Don’t Let the 'Widow's Penalty' Blindside You: How to Prepare

If one spouse passes away, the surviving spouse could pay nearly double the amount of income taxes. Are you planning for this?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The “widow’s penalty” occurs when a person’s tax filing status goes from married filing jointly to single. This change can cause the surviving spouse to have to pay nearly double the taxes compared to what they were paying.

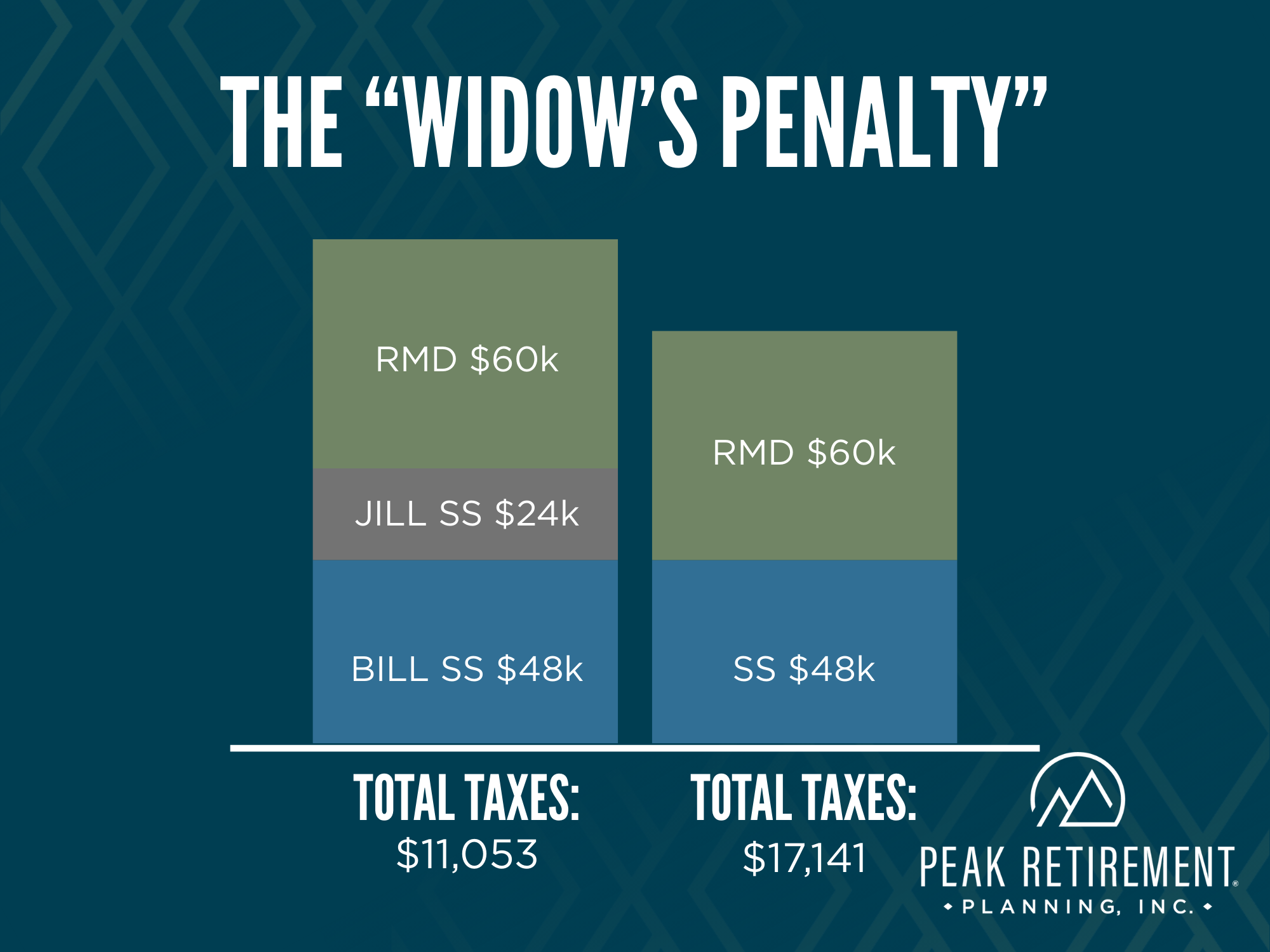

I am going to share an example of a client of ours (we’ll call her Jill) whose spouse (we’ll change his name to Bill) passed away prematurely before Jill started working with us. Their situation is illustrated in the graphic below. Let me walk you through the impact of the widow’s penalty and how severe it was for Jill.

As you can see with this chart, while Bill and Jill were together, they filed their taxes jointly, each received Social Security, and both were older than 73, which means they were forced to take required minimum distributions (RMDs) from the money they had saved in IRAs over all their working years.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

All their income combined resulted in a tax bill of $11,053. To me, that is a lot of money to have to pay the government, considering Jill and Bill are no longer working. Unfortunately, it gets worse.

When Bill passed, Jill was required to continue the same RMD amount because she was the beneficiary and received all the investments.

However, there were two major changes that occurred. The first was that Jill’s Social Security fell off. When one spouse passes away, their Social Security income goes away, and the higher of the two remains.

It is great that Jill can take the higher of the two but unfortunate that she will have a loss of income from what she was used to.

This is less of concern since it is typically correct that most surviving spouses will not need 100% of what they needed while their spouse was living, so we can manage that loss. The second change was that Jill’s tax status went from married filing jointly to single.

