5 Things Federal Employees Should Know for Retirement

Knowing the ins and outs of retirement is challenging, especially for federal government employees.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

After years of serving the federal government, it’s time for federal employees to reap the many unique rewards a federal retirement plan offers.

Retirement preparation is hard for everyone, but navigating federal benefits can add a layer of complexity and red tape that may seem daunting to even the most seasoned financial professional.

I have a heart and passion for serving federal employees. My mother, who is also my best friend and now works for me, is a retired federal employee. I successfully helped her navigate her federal employee benefits and financial plan so she could retire at the age of 57.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The Kiplinger Adviser Intel program handpicks financial advisers and business owners from around the world to share retirement, estate planning and tax strategies to preserve and grow your wealth. These experts, who never pay for inclusion on the site, include professional wealth managers, fiduciary financial planners, CPAs and lawyers. Most of them have certifications including CFP®, ChFC®, IAR, AIF®, CDFA® and more, and their stellar records can be checked through the SEC or FINRA.

Also, my mentor, whom I meet with every month, is a retired deputy commander at the U.S. Defense Logistics Agency (DSCC), and many more of my family members are retired federal employees.

In addition, our firm has many clients who are current or retired federal employees. Really, I was forced into becoming a federal employee specialist.

I once worked with a federal employee who had previously visited with another financial planner. The employee said that the financial planner did not specialize in federal benefits and did not even know what a Thrift Savings Plan (TSP) was.

My point? Make sure you do not leave the success of your retirement (something you have worked hard to achieve for 30 or 40 years) to a coin flip by working with someone who does not understand your situation.

You need someone who speaks your language and understands TSP, FERS, CSRS, FEGLI, FEHB, FLTCIP, G Fund. If they do not know what those acronyms mean, then run away.

Obviously, it is really important to get help from a financial planner specializing in federal benefits, especially as it relates to these five things federal employees should know about some of their retirement options.

1. TSP (Thrift Savings Plan) rollover

The TSP is a great investment. It is low-cost, simple, provides a generous 5% match and even has a Roth option. In 2026, it will have the option to do in-plan Roth conversions. (See one of my other Kiplinger articles to find out Why I Love Roth IRAs and Roth Conversions.)

However, the TSP can be limited, which may not make it the best investment for your retirement. The biggest limitation is that the TSP has only five investment options.

Those five options are not bad, but you could be cutting yourself off from an entire universe of other investment options.

Many of the clients we work with roll over their TSP to an IRA to have more options. You can do this when you retire, or you can do something called an in-service withdrawal.

When you are 59½, if you are still working, you can do an in-service withdrawal and move your TSP to an IRA to allow you to take advantage of strategies like those mentioned above while still contributing to your TSP and taking advantage of the employer match.

Keep the Rule of 55 in mind so you don't face a 10% penalty if you retire early. In this case, it may make sense to leave some money in your TSP until age 59½. (You can learn more about that in our YouTube video on the topic.)

Also, if you have a large amount in your TSP or tax-deferred investments, then you may be setting yourself up for trouble with the potential of increased tax rates and large amounts you will be required to take out due to required minimum distributions (RMDs).

Roth conversions are a strategy you could use to turn a forever-taxed investment into a never-again-taxed investment, which could potentially save you money on your hard-earned dollars in retirement.

Be careful when you do this, as there are many things to be aware of. Make sure you seek help from a CPA and a financial planner who specializes in tax planning.

You will need to run projections to see if you should do it and, if so, how much you should do. Tax planning is vital in retirement. It’s so important that I wrote a book called I Hate Taxes! I truly do.

2. FEGLI (Federal Employees’ Group Life Insurance): Option B gets expensive

If you have Option B heading into retirement and plan to keep it, then you want to do your due diligence to see what other options you have.

Option B gets more expensive the older you get. If you are eligible and can qualify for private life insurance, then you may be able to find better options with better features/benefits.

It could also decrease your cost from what you are paying with FEGLI.

3. FEGLI: 75% reduction

If you have had Basic FEGLI coverage in place for at least five years before you retire, then you are eligible for what is called a “75% reduction” when you retire.

This means you can keep 25% of your Basic life benefit for no cost for the rest of your life. Most of our clients choose this option.

4. FERS (Federal Employees Retirement System) pension: Working until age 62

I once had a client who was a federal employee and was looking to retire at age 61. She said, “Joe, I am retiring this year, and I do not care what you say!”

