14 Ways to Spend $1 Trillion

The latest estimate says the government will spend $1.5 trillion more than it takes in this year. Imagine what that means in terms we can all understand.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Think last year produced a tsunami of red ink for the federal government? Well, a $1.3 trillion deficit is nothing to sneeze at. But the Congressional Budget Office has just come up with an estimate of how much we’ll add to the national debt in Fiscal 2011: $1.5 trillion. That means an extra $1.5 trillion will be piled atop a mountain of national debt that already exceeds $14 trillion. It’s tough for most of us to get our heads around such a colossal number.

But, seriously, how much is $1 trillion? To help you wrap your head around that mind-boggling number, and to try to put deficit spending into perspective, we did some mental shopping:

See our Slide Show WHAT $1 TRILLIONWOULD BUY

$1 Trillion Would Buy:

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The 2011 Toyota Prius II wins Kiplinger’s Best in Class honors for cars in the $20,000-to-$25,000 price range. At a sticker price of $23,810 each, $1 trillion would let you buy a Prius for about 40% of all American families.

$1 Trillion Would Buy:

According to the latest figures from the National Association of Realtors, the national median price for existing single-family homes in the third quarter of 2010 was $177,900. There are about 80 million detached, single-family homes in the U.S., according to the NAR and the Census Bureau.

$1 Trillion Would Buy:

That’s calculated at the federal minimum wage of $7.25 an hour. Still hard to get your mind around? How about this: One trillion dollars is enough to hire all 2.8 million residents of the state of Kansas -- men, women and children -- in full-time, minimum-wage jobs for the next 23 years.

$1 Trillion Would Pay:

A YEAR’S SALARY FOR 18 MILLION TEACHERS

According to the National Education Association, the average elementary school teacher salary in the U.S. is about $55,300. NEA estimates that there are about 2 million elementary school teachers, so $1 trillion would cover their salaries for about 9 years.

$1 Trillion Would Pay:

CONGRESS FOR THE NEXT 10,742 YEARS

The current salary for rank-and-file members of the House of Representatives and the U.S. Senate is $174,000. That's 535 lawmakers -- not counting their staffs or the extras paid to congressional leaders..

$1 Trillion Would Buy:

THE STAR POWER OF LEBRON JAMES FOR THE NEXT 50,000 YEARS

A lot of numbers are being thrown around about just how much the basketball superstar will be paid for playing for the Miami Heat. But let’s say it’s just $20 million a year. At that rate, $1 trillion would cover the tab for King James for the next 50 millennia. Heck, King Tut was born less than four millennia ago.

$1 Trillion Would Buy:

Got a hankering for something sweet? A sweet $1 trillion will buy you that many 1.55-ounce Hershey’s Milk Chocolate bars at 75 cents apiece. That’s 64 million tons of chocolate, equivalent to the weight of more than 150,000 Boeing 747-400s.

$1 Trillion Would Buy:

4,000 CELEBRITY DIVORCE SETTLEMENTS

It’s been widely reported that Tiger Woods paid anywhere from $100 million to $750 million to settle the divorce from his wife, Elin Nordegren. Let’s assume it cost Tiger $250 million. At that rate, a trillion dollars would cover plenty more tabloid breakups.

$1 Trillion Would Generate:

$6.2 BILLION A MONTH GUARANTEED FOR LIFE

With the demise of the company pension plan -- and its wonderful promise of regular checks in retirement -- immediate-payout annuities are garnering more attention. These investments let you trade a lump sum for a guaranteed stream of income for the rest of your life. For example, a 65-year-old man with a sweet quarter of a million nest egg to invest could buy an annuity that will pay him $1,549 a month.Even at today’s record-low interest rates (the lower the interest rate, the more expensive it is to buy future income), $1 trillion earns its way -- and then some. The $6.2 billion monthly income figure is for men; because women live longer, on average, $1 trillion would buy a 65-year-old woman a little less. But having $5.8 billion a month to fall back on should help cover some bills.

$1 Trillion Would Earn:

$12.9 BILLION OF INTERESTON A ONE-YEAR CD

Everyone knows that interest rates on bank accounts, money-market funds and certificates of deposit are ludicrously low. But even at just 1.29% -- the best rate we could find recently -- $1 trillion socked away in a one-year CD would still yield a handsome return.

$1 Trillion Would PAY:

56.8 MILLION U.S. ARMY PRIVATES

Annual basic pay for an active-duty U.S. Army private with less than two years of experience is $17,611 a year. So $1 trillion goes a mighty long way, even by military spending standards. To put that in perspective, 56.8 million is more than 100 times the total number of active-duty soldiers in the Army today.

$1 Trillion Would Cover:

19.2 MILLION AMERICAN FAMILIES

Median household income in the U.S. (half the families earn more, half earn less) was $52,029 in 2008, according to the Bureau of the Census. There are about 100 million families in the country, so $1 trillion is enough to cover the income of about one-in-five families.

$1 Trillion Would Pay:

ESTATE TAXES FOR2,871 BILLIONAIRES

Congress has reinstated the federal estate tax – at least for the next couple of years – with a 35% flat rate after a $5 million exemption. Still, $1 trillion would cover the taxes due on 2,871 taxable estates of $1 billion each.

