Social Security: DeSantis, Haley Split Over Reforms During GOP Debate

Candidates spar over Social Security’s retirement age and COLA increases as the 2024 election year kicks off.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Two presidential candidates gave starkly different views on Social Security reforms yesterday (January 10) as the fifth Republican primary debate kicked off for the 2024 election year.

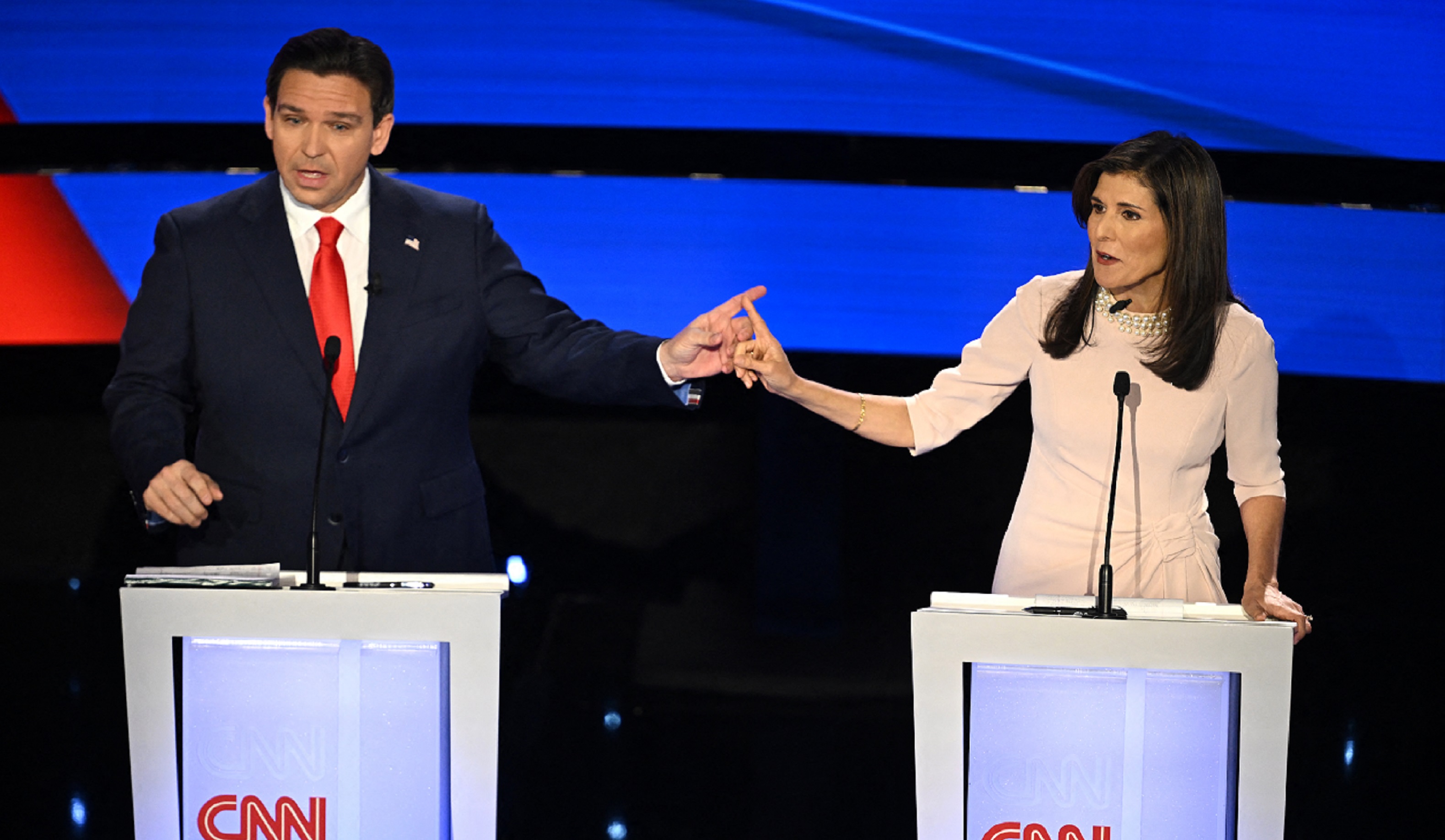

The candidates — former South Carolina Gov. and U.N. Ambassador Nikki Haley and Florida Gov. Ron DeSantis — took the stage last night as former President Donald Trump, the GOP front-runner, declined to participate and chose instead to hold a town hall. (Former New Jersey Gov. Chris Christie dropped out of the race earlier in the day.)

Hosted by CNN, the debate was held at Iowa’s Drake University just five days before the January 15 Iowa caucus, the first-in-the-nation GOP presidential primary.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Social Security’s solvency and retirement age

CNN moderator Jake Tapper kicked off the Social Security portion of the debate by referring to the 2022 annual report of Social Security Trustees, which found that the Social Security Administration will be unable to pay full benefits by 2034 if Congress does not take action on funding.

Tapper asked DeSantis if he still stands by his previous statement to not “mess with” Social Security. “Does that mean you have committed to never raising the retirement age and never cutting benefits?”

