Stock Market Today: Stocks Slip Again on Dour Jobs Data

Worse-than-expected weekly unemployment claims, as well as continued gridlock on COVID stimulus, stymied stocks Thursday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Several major earnings reports sounded an optimistic tone Thursday on Wall Street, but stocks nonetheless struggled to pick up steam thanks to broader economic concerns.

Walgreens Boots Alliance (WBA, +4.8%) shot higher Thursday after topping quarterly earnings estimates and predicting profit growth in its next fiscal year. Morgan Stanley (MS, +1.3%) also finished with gains after blowing past profit and revenue expectations.

Initial jobless claims for last week climbed to 898,000, however, up from 845,000 the prior week and higher than expected.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The four-week moving average also ticked higher, rising to 866k from 860k," add Michael Gapen and Jonathan Millar of Barclays Investment Bank. "The pace of improvement in initial claims had slowed markedly since late August, and, taken at face value, this week's initial jobless claims report suggests the rate of job separation remains elevated and may be rising."

But the pair add that "the usefulness of claims data in assessing labor market conditions continues to be challenged by processing issues and the numerous state and federal programs."

And while President Donald Trump signaled a willingness to go higher on stimulus negotiations, Senate Majority Leader Mitch McConnell made clear Senate Republicans would be unlikely to pass anything in the $1.8 trillion to $2.2 trillion range being discussed by the House and Trump's administration.

