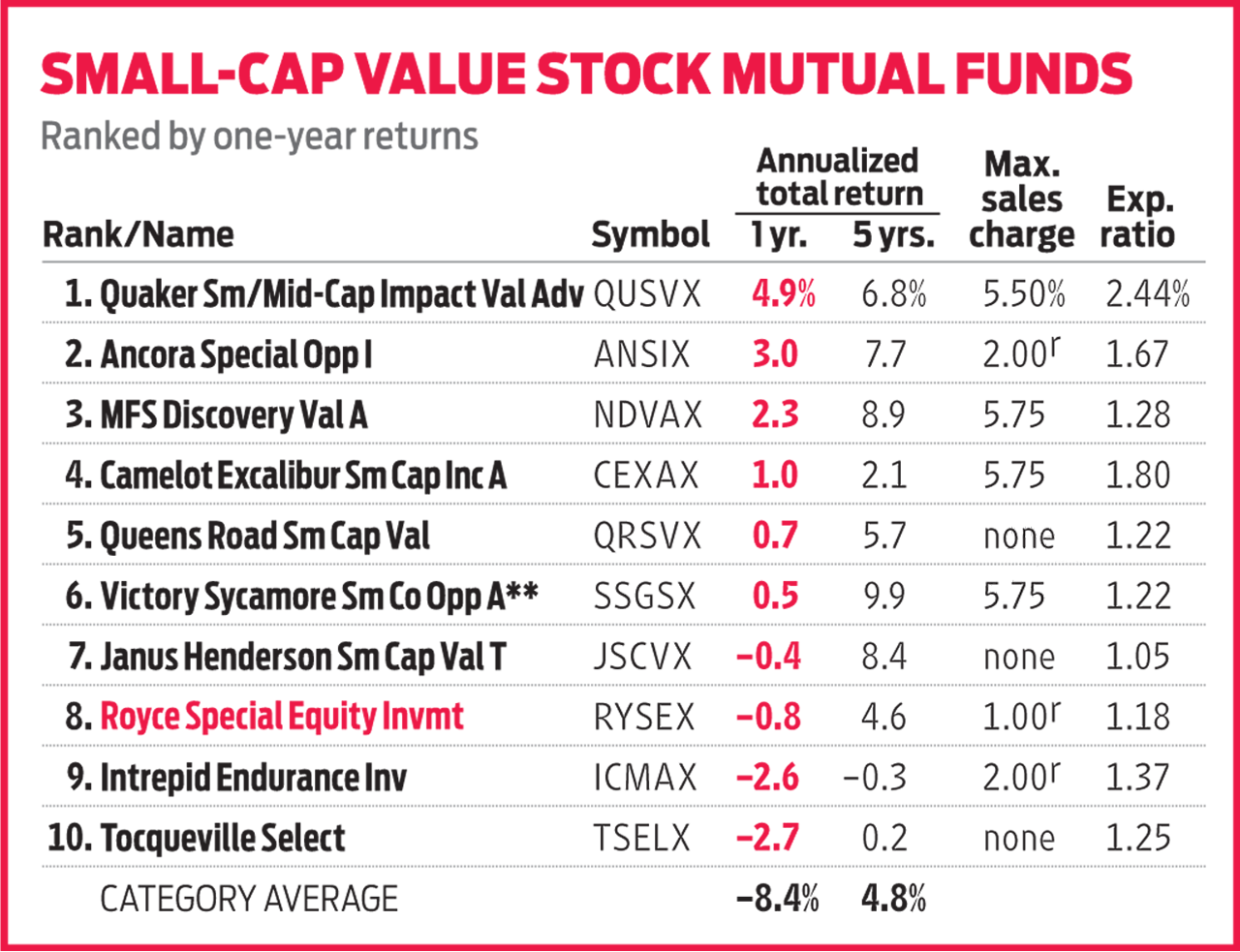

Royce Special Equity Fund Wins by Losing Less

A hefty chunk of cash has helped this small-company fund’s performance.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Cash is always king at Royce Special Equity (RYSEX). Managers Charles Dreifus and Steve McBoyle want to have ample funds to snap up shares when they see opportunities. The small-company stock fund typically holds 8% to 10% of its assets in ready money—more than its peers (funds that invest in value-priced small-cap stocks), which maintain a roughly 3% cash position.

