Charitable Giving Under the New Tax Law

The new tax law may discourage donations. But you can still support your causes and reduce your tax bill with these strategies.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The chance to get a deduction for their generosity often motivates charitable givers to become even more generous and write larger checks. But under the Tax Cuts and Jobs Act, far fewer taxpayers will itemize deductions when they file their tax returns for 2018—and beyond—compared with 2017. And that is leading to a lot of hand-wringing among charities.

The new tax law nearly doubles the standard deduction in 2018—to $12,000 for singles and $24,000 for joint filers younger than age 65—while capping or eliminating other deductions. That means it will no longer make sense for as many taxpayers to itemize. The Tax Policy Center estimates that the number of households claiming an itemized deduction for charitable giving will fall from about 37 million to about 16 million in 2018.

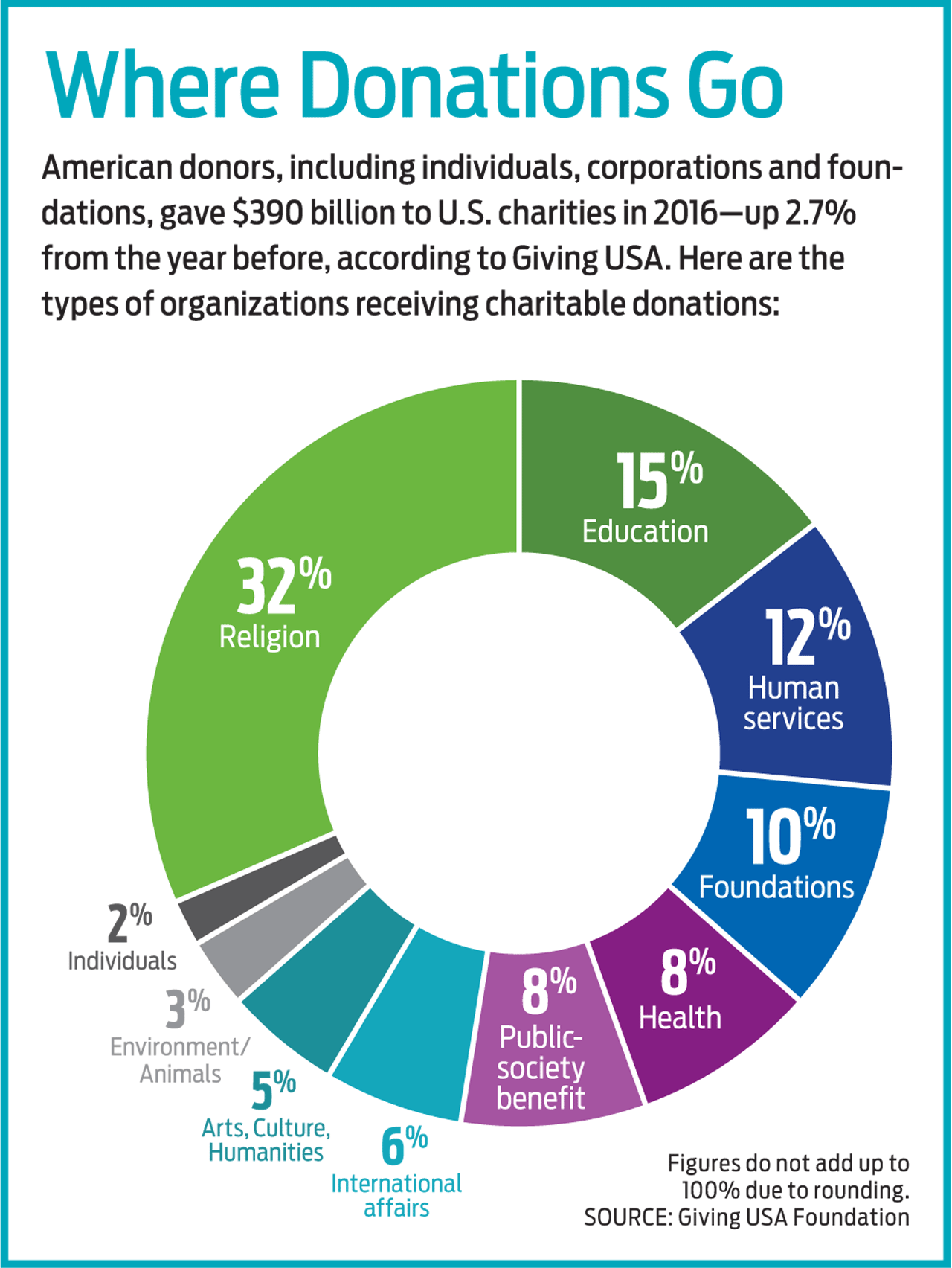

Though it’s too soon to know the precise fallout from the new tax law, nonprofits are concerned. The Council on Foundations estimates that the new rules will decrease charitable giving in the U.S. by $16 billion to $24 billion annually (total giving was $390 billion in 2016, according to Giving USA). But there are alternatives that let you take a tax deduction while consistently supporting your favorite groups. And even if tax incentives don’t factor into your philanthropy at all, tweaking your strategy in other ways can mean a bigger impact on causes you care about.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Set up your own charitable fund

