The End of Retirement as We Know It

Baby Boomers face a retirement like no generation before them, and rather than being the 'beginning of the end,' it's the beginning of a new life phase.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

As the largest cohort of Baby Boomers start turning 65 this year, a point when most people traditionally stop working for a living, they will experience “a retirement” unlike any other generation.

For starters, they will be happier than previous generations of retirees, and rather than sit on a porch gazing at sunsets and looking backward, they want to do more, according to researchers. They will also live longer and have more energy thanks to advances in medicine, technology and living healthier. Significantly more people say they will work into their 70s than any prior generation. While many will struggle financially to live comfortably throughout their retirement, no generation has retired with as much money saved as the Boomers.

They will also experience changes they had not anticipated.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

As an executive life coach who has traveled more than 2 million miles around the world, meeting and talking with people confronting the end of their normal work life, I am a professional listener. And what I have heard loud and clear from people is this refrain over and over: “This isn’t what I was expecting!”

For some, it’s a divorce or the beginning of a new relationship. Many thought they would still be working, only to unexpectedly lose their job, while others surprised themselves by starting a new business. Rather than preparing for a traditional retirement, many are facing periods of multiple changes and transitions, unprecedented in previous generations.

It’s what I call the “new life phase” — a time for facing new opportunities and challenges that seem to come out of nowhere, and for stretching out the productive, creative and purpose-driven peak of life.

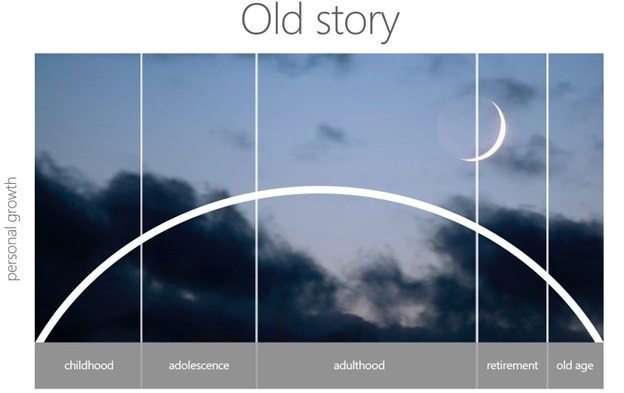

A new life chart for a new life phase

For earlier generations, this time of challenge and opportunity and the need for having to keep figuring things out well beyond the normal retirement age, was not an option or necessary. Instead, society considered people at this stage to be “over the hill.” A popularly used life chart was shaped like an arc, rising through childhood, adolescence and part of adulthood, which was the so-called learning and earning phase of life. Then having reached a peak, the life chart went into steady decline through retirement and old age.

That chart was based on assumptions that are no longer true, such as people grew old in their 40s and 50s and died in their mid-60s, which was the case in the middle of the last century. Even now, as life expectancy has risen, people often are mistaken about where they are on the life chart. A recent economic study about retirement-aged Boomers by economist Robert Shapiro on behalf of the Retirement Income Institute noted that people in their 50s and early 60s underestimate their likelihood of living until just 75 by an average of 25%.

The best way to illustrate the change in aging is a new chart showing a steady rise into early adulthood and then a leveling through middle age until we reach another rise past middle age that stretches into a new peak, which represents the new life stage. Psychologists worldwide have found that well-being follows a U curve, and that happiness is at its lowest level when people are in their 30s and 40s and then increases steadily starting at age 50. This happiness trajectory aligns with research that finds our lives continue to evolve positively in our later years.

Start the new phase by talking it over with someone you admire and trust

This new phase of life can feel a little bit like a second adolescence. We find the structures we fit into comfortably a decade ago — socially, professionally, relationally — start to feel like a poor fit. We need a new purpose, a new vision, encouragement and a personal plan to make this newly available phase of life our best life.

The plan should be shared with others. When I tell people about my studies and interviews with older people about “aging with purpose,” they often give me examples of more people I should interview. Their instinct to keep talking about this change is right, because turning to those you admire is a great starting point for any new adventure.

The new phase of life involves having a purpose in life, whether it is a job, being a mentor, having connection to others or a spiritual connection. The new life phase can take on a whole new dimension when you discuss it with partners, friends, family and colleagues. In a variety of ways, we feed off one another’s ideas, stories and insights. The results benefit everyone.

Related Content

- Your Retirement Reckoning: Four Questions to Ask

- Is 100 the New 70?

- The Five Stages of Retirement (and How to Skip Three of Them)

- Nervously Nearing Retirement? Four Do’s, Four Don’ts and One Never

- Being Rich vs. Being Wealthy: What’s the Difference?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Richard Leider is an Education Fellow with the Alliance for Lifetime Income’s Retirement Income Institute and Founder of Inventure – The Purpose Company, a firm created to guide individuals to live, work and lead on purpose. He is ranked by Forbes as one of the “Top 5” most respected coaches and is a contributing author to many coaching books. He is one of a select few coaches who have been invited to work with over 100,000 leaders from over 100 organizations such as AARP, Ameriprise, Blue Zones, Ericsson, Habitat for Humanity, Lifespark, Mayo Clinic, Modern Elder Academy, National Football League, Outward Bound, United Health Group and the U.S. Department of State.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.