One of the Toughest Questions for Wealthy People to Answer

If you're rich, you need to be prepared for the day when your child asks you this question. Your ability to answer could be key to helping your family's wealth last for generations.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

“Dad — are we wealthy?” That’s the exact question a seventh-grader recently asked of a client of mine. In the moment, poor Dad didn’t know how to respond.

When we later chatted about the situation, our dialogue went something like this:

Me: Tell me more … why did that conversation make you uncomfortable?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Client: Well, I just didn’t know what to say. It is obvious that we have wealth compared to some of my child’s friends, but I wasn’t clear on how to address that. I worry about what I share with my children because I don’t want them to feel entitled.

Me: How does the wealth currently show up in the child’s eyes?

Client: Well, one thing my children have noticed is that we travel a lot as a family whereas many of their friends’ families do not.

Me: Interesting. Why do you put an emphasis on travel as a family?

Client: We believe it’s important to expose them to different cultures, beliefs and ways of thinking to help them become well-rounded adults. We also believe it is a key part of their education and allows us to instill some of our values around giving back to others as we often participate in relief efforts during our travels.

Me: So, how could you shift your framing of what being wealthy means with your children to line up with your beliefs?

Client: Oh, I hadn’t really thought of it that way before.

Me: That’s quite normal. Let’s talk through what it might sound like …

I often am approached by wealthy clients following Family Dynamics speaking events. All seem to be seeking answers to the same very important, yet very difficult, questions. What do I tell my children about our wealth? When and how do I tell them? Won’t they already know, given their own comparisons of our home, cars and vacations vs. those of their friends? What do I say if they ask us if we are wealthy? How do we ensure that they grow up with a sense of purpose and not a sense of entitlement?

These questions require substantial thought. But taking the time to explore the answers could give families the tools they need to help protect their wealth, pass along their values and make sure their families secure their fortunes for generations to come.

It still surprises me that the thought process in this line of questioning often is limited to “financial” wealth, rather than considering the intangibles that come with a family’s wealth. So, what’s the difference?

