Why Investors Shouldn't Romanticize Bitcoin, From a Financial Planner

Investors should treat bitcoin as the volatile, high-risk asset it is. A look at the data, along with comparisons to the Magnificent 7 stocks, indicates a small (1% to 2%) portfolio allocation for most investors would be the safest.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

"Do you think I should put some money in bitcoin or crypto?" That's a question I get a lot as a financial planner.

These cryptocurrency conversations tend to swing between two poles.

On one end, you have the "bitcoin is going to zero" crowd that will never believe in deregulated finance, the blockchain or bitcoin itself.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

On the other, the "bitcoin replaces every asset" crowd that believe the entire future is built on the blockchain, the U.S. dollar is going away, and cryptocurrencies will replace it all.

Both are emotionally interesting and analytically useless.

My position, as always, is simpler. Treat bitcoin like any other asset class. Look at the data. Evaluate risk. Study correlations. Understand where it fits in a portfolio and where it absolutely does not.

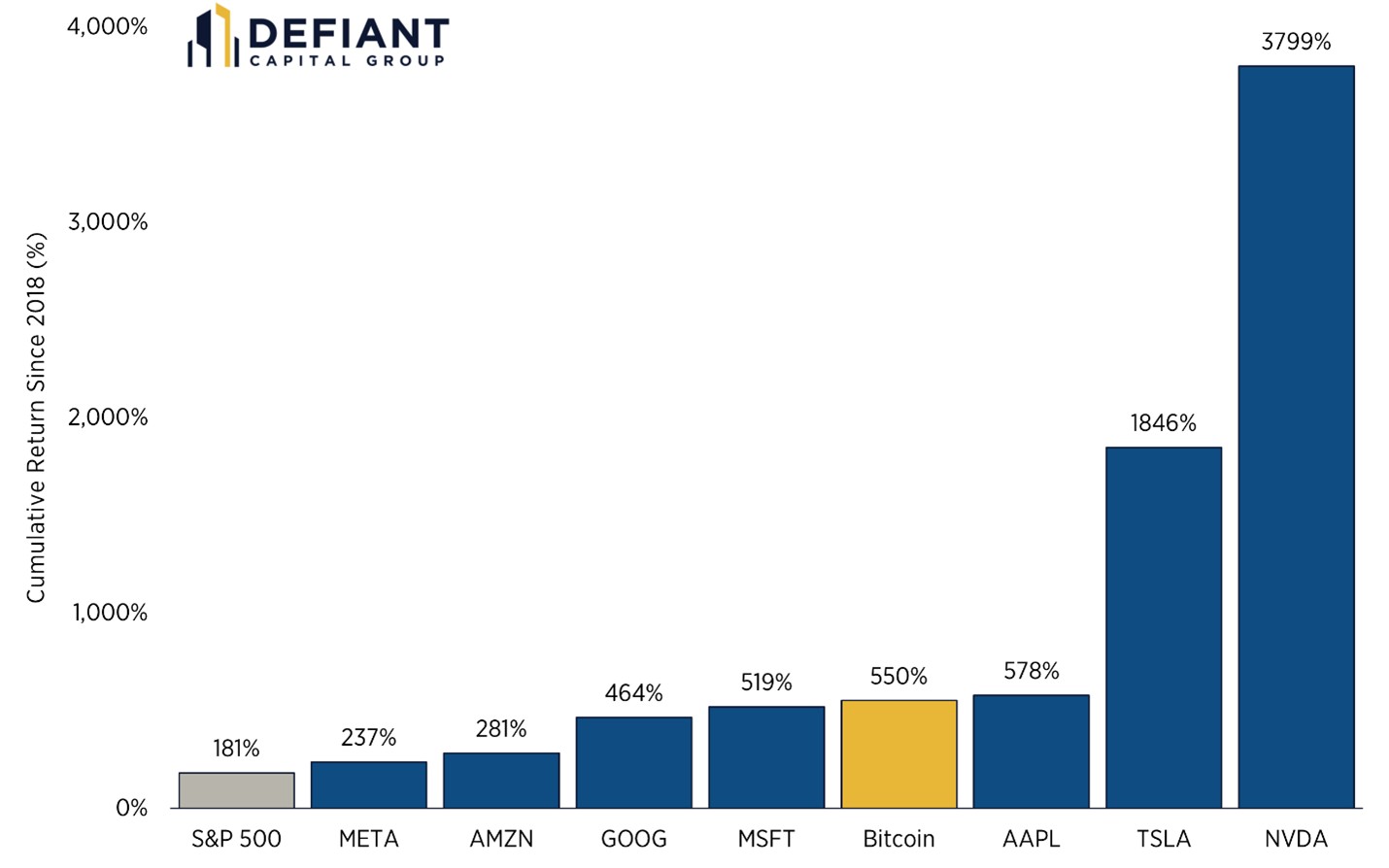

A look at historical data

With that lens, I decided to revisit my analysis from 2020, Implications of Adding Bitcoin (Crypto Currencies) to Traditional Portfolios, and look at bitcoin's (potential) role in a portfolio. I pulled historical price data on bitcoin, the S&P 500 and the Magnificent 7 — Apple (AAPL), Alphabet (GOOG; GOOGL), Microsoft (MSFT), Amazon.com (AMZN), Meta Platforms (META), Tesla (TSLA) and Nvidia (NVDA).

About Adviser Intel