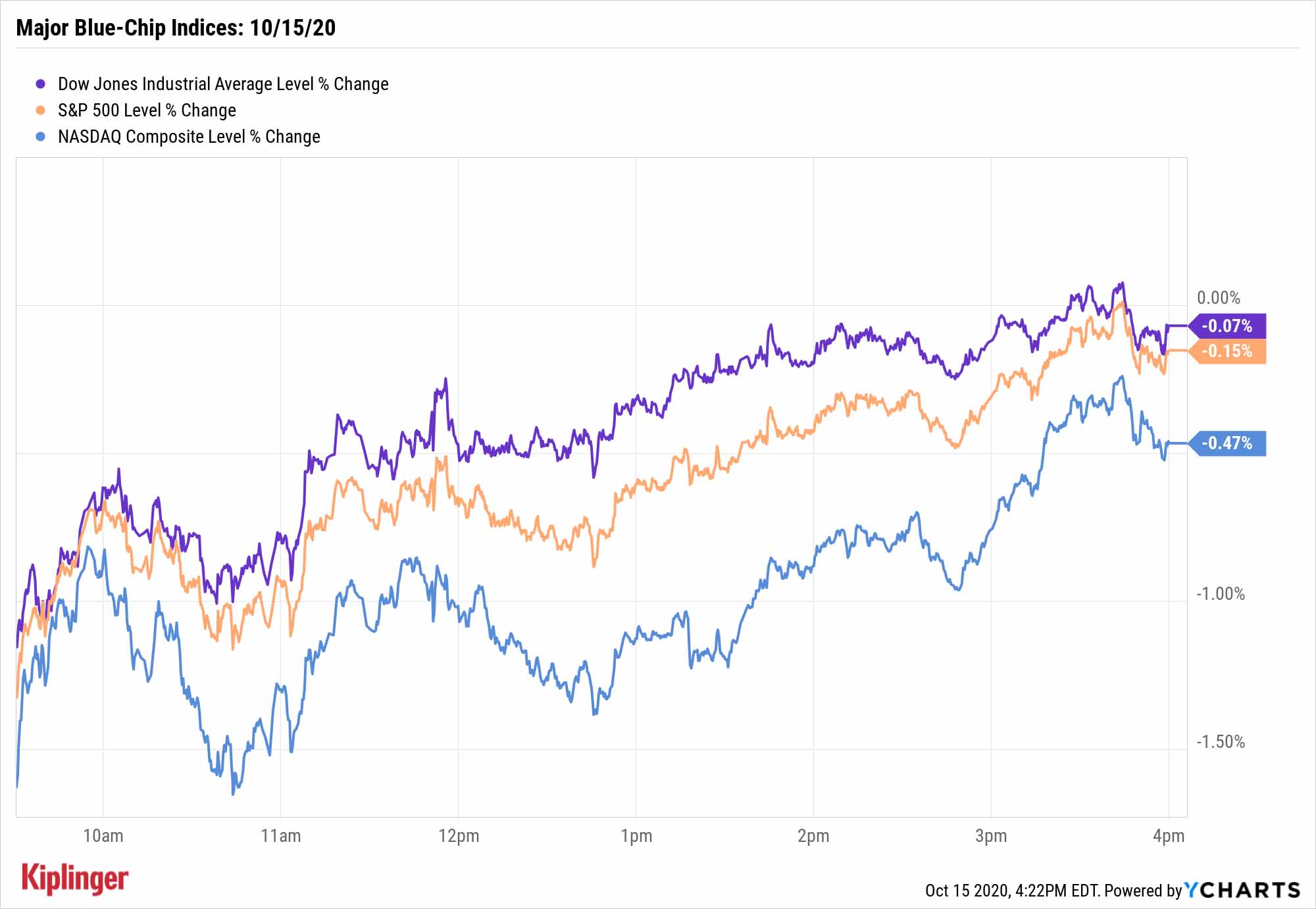

The Dow Jones Industrial Average slipped by a thin 20 points to 28,494, while the Nasdaq Composite declined 0.5% to 28,494 – the latter hobbled by a Goldman Sachs report downgrading the firm's technology outlook to Neutral amid a potential (likely temporary) rotation into value.

Other action in the stock market today:

- The S&P 500 lost 0.2% to 3,483.

- The Russell 2000 popped 1.1% to 1,638.

- Cloud computing service Fastly (FSLY) plunged 27.2% after reporting that demand from its largest customer, TikTok owner ByteDance, failed to meet expectations.

- Chinese electric vehicle stock Nio (NIO) jumped 5.9%, to surpass 30% gains in two days, amid upgrades from analysts at Citigroup and JPMorgan. The latter said shares could roughly double from Nio's Tuesday closing price of $21.62 per share to JPMorgan's target of $40.

Is a Rotation Really in Store?

Many investors will no doubt take Goldman's value prediction with a ladle of salt. After all, growth stocks have been wiping the floor with value for more than a decade. But Goldman points to a history of outperformance in value when both bond yields and economic growth are on the upswing, and that's the environment Goldman sees coming – again, at least for a short while.

There are two ways to chase this possible pivot. The most obvious? Buy value stocks – companies that are underpriced compared to their sales, earnings or other metrics.

But you can also target more defined slices of the market. Goldman, for instance, likes specific industries such as autos and luxury goods, but also broad sectors, including energy (which is robustly represented in these analyst-favorite dividend stocks) and health care (which you can easily access via these five established mutual funds).

Generally speaking, sector investing can give you an edge, whether it's tilting your portfolio toward growth or positioning it more defensively. And one of the most efficient ways to get it done is through sector funds, which let you buy dozens of stocks with one simple trade. Read on as we provide you with our 16 favorite options across all of the market's sectors.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

A Scary Emerging AI Threat

A Scary Emerging AI ThreatThe Kiplinger Letter An emerging public health issue caused by artificial intelligence poses a new national security threat. Expect AI-induced psychosis to gain far more attention.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Small Caps Can Only Lead Stocks So High: Stock Market Today

Small Caps Can Only Lead Stocks So High: Stock Market TodayThe main U.S. equity indexes were down for the week, but small-cap stocks look as healthy as they ever have.

-

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market Today

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market TodayTaiwan Semiconductor's strong earnings sparked a rally in tech stocks on Thursday, while Goldman Sachs' earnings boosted financials.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.