The cash also cushions the fund when stocks slide. In 2018, for instance, the Russell 2000 small-company stock index sank 26.9% between September and late December. Special Equity held up much better, with a 16.9% loss. That’s a key reason the fund ranks well, relative to its peers, over the past 12 months.

But the managers aren’t afraid to let cash build when small-cap stocks soar, and that can be a drag on performance. Since the start of 2019, the Russell 2000 has gained 14.5%. Special Equity is up just 5.6%. The fund’s cash position at last report: 21% of assets.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Overall, the fund’s strategy of winning over time by losing less has earned mixed results. Special Equity’s five-, 10- and 15-year annualized returns, for instance, lag its typical peer and the Russell 2000 index. But the fund has been roughly 15% to 20% less volatile than its peers over those stretches. And since its 1998 inception, Special Equity has bested the index by an average of 1.5 percentage points per year.

Dreifus and McBoyle favor small, profitable firms that trade at a discount. A stock is a bargain if, among other measures, it trades below its enterprise value, which Dreifus says is the price you’d have to pay to buy the company outright. Then they home in on stocks that score well on profitability measures such as return on assets and free cash flow (cash profits left after capital outlays). In particular, the managers are looking for companies that report their financial results with no embellishment. “We want firms that are cheap, good and ethical,” says Dreifus. Few companies make the cut. The current portfolio comprises just 38 stocks.

The managers took advantage of the 2018 market sell-off to add five stocks to the fund. One of them, Johnson Outdoors (JOUT), makes outdoor recreation gear. It has gained 38.4% so far this year.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ryan joined Kiplinger in the fall of 2013. He wrote and fact-checked stories that appeared in Kiplinger's Personal Finance magazine and on Kiplinger.com. He previously interned for the CBS Evening News investigative team and worked as a copy editor and features columnist at the GW Hatchet. He holds a BA in English and creative writing from George Washington University.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

The 5 Best Actively Managed Fidelity Funds to Buy and Hold

The 5 Best Actively Managed Fidelity Funds to Buy and Holdmutual funds Sometimes it's best to leave the driving to the pros – and these actively managed Fidelity funds do just that, at low costs to boot.

-

The 12 Best Bear Market ETFs to Buy Now

The 12 Best Bear Market ETFs to Buy NowETFs Investors who are fearful about the more uncertainty in the new year can find plenty of protection among these bear market ETFs.

-

Don't Give Up on the Eurozone

Don't Give Up on the Eurozonemutual funds As Europe’s economy (and stock markets) wobble, Janus Henderson European Focus Fund (HFETX) keeps its footing with a focus on large Europe-based multinationals.

-

Vanguard Global ESG Select Stock Profits from ESG Leaders

Vanguard Global ESG Select Stock Profits from ESG Leadersmutual funds Vanguard Global ESG Select Stock (VEIGX) favors firms with high standards for their businesses.

-

Kip ETF 20: What's In, What's Out and Why

Kip ETF 20: What's In, What's Out and WhyKip ETF 20 The broad market has taken a major hit so far in 2022, sparking some tactical changes to Kiplinger's lineup of the best low-cost ETFs.

-

ETFs Are Now Mainstream. Here's Why They're So Appealing.

ETFs Are Now Mainstream. Here's Why They're So Appealing.Investing for Income ETFs offer investors broad diversification to their portfolios and at low costs to boot.

-

Do You Have Gun Stocks in Your Funds?

Do You Have Gun Stocks in Your Funds?ESG Investors looking to make changes amid gun violence can easily divest from gun stocks ... though it's trickier if they own them through funds.

-

How to Choose a Mutual Fund

How to Choose a Mutual Fundmutual funds Investors wanting to build a portfolio will have no shortage of mutual funds at their disposal. And that's one of the biggest problems in choosing just one or two.