Stock Market Today: What Lousy Job Numbers? Major Indices Shoot to New Highs

Hope springs eternal for federal COVID stimulus, helping stocks rewrite the record book Friday despite a drab November payrolls report.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The Bureau of Labor Statistics delivered a doozy of a nonfarm payrolls report Friday.

The good news: The unemployment rate dipped to 6.7% in November from 6.9%. The bad news? The U.S. added just 245,000 jobs last month – substantially lower than economists' expectations and a clear slowdown from October's revised 610,000 additions.

"It's not surprising to see a one-month pause in the rapid pace of payroll gains we have seen, with slower hiring due to temporary COVID-related reductions in activity, even if the actions fall short of the dramatic springtime lockdowns," says Rick Rieder, BlackRock's chief investment officer of global fixed income.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Some on Wall Street were a little more pointed in translating the payroll numbers, however.

"This is a disappointing report, and one that shows the third wave of the pandemic is having a bigger effect on hiring than had been thought, says Brad McMillan, chief investment officer for Commonwealth Financial Network. "This is a wake-up call for Congress and should support more federal stimulus."

Capitol Hill appears to be listening. Today it was House Speaker Nancy Pelosi weighing in, saying "there is momentum" toward a COVID-19 relief bill as the clock winds down on 2020.

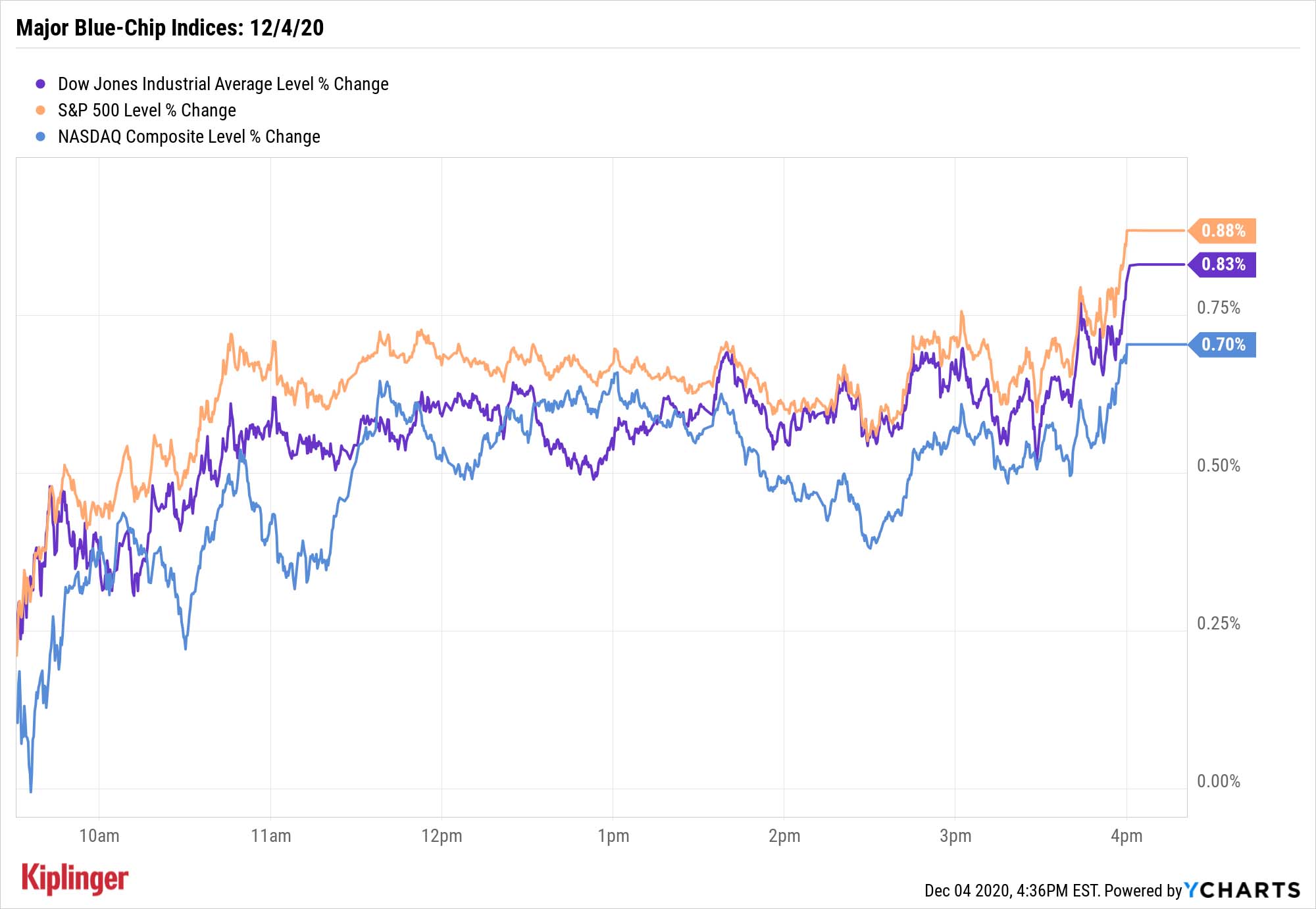

Wall Street clearly put more (ahem) stock in Washington negotiations than slowing employment gains, as investors drove the Dow Jones Industrial Average (+0.8% to 30,218) to fresh-all time highs, led by Caterpillar (CAT, +4.3%), Chevron (CVX, +3.9%) and International Business Machines (IBM, +2.9%).

Other action in the stock market today:

- The S&P 500 advanced 0.9% to hit a new high of 3,699.

- The Nasdaq Composite broke through the ceiling, too, gaining 0.7% to 12,464.

- The small-cap Russell 2000 reached a new peak with a 2.4% jump to 1,892.

- Gold futures slipped a mere 0.1%, finishing at $1,840 per ounce.

- U.S. crude oil futures improved by 0.3% to settle at $45.87 per barrel.

What Are Wall Street's Biggest Investors Buying?

We've written at various points about a "great rotation" into value stocks, and how it's expected to continue when COVID vaccines advance past the trial stages.

You're also starting to see signs of that in so-called smart money stock transactions – though in several cases, hedge funds and other billionaires are sticking with highfliers from earlier in the year.

Recently, influential investors such as Warren Buffett released new info about their latest trades, and we delved into many of the stocks these institutional investors were unloading. Now, we're digging into some of their highest-conviction positions.

Read on as we show you some of the billionaires' top stock picks for the third quarter. In some cases, the smart money added on to already large existing positions. In others, they made a statement by pushing a pile of money into new stakes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.