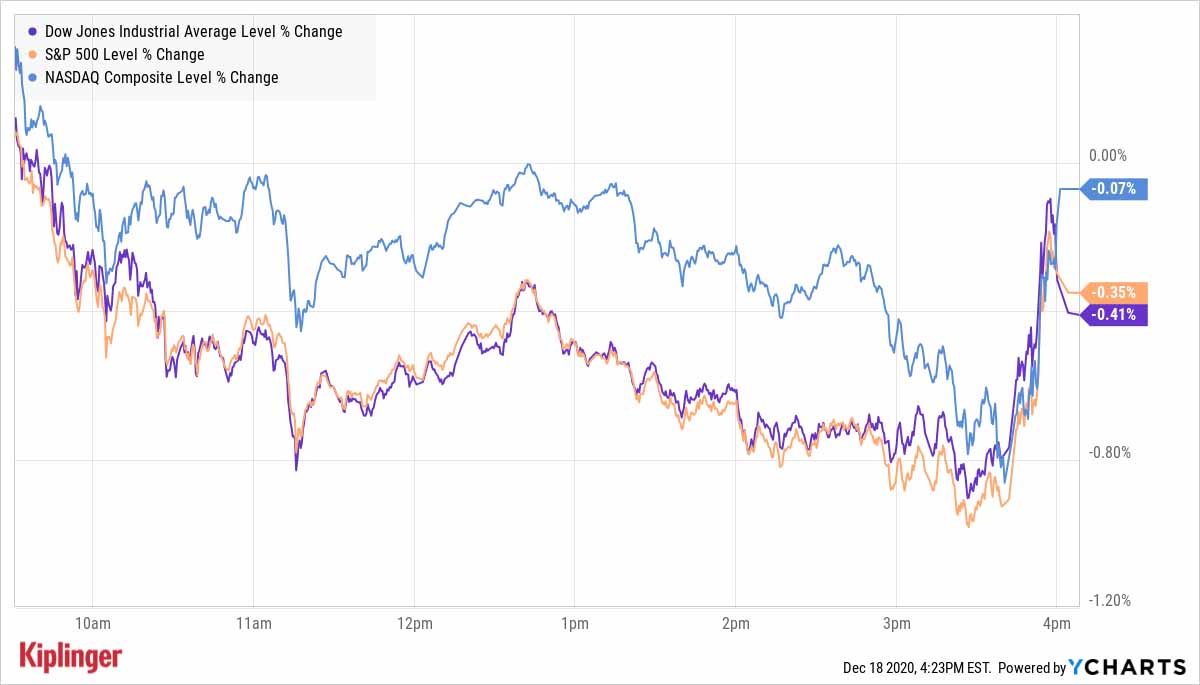

As the markets prepared for one of the splashiest big-index inclusions of the past decade (more on that in a moment), investors found little else to be optimistic about Friday.

COVID stimulus negotiations remained exactly where they've been the past couple of days – "Kind of the same place, no progress," Senate Republican Whip John Thune said Friday. An omnibus spending bill was in the same state of limbo; Congress might need to pass a stopgap bill to keep the government running until a final bill is hammered out.

The Dow Jones Industrial Average started the day with marginal gains but weakened as the day progressed, but an afternoon pop limited the damage to a 0.4% decline to 30,179. The rest of the major indices followed suit.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Other action in the stock market today:

- The S&P 500 declined 0.4% to 3,709.

- The Nasdaq Composite slipped marginally to 12,755.

- The small-cap Russell 2000 lost 0.4% to 1,969.

- Gold futures edged 0.1% lower to $1,888.90 per ounce.

- U.S. crude oil futures jumped 1.5% to settle at $49.10 per barrel.

The Big Rebalancing Act

One of the biggest underlying themes Friday had to do with just one stock: Tesla (TSLA).

It's not that the electric vehicle maker continued its rip-roaring 2020 rally, which has seen it gain 707% and brought its worth to $659 billion, with a 6.0% gain today on extremely high volume. It's why.

Tesla will join the S&P 500 as of Monday, Dec. 21, and as we discussed in today's free A Step Ahead e-letter, this is a massive rebalancing – one that requires S&P 500-tracking funds to gobble up some $80 billion in shares.

But that's not the only rebalancing going on.

The tech-heavy Nasdaq 100 – a growth-heavy collection of 100 of the Nasdaq's largest non-financial companies – is welcoming a few new components to the mix, including Match Group (MTCH) and Peloton Interactive (PTON). However, to make room, a few companies, including Expedia (EXPE) and Take-Two Interactive (TTWO), will be sent to the Nasdaq Next Generation Index – the next 100 largest stocks.

That's hardly a death sentence. "If you look back at the movement of companies between the Nasdaq 100 and the Nasdaq Next Generation Index from 2009 to the present, 17 of the companies that moved into the Next Generation Index were eventually added back into the Nasdaq 100 Index," says Ryan McCormack, Factor and Core Equity Strategist at Invesco, who also notes that the average 12-month return of companies following the move down was 18.8%, with a median return of 9.6%.

Investors can get access to both indices, as well as other connected strategies, via a number of growthy exchange-traded funds (ETFs). Take a look.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

Stocks Extend Losing Streak After Fed Minutes: Stock Market Today

Stocks Extend Losing Streak After Fed Minutes: Stock Market TodayThe Santa Claus Rally is officially at risk after the S&P 500's third straight loss.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.