Taxes in Retirement: What ESOP Participants Need to Know

Most Employee Stock Ownership Plans (ESOP) participants transfer their company stock to a traditional IRA starting around age 55, so taxes on that money have been deferred.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

When you retire, one of the biggest changes Employee Stock Ownership (ESOP) participants will face is how taxes are handled.

During your working years, taxes are automatically withheld from your paycheck. In retirement, the responsibility to pay taxes shifts to you.

Without proper planning, this change can lead to financial surprises. Let's explore how taxes work in retirement, the differences between account types, and how working with a financial adviser or CPA can help you create a tax-efficient withdrawal strategy.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The shift: Paying taxes on your own in retirement

Once you retire, income sources like Social Security, pensions and withdrawals from retirement accounts replace your paycheck. Taxes are no longer automatically withheld (except for pensions and Social Security if you request it).

This means you’ll need to estimate your tax liability and pay quarterly estimated taxes to the IRS. Failing to do so can lead to penalties and interest charges.

Understanding how your retirement accounts are taxed is key to avoiding surprises and keeping more of your hard-earned savings.

Taxable, tax-deferred and tax-free accounts

Retirement savings are typically held in three types of accounts, each with different tax implications:

Tax-deferred accounts. Examples are traditional IRAs, 401(k)s and Employee Stock Ownership Plans (ESOPs).

- Contributions are made pre-tax, and earnings grow tax-deferred

- Most ESOP participants will transfer company stock to an IRA beginning at age 55 through a process known as diversification.

- Withdrawals are taxed as ordinary income, and required minimum distributions (RMDs) begin at age 73 or 75, depending on your age

Taxable accounts. An example is a brokerage account.

- Contributions are made with after-tax dollars, and there are no tax benefits upfront

- Earnings are subject to capital gains taxes (short-term or long-term, depending on how long assets are held)

Tax-free accounts. Examples are Roth IRAs and Roth 401(k)s.

- Contributions are made with after-tax dollars, but withdrawals of earnings are tax-free if certain conditions are met

- Roth accounts have no RMDs, making them excellent tools for tax-efficient planning

How a financial adviser or CPA can help

Navigating retirement taxes requires a strategic approach. A financial adviser or CPA can:

- Estimate taxes. Help you calculate quarterly estimated payments and avoid penalties.

- Handle ESOP diversification. Help you transfer company stock to your IRA where you will have a wide range of options including stocks, bonds, mutual funds or ETFs.

- Prioritize withdrawals. Advise on which accounts to draw from first to minimize your tax liability over the course of your retirement.

- Optimize Roth conversions. Suggest strategies to convert tax-deferred accounts to Roth accounts during low-income years. Typically between retirement date and age 73 when RMDs begin.

- Plan RMDs. Help you prepare for RMDs and minimize the tax impact.

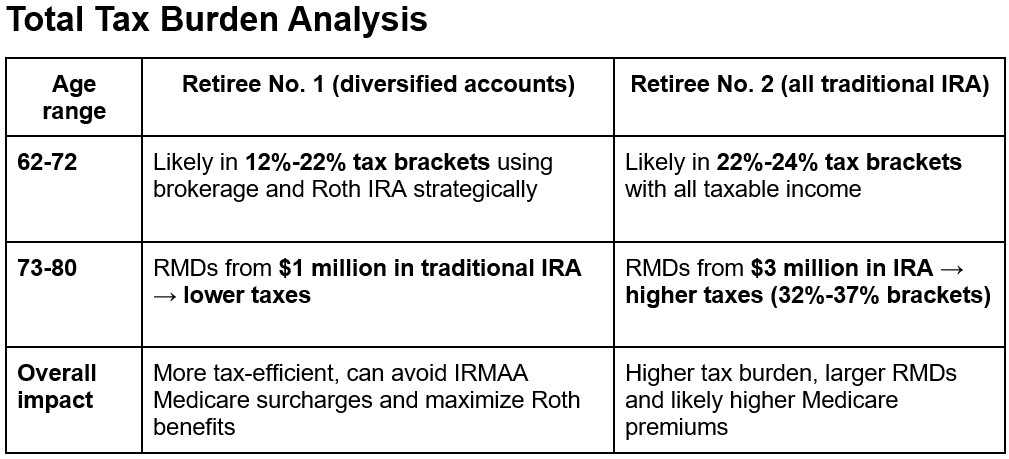

Who pays more taxes in retirement? Two scenarios

Imagine two retirees, each with $3 million saved but in different types of accounts.

Retiree No. 1: The tax-savvy saver

- $1 million in Roth IRAs (grows tax-free, withdrawals are tax-free)

- $1 million in a taxable brokerage account (low capital gains taxes)

- $1 million in traditional IRAs/401(k)s (taxed as regular income when withdrawn)

Withdrawal strategy:

- Begin with taxable account withdrawals to take advantage of lower long-term capital gains rates.

- Take modest withdrawals from tax-deferred accounts throughout retirement to reduce the size of future required minimum distributions (RMDs) and smooth out taxable income.

- Supplement income from Roth accounts as needed to fill income gaps without pushing into higher tax brackets.

Tax outcome: By staging withdrawals across all accounts, the retiree minimizes taxable income while proactively reducing RMDs. This approach also allows the Roth funds to continue growing tax-free for later years or tax-free for the next generation.

Retiree No. 2: The traditional saver

- All $3 million is in a traditional IRAs/401(k)s (taxed as regular income when withdrawn)

Withdrawal strategy:

- Start withdrawals earlier than required to spread out tax liability and avoid large RMDs.

- Consider partial Roth conversions during early retirement years when income is lower.

Tax outcome: Without taxable or Roth accounts to offset tax-deferred withdrawals, the retiree will likely face higher taxes, especially after RMDs begin. Proactive planning can help reduce the long-term tax burden.

Retiree No. 1 has significantly lower taxes across her lifetime due to diversified account types – especially tax-free Roth withdrawals. Retiree No. 2 pays more in taxes due to large RMDs beginning at age 73 and Medicare IRMAA surcharges in later years.

Key takeaways

- Retirement changes how taxes are paid, requiring careful planning.

- ESOP participants can continue tax deferral by transferring company stock to an IRA or 401(k) account.

- The type of account you hold — taxable, tax-deferred or tax-free — affects your tax liability.

- A financial adviser or CPA can create a personalized strategy to estimate taxes and optimize withdrawals.

By working with a trusted adviser, you can reduce your tax burden, preserve your wealth, and enjoy a financially secure retirement.

Have questions about retirement tax planning? Contact Peak Wealth Planning to create a strategy that works for you.

Find out more about ESOPs by reading Peter’s six-part series about them on Kiplinger.com, starting with part one: Five Key Advantages to Working at an Employee-Owned Company.

Related Content

- How the IRS Taxes Retirement Income

- Five Reasons Not to Give Your Child Power of Attorney

- How Much Retirement Income Could Your ESOP Generate?

- Should an ESOP Be Your Only Retirement Account?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Peter Newman founded Peak Wealth Planning, LLC in 2014 to provide financial planning and investment management for individuals who built their wealth through ESOP participation, business ownership or real estate investing. He helps families diversify their concentrated stock, reduce estate taxes, preserve wealth and generate stable retirement income. Peter holds the Chartered Financial Analyst designation, considered by many to be the gold standard for investment management.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.