$1 Trillion Would Buy:

$1 MILLION SPENDING A DAY FOR NEARLY 3,000 YEARS

Thanks to the visitor who pointed this out in a comment on an earlier version of this story. What’s $1 trillion mean to you? Let us and your fellow Kiplinger.com visitors know by commenting below.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

How to Search For Foreclosures Near You: Best Websites for Listings

How to Search For Foreclosures Near You: Best Websites for ListingsMaking Your Money Last Searching for a foreclosed home? These top-rated foreclosure websites — including free, paid and government options — can help you find listings near you.

-

Four Tips for Renting Out Your Home on Airbnb

Four Tips for Renting Out Your Home on Airbnbreal estate Here's what you should know before listing your home on Airbnb.

-

Is Relief from Shipping Woes Finally in Sight?

Is Relief from Shipping Woes Finally in Sight?business After years of supply chain snags, freight shipping is finally returning to something more like normal.

-

Economic Pain at a Food Pantry

Economic Pain at a Food Pantrypersonal finance The manager of this Boston-area nonprofit has had to scramble to find affordable food.

-

The Golden Age of Cinema Endures

The Golden Age of Cinema Enduressmall business About as old as talkies, the Music Box Theater has had to find new ways to attract movie lovers.

-

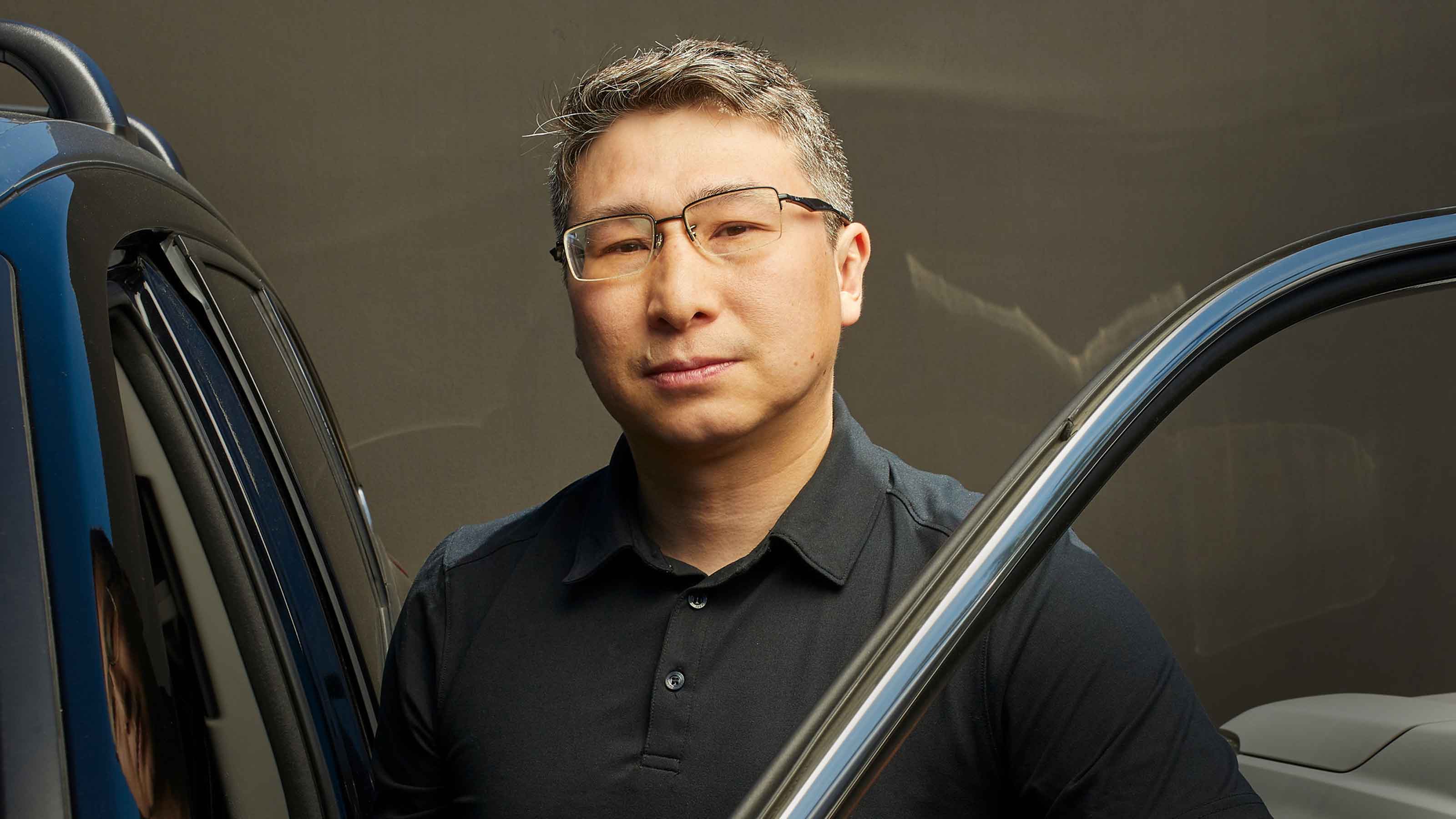

Pricey Gas Derails This Uber Driver

Pricey Gas Derails This Uber Driversmall business With rising gas prices, one Uber driver struggles to maintain his livelihood.

-

Smart Strategies for Couples Who Run a Business Together

Smart Strategies for Couples Who Run a Business TogetherFinancial Planning Starting an enterprise with a spouse requires balancing two partnerships: the marriage and the business. And the stakes are never higher.

-

Fair Deals in a Tough Market

Fair Deals in a Tough Marketsmall business When you live and work in a small town, it’s not all about profit.