But I had to say something because she would get a 10% increase to her pension calculation by waiting another year to retire. If you are over 62 and have 20 years of service, then you are eligible for a higher pension.

5. FERS pension: Survivor benefit

If you are married, then you have the option of choosing a survivor benefit for your spouse. This means your spouse can continue on your pension if you pass away.

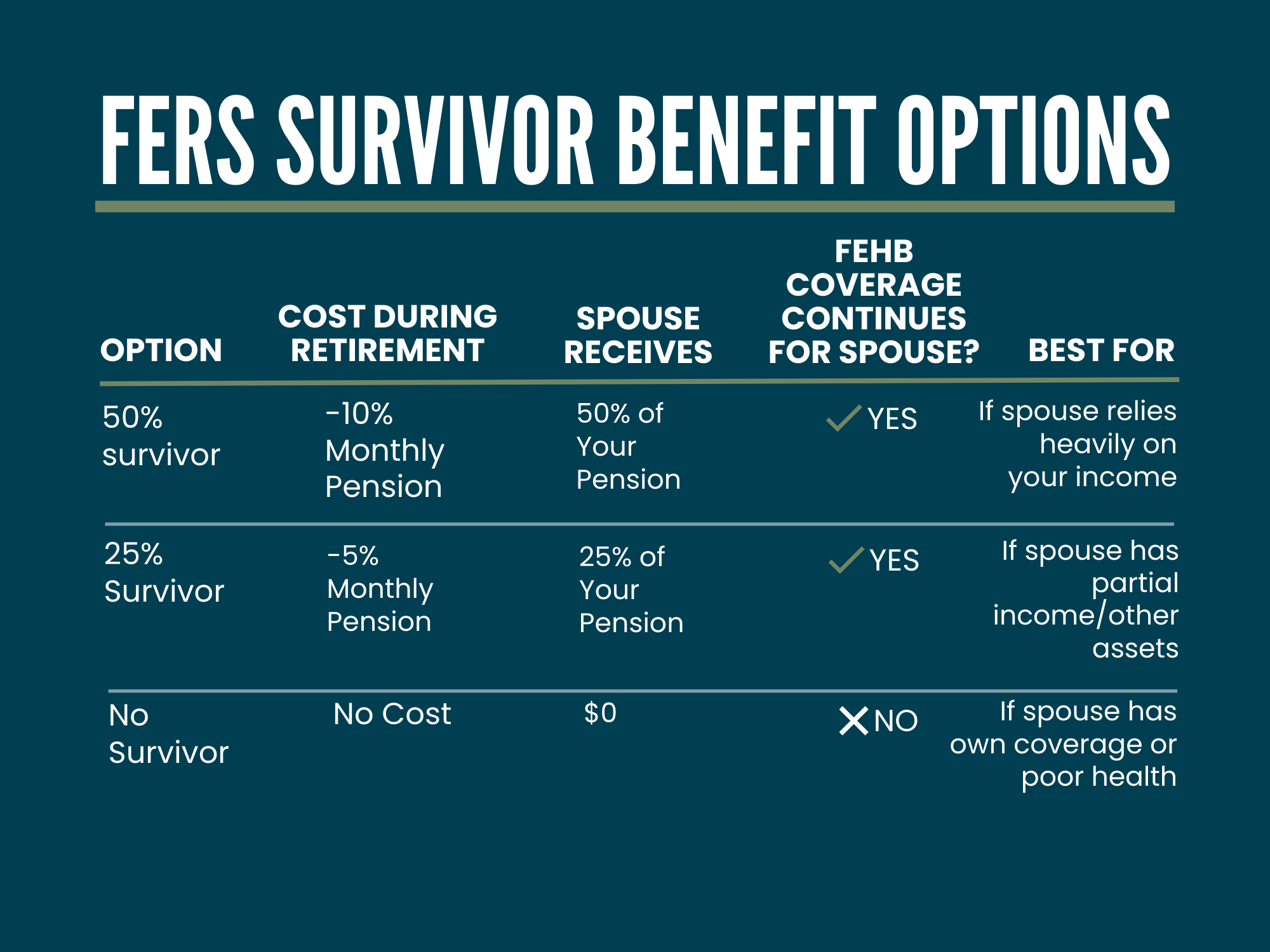

The amount depends on what you choose:

- You can choose for your spouse to get 50% of your pension. Keep in mind that this option will cost 10% of your ongoing pension. That can add up.