If you are close to the threshold for taking the standard deduction, you may be able to get a tax break for your donations by employing a tactic called bunching. Basically, you make two or more years’ worth of donations in a single year so that—along with your other deductible expenses—you’ll end up with enough deductions to itemize that year. Then you skip donating the next year or two and revert to taking the standard deduction.

Although this tactic will provide a tax break for you, it may not be ideal for the charity. “This model would significantly impact nonprofits, many of which have little in reserves,” says Mirah Horowitz, executive director of Lucky Dog Animal Rescue in Arlington, Va. But a donor-advised fund avoids that problem. Contributing to one allows you to pool your donations in one pot, deduct the entire contribution in the year you make it and then spend time deciding how you want to dole out grants. You can continue to give in “off” years—on a more regular schedule that will benefit the charity, too—while taking the standard deduction.

Donor-advised funds are available through financial-services firms, independent groups such as the National Philanthropic Trust, community foundations and “single-issue charities,” such as hospitals, universities and religious organizations. The funds have become increasingly popular: In 2017, Fidelity Charitable, a donor-advised fund sponsor, reported an 83% increase in new donors over the previous year, while Schwab Charitable saw the number of new accounts opened in the last six months of 2017 jump by 91% compared with the same period in 2016.

Donor-advised funds are flexible about the type of donations they will accept. Besides cash, mutual funds and other publicly traded securities, funds may accept illiquid or complex assets such as restricted stock, privately held business interests and retirement accounts. On the quirkier end, they may accept collectibles, personal property such as jewelry and artwork, timberland, royalties, and bitcoin—an increasingly popular option. Fidelity Charitable, for instance, received nearly $70 million in cryptocurrency last year, nearly 10 times more than in the previous year.

Once you’ve contributed to a fund, the money can be invested in a variety of growth, balanced, conservative or socially responsible investment pools, where it can grow tax-free. If your fund is large enough—say, $250,000 or more—you might qualify for professional management.

Donor-advised funds make it easy to involve generations of the family in philanthropy. You can appoint your kids as advisers or successors to the fund and get their input on giving. Jim Black and his wife, Audrey, of Raleigh, N.C., set up a fund through the North Carolina Community Foundation in 2014 for themselves and their three sons. The couple kicked in $100,000 to start, and they consulted with their children before making two grants of $5,000 each, in 2016 and 2017. The money went to Rex Healthcare Foundation at UNC Rex Healthcare, a Raleigh hospital where Audrey’s father worked and where the couple’s sons were born. Because their sons are raising young families, “I don’t expect them to add money to the fund anytime soon, but we wanted to create a philanthropic vehicle for the family,” says Jim. “They can put in money as they’re able and involve their kids later on.” The family will reconvene this year to discuss a third grant.

Donor-advised funds, though, have rules and restrictions you don’t face when simply writing checks to charities. You’ll need a minimum of $5,000 to set up a donor-advised fund at Fidelity Charitable, Schwab Charitable or TIAA Charitable; $10,000 at the T. Rowe Price Program for Charitable Giving; and $25,000 at Vanguard Charitable or the National Philanthropic Trust. Minimums for community foundations vary, but a few have no minimum, and several start as low as a few thousand dollars (find your local foundation).

Also, some funds set limits on subsequent contributions (Fidelity has no minimum, but others vary between $250 and $5,000), set a minimum amount per grant that you can recommend (typically no less than $50) or specify how many years can pass before you make a grant. While most sponsors let you donate to any eligible 501(c)(3) charity, those focused on a single issue, such as universities, may reserve a percentage for their institution or impose other restrictions.

The fund sponsor also handles your recordkeeping, but this comes at a cost. You’ll pay annual administrative fees (say, the larger of $100 or 0.60% on up to $500,000 in assets, though the percentage will shrink as your fund grows larger) as well as expenses for your fund’s underlying investments.

