Stock Market Today: Dow 30,000 in Sight After Another Vaccine Rally

Moderna (MRNA) followed up last week's Pfizer (PFE) act with outstanding vaccine data of its own, pushing the Dow to new highs just 50 points shy of 30,000.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Don't dismiss that feeling of déjà vu. Today's market action was absolutely similar to last Monday's vaccine-fueled rally. This time, however, it wasn't Pfizer (PFE) and BioNTech (BNTX), but Moderna (MRNA, +9.6%) releasing good news about its trial candidate.

Early data suggests Moderna's mRNA-1273 vaccine is 94.5% effective, which Dr. Anthony Fauci, the nation's top infectious-diseases official, called "truly outstanding."

Better still, Moderna's vaccine can be stored for 30 days between 36 to 46 degree Fahrenheit (about what you'd find in a refrigerator), and for six months at -4 degrees. That's much more forgiving for storage and transportation purposes than Pfizer's vaccine, which must be kept at -94 degrees.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Last week’s Pfizer news was great, but today's Moderna vaccine news is even better," says Ryan Detrick, chief market strategist for LPL Financial. "Being able to store the vaccine in a standard fridge for up to a month makes transportation and usability so much easier. Yes, new cases and hospitalizations are soaring, but we are inching closer to ending this pandemic."