- Or you can choose for your spouse to get 25% of your pension. This will cost 5% of your pension ongoing.

- The last option is no election. If you choose this, then it will not cost anything, and your pension will be unreduced. Keep in mind that if you choose this and you pass away, then your spouse cannot continue to use your FEHB (Federal Employees Health Benefits) ongoing. This could be a problem if the spouse needs that health insurance coverage.

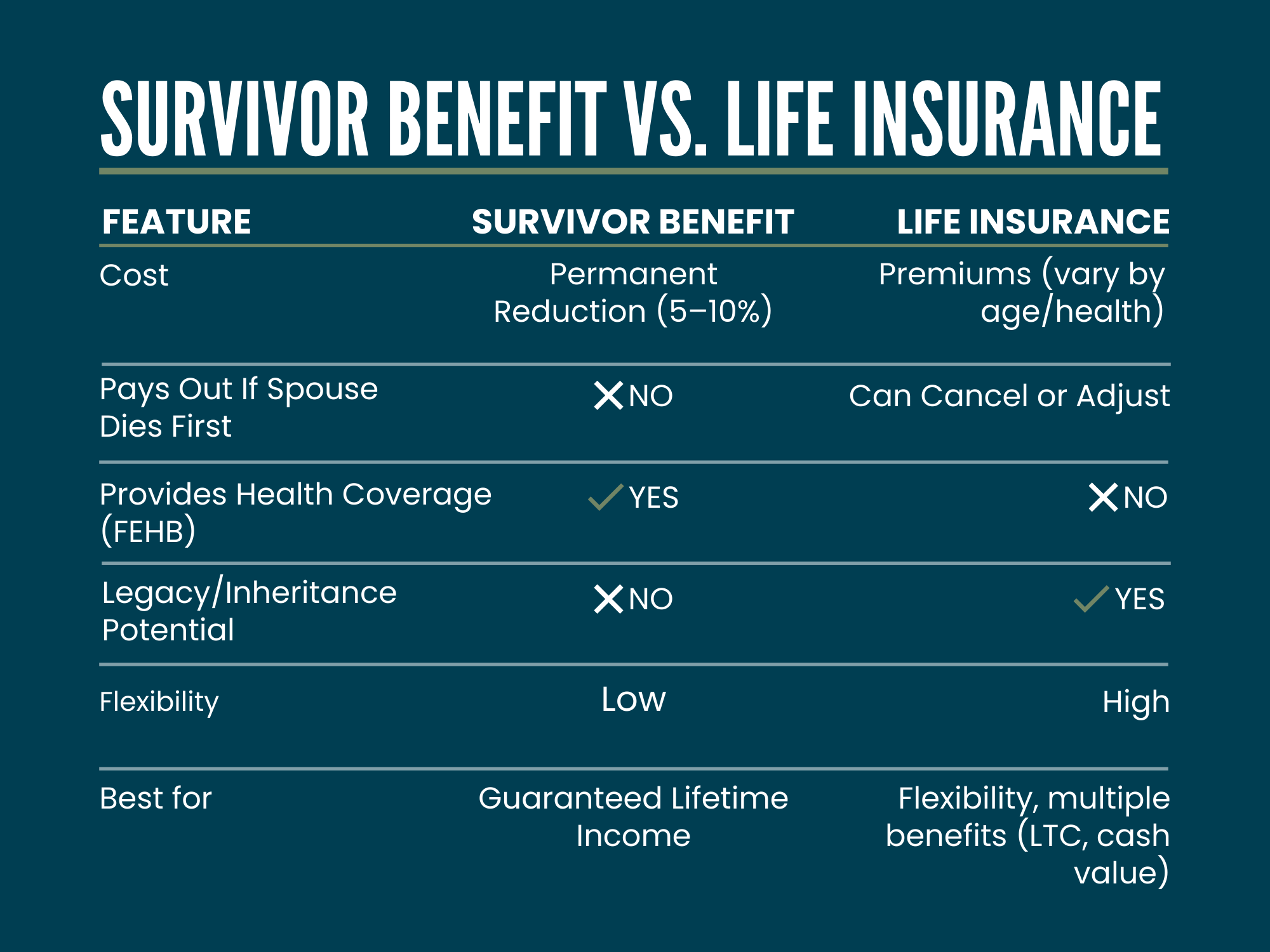

As an alternative strategy, you could replace the survivor pension with life insurance. This strategy could be used when the spouse is likely to predecease the federal employee due to poor health, advanced age or other issues.