The author of this article is a participant in Kiplinger's Adviser Intel program, a curated network of trusted financial professionals who share expert insights on wealth building and preservation. Contributors, including fiduciary financial planners, wealth managers, CEOs and attorneys, provide actionable advice about retirement planning, estate planning, tax strategies and more. Experts are invited to contribute and do not pay to be included, so you can trust their advice is honest and valuable.

The numbers tell a much more reasonable story than the headlines.

1. Bitcoin's recent performance looks different than people think

The first thing everyone wants to know is who "won." On pure returns, bitcoin has outperformed almost everything over longer periods. This is true. It's also incomplete.

The story is really two parts — bitcoin pre-2018 and bitcoin post-2018.

For the purposes of this analysis, I am looking only at bitcoin post-2018, since its 1,000%+ returns pre-2018 are easy enough to interpret. The question now is: Would you still invest new money today?

Below is a look at annual returns across bitcoin, each Mag 7 component and the S&P 500 since 2018.

I compare bitcoin directly to the Mag 7 because, like crypto, these companies represent high-growth, high-volatility, future-oriented assets that dominate both narrative and performance cycles. If an investor is choosing "the next big thing," these are the most realistic substitutes.

Source: Koyfin. As of 11/19/2025

A few things jump out from this dataset:

- Bitcoin has delivered several years of triple-digit returns

- Bitcoin has also had multiple calendar years where it fell more than 50%

- The Mag 7, despite massive recent dominance, still look orderly compared to bitcoin's volatility