I have already indicated how severe this is and how it can cause the surviving spouse to pay nearly double the amount of taxes. Let’s explore the tax brackets to understand why this is the case.

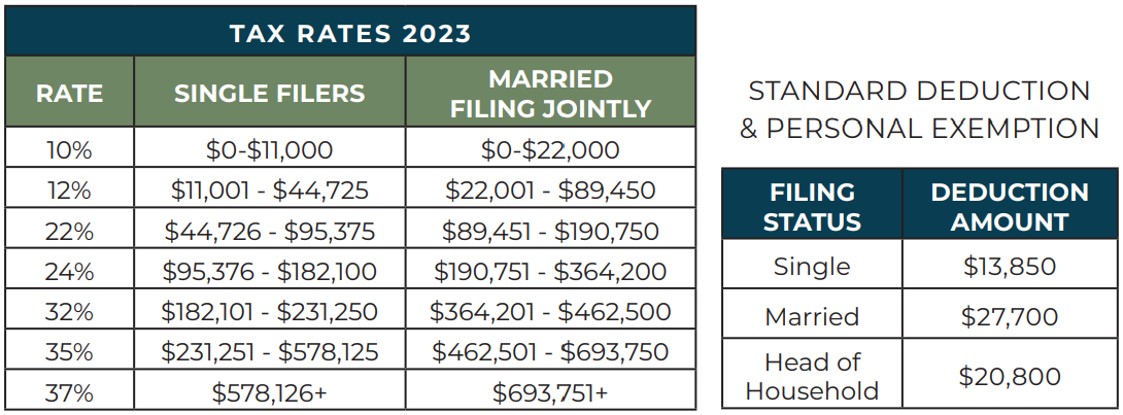

As you can see from these charts, two things fuel the fire for the widow’s penalty:

- The standard deduction gets cut in half. This means the surviving spouse will be left with less tax-free income.

- The tax brackets are smaller. For example, if you have $85,000 of taxable income and you are married filing jointly, then you are in the 12% tax bracket, but if you are single with $85,000 of taxable income, then you will be in the 22% tax bracket. See how this can be an issue? This is how that near doubling of taxes can occur.

It bothers me that not only will the surviving spouse have less income, but they will also have to pay more taxes, which leaves them with less money during the time when they need it the most.

How do we plan for this? By utilizing the married filing jointly tax brackets while you can. One spouse is likely to pass away first, so be prepared when that happens.

Also, consider that tax rates may be the lowest we’ll see because they are among historical lows, and most experts expect them to increase due to our country's current debt crisis and overspending.

Now may be the best time to pay taxes on those tax-deferred vehicles like your IRA and 401(k) while this tax “sale” is here and while you are still in the more generous married filing jointly tax brackets. You could utilize strategies like a Roth conversion to maximize these types of opportunities.

What else you can do

Another consideration is optimizing when you take Social Security to ensure your spouse will be left with the highest benefit when you pass away.

Lastly, if you are going to be drawing larger RMDs in the future, now is the time to start reducing that potential liability, to leave your spouse with less taxable income in the future when it matters the most.

To close, it truly bothers me how severe the widow’s penalty is. Jill was penalized $30,000 per year ($24,000 from the loss of income and $6,000 from the increased tax bill).

This is something that can be devastating to surviving spouses, especially when one spouse passes away early — and for those who have done a great job saving. In sum, the tax code penalizes those who have saved and those who have had a spouse pass early.

Unfortunately, you can change only what you can control. We cannot control the tax code or laws, but we can control how we plan for it. So, let's get planning now and make sure our loved ones can continue on with the plan they deserve.

Related Content

- Social Security Strategies to Help Widows Replace Lost Income

- Should I Hire an Estate Planning Attorney Now That I Am a Widow?

- Optimize Your Taxes With These Two Common Strategies

- Social Security for Widowed Parents Falls Far Short of Need

- How to Qualify for Social Security Spousal and Survivor Benefits

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Joe F. Schmitz Jr., CFP®, ChFC®, CKA®, is the founder and CEO of Peak Retirement Planning, Inc., which was named the No. 1 fastest-growing private company in Columbus, Ohio, by Inc. 5000 in 2025. His firm focuses on serving those in the 2% Club by providing the 5 Pillars of Pension Planning. Known as a thought leader in the industry, he is featured in TV news segments and has written three bestselling books: I Hate Taxes (request a free copy), Midwestern Millionaire (request a free copy) and The 2% Club (request a free copy).

Investment Advisory Services and Insurance Services are offered through Peak Retirement Planning, Inc., a Securities and Exchange Commission registered investment adviser able to conduct advisory services where it is registered, exempt or excluded from registration.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

The Tool You Need to Avoid a Post-Divorce Administrative Nightmare

The Tool You Need to Avoid a Post-Divorce Administrative NightmareLearn why a divorce decree isn’t enough to protect your retirement assets. You need a QDRO to divide the accounts to avoid paying penalties or income tax.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off

When Estate Plans Don't Include Tax Plans, All Bets Are OffEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain Why

When Estate Plans Don't Include Tax Plans, All Bets Are Off: 2 Financial Advisers Explain WhyEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly Mistakes

Counting on Real Estate to Fund Your Retirement? Avoid These 3 Costly MistakesThe keys to successful real estate planning for retirees: Stop thinking of property income as a reliable paycheck, start planning for tax consequences and structure your assets early to maintain flexibility.

-

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)February gets a bad rap for being the month when resolutions fade — in fact, it's the perfect time to reset and focus on small changes that actually pay off.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.