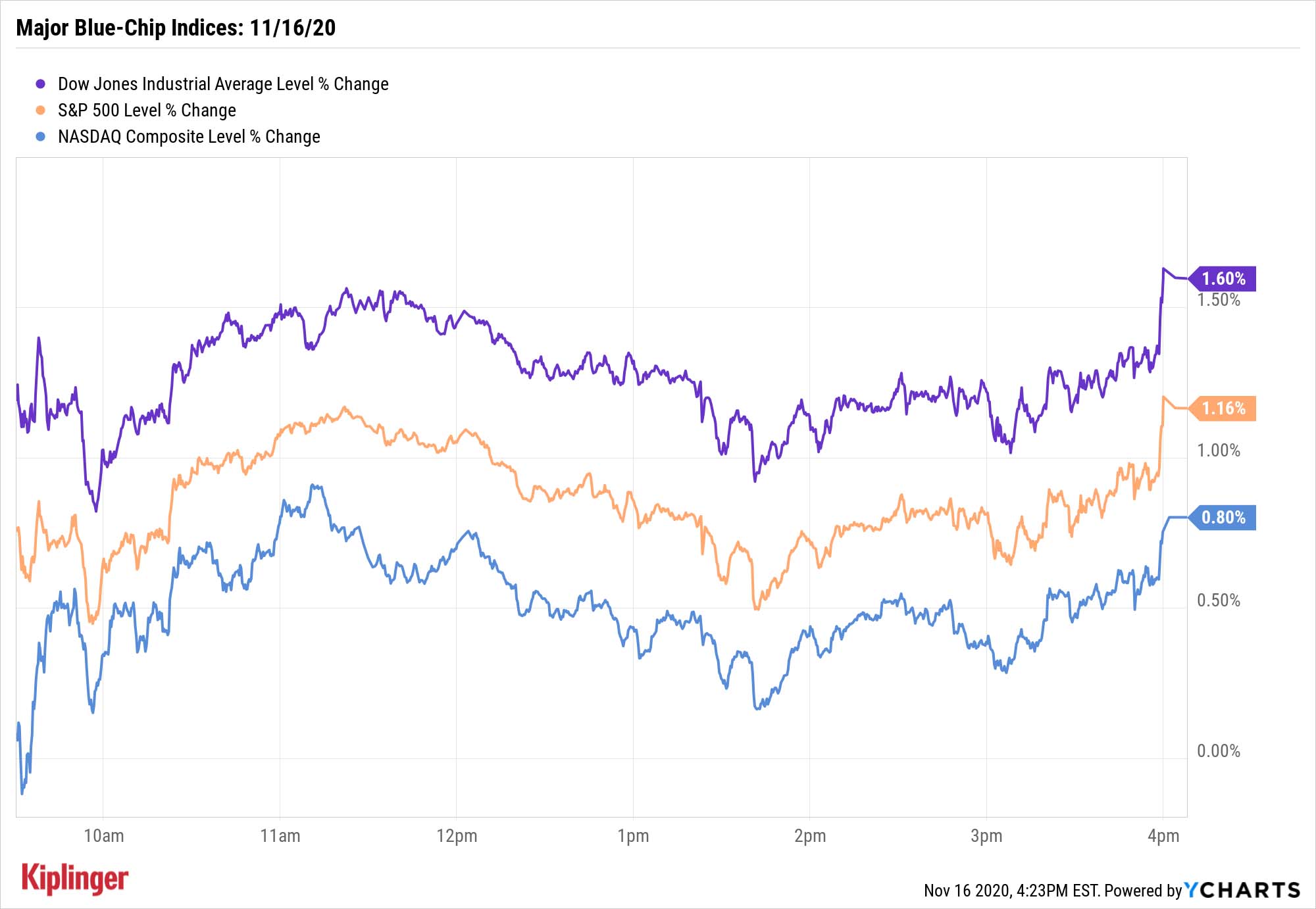

And just like last week, investors gobbled up airlines, cruise lines and other COVID-battered stocks whose fates are tethered to vaccine success. The Dow Jones Industrial Average jumped 1.6% to a new high of 29,950, lifted by big gains from industrial stocks such as Boeing (BA, +8.2%) and Honeywell (HON, +3.5%).

Other action in the stock market today:

- The S&P 500 also hit a new high, gaining 1.2% to 3,626.

- The small-cap Russell 2000 rewrote the record books, soaring 2.4% to 1,785.

- Once again, the tech-heavy Nasdaq Composite lagged the group, finishing up 0.8% to 11,924.

How to Play This Rotation

Wall Street's pros continue to have faith in a continued rotation out of 2020's early winners and into the market's more battered (but recovering) names.

"The path of least resistance for equities seems to be higher at the moment as favorable vaccine news, along with less uncertainty regarding the election, is proving to be a positive catalyst in the near term," says Brian Price, Head of Investment Management for Commonwealth Financial Network. "It's encouraging that we're seeing a rotation from growth and momentum-oriented stocks to value and cyclical names."

We've previously highlighted ways to invest in value now -- stock investors can target these seven picks, while those who prefer funds can explore these seven options. You can leverage this movement in other ways, too, such as sector investing -- among these 16 sector funds are products that provide exposure to industrials, financials and other recovery-sensitive plays.

Another area of the market to watch is the biotechnology space. Yes, this contains companies involved in developing COVID vaccines and treatments, but in general, many healthcare plays should also get a boost when the pandemic recedes and providers can resume regular treatments.

Read on as we look at 14 biotech and biopharmaceutical stocks that look attractive as 2020 winds down and 2021 nears. This list includes Big Pharma firms that are adding biotech exposure, biotech-industry leaders and smaller biotechnology firms that are trying to catch their big break.

Kyle Woodley was long BA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Nasdaq Takes a Hit as the Tech Trade Falters: Stock Market Today

Nasdaq Takes a Hit as the Tech Trade Falters: Stock Market TodayThe Dow Jones Industrial Average outperformed on strength in cyclical stocks.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

Nasdaq Leads as Tech Stages Late-Week Comeback: Stock Market Today

Nasdaq Leads as Tech Stages Late-Week Comeback: Stock Market TodayOracle stock boosted the tech sector on Friday after the company became co-owner of TikTok's U.S. operations.

-

AI Stocks Lead Nasdaq's 398-Point Nosedive: Stock Market Today

AI Stocks Lead Nasdaq's 398-Point Nosedive: Stock Market TodayThe major stock market indexes do not yet reflect the bullish tendencies of sector rotation and broadening participation.