- The S&P 500 remains the steady compounder it has always been

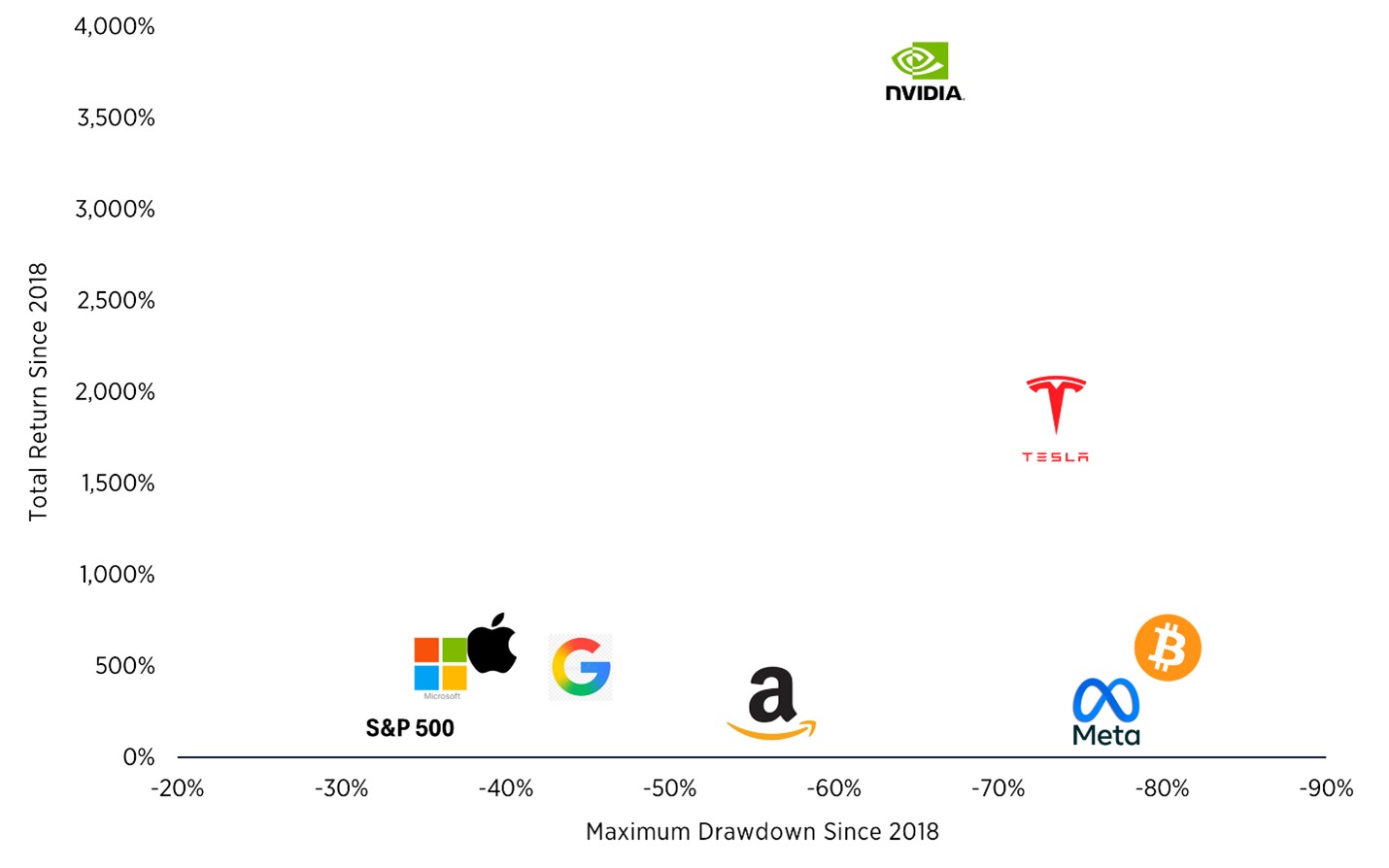

So, yes, bitcoin's long-term return profile is exceptional. But when compared with the Mag 7, those exceptional returns come with extreme volatility, and since 2018, it actually underperforms many of the Mag 7.

The level of volatility relative to return would suggest that the risk premium, or excess return an investor can expect to earn from investing in bitcoin, is not justified. Simply put: Return alone doesn't settle the question.

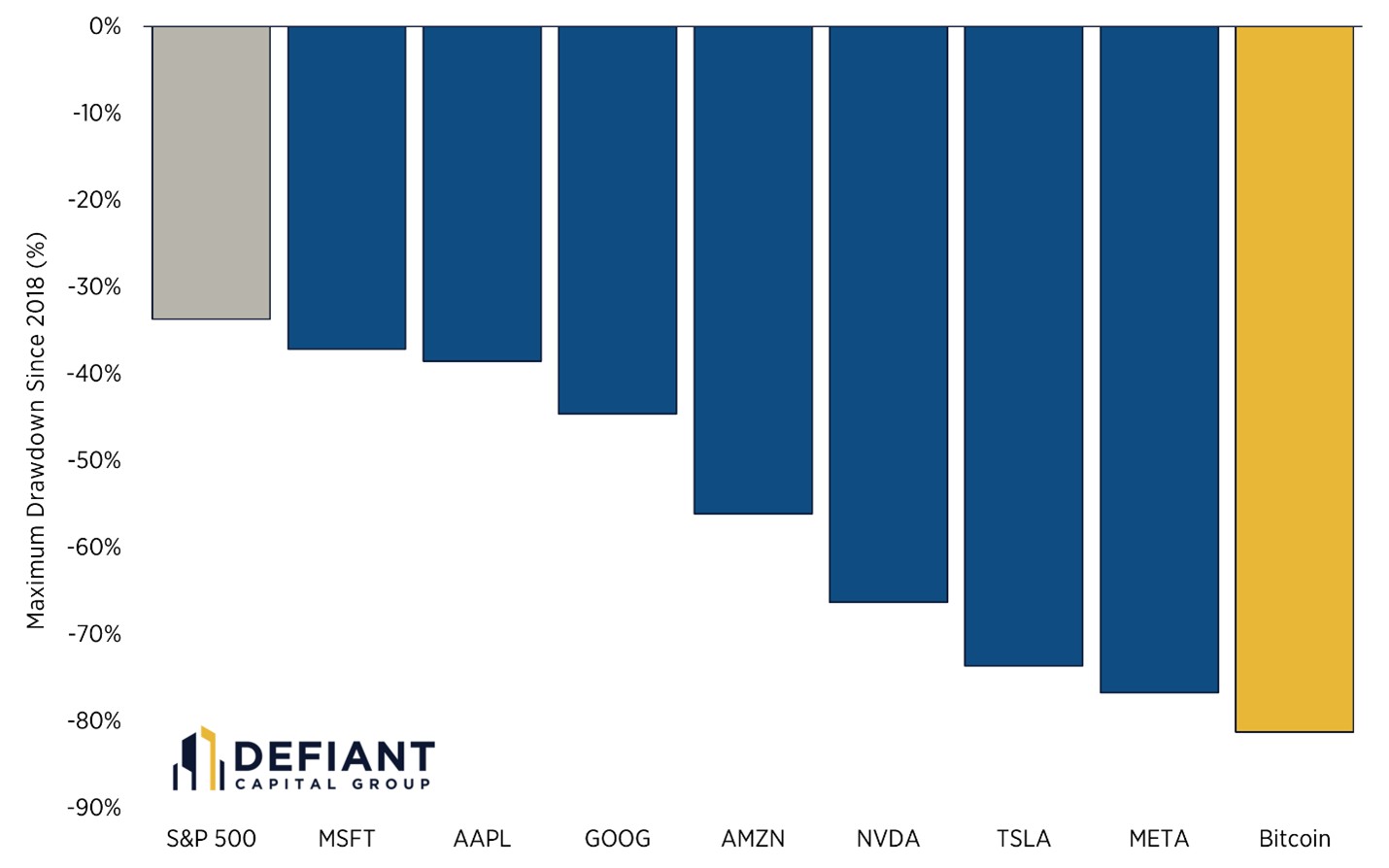

2. Drawdowns: The part most people ignore

If someone tells you only the return, and not the drawdown, they're leaving out the part that determines whether investors actually stick with an asset.

Bitcoin's drawdowns are not just large — they are violent.

Even mega-cap growth stocks, which are hardly low-risk, don't draw down as much as bitcoin has experienced. Nvidia, Meta and Tesla have had large drops, but bitcoin has had periods where it lost more than 80% of its value.

This isn't just an academic point. A portfolio allocation works only if an investor can stay invested. Most people will not hold through an 80% decline, no matter what narrative they believe.

And more importantly, the return (as shown above) has not rewarded investors for holding bitcoin the same way it has for Nvidia, Tesla or even Apple.

In practice, the biggest risk to bitcoin holders isn't the asset itself — it's the behavioral failure it induces.

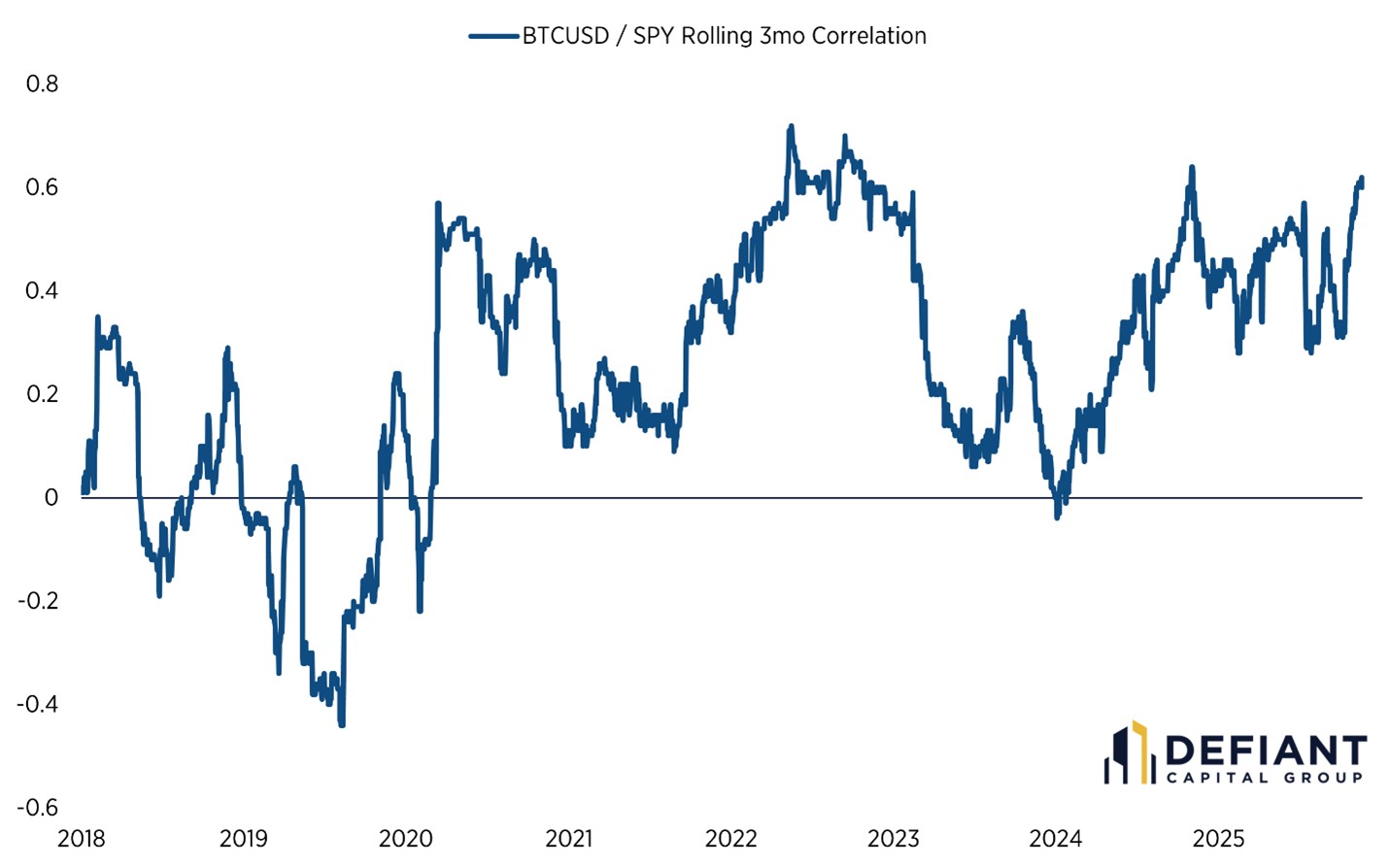

3. Correlations: The case for diversification is more nuanced than people think

One of the strongest arguments in favor of bitcoin is its historically low correlation to stocks. That was true in the early years. It's less true today.

Using rolling three-month correlations, the relationship between bitcoin and the rest of the market looks very different depending on the period.

A few insights explain most of bitcoin's behavior:

- Bitcoin increasingly trades like a risk-on asset, not a diversifier

- Correlations rise during periods of market stress, the exact moments investors want diversification to work

- Since 2018, bitcoin has not behaved like "digital gold." Specifically, whereas gold has a low correlation to the broader market and lower volatility, bitcoin is the oppositive

- Correlations remain unstable across cycles, making forecasting its performance in the future difficult, especially as a risk diversifier

The bottom line: Based on behavior and the way it moves with the broader stock market (e.g. S&P 500), bitcoin is not your portfolio's insurance policy. It is more like high-beta tech with a different marketing department.

4. So, should bitcoin be in a portfolio?

This is the part where investors expect a binary answer. In my view, it's not that simple.

I suggest investors think about bitcoin the same way you think about private investments, early venture or any asymmetric risk asset — sizing matters more than prediction.

Regarding the specific role of bitcoin in a portfolio, here's how we think about it at Defiant Capital Group (as always, this is highly client-specific and it's not right for all clients):

Potential benefits

Asymmetric upside. The upside tail is real and historically has been meaningful.

Low long-term correlation. Even imperfect diversification can help when position sizes are small.

Rebalancing optionality. Volatility creates opportunities if the investor is disciplined.

Institutional adoption. ETFs and custodial improvements make the asset more investable. As more institutions hold bitcoin and other cryptocurrencies, there is an increasingly stronger and more stable market for it.

Risks that matter

Extreme drawdowns. The path is often worse than the result.

Regime-dependent correlation. Works until it doesn't.

Speculative flows. Narrative changes drive returns as much as fundamentals.

Behavioral strain. The average investor massively underperforms the asset because they enter and exit at the wrong times.

And for entrepreneurs, who are the bulk of our client base, bitcoin has to be viewed through an even narrower lens.

If most of your wealth already lives in a single business, you don't need more convexity or more volatility. You need stability, planning and liquidity alignment.

Bitcoin had an incredible rally up to 2017/2018, but since then, the performance has looked more like a high-tech stock. Yes, it can still massively outperform the broader market, but at significantly higher risk.

In our view, bitcoin can play a role in a diversified portfolio, but usually a very small one.

5. A practical allocation framework for bitcoin and crypto

Going straight to the point, here's the general framework we use with clients:

1. Keep it small. We view investing in bitcoin or other cryptocurrencies like a risky stock investment — there's high concentration, high risk and the ability for loss. Invest only what you are willing to completely lose.

For most investors, that's a 1% to 2% investment, which is typically enough to capture the upside without exposing the portfolio to catastrophic drawdowns.

The larger the allocation, the larger the required discipline of the investor.

Looking for expert tips to grow and preserve your wealth? Sign up for Adviser Intel, our free, twice-weekly newsletter.

2. Rebalance regularly. Volatility is only useful if harvested. Without rebalancing, the allocation drifts into a behavioral problem.

3. Match the sizing to the investor's real risk budget. Look at an investment in bitcoin relative to your existing portfolio and other income streams. Make your allocation in the context of both income and portfolio investments.

4. Understand how bitcoin actually behaves. In our view, bitcoin is no longer a portfolio hedge — its correlation to equity markets is too high, its volatility is closer to that of a mega-cap tech company, and its drawdowns are significantly higher than the broader stock market.

Since 2018, bitcoin has not performed like gold, an inflation hedge or even provided downside protection.

The data simply doesn't support that story.

6. The bottom line

Bitcoin's long-term returns are undeniable. So are its drawdowns. So is its volatility. So is its inconsistent correlation profile.

The most productive way to think about crypto is not as a replacement for traditional assets and not as a guaranteed moonshot. It is an asset with a unique return distribution that can fit into a portfolio if treated with discipline, structure and humility.

At Defiant Capital Group, we don't dismiss bitcoin. But we don't romanticize it either. Like anything else in a portfolio, it has to earn its place.

And the way it earns that place is not through prediction, but through design — the same principle that guides everything we build for clients.

Related Content

- Crypto Trends to Watch in 2026

- How Spot Bitcoin ETFs Work: Are They Right for You?

- Three Common Mutual Fund Misconceptions Debunked

- Five Financial Strategies for High-Net-Worth Individuals

- A Simple Trick for Better Investing: Stop Timing the Market

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jonathan Dane is the Founder of Defiant Capital Group and is responsible for leading the firm’s business strategy and investment management activities. He serves as the firm’s Chief Investment Officer and leads all strategic investment decision-making including portfolio construction, manager due diligence and selection and deployment of client capital. In addition, he serves on several advisory boards, including the Advisory Board of Institutional Investor’s RIA Institute and as a Strategic Advisor to 1787 Ventures and Quinn, an AI-powered financial planning technology.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.