Upping your impact

Whether or not you use a donor-advised fund, there are ways to make a greater impact with your giving. Start by asking yourself what issues deeply move you, says Eileen Heisman, chief executive officer of the National Philanthropic Trust. It could be a disease affecting a relative, an ongoing social problem or a cause tied to your faith or hobbies. “You can’t be all things to all people, but you may have a visceral reaction to certain things,” she says.

Greg and Diane Ogawa of Albuquerque focus their giving on education and “critical social needs,” such as health care, homelessness and hunger. “We’ve seen firsthand the difference a great education makes,” says Diane. They have set up endowments in a variety of places, including the private schools their two daughters attended, to honor students involved in community service and to provide financial aid.

Once you’ve homed in on causes that are important to you, consider whether you want to lend support to local, national or international organizations. Each has its merits. For example, you may feel more connected to a problem in your hometown or think that local groups are better equipped to solve it than a national organization that operates in multiple markets. But your dollar may go further overseas. GiveWell, a nonprofit that curates a list of heavily vetted, underfunded charities, recommends only international organizations working in low-income countries. The organization concluded that those programs were more cost-effective than initiatives in the U.S.

Once you have a short list, scrutinize each charity’s mission, goals and programs described on its website to make sure they align with your values. Dozens of organizations may pledge to end hunger, for example, but you may prefer one that distributes food instead of one that focuses on advocacy or raising awareness.

The temptation to sprinkle money among multiple charities can be strong, but many experts advise focusing on a few to make a bigger impact—or even just one that you’ve thoroughly vetted. And instead of designating your funds for a specific program, consider marking your donation as “unrestricted,” meaning the charity can use the funds wherever the need is greatest.

Inevitably, calls to support your friend’s charity race or a humanitarian need will pop up over the year, so reserve part of your charitable budget—say, 15%—for these opportunities.

Time it right

Charities tend to see two spikes in contributions: during their push for donations at the end of the calendar year and during appeals at the end of their fiscal year, typically in June. If you’re dispensing a lump sum, consider doing so in the slower months on the heels of the giving season, namely January, February or March. Or contact the nonprofit itself to ask when funding is critical. The Center for Disaster Philanthropy, which disburses funds to meet medium- and long-term needs after disasters, found that 70% of disaster giving flows in within a month of the event, after which there’s a steep decline. “But the recovery after a major disaster is likely to last for years, when philanthropic dollars are most needed but hardest to come by,” says Bob Ottenhoff, CEO of the CDP.

Alternatively, consider setting up recurring donations, which charities appreciate because the reliable flow of income helps them budget and alleviates the need to re-solicit donors.

If you’re planning to donate stock or make a grant through a donor-advised fund or make a tax-free transfer from your IRA, aim to complete the transaction by early December in case of processing delays, or earlier if your fund requires it.

Vet the charity

“Overhead,” or the portion of expenses that charities use for administrative and fund-raising costs, has gotten a bad rap over the years, but it’s one small part of the picture. “People see it as the fat, but the fat pays the rent,” says Heisman. “Overhead is needed to run well.”

More important is how effectively a charity is accomplishing its goals or making an impact. This should be discussed on the charity’s website or shared with you if you contact the charity’s development office (or the executive director, if it’s a smaller charity). “If the organization can’t clearly track and communicate its progress, that’s a red flag to me as a donor,” says Gabe Cohen, senior director of marketing and communications at GuideStar, which gathers information on nonprofits. Other things to look for alongside overhead costs: financial transparency (there should be links to financial documents, including the charity’s Form 990, which is the report that most tax-exempt organizations must file with the IRS), the experience and training of leadership staff, and evidence that past mistakes or risks were handled responsibly.

Websites that review charities or serve as watchdogs, such as Charity Navigator and the Better Business Bureau’s Wise Giving Alliance, can also give a sense of the larger picture and help you interpret important details more easily than slogging through a dense Form 990. GuideStar presents a neutral snapshot, including balance-sheet data, program descriptions and links to financial documents. On GuideStar, charities can also answer five questions to assess their impact and five questions about board oversight and performance. Don’t rely solely on one review to make a judgment, and don’t immediately dismiss an organization that rates low or isn’t profiled without reading about it further in the news, on the charity’s website or on other review sites.

What about personal campaigns that benefit an individual or family through crowdfunding platforms such as GoFundMe? Approach them with caution. GoFundMe guarantees that funds will go to the beneficiary, not the campaign organizer, and it will refund up to $1,000 to donors if there is evidence of misuse. But donations to personal campaigns are considered gifts and are not tax-deductible. It may make sense to chip in for someone you know, or when a specific story moves you. But to help people struck by widespread tragedies, “you may want to give to an organization with boots on the ground that knows how to disperse the money according to who needs it most,” says Cohen.

