What the New Tax Law Means for Small Businesses

The most sweeping tax overhaul in three decades brings lots of good cheer for businesses, ranging from a lower corporate tax rate to big tax savings for asset purchases.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The most sweeping tax overhaul in three decades brings lots of good cheer for businesses, ranging from a lower corporate tax rate to big tax savings for asset purchases. But there are also some deductions that disappear and other breaks that are pared back to offset part of the massive cost of the tax cuts. Here’s a look at some of the key provisions in the new tax law that affect small businesses. Unless otherwise stated, most of these apply beginning in tax year 2018.

[EMBED TYPE=WIDGET ID=169]

Corporate Tax Rate Slashed

The new law reduces the income tax rate on regular corporations (sometimes referred to as C corporations) from a top rate of 35% to a flat 21%. Personal service corporations also get the 21% rate. Although this low rate is a boon for most companies, some small C corporations could actually end up paying a bit more. That’s because the law didn’t keep the 15% corporate rate on the first $50,000 of taxable income. For example, a C corporation with $30,000 of taxable income will pay $6,300 of tax when it files its 2018 federal return (compared to $4,500 under prior law).

The corporate alternative minimum tax is gone.

Tax Relief for Passthrough Businesses

While cutting the corporate rate to 21%, lawmakers decided to offer a different kind of relief to sole proprietors and farmers who report income on Schedules C and F of their income tax returns, and to individuals who own pass-through entities—such as S corporations, partnerships and LLCs—which pass their income to their owners for tax purposes. Starting with 2018 returns, many of these people can deduct 20% of their qualifying income before figuring their tax bill.

This change is one of the most complex provisions in the new law. That’s because there are lots of special anti-abuse rules and restrictions, most of which apply to high earners. There are also lots of unsettled issues and as-yet unanswered questions that are begging for IRS guidance.

Two rules apply to taxpayers with taxable incomes in excess of $157,500 on an individual return and $315,000 on a joint return. First, the break phases out for these people who are in many professional service fields. And if you’re in an affected field and your taxable income exceeds $415,000 for joint returns … $207,500 for all others, the deduction is zero for that business.

Second, there is a W-2 wages-paid limitation for high-income earners that applies even if the person isn’t engaged in a specified service business. This caps the deduction at the basic 20% or, if lower, a figure that looks at W-2 wages paid by the firm and the basis of certain assets.

QUIZ: What Do You Know About the New Tax Brackets?

Buying Business Assets

100% bonus depreciation is back. Firms can write off the entire cost of qualifying assets that they buy and place in service after Sept. 27, 2017. It generally lasts until 2022 and then phases out 20% for each year thereafter. The break applies to new and used assets with lives of 20 years or less.

There’s also a higher cap on expensing business assets. The maximum amount a taxpayer can expense for new or used business assets instead of depreciating them is $1 million. This limitation phases out dollar for dollar once more than $2,500,000 of assets are placed in service during the year. These figures will be adjusted annually for inflation.

More property is eligible for expensing. Included now are depreciable personal assets used predominantly to furnish lodging such as beds, refrigerators, and stoves in hotels, apartments and dormitories. Also eligible are certain improvements made to commercial buildings: Roofs, HVAC equipment, fire protection and alarms, and security systems.

New farm equipment can be depreciated over five years instead of seven years. This doesn’t cover grain bins, cotton ginning assets, fences or land improvements.

Note that the law keeps the current depreciable recovery periods for real estate: 27.5 years for residential rental property and 39 years for commercial realty.

Bigger Vehicle Tax Breaks

Now is the best time tax-wise to buy a vehicle for your business. That’s because buyers of new or used business vehicles get lots of breaks under the new tax law.

The annual depreciation caps for passenger autos have risen sharply. If bonus depreciation is claimed, the first-year ceiling is $18,000 for cars acquired after Sept. 27, 2017, and put into service in 2018. The second- and third-year caps are $16,000 and $9,600. After that…$5,760. For autos bought before Sept. 28, 2017, but first placed in use during 2018, the first-year cap with bonus depreciation is $16,400. If no bonus depreciation is taken, the first-year ceiling drops to $10,000.

- The breaks are even juicier for buyers of heavy SUVs or heavy pickup trucks. Thanks to bonus depreciation, if you purchase a heavy SUV for your business, you can write off up to 100% of the cost. And if you buy a heavy pickup truck for business use, you can expense up to the full cost.

Write-offs for Golf Club Outings Axed—Client Meals in Limbo

Before 2018, firms could generally take a tax write-off for half of their business-related entertainment costs. The tax law eliminated this break, so no more writing off show tickets, golf course fees, sporting events and the like, even if taking clients.

Holiday parties are still fully deductible. And no changes to employee meals while on business travel—still 50% deductible by the employer. The cost of an employer-operated eating facility such as a cafeteria, which used to be fully deductible, is now subject to a 50% bite (after 2025, the cost is completely disallowed).

- The deductibility of client meals is murky. There’s a sharp divide among tax practitioners on this issue. Some tax professionals say that client meals such as at a restaurant for a business dinner or a post-golf lunch at a country club, are 50% deductible if business is conducted or discussed. Others aren’t so sure and take the position that client meals can’t be written off any more. This issue is obviously begging for IRS guidance sooner rather than later.