In this case, life insurance would be a better option because the FERS survivor pension benefit does not pay out if the spouse dies first. In this case, you would have paid all that money and then gotten no benefit.

But with life insurance in place, your spouse would still be taken care of and would have other options, like leaving a potential legacy to family, taking cash value out or utilizing that benefit for long-term care if the life insurance you get has that option. There is potentially more flexibility and benefits.

Looking for expert tips to grow and preserve your wealth? Sign up for Adviser Intel, our free, twice-weekly newsletter.

To close, I want to give you the advice my father always gave me. My dad, the hardest worker I know, always taught me that if you want something, then you must go get it.

So, utilize these federal employee planning strategies to go get the retirement you have dreamed of.

Related Content

- Four Steps to Take if You Lose Your Job Near Retirement

- Five Military Benefits That Vets Might Not Know They’ve Earned

- Converting Retirement Savings to a Roth IRA? Don't Do This

- You're 62 Years Old With $1 Million Saved: Can You Retire?

- Should You Move Your 401(k) to an IRA Once You Hit 59½?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Joe F. Schmitz Jr., CFP®, ChFC®, CKA®, is the founder and CEO of Peak Retirement Planning, Inc., which was named the No. 1 fastest-growing private company in Columbus, Ohio, by Inc. 5000 in 2025. His firm focuses on serving those in the 2% Club by providing the 5 Pillars of Pension Planning. Known as a thought leader in the industry, he is featured in TV news segments and has written three bestselling books: I Hate Taxes (request a free copy), Midwestern Millionaire (request a free copy) and The 2% Club (request a free copy).

Investment Advisory Services and Insurance Services are offered through Peak Retirement Planning, Inc., a Securities and Exchange Commission registered investment adviser able to conduct advisory services where it is registered, exempt or excluded from registration.

-

3 Smart Ways to Spend Your Retirement Tax Refund

3 Smart Ways to Spend Your Retirement Tax RefundRetirement Taxes With the new "senior bonus" hitting bank accounts this tax season, your retirement refund may be higher than usual. Here's how to reinvest those funds for a financially efficient 2026.

-

5 Retirement Tax Traps to Watch in 2026

5 Retirement Tax Traps to Watch in 2026Retirement Even in retirement, some income sources can unexpectedly raise your federal and state tax bills. Here's how to avoid costly surprises.

-

Trump's New Retirement Plan: What You Need to Know

Trump's New Retirement Plan: What You Need to KnowPresident Trump's State of the Union address touched upon several topics, including a new retirement plan for Americans. Here's how it might work.

-

3 Smart Ways to Spend Your Retirement Tax Refund

3 Smart Ways to Spend Your Retirement Tax RefundRetirement Taxes With the new "senior bonus" hitting bank accounts this tax season, your retirement refund may be higher than usual. Here's how to reinvest those funds for a financially efficient 2026.

-

Trump's New Retirement Plan: What You Need to Know

Trump's New Retirement Plan: What You Need to KnowPresident Trump's State of the Union address touched upon several topics, including a new retirement plan for Americans. Here's how it might work.

-

Buy and Hold … or Buy and Hope? It's Time for a Better Retirement Planning Strategy

Buy and Hold … or Buy and Hope? It's Time for a Better Retirement Planning StrategyOnce you're retired, your focus should shift from maximum growth to strategic preservation and purposeful planning to help safeguard your wealth.

-

Your Legacy Is More Than Your Money: How to Plan for Values, Not Just Valuables

Your Legacy Is More Than Your Money: How to Plan for Values, Not Just ValuablesLegacy planning integrates your values and stories with legal and tax strategies to ensure your influence benefits loved ones and good causes after you're gone.

-

Will Real Estate and Private Equity Start to Shine Again in 2026?

Will Real Estate and Private Equity Start to Shine Again in 2026?Real estate, private equity and general partner stakes could benefit from future interest rate cuts. What are the risks and rewards of investing in each?

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

4 High-End Experiences Worth the Splurge After 50

4 High-End Experiences Worth the Splurge After 50These curated date ideas provide the perfect backdrop for couples ready to enjoy the very best that the world has to offer.

-

Health Care Stocks Have Sagged. Can You Bet on a Recovery?

Health Care Stocks Have Sagged. Can You Bet on a Recovery?The flagging health care sector has perked up a bit lately. Is it time to invest?