The biggest charity scams are centered on kids, cancer and veterans, says Heisman. Bogus institutions may share similar names with legitimate nonprofits and pressure you to donate before you have had time to properly vet them. Don’t click on a link in an unsolicited e-mail or respond to an unsolicited call. Instead, head to the charity’s website to do your own research. Verify a charity’s 501(c)(3) status (meaning that it can receive tax-deductible contributions) through the IRS’s Exempt Organizations Select Check.

More tax-savvy ways to give

If you donate cash and itemize your deductions, the new tax law allows more-generous write-offs. You can now deduct up to 60% of your adjusted gross income, up from 50%. (If your cash donations exceed that limit, you can carry forward any unused deductions for five years.)

Consider donating shares of appreciated stock or mutual funds. You can deduct the current value of the investment as a charitable contribution if you itemize, and you’ll avoid paying capital gains taxes on the profits. Plus, the charity will receive the full value of your investment. Your deduction for donating stocks and fund shares to a public charity or donor-advised fund is limited to 30% of AGI. Again, you can carry forward unused deductions.

To donate a sizable sum and get some income in return, a charitable gift annuity can make sense (see What You Must Know About Charitable Gift Annuities). You give cash or securities and get a partial tax deduction up front, then receive fixed payments for the rest of your life. Donating assets to a charitable remainder trust also nets a partial tax deduction, and you or your beneficiaries will receive an income stream until the assets revert to the charity after a certain amount of time or until the death of the last beneficiary.

If you’re 70½ or older, you can transfer up to $100,000 from a traditional IRA tax-free to charity each year. It will count as your required minimum distribution without being added to your adjusted gross income. Your charitable gift won’t be taxed, as it would be if you were to take a distribution and then donate the cash to charity. Plus, keeping your RMD out of your adjusted gross income could help keep your income below the threshold for being subject to the high-income surcharge for Medicare parts B and D, as well as hold down the percentage of your Social Security benefits that’s subject to taxes.

Or you can name a charity as the beneficiary of your IRA. That way, neither your heirs nor your estate will pay income taxes on the assets, and the charity will receive the full value. If tax-efficiency is your main goal, leave your traditional IRA to charity and your taxable accounts to your heirs, says Karla Valas, of Fidelity Charitable. Your heirs will receive a step-up in basis to the value of the securities at the time of your death.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

9 Types of Insurance You Probably Don't Need

9 Types of Insurance You Probably Don't NeedFinancial Planning If you're paying for these types of insurance, you might be wasting your money. Here's what you need to know.

-

Standard Deduction 2026 Amounts Are Here

Standard Deduction 2026 Amounts Are HereTax Breaks What is the standard deduction for your filing status in 2026?

-

Three Popular Tax Breaks Are Gone for Good in 2026

Three Popular Tax Breaks Are Gone for Good in 2026Tax Breaks Here's a list of federal tax deductions and credits that you can't claim in the 2026 tax year. High-income earners could also get hit by a "surprise" tax bill.

-

Five Ways Trump’s 2025 Tax Bill Could Boost Your Tax Refund (or Shrink It)

Five Ways Trump’s 2025 Tax Bill Could Boost Your Tax Refund (or Shrink It)Tax Refunds The tax code is changing again, and if you’re filing for 2025, Trump’s ‘big beautiful’ bill could mean a bigger refund, a smaller one or something in between next year. Here are five ways the new law could impact your bottom line.

-

New SALT Deduction Could Put Thousands Back in California Homeowners’ Pockets

New SALT Deduction Could Put Thousands Back in California Homeowners’ PocketsTax Breaks The federal state and local sales tax (SALT) deduction cap is higher this year, and could translate into bigger savings for Golden State homeowners.

-

Key 2025 Tax Changes for Parents in Trump's Megabill

Key 2025 Tax Changes for Parents in Trump's MegabillTax Changes Are you a parent? The so-called ‘One Big Beautiful Bill’ (OBBB) impacts several key tax incentives that can affect your family this year and beyond.

-

Amazon Resale: Where Amazon Prime Returns Become Your Online Bargains

Amazon Resale: Where Amazon Prime Returns Become Your Online BargainsFeature Amazon Resale products may have some imperfections, but that often leads to wildly discounted prices.

-

Elon Musk and Most Taxpayers Don't Like What's in Trump's 'Big Beautiful Bill'

Elon Musk and Most Taxpayers Don't Like What's in Trump's 'Big Beautiful Bill'Tax Policy President Trump is betting big on his newest tax cuts, signed into law on July 4. But not everyone is on board.