Stock Market Today: Markets End Raucous Week on a Restrained Note

An encouraging October jobs report and a clearer presidential picture didn't do much Friday for a market exhausted from running.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Friday not only provided more clarity on the U.S. presidential election, but also good news on America's employment situation.

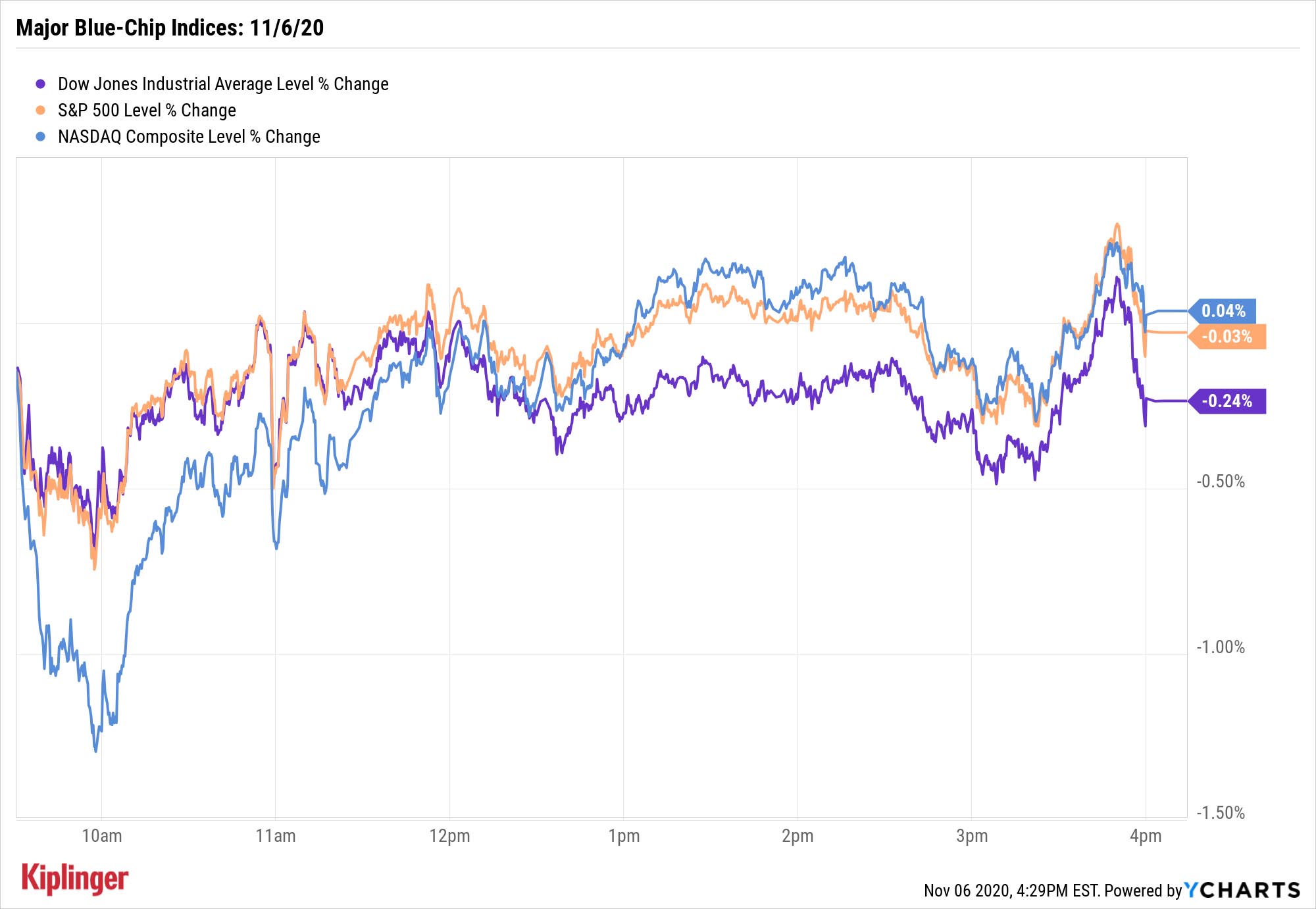

Neither development was met with another round of buying by investors, but one can forgive the bulls for being exhausted after a brisk week of gains. (The Dow Jones Industrial Average, for instance, slipped 0.2% to 28,323, but finished the week up 6.8%.)

The Labor Department reported that the U.S. added a stronger-than-expected 638,000 jobs in October, bringing the unemployment rate down to 6.9%.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The economy continues to display very impressive resilience across multiple sectors and facets, such as housing, auto sales, retail sales broadly, manufacturing, and increasingly services," says Rick Rieder, BlackRock's chief investment officer of Global Fixed Income and head of the BlackRock Global Allocation Investment Team. "Government employment provided more than a quarter-of-a-million jobs drag, while private sector employment gained an impressive 900,000 jobs."

And while presidential election results are still pending from six states, the numbers increasingly point to a Biden victory, fueling more rip-roaring gains in many "Biden stocks." That includes marijuana stocks such as Canopy Growth (CGC, +10.9%) and Tilray (TLRY, +23.2%), which continued their recent ascents Friday.

Other action in the stock market today:

- The S&P 500 slipped by just one point to 3,509.

- The Nasdaq Composite eked out a four-point gain to 11,895.

- The small-cap Russell 2000 dropped 0.8% to 1,646.

One Source of Uncertainty Is Fading, But More Remain

Regardless of who ultimately is elected, the economy is hardly out of the woods.

Earlier this week, Sen. Mitch McConnell signaled a sudden willingness to make progress on COVID-related stimulus, which might be needed even more as winter approaches and the pandemic's "second wave" sweeps across much of the country.

Yes, there's plenty of hope that at least one vaccine will be approved in the next few months, which could very well light a spark under these 11 stocks that desperately need some form of normalcy to return. But the vaccine race's timeline is uncertain – both for approval and for rollout to Americans across the country.

For the time being, that means continued opportunity for so-called coronavirus stocks whose businesses benefited from the first wave this spring. Yes, some COVID plays have seemingly maxed out their opportunity. But a number look positioned to take advantage of similar consumer and business behavior this winter, as well as longer-term trends that COVID-19 helped accelerate.

Read on as we take a look at a dozen of the best coronavirus stocks to buy.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.