To be on the safe side, business owners should track all of their receipts in separate ledger accounts based on the specific type of meal or entertainment expense.

Say Goodbye to the Domestic Production Deduction

The new tax law brought an end to the popular write-off for 9% of income derived from U.S. production activities. Business lobbying groups and tax professionals, who were hoping for a two- or three-year phase-out period, didn’t get their wish.

- Repeal is effective for tax years beginning after 2017. This means taxpayers with a fiscal year that straddles 2017 and 2018 may still be eligible for the deduction.

Squeezing Commuter Benefits

The new law eliminates the rule that allows employers to deduct the cost of transportation-related fringe benefits for employees, such as parking and mass transit passes. The write-off is axed regardless of whether benefits are paid directly by the employer or through a reimbursement arrangement or compensation reduction agreement. Employees can still use up to $260 a month in pre-tax money to cover parking, mass transit passes and vanpools.

Curiously, firms that choose to subsidize employees who ride their bikes to work can continue to take a tax deduction for their contributions (up to $20 per month per employee to reimburse expenses). But the tax law did take a swipe at the cyclists themselves: They will now be taxed on their subsidy. Note that even without this perk, it is still in most cases cheaper to bike to work than to drive or take mass transit. And that’s without factoring in the health benefits of bicycle commuting.

TOOL: How Much Can I Save Biking to Work?

Net Operating Loss Deduction

The new law pares back the deduction for net operating losses (NOLs). First, NOLs will only be able to offset 80% of taxable income in future years. Second, NOL carrybacks are generally prohibited. Instead, NOLs can be carried forward indefinitely. Under the old law, NOLs could be carried back two years and carried forward 20 years.

Note that the rule barring NOL carrybacks contains an oversight. The statutory language says that the general prohibition on NOL carrybacks applies to NOLs arising in tax years ending after Dec. 31, 2017, while the conference committee used an effective date for NOLs arising in years beginning after Dec. 31, 2017. The law as currently written allows calendar-year filers to carry back 2017 losses, but taxpayers with a fiscal year that straddles 2017 and 2018 are prohibited from doing the same.

New Family-Paid-Leave Credit

Firms that provide paid family or medical leave to their workers get a new, temporary credit for 2018 and 2019, generally equal to 12.5% of the amount of wages paid during the time of leave. The credit is larger for employers that pay workers over half their normal wages while on leave.

There are lots of rules and limitations to comply with. For example, employers must have a written policy that gives full-time workers at least two weeks of paid family and medical leave each year (the leave time is prorated for part-timers). And the credit doesn’t apply to employees with total wages in excess of $72,000 in 2017. The IRS has published a series of FAQs on this subject.

Capping Business Losses on Individual Returns

Congress has clamped down on individual taxpayers who take large business losses on their returns. Under the new law, a couple filing a joint return is limited to $500,000 in such losses, while single filers can take no more than $250,000 in losses. The amount of trade or business loss that exceeds these caps is nondeductible, but any excess can be carried forward. Note that this limitation applies after application of the current passive-activity loss rules.