DeSantis responded that a promise has been made to older adults, who’ve paid for their benefits. “Every single paycheck that you’ve had your entire life, they've taken money out of,” he said, looking into the camera. “That promise needs to be fulfilled.”

Life expectancy has been decreasing in the last five years, he said, “so I don’t see how you can raise the retirement age when our life expectancy is collapsing in this country.”

When pushed for clarification on whether he would consider raising the retirement age for younger adults, as opposed to current older adults, DeSantis said he would not raise the age in the face of declining life expectancy.

Haley took a different view. “What I’ll tell you is Social Security is going to go bankrupt in 10 years. Medicare is going to go bankrupt in eight,” Haley said. “We have to keep our promises to seniors, but we also can’t put our head in the sand.”

The retirement age should be increased for those in their 20s, however, to reflect life expectancy, she said. When Tapper pressed her on that point, Haley said that those in their 20s should plan on it to be increased to reflect more of what life expectancy will be.

“We have to go and look at what we can do to get out of this. We want to make sure that everybody who was promised, gets it. But we also want to make sure that our kids have something when they get it, too,” she said.

Are their claims on target?

According to the Social Security Administration’s chief actuary, who is making a concerted effort to quell fears over dwindling reserves in the trust fund, there is a risk that Social Security benefits will be reduced in 10 years, but the trust fund will not completely run out of money. The probable “worst-case scenario here is that we, within 10 years, reach a point where we can only pay about 80% of the level of benefits that are scheduled or intended into law by Congress as of that point in time and going forward,” Steve Gross, chief actuary, said last year.

According to data from the Poynter Institute’s PolitiFact, there is data that supports each candidate’s claim regarding life expectancy.

Life expectancy rose from 1960 to 2018, according to the data. But in 2020 and 2021, life expectancy fell, which may be due in part to the coronavirus pandemic, the data shows.

But there was also a slight rise in life expectancy last year, according to preliminary data.

COLA increases

DeSantis said he would work with both sides of the political aisle, but “I am not going to mess with seniors’ benefits in this high-inflation environment.” Social Security’s cost of living adjustment (COLA) is not enough to cover rising costs, he said.

According to the Social Security Administration, the purpose of the COLA is to ensure that the purchasing power of Social Security benefits and SSI payments is not eroded by inflation.

Haley said that, instead of COLAs, increases should be based on inflation. “We limit benefits on the wealthy, and we expand Medicare Advantage plans, which seniors love,” she said.

DeSantis also said that Social Security had “massive surpluses” for decades but that Congress spent those surpluses. "They have a big problem with that so, number one, we need term limits for members of Congress,” he said, adding that a balanced budget amendment to the U.S. Constitution is needed, along with the allowance of a line-item veto for the president.

RELATED CONTENT

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Esther D’Amico is Kiplinger’s senior news editor. A long-time antitrust and congressional affairs journalist, Esther has covered a range of beats including infrastructure, climate change and the industrial chemicals sector. She previously served as chief correspondent for a financial news service where she chronicled debates in and out of Congress, the Department of Justice, the Federal Trade Commission and the Commerce Department with a particular focus on large mergers and acquisitions. She holds a bachelor’s degree in journalism and in English.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

The New Estate Tax Exemption Amount for 2026

The New Estate Tax Exemption Amount for 2026Estate Tax The IRS has increased the exemption as we enter into a promising tax year for estates and inheritances.

-

About 40% of Heirs Say They Can’t Afford an Inherited Home

About 40% of Heirs Say They Can’t Afford an Inherited HomeEstate Planning The ‘Great Wealth Transfer’ may not help with high property taxes, soaring homeownership costs, and liquidity issues in 2025.

-

New List Out On Medicare Part B Drugs Eligible for Rebates

New List Out On Medicare Part B Drugs Eligible for RebatesSome Medicare beneficiaries may pay lower coinsurance rates from April 1 to June 30 for the drugs, HHS says.

-

Lawmakers: Nix Social Security Offsets For Seniors In Student Loan Default

Lawmakers: Nix Social Security Offsets For Seniors In Student Loan DefaultOffsetting Social Security benefits to pay for defaulted student loans can be devastating for some beneficiaries, lawmakers say.

-

HHS Funding Secured As Major Government Shutdown Avoided

HHS Funding Secured As Major Government Shutdown AvoidedWith passage of the fiscal 2024 appropriations package, Medicare and Social Security are among the key agencies to receive funding through September 30.

-

Social Security Chief Testifies in Senate About Plans to Stop ‘Clawback Cruelty’

Social Security Chief Testifies in Senate About Plans to Stop ‘Clawback Cruelty’Social Security plans to default to withholding 10% (not all) of the recipient's monthly benefits to recoup debt, SSA head says.

-

Social Security Chief Vows to Fix ‘Cruel-Hearted’ Overpayment Clawbacks

Social Security Chief Vows to Fix ‘Cruel-Hearted’ Overpayment ClawbacksCapping Social Security clawbacks at 10% for some beneficiaries is among the changes that O'Malley plans to propose.

-

Biden's Budget Rejects Any Cuts To Social Security and Medicare

Biden's Budget Rejects Any Cuts To Social Security and MedicareThe president's $7.3 trillion budget seeks to expand programs including some drug provisions under the Inflation Reduction Act.