Wealth holistically defined

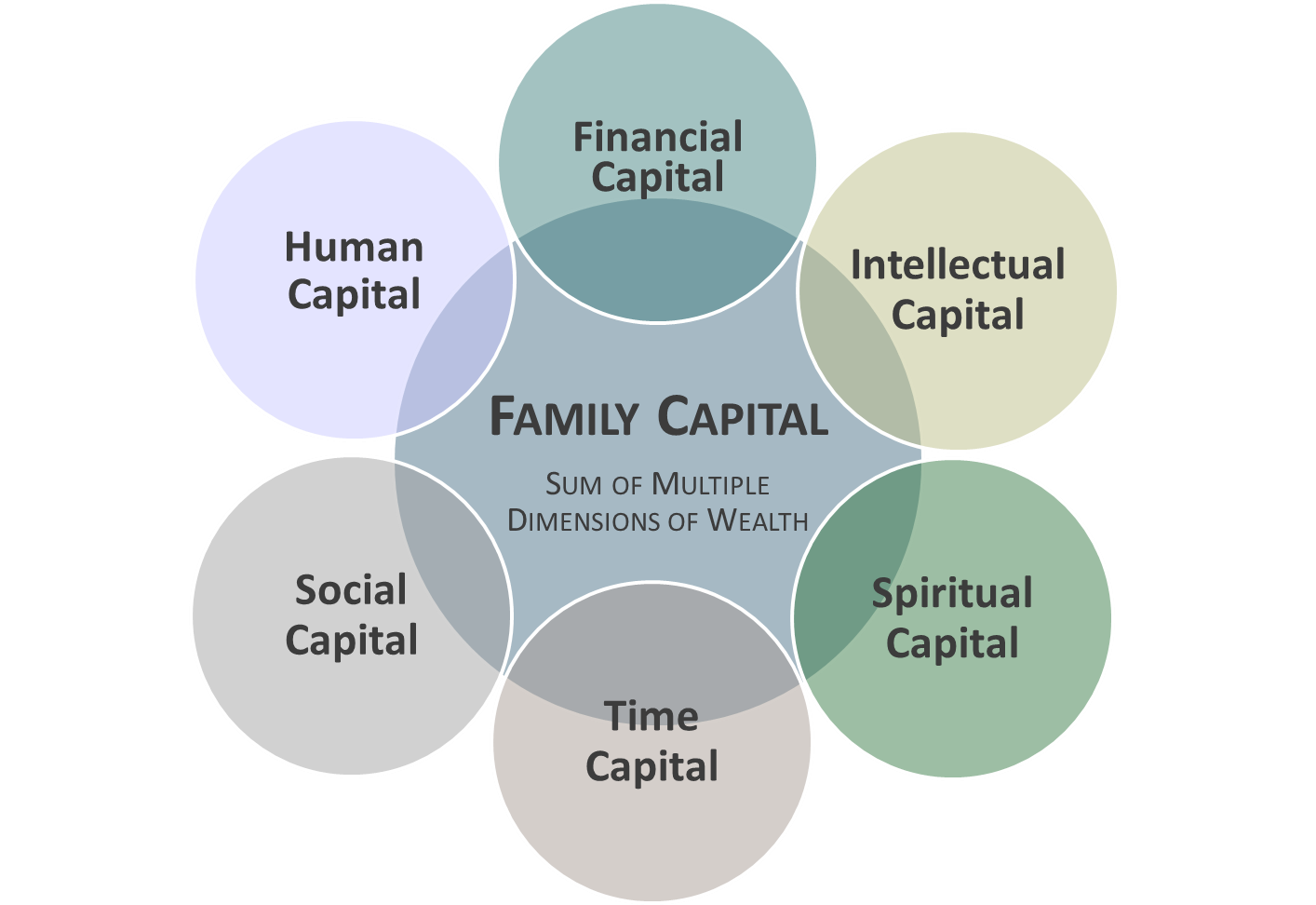

Seeing that most people think about financial capital when it comes to wealth, oftentimes they don’t think about all the forms of capital that helped them prosper. I urge clients to consider five additional areas:

- Human Capital: includes the personal growth and development of family members, and their physical and emotional well-being. It’s where the issues of Self-Awareness & Self-Management come into play … what some today refer to as “soft skills.”

- Intellectual Capital: includes developing financial, entrepreneurial and other skills, talents and capabilities of individual family members … what is often referred to as “hard skills.”

- Social Capital: includes the family name, reputation and social standing. For some families, it might also include philanthropy and volunteerism.

- Spiritual Capital: may include a family’s strong tradition of faith, family values and guiding principles.

- Time Capital: encompasses how we spend our time, our most precious asset in today’s fast-paced society.

While your family might prioritize these forms of wealth differently than others, the combination of your family’s Financial Capital, Human Capital, Intellectual Capital, Social Capital, Spiritual Capital and Time Capital defines your family’s true wealth. We call it “Family Capital.”

A family’s investment of time, financial and intellectual capital in the personal growth and development of its human capital, is essential to maintaining their financial capital over the long term. Seeing how these areas intersect and support one another can help cultivate these various dimensions of Family Capital. And that can help position your family to flourish today and for generations to come.

Putting it into practice

All this brings us back to the father whose seventh-grader put him on the spot, and the advice I gave him. We talked about how the family uses wealth as a tool to align with their values, the importance of education, diversity, acceptance, community, spending time together as a family and more. We then used the Family Capital model to explore a broader interpretation of the wealth and how that might be presented in a way that his child could understand. We also talked about how the model could be a useful tool in determining development needs for the family as they worked to prepare future stewards of the family legacy.

You see, this client was already utilizing his financial capital in a way that connected with some of his values and in a way that provided for the human, social and spiritual capital development of his family. But, he just hadn’t seen it that way before. This offered a tremendous opportunity to reframe what wealth means!

Sustaining wealth for generations to come

In previous columns, I cited the three reasons why wealth tends to dissipate by the third generation.

- Lack of communication and trust in the family.

- Not properly preparing heirs.

- No shared purpose.

The Family Capital model can be an incredible tool in helping families progress in all three of these areas. It serves as a model to broaden and increase communication and trust. It aids in the development plans of both individual family members and the collective family. And, it can certainly help a family to connect around a shared purpose attached to their core values.

In my previous columns in this series — “The Right Plan Can Bond Your Family Together Better Than Super Glue,” “My Family Drives Me (Financially) Nuts,” “Stop Pushing My Buttons! Family Tensions Can Prevent Forward Planning” and “Wealth: The Ultimate Magnifying Glass” — I shared research illustrating that the vast majority of reasons for the failure of generational wealth transfer are non-financial. Additionally, I pointed out there can be consequences if families do not exercise a high degree of purposefulness regarding the non-financial elements of their lives. We also explored what it takes to become an Enterprising Family and visited on how to thrive in an emotionally complex family system. We then looked at some of the unique complexities of families of financial wealth and how to navigate them.

What comes next

There are key concepts designed to help your family create a framework in approaching Family Dynamics. We will complete this series in the next month by exploring the next steps in how your family can start its journey in becoming an Enterprising Family.

Wells Fargo Wealth Management provides products and services through Wells Fargo Bank, N.A. and its affiliates. Brokerage services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC, Member SIPC, a registered broker-dealer and separate non-bank affiliate of Wells Fargo & Company. © 2017 Wells Fargo Bank, N.A. All rights reserved. Member FDIC. NMLSR ID 399801 Wells Fargo and Company and its affiliates do not provide legal advice. Please consult your legal advisers to determine how this information may apply to your own situation.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Katherine Dean is the Head of Family Dynamics for Wells Fargo Private Bank. Dean leads the ongoing evolution of the Family Dynamics program curriculum as well as the management of the Family Dynamics team that is distributed across the country. The Family Dynamics team helps families sustain their wealth across generations, by facilitating decision-making about the complex issues that arise as a result of substantial wealth.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain Why

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain WhyEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly Mistakes

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly MistakesThe keys to successful real estate planning for retirees: Stop thinking of property income as a reliable paycheck, start planning for tax consequences and structure your assets early to maintain flexibility.

-

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)February gets a bad rap for being the month when resolutions fade — in fact, it's the perfect time to reset and focus on small changes that actually pay off.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.