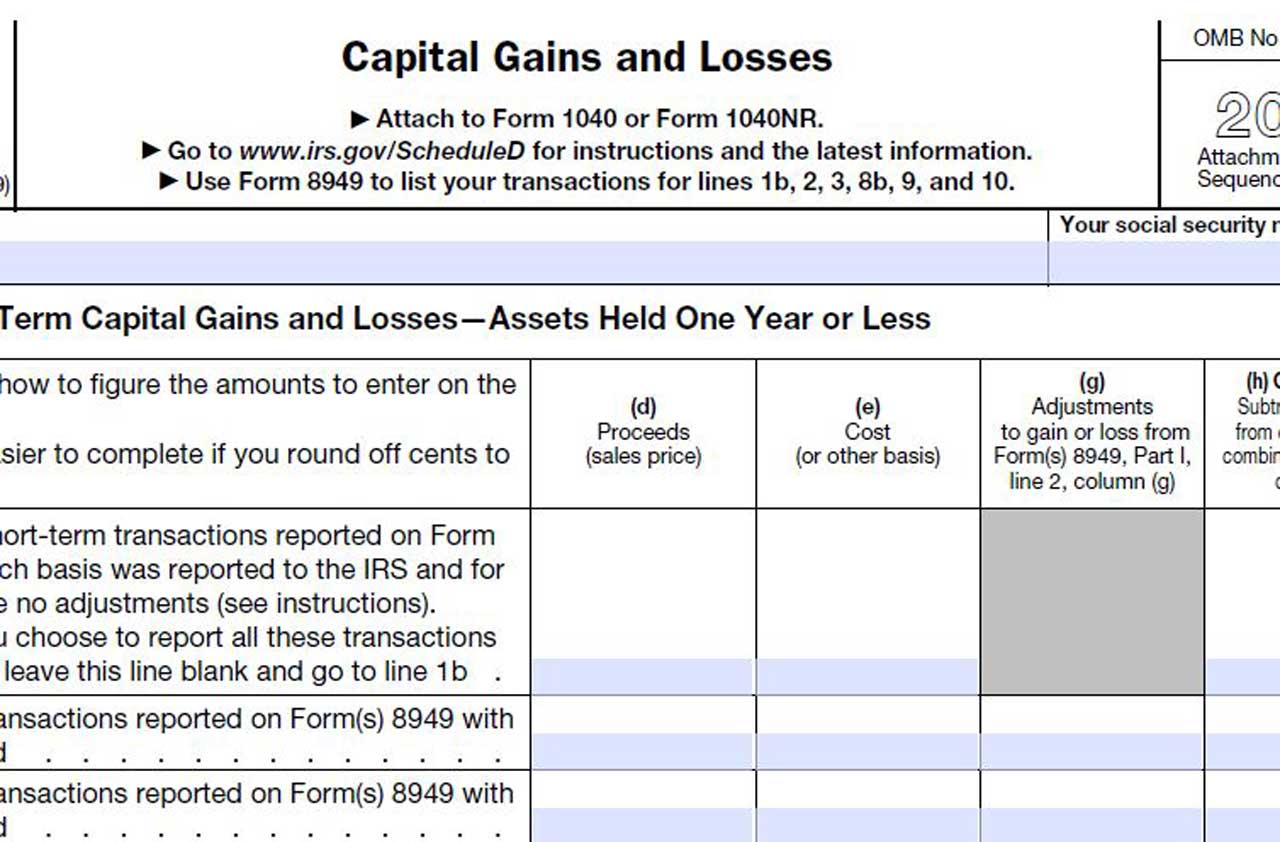

Like-Kind Exchanges Survive…But Only for Real Estate

Generally, an exchange of property is a taxable transaction, just like a sale. But the law includes an exception when investment or business property is traded for similar property. Any gain that would be triggered by the sale of such property is deferred in the case of a like-kind exchange. This break has applied to assets such as real estate and tangible personal property such as heavy equipment and artwork.

- The new law now restricts its use to like-kind exchanges of real estate.

INTERACTIVE MAP: State-by-State Guide to Taxes on Income, Property, Everything You Buy

Settling Sexual Harassment Claims

The tax laws have caught up with the Time’s Up and #MeToo movements.

- Businesses that settle sexual harassment claims cannot deduct the settlement amounts they pay if the payments are subject to a nondisclosure agreement. The same goes for attorney’s fees. It remains to be seen what impact this will have on employers involved in these suits. For example, will there be fewer nondisclosure agreements or less money paid out?

More Businesses Can Use the Cash Method of Accounting

Under the old law, C corporations with average gross receipts of $5 million or more over the previous three tax years weren’t able to use the cash method of accounting. The new law raises the dollar threshold to $25 million, so many more C corporations can now qualify to use the cash method instead of having to use the accrual method. This same $25 million threshold also applies to partnerships or LLCs with C corporation owners.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Joy is an experienced CPA and tax attorney with an L.L.M. in Taxation from New York University School of Law. After many years working for big law and accounting firms, Joy saw the light and now puts her education, legal experience and in-depth knowledge of federal tax law to use writing for Kiplinger. She writes and edits The Kiplinger Tax Letter and contributes federal tax and retirement stories to kiplinger.com and Kiplinger’s Retirement Report. Her articles have been picked up by the Washington Post and other media outlets. Joy has also appeared as a tax expert in newspapers, on television and on radio discussing federal tax developments.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

States That Tax Social Security Benefits in 2026

States That Tax Social Security Benefits in 2026Retirement Tax Not all retirees who live in states that tax Social Security benefits have to pay state income taxes. Will your benefits be taxed?

-

Ten States with the Lowest Sales Tax in 2025

Ten States with the Lowest Sales Tax in 2025Sales Tax Living in one of the lowest sales tax states doesn't always mean you'll pay less.

-

10 Least Tax-Friendly States for Middle-Class Families

10 Least Tax-Friendly States for Middle-Class FamiliesState Tax Here’s what living in one of the least tax-friendly states for middle-class families costs residents.

-

Low-Tax States for 'Middle-Class' Families in 2026

Low-Tax States for 'Middle-Class' Families in 2026State Tax Here are the best states for families with middle incomes (due to low tax burdens).

-

15 States That Tax Military Retirement Pay (and Other States That Don't)

15 States That Tax Military Retirement Pay (and Other States That Don't)retirement Taxes on military retirement pay vary from state-to-state. How generous is your state when it comes to helping retired veterans at tax time?

-

5 Tax Deadlines for October 17

5 Tax Deadlines for October 17tax deadline Many taxpayers know that October 17 is the due date for filing an extended tax return, but there are other tax deadlines on this date.

-

Penalties for Filing Your Tax Return Late

Penalties for Filing Your Tax Return Latetax deadline Stiff penalties await those who didn't file their return (or pay any tax owed) by the tax filing deadline.

-

9 Tax Deadlines for April 18

9 Tax Deadlines for April 18tax deadline Between requesting a tax extension, making IRA or HSA contributions, and meeting other tax deadlines, there's more to do on Tax Day than just